Canada Carbon Tax Rebate Payment: If you’ve been keeping tabs on the Canada Carbon Tax Rebate Payment Schedule in 2026, you’ve probably noticed that things are looking… a little different. Whether you’re a student, a parent, a retiree, or a finance pro helping clients navigate CRA policies, this guide has everything you need — straight facts, clear explanations, and friendly advice.

Canada Carbon Tax Rebate Payment

The Canada Carbon Tax Rebate Payment Schedule in 2026 isn’t just “delayed” — it’s done. The April 2025 payment was the final standard payout. Because the federal carbon levy was suspended, the rebate program lost its funding base. Still, Canadians can — and should — stay proactive:

File taxes on time.

Track CRA updates.

Explore energy-saving rebates that still exist through provincial or federal programs.

This shift signals the end of one chapter but the start of another — where personal sustainability and smarter energy choices take the spotlight.

| Topic | Details (2026 Update) | Pro Insight / Why It Matters |

|---|---|---|

| Program Name | Canada Carbon Rebate (formerly CAIP) | Changed from “Climate Action Incentive Payment” |

| Program Status (2026) | Discontinued – no new payments after April 2025 | Federal carbon levy abolished for 2025–2030 |

| Final Payment Date | April 15, 2025 (last quarterly payment) | The last standard CRA rebate payout |

| Eligibility (2026) | Only late 2024 tax filers may receive final “catch-up” payment | Keep tax filings up to date to qualify |

| Average 2025 Rebate | $228 (Alberta single), $114 (spouse), $57 (per child) | Based on 2024 base year – CRA data |

| Replacement Programs | Energy efficiency grants, provincial climate rebates | Check programs by province |

| Official Reference | CRA Carbon Rebate Page | Always verify via CRA for accuracy |

What Is the Canada Carbon Tax Rebate Payment?

Let’s rewind for a second. The Canada Carbon Tax Rebate, officially known as the Climate Action Incentive Payment (CAIP) and now referred to as the Canada Carbon Rebate (CCR), was created to offset the costs of the federal carbon pricing program.

The deal was simple: Canadians in certain provinces paid more for fuel and energy due to carbon pricing. In return, the government gave money back — automatically, through your CRA tax filings — to help balance those extra costs.

But here’s the 2026 reality check:

The federal carbon levy — the thing that made the rebate possible — was abolished starting April 1, 2025. So, as of 2026, there’s no more recurring quarterly rebate.

Why the Change? (And What It Means for You)

According to the Government of Canada’s March 15, 2025 announcement, the federal fuel charge is suspended for the period April 1, 2025 – March 31, 2030.

That means:

- No new federal carbon tax collections,

- No corresponding Canada Carbon Rebate payments,

- The final scheduled rebate was issued in April 2025.

In short, there’s no “payment schedule” for 2026 because the program itself isn’t active. However, if you’re a late filer or haven’t received your final rebate, you might still see a one-time payment once your return is processed.

How the Canada Carbon Tax Rebate Payment Worked (Before 2026)?

To appreciate what’s changing, it helps to know how the old system worked.

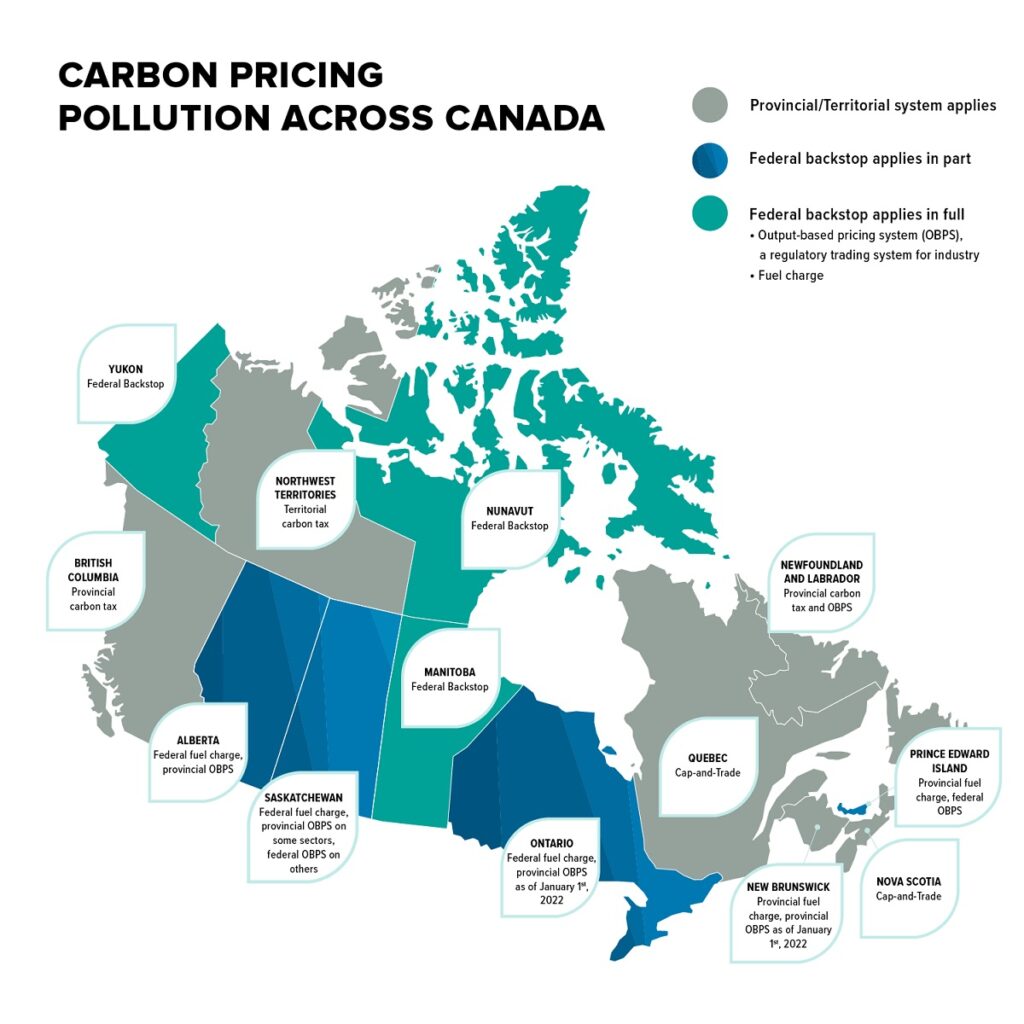

The Federal Carbon Pricing System

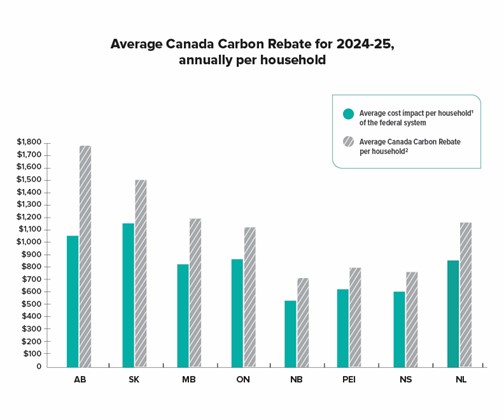

Under the Greenhouse Gas Pollution Pricing Act, certain provinces (like Alberta, Saskatchewan, Manitoba, Ontario, and others) had a federal “backstop” carbon tax applied to fuels.

That tax was meant to encourage energy conservation and reduce emissions, while rebates ensured that households weren’t unfairly burdened.

How Canadians Got Paid?

If you lived in a “backstop” province, you didn’t need to apply for the rebate. You just:

- Filed your income tax return.

- Claimed the Climate Action Incentive line.

- Waited for CRA to issue quarterly payments — January, April, July, October.

Payments were direct deposited or mailed and were tax-free.

Example of Rebate Amounts (Final Year – 2025)

Here’s what Canadians received for the final April 2025 payment, based on 2024 tax data:

| Province | Single Adult | Spouse/Partner | Per Child | Rural Supplement |

|---|---|---|---|---|

| Alberta | $228 | $114 | $57 | +20% |

| Ontario | $140 | $70 | $35 | +20% |

| Manitoba | $190 | $95 | $48 | +20% |

| Saskatchewan | $206 | $103 | $52 | +20% |

These numbers give context to what’s ending — and what Canadians lose going forward.

What Happens in 2026?

Let’s make it clear as day:

No recurring Canada Carbon Rebate in 2026.

No new CRA payment dates in January, April, July, or October.

Possible one-time catch-up payments for those who filed late for 2024.

Provincial or alternate incentives may continue.

You might see other programs pop up under energy efficiency, home retrofits, or green energy credits — but those are separate from the old federal carbon rebate.

Step-by-Step: How to Check Your Canada Carbon Tax Rebate Payment or Pending Payment

Even if the regular schedule ended, it’s smart to verify your status.

Step 1. Log in to CRA My Account

Visit CRA My Account.

- Go to “Benefits & Credits.”

- Look for “Canada Carbon Rebate” or “Climate Action Incentive Payment.”

Step 2. Confirm Your 2024 Tax Return Is Filed

If you missed filing, do it immediately — CRA can’t assess your eligibility or issue late payments otherwise.

Step 3. Check Direct Deposit Information

If your banking info is outdated, you could miss a payment. Update it online through CRA My Account.

Step 4. Monitor CRA News Releases

Sometimes, new transitional or energy assistance programs are announced mid-year.

Step 5. Explore Other Federal & Provincial Supports

Even without a carbon rebate, you may qualify for:

- GST/HST Credit

- Canada Workers Benefit (CWB)

- Home Efficiency Rebates (Natural Resources Canada)

- Provincial climate programs like Alberta’s Energy Savings for Homes or Ontario’s Save on Energy programs.

Real-Life Examples

Example 1 – Sarah from Ontario

Sarah used to get $280 yearly through her carbon rebate. In 2026, that stops. However, she applies for the Canada Greener Homes Grant and receives $5,000 toward new insulation — a much bigger long-term benefit.

Example 2 – Mike from Alberta

Mike filed late for 2024. In early 2026, CRA issues his “catch-up” rebate automatically after processing his return. It’s the final payment he’ll receive under the federal carbon pricing program.

Expert Insight: What Comes Next?

From an economic and policy angle, removing the carbon levy is a major shift.

Experts note three big implications:

- Lower fuel costs in provinces where the levy was applied.

- Reduced federal climate revenue, meaning fewer direct household rebates.

- Provincial flexibility — provinces can now innovate or reintroduce their own carbon or green programs.

Environmental analysts caution that without a carbon price, emission reductions may slow unless replaced by equally strong incentives for clean tech.

For professionals in accounting, sustainability, and policy — this is a big transition period to watch.

Canada Housing Benefit $500 Payment in October 2025: Are You Eligible to Get it? Payment Date

Canada OAS Payment Increased to $1,615 in October 2025: Who will get it? Check Payment Date

Canada GIS Allowance for October 2025: Check Expected Payment Date, Rules and Eligibility

Practical Tips Going Forward

Here’s how to adapt if you counted on those quarterly rebate deposits:

- Rebalance your monthly budget to remove that rebate income.

- Look into home energy upgrades (solar, insulation, heat pumps). These can reduce long-term utility costs and qualify for provincial rebates.

- Claim every credit possible — GST/HST, Canada Workers Benefit, Disability Tax Credit, etc.

- Follow the CRA and Natural Resources Canada websites for future programs.

- Stay informed: policy shifts like this can change quickly with new government priorities.