The £230 State Pension boost will take effect in April 2025, raising the full weekly payment under the United Kingdom’s “triple lock” guarantee. The Department for Work and Pensions (DWP) confirmed that the uprating is designed to protect pensioners’ incomes against rising living costs.

£230 DWP State Pension Boost in Oct 2025

| Key Fact | Detail/Statistic |

|---|---|

| New State Pension (full rate) | £230.25 per week from April 2025 |

| Basic State Pension (old system) | £176.45 per week from April 2025 |

| Triple Lock Mechanism | Highest of inflation, earnings, or 2.5% |

| Qualifying Years Needed (new system) | 35 years for full pension, 10 years minimum for any |

| Official Website | GOV.UK |

The April 2025 increase provides a significant uplift for pensioners, but debates continue over the sustainability of the triple lock. A review of the State Pension age is also expected later in the decade, which could affect when future generations begin receiving payments.

What Is Changing in 2025

From 6 April 2025, the full new State Pension will rise from £221.20 to £230.25 per week. The basic State Pension, for those who reached pension age before April 2016, will increase to £176.45 per week.

The increase follows the triple lock rule, under which pensions grow in line with whichever is highest: inflation, average earnings, or 2.5 per cent. The DWP confirmed the rise after average wage growth in mid-2024 outpaced inflation.

Who Is Eligible

Qualifying Years Requirement

According to government guidance, pensioners need at least 35 qualifying years of National Insurance (NI) contributions to receive the full new State Pension. A minimum of 10 years is required to receive any payment at all.

Periods of “contracting out”—when workers paid into certain occupational or private schemes instead of the additional State Pension—may reduce the final amount. In such cases, individuals may receive a smaller State Pension but potentially higher private pension benefits.

Voluntary Contributions

The government allows certain gaps in NI records to be filled through voluntary contributions. This option is available for people who are not yet of pension age but want to secure a higher pension entitlement. According to Age UK, not all gaps can be filled, and deadlines may apply.

Why the Increase Matters

Pensioners have faced sharp cost-of-living pressures over the past three years. Food and energy bills surged after the pandemic and during the war in Ukraine. Although inflation slowed in 2024, household budgets remain tight.

“The triple lock is vital to ensuring pensioners’ incomes keep pace with rising costs,” said Tom Selby, director of public policy at AJ Bell, in a statement reported by the BBC. “Without it, many older people would risk falling behind in real terms.”

However, some economists have questioned the policy’s long-term affordability. The Institute for Fiscal Studies (IFS) has previously warned that the triple lock could push State Pension spending to unsustainable levels by the 2040s.

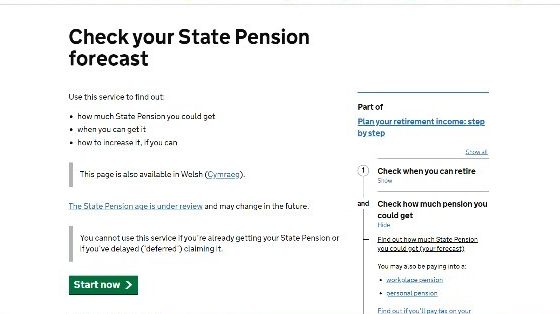

How to Check Your State Pension Forecast?

The government urges individuals to use the State Pension forecast tool on GOV.UK. This service allows users to see their current entitlement, identify gaps in contributions, and explore whether voluntary top-ups are available.

New UK Driving Rule Change for Seniors Begins from 1 October 2025 – Check Revised Rules

DWP £250 Support for UK Families Confirmed – Payment Date, Eligibility, and Payment Rules

The £1,700 Death Cost No One Warns You About; UK Households Face Shocking New Pressure

FAQ

How many years of contributions do I need for the full pension?

You generally need 35 qualifying years of NI contributions for the full new State Pension. At least 10 years are required for any payment.

What if I have gaps in my record?

You may be able to make voluntary NI contributions to fill certain gaps. The government sets deadlines for backdating, so it is important to check promptly.

Can I defer my State Pension?

Yes. Deferring increases your weekly payment. According to DWP, for every nine weeks you defer, your pension increases by about 1 per cent.

What about Pension Credit?

If your income is below a certain threshold, you may qualify for Pension Credit, which tops up weekly income. This is separate from the State Pension but helps support low-income pensioners.

Will the triple lock continue beyond 2025?

The government has confirmed the triple lock for April 2025. However, future commitments will depend on economic conditions and political decisions. Think tanks including the IFS have warned of long-term cost pressures.