Canada Child Benefit (CCB): The Canada Child Benefit (CCB) coming in October 2025 is more than just a date on the calendar. It’s a vital support system for millions of Canadian families trying to keep up with rising costs of groceries, daycare, and housing. Whether you’re a parent, an advisor, or simply planning your household budget, understanding how CCB works in October 2025 can make a real difference in your finances. In this guide, we’ll cover when you’ll get paid, how much you can expect, how the amount is calculated, and how to make sure you’re getting every dollar you deserve. I’ll keep it friendly and straightforward, like a conversation with someone who’s been through this before — but with all the details professionals expect.

Canada Child Benefit (CCB)

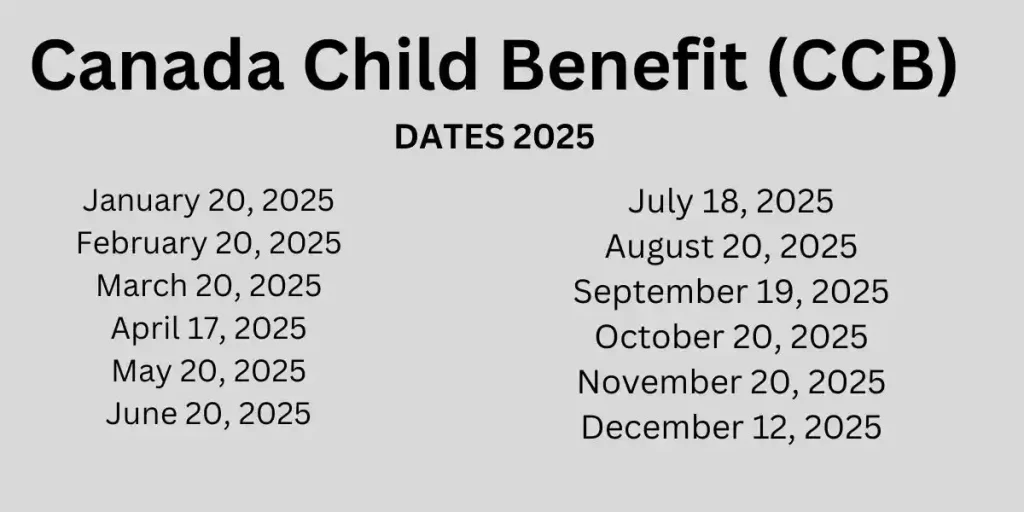

The Canada Child Benefit (CCB) for October 2025 will be paid on October 20. Families can receive up to $7,997 per year for each child under 6 and $6,748 for children aged 6–17, depending on income. The benefit, issued by the CRA, is tax-free and helps millions of families manage rising costs of living. This article covers eligibility, payment calculations, examples, provincial top-ups, and tips for maximizing your benefit safely.

| Topic | Details / Amounts (2025–26) |

|---|---|

| October 2025 Payment Date | October 20, 2025 |

| Benefit Year | July 1, 2025 – June 30, 2026 |

| Under age 6 (maximum) | $7,997 per year (≈ $666.41 per month) |

| Ages 6–17 (maximum) | $6,748 per year (≈ $562.33 per month) |

| Full Benefit Threshold | Adjusted family net income ≤ $37,487 (no reduction) |

| Phase-out threshold | Begins above $37,487 – gradual reduction up to $81,222 |

| Additional Reductions (High Income) | Extra 3.2%–8% reduction above $81,222 depending on children |

| Child Disability Benefit (CDB) | Extra amount if child qualifies for Disability Tax Credit |

| Payment Method | Direct deposit (same day) or cheque (up to 5–10 days delay) |

| Official CRA Page | Canada Child Benefit Overview |

What Is the Canada Child Benefit (CCB)?

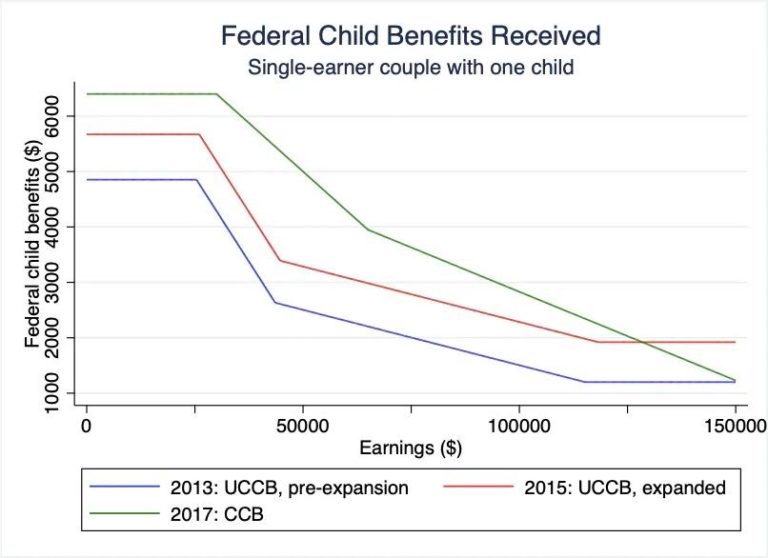

The Canada Child Benefit is a tax-free monthly payment issued by the Canada Revenue Agency (CRA) to help families raise children under 18. It replaced older programs like the Canada Child Tax Benefit and the Universal Child Care Benefit in 2016. The CCB is income-tested — meaning the lower your household income, the higher your payment. Its main goal is to reduce child poverty and help families manage day-to-day expenses like food, clothes, and school supplies.

Over the years, the CCB has been credited with lifting hundreds of thousands of children out of poverty, according to Statistics Canada and the Parliamentary Budget Officer. It’s widely considered one of Canada’s most effective anti-poverty programs. The benefit adjusts every July based on the previous year’s income tax return and is indexed to inflation, ensuring payments keep pace with rising prices.

When Will the October 2025 CCB Payment Arrive?

For October 2025, the Canada Child Benefit will be deposited on Monday, October 20, 2025.

If you’re signed up for direct deposit, the funds should appear in your account that morning. However, if you receive a paper cheque, expect it to arrive several days later depending on mail delivery times and possible postal delays.

If the 20th falls on a weekend or federal holiday, CRA issues payments on the previous business day. That means in years when October 20 lands on a Sunday, you’d receive payment on Friday, October 18.

CRA has encouraged all recipients to switch to direct deposit through My Account, as postal disruptions or lost cheques can cause serious delays — an issue that was widely reported in past postal strikes.

Why the Canada Child Benefit (CCB) Matters in 2025?

Canada’s cost of living has been climbing steadily. The average family spends about $16,000 per year per child, and essentials like childcare and groceries have gone up faster than inflation.

The CCB helps fill that gap. According to the Parliamentary Budget Office, families earning under $45,000 receive the highest benefit — and many single-parent households rely on CCB for up to 20% of their disposable income. This program doesn’t just help families make ends meet — it supports local economies. Economists note that each dollar of CCB payments generates roughly $1.30 in local economic activity as families spend it on necessities.

How the CCB Amount Is Calculated?

Step 1: Determine Your Eligible Children

Count all children under 18 who live with you and for whom you are the primary caregiver (usually the parent who spends the most time caring for the child).

Step 2: Check Their Ages

There are two payment brackets:

- Under 6 years old: $7,997 max per year

- Ages 6–17: $6,748 max per year

Step 3: Find Your Adjusted Family Net Income (AFNI)

Your AFNI comes from your 2024 tax return (line 23600). It’s your total income minus certain deductions.

Step 4: Apply Reduction Rates

If your AFNI is above $37,487, your payment decreases by:

- 7% of income over the threshold (for one child)

- 13.5% (for two children)

- 19% (for three)

- 23% (for four or more)

Once your income passes $81,222, additional reductions (3.2%–8%) kick in for higher brackets.

Example 1: One Child Under 6, Moderate Income

- AFNI: $45,000

- Over threshold: $45,000 − $37,487 = $7,513

- Reduction: $7,513 × 7% = $526

- Annual benefit: $7,997 − $526 = $7,471

- Monthly payment: ≈ $622

You’d receive about $622 in October 2025.

Example 2: Two Children (Ages 5 and 10), Higher Income

- AFNI: $75,000

- Excess: $75,000 − $37,487 = $37,513

- Reduction: 13.5% of $37,513 = $5,064

- Total max benefit: $7,997 + $6,748 = $14,745

- Final benefit: $14,745 − $5,064 = $9,681 per year

- Monthly: ≈ $806.75

So, in October 2025, your payment would be about $807.

How to Apply or Update Your Canada Child Benefit (CCB)?

1. File Your Taxes on Time

Your 2024 tax return determines your 2025–26 CCB amount. If you don’t file, CRA can’t confirm your income and may pause payments.

2. Apply Once

Use the RC66 form or apply directly online through CRA My Account. Most provinces allow automatic enrollment when you register a child’s birth.

3. Choose Direct Deposit

It’s faster, safer, and ensures your CCB isn’t delayed by mail issues or lost cheques.

4. Keep Information Updated

Update your marital status, number of children, address, and banking info right away if anything changes. Delays in updates often lead to overpayments (which CRA can later reclaim) or missed payments.

Bonus: Provincial & Territorial Top-Ups

Each province or territory may add its own supplement on top of the federal CCB. For example:

- Ontario: Ontario Child Benefit (up to $1,607 per year per child)

- British Columbia: BC Family Benefit (additional monthly payments for families earning under $106,000)

- Quebec: Family Allowance program (paid by Retraite Québec, not CRA)

- Newfoundland and Labrador: NL Child Benefit for low-income families

Social & Economic Impact

Since its launch in 2016, the CCB has been a game changer. Between 2016 and 2024, Canada’s child poverty rate dropped from 11% to just under 7%. Research from the University of Toronto found a strong link between the CCB and reductions in food insecurity.

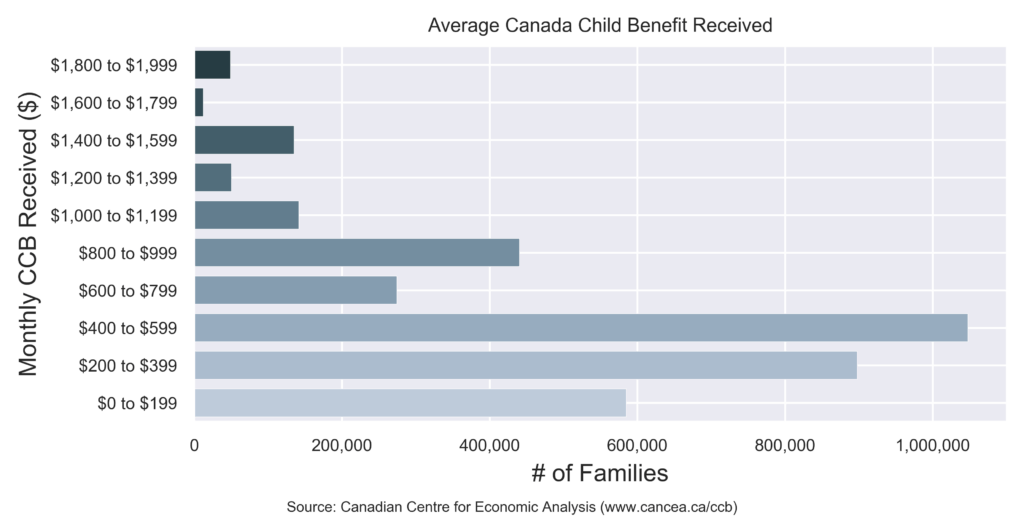

The CRA disburses around $23 billion annually through this program, reaching about 3.5 million families nationwide.

Economists estimate that every $1 of CCB generates roughly $1.30 in economic activity because families spend it locally — on groceries, rent, childcare, and transportation.

Professional & Financial Planning Tips

If you’re an advisor, planner, or social worker, the CCB is a powerful tool to help families manage cash flow.

- Plan around benefit cliffs: Even a small income increase can reduce benefits. Help clients forecast these impacts.

- Encourage filing for the Disability Tax Credit to unlock the Child Disability Benefit.

- Advise clients to budget CCB payments as part of essential monthly income, not extra cash.

- For immigrant families, explain residency requirements and documentation so they can access benefits quickly.

CRA also provides training webinars for community workers on how to support clients with applications and benefit reviews.

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

$10,800 CRA & Service Canada Payments Expected in October 2025 – Check Eligibility & Payment Date

Canada’s Small Business Carbon Rebate: Check Eligibility Criteria and Payment Dates!

Common Issues and Mistakes

- Late Tax Filing: If you file after April 30, your payments can be delayed or temporarily stopped.

- Missing Updates: CRA must be notified of changes in custody, marital status, or residency immediately.

- Overpayments: CRA may recover funds if you receive more than you were entitled to.

- Not Checking CRA My Account: Many miss important notices sent electronically.

- Unclaimed Benefits: Some families fail to apply for the Disability Benefit or provincial top-ups.

The Bigger Picture: CCB’s Legacy and Future

The CCB represents Canada’s commitment to supporting families and children. Over time, indexation has kept it relevant against inflation, but policy experts suggest further enhancements — such as automatic enrollment for newcomers and higher benefits for infants.

A 2024 study by the Canadian Centre for Policy Alternatives argued that increasing benefits for low-income families could cut child poverty by an additional 30%. There’s also ongoing debate about aligning CCB with universal childcare policies for a more comprehensive family support system.

Regardless of future changes, the October 2025 payment is a reminder of how a well-designed benefit can make a real difference for Canadian families.