Canada’s Small Business Carbon Rebate: If you’re a small business owner in Canada, there’s some good news that could put real money back in your pocket — it’s called the Canada Small Business Carbon Rebate. Whether you run a coffee shop in Calgary or a logistics firm in Ontario, this rebate could mean hundreds or even thousands of dollars in savings. The federal government designed this rebate to return carbon tax revenues to small and medium-sized enterprises (SMEs) that have been paying higher costs due to Canada’s carbon pricing system. Think of it like a refund for doing your part in the fight against climate change — and yes, you might already qualify without even realizing it.

Canada’s Small Business Carbon Rebate

The Canada Small Business Carbon Rebate is more than a refund — it’s recognition that small businesses play a crucial role in Canada’s climate plan. By ensuring you meet the simple eligibility rules and file on time, you could receive a meaningful payout that helps balance rising operating costs. So don’t leave money on the table — double-check your CRA account, keep those tax filings tight, and get ready for your well-earned carbon rebate.

| Detail | Information |

|---|---|

| Program Name | Canada Carbon Rebate for Small Businesses |

| Eligibility | Canadian-Controlled Private Corporations (CCPCs) with ≤ 499 employees |

| Payment Type | Automatic — issued by CRA (no application needed) |

| Payment Dates | Began December 2024; final rebate expected after July 15 2025 filing deadline |

| Fuel-Charge Years Covered | 2019–20 through 2024–25 |

| Average Payouts | Estimated $2,000 – $10,000 per small business, depending on province & staff count |

| Where to Check | Official CRA Portal |

| Non-Taxable Status | As of July 2025, rebates are proposed to be non-taxable (pending legislation) |

| Designated Provinces | AB, SK, MB, ON, NB, NS, PEI, NL |

| Official Source | canada.ca |

Why the Canada’s Small Business Carbon Rebate Exists?

When Canada introduced the federal carbon pricing system back in 2019, businesses began paying extra on fuels such as gasoline, diesel, and natural gas. The aim was to make polluters pay and encourage cleaner operations — but it also meant higher costs for small businesses already operating on tight margins.

To offset those costs, Ottawa created the Canada Carbon Rebate for Small Businesses (formerly known as the Climate Action Incentive Fund). It’s basically the government saying: “Hey, we know carbon pricing affects your costs, so here’s your share back.”

According to Finance Canada, small and medium-sized businesses account for over 40% of employment in the private sector — so ensuring they get their fair carbon rebate is crucial for both economic stability and climate fairness.

Who’s Eligible (and Who Isn’t)

To qualify, your business must meet all these requirements:

- Be a Canadian-Controlled Private Corporation (CCPC).

- Employ 499 or fewer people nationwide.

- Have at least one employee in a designated province (where the federal fuel charge applies).

- File your corporate income tax return on time.

If your business filed its 2023 tax return by July 15, 2024, you’re already in line for payment. Even if you missed that deadline, you can still qualify if you file before December 31, 2024 — pending the new legislation’s Royal Assent.

Who’s out? Cooperatives, credit unions, charities, and non-profits don’t qualify under this program.

How the Payment Works?

Here’s the cool part: you don’t have to apply. The Canada Revenue Agency (CRA) calculates your rebate automatically based on the number of employees (as shown on T4 slips) and your business’s location.

Payments are issued directly by CRA, either through:

- Direct deposit (if you’ve already set it up), or

- Cheque, mailed to your business address.

Example:

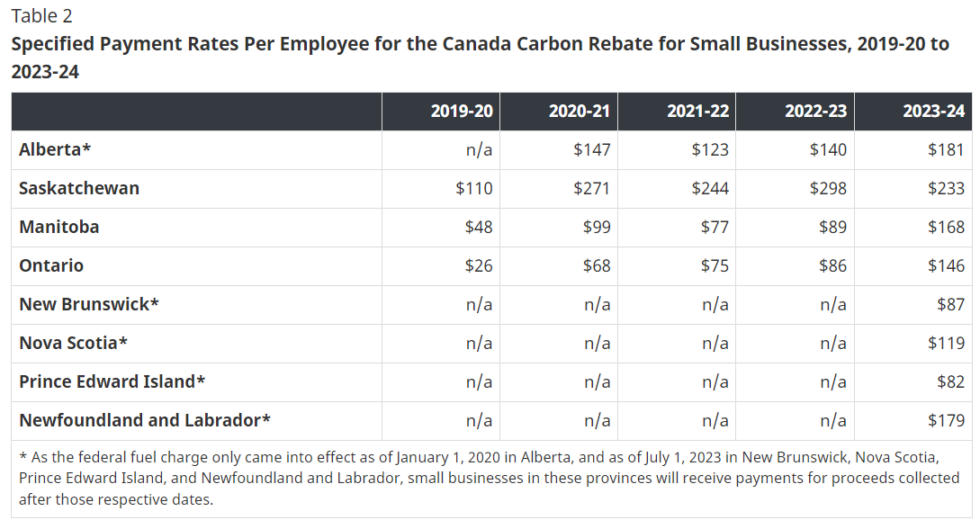

Let’s say you own a small trucking firm in Saskatchewan with 20 employees. CRA multiplies your eligible employee count by your province’s per-employee rate. If Saskatchewan’s rate is $230 per employee, your total rebate could be around $4,600.

When You’ll Get Paid?

The first batch of payments started rolling out in December 2024. Businesses with direct deposit often received funds around December 16, 2024.

If you’re filing later — between July 16 and December 31, 2024 — your rebate will arrive once the enabling legislation becomes law.

The final rebate will cover the 2024–25 fuel-charge year, provided you file your 2024 corporate tax return by July 15, 2025.

Step-by-Step Guide to Checking Eligibility for Canada’s Small Business Carbon Rebate

Step 1 – Confirm You’re a CCPC

Visit the CRA website and review the CCPC definition. Most incorporated Canadian businesses qualify.

Step 2 – Verify Your Employee Count

Count all employees on payroll (full- and part-time) for the relevant calendar year. If you had ≤ 499, you’re eligible.

Step 3 – Check Your Province

Only businesses with at least one employee in a designated province are eligible. These include:

- Alberta

- Saskatchewan

- Manitoba

- Ontario

- New Brunswick

- Nova Scotia

- Prince Edward Island

- Newfoundland and Labrador

Step 4 – File Your Taxes on Time

Ensure your corporate return is filed before the relevant July 15 deadline. CRA uses your return to determine payment amounts.

Step 5 – Wait for the Deposit

Once processed, your rebate will appear as a line item in your CRA account or direct deposit.

Real-World Example

Meet Renee, who owns a bakery in Manitoba. With 10 employees, her energy costs rose after the carbon price kicked in. She filed her 2023 corporate taxes in June 2024 and received a $2,300 rebate in December.

Renee said the rebate covered almost two months of her commercial gas bill — not bad for money she didn’t even have to apply for.

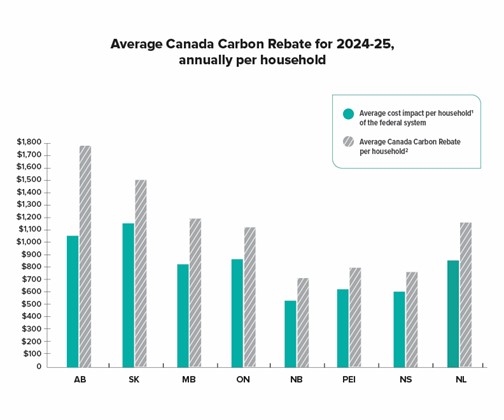

How Much Money Are We Talking About?

Amounts vary by province and fuel-charge year. On average, small businesses are expected to receive between $2,000 and $10,000, depending on the number of employees and location.

According to the Department of Finance, over $2.5 billion in total rebates are being distributed to approximately 600,000 small businesses nationwide.

Common Mistakes to Avoid

- Missing the filing deadline — late filers risk missing payments entirely.

- Incorrect payroll data — ensure your T4s match your tax return.

- Ignoring direct deposit setup — cheques take longer and can get lost.

How This Compares to U.S. Small Business Programs?

While the U.S. doesn’t have an identical federal carbon rebate, American SMEs can access tax credits and grants through programs like the Inflation Reduction Act (IRA). These reward companies investing in clean energy and efficiency upgrades.

So, if you run a cross-border operation, think of the Canadian rebate as your northern counterpart to U.S. clean-energy incentives.

$10,800 CRA & Service Canada Payments Expected in October 2025 – Check Eligibility & Payment Date

Canada $2616 Caregiver Credit (CCC) in 2025; How to Claim it? Check Eligibility & Payment Date

Expert Tips to Maximize Your Rebate

- Set reminders for July 15 deadlines every year.

- Review payroll accuracy — CRA uses this data to calculate your payout.

- Stay subscribed to CRA updates for legislative changes.

- Consider green upgrades — energy-efficient improvements may qualify you for additional provincial or federal incentives.