The Internal Revenue Service (IRS) has confirmed that the average tax refund for 2025 is nearly $3000, reflecting an increase from last year’s figure. Millions of U.S. taxpayers are now receiving payments, with timing and eligibility depending on individual filings and credits.

$3000 on Average Confirmed

| Key Fact | Detail/Statistic |

|---|---|

| Average refund in 2025 | $3324 (some reports cite $2,939) |

| Standard IRS refund timeline | Within 21 days of e-file acceptance |

| Refunds with EITC or ACTC credits | Delayed until mid-February by law |

| Official Website | IRS.gov |

The IRS continues to emphasize electronic filing and direct deposit as the fastest, most reliable way to receive refunds. Officials said most payments should reach taxpayers within three weeks, though cases involving credits or manual reviews may extend beyond that window.

Why Refunds Average $3000 in 2025

The IRS said refunds have grown slightly this year because of changes in withholding patterns, tax credits, and filing volumes. According to a March 2025 update, the average refund reached $3,324, up nearly 6 percent from 2024.

However, some outlets, including Newsweek, reported a more conservative figure of $2,939 based on June distribution data. The difference reflects the timing of filings and the inclusion of late-season paper returns, which often bring smaller or adjusted refunds.

Who Is Eligible for a Refund?

Refunds are not guaranteed. A taxpayer qualifies only when total tax payments — through wage withholding or estimated payments — exceed their tax liability. Eligibility also depends on accurate filing and whether credits are claimed.

Those who file for the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) face mandatory processing delays. Federal law requires the IRS to hold these refunds until at least mid-February to prevent fraud and improper payments.

When Payments Are Issued

The IRS advises most filers to expect refunds within 21 days if they submit electronically and select direct deposit. Paper returns can take four to six weeks or longer.

Data published by tax advisory firms shows that e-filed returns submitted in May were paid by direct deposit between late May and mid-June. Paper checks followed one week later, while mailed returns took until July.

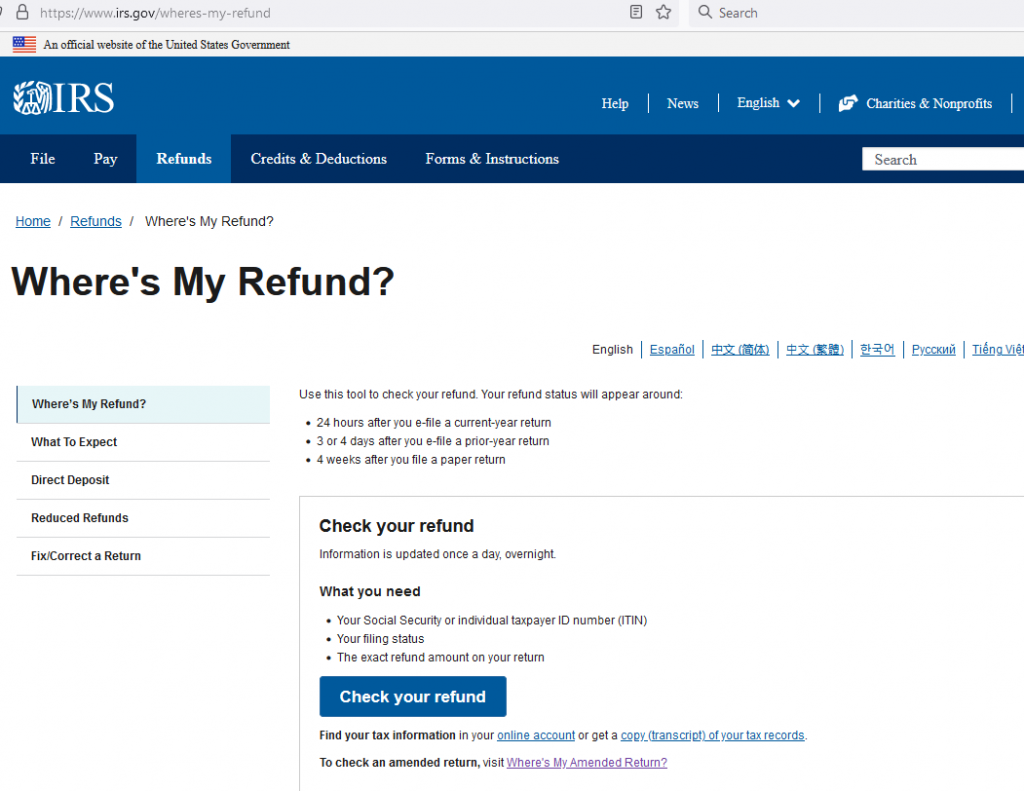

Refund status can be tracked using the IRS’s “Where’s My Refund?” tool or the IRS2Go mobile application.

Expert Perspectives on Taxpayer Relief

Economists note that while a $3,000 refund may feel significant, it reflects taxpayers’ overpayment throughout the year. “A refund is not a bonus from the government,” said Mark Steber, chief tax information officer at Jackson Hewitt, in comments reported by CBS News. “It’s simply the IRS returning your own money without interest.”

Financial advisers caution households against relying on refunds for basic budgeting. Instead, they recommend adjusting withholding to keep more income during the year, while using refunds to pay down debt or build savings.

Broader Context for 2025 Filings

The 2025 tax season began on January 27, with more than 50 million returns filed by mid-March, according to the IRS. Agency officials reported smoother operations compared to pandemic-era seasons, citing new technology investments and additional staff funded by the Inflation Reduction Act.

Still, delays persist for paper filers and for cases requiring manual review. The IRS warned that certain claims — such as large charitable deductions or cryptocurrency transactions — may trigger additional verification steps.

US $4983 Direct Deposit in October 2025 For Everyone – Check Eligibility & Payment Date

$400 Inflation Refund Check Coming for these People – Check Eligibility & Payment Date

FAQ

1. What is the average tax refund for 2025?

The average refund reported by the IRS in March 2025 was $3,324, though later figures suggested closer to $2,939 depending on filing patterns.

2. How long does it take to receive my refund?

Most e-filed returns with direct deposit are issued within 21 days. Paper returns or mailed checks can take several weeks longer.

3. Why are refunds higher in 2025?

Refunds increased because of changes in withholding, tax credits, and the mix of early electronic filings.

4. Will everyone get $3,000 back?

No. Refunds vary widely based on income, tax liability, credits claimed, and whether payments exceeded what was owed.

5. Why is my refund delayed?

Delays occur for paper filings, incorrect information, or claims involving EITC and ACTC. By law, these refunds cannot be released until mid-February.

6. How can I check the status of my refund?

The IRS provides the “Where’s My Refund?” tool and the IRS2Go app for real-time updates.