Canada $8,396 Age Amount Tax Credit: If you’ve seen talk online about the “Canada $8,396 Age Amount Tax Credit in October 2025,” you’re not alone. The buzz sounds promising — but what’s real, what’s outdated, and what can you actually claim? Let’s break it down like a friendly chat over coffee, with some rock-solid facts and clear steps from an experienced tax pro’s playbook. Whether you’re retired, approaching 65, or helping your parents figure out their taxes — this guide’s for you.

Canada $8,396 Age Amount Tax Credit

The Canada Age Amount Tax Credit remains one of the most straightforward ways seniors can cut their taxes. The rumored $8,396 October 2025 payment? Not real — but the credit itself definitely is. By 2025, expect a maximum amount around $9,028, phased out as your income rises past about $44,000. To claim it, you must be 65 or older, file a tax return, and calculate your reduction based on income. It won’t make you rich overnight, but it’ll absolutely help keep more of your hard-earned money in your pocket.

| Topic | 2024 / 2025 Figures | Key Details & Official Links |

|---|---|---|

| Maximum Federal Age Amount | $8,790 (2024) → ~ $9,028 (2025 projected) | Canada Revenue Agency |

| Clawback Starts At | $44,325 net income (2024) | Income above this reduces credit by 15% |

| Eliminated By Income Of | $102,925 (2024) | No federal credit beyond this threshold |

| Age Requirement | 65 or older by Dec 31 of tax year | Applies to Canadian residents only |

| Transferable To Spouse? | Yes, if unused | H&R Block Canada |

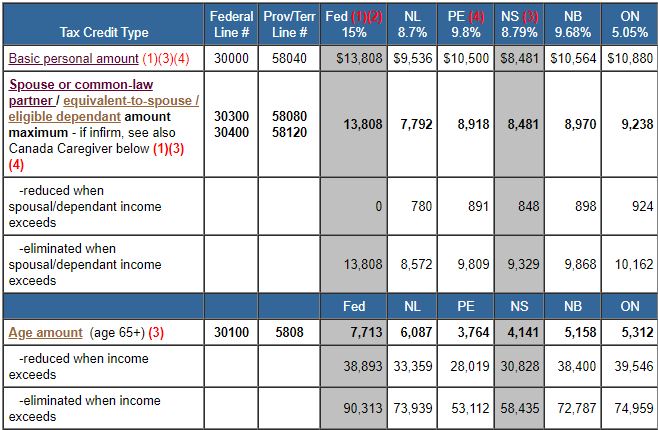

| Province Versions? | Yes – separate provincial age credits apply | CRA Provincial Info |

What’s the Canada $8,396 Age Amount Tax Credit?

The Age Amount Tax Credit is a non-refundable federal tax credit available to Canadians who are 65 years or older by December 31 of the tax year.

Here’s the simple idea: it’s designed to help seniors by lowering the amount of federal income tax they owe. It’s non-refundable, meaning it can bring your taxes down to zero — but if you owe no tax, you won’t get a “refund check” from it.

In earlier years, this credit’s base amount was $8,396, but it has been indexed to inflation and will likely rise to $9,028 in 2025, according to CRA updates and independent tax analysts.

The Big Picture: Why This Credit Exists

Canada’s tax system includes several senior-friendly benefits: the Age Amount, the Pension Income Amount, and income-tested benefits like OAS (Old Age Security) and GIS (Guaranteed Income Supplement).

The Age Amount specifically helps those with modest retirement incomes — people who worked all their lives, saved a bit, but don’t have large private pensions. CRA data shows more than 5 million Canadians aged 65 and up file returns each year, and a significant portion qualify for at least part of the Age Amount credit.

How the Math Works (Made Simple)

Let’s keep it real — nobody loves formulas, but here’s how the math shakes out.

- Start with the maximum amount.

For 2024 that’s $8,790 (2025 ~ $9,028). - Find your net income (Line 23600 on your return).

- Subtract the clawback threshold.

Example: $50,000 – $44,325 = $5,675. - Multiply the difference by 15%.

$5,675 × 0.15 = $851.25. - Subtract that from the max credit.

$8,790 – $851.25 = $7,938.75 eligible credit.

But remember: it’s non-refundable. So, if you owe less than that in tax, it’ll only bring your bill down to $0 — not further.

Comparison: Age Amount vs Other Senior Benefits

| Benefit | Who Qualifies | Type of Benefit | Payout/Effect |

|---|---|---|---|

| Age Amount Tax Credit | 65+ Canadians with modest incomes | Non-refundable tax credit | Reduces tax owed |

| Pension Income Amount | Any taxpayer with eligible pension income | Non-refundable tax credit | Reduces tax owed up to $2,000 |

| OAS (Old Age Security) | 65+ with residency requirements | Monthly pension benefit | Direct deposit payment |

| GIS (Guaranteed Income Supplement) | Low-income OAS recipients | Income-tested cash benefit | Monthly tax-free payment |

So, while OAS and GIS put cash directly into your pocket, the Age Amount helps you keep more of what you’ve earned by reducing your tax burden.

How to Claim Canada $8,396 Age Amount Tax Credit Step by Step?

- Confirm you’re 65 by December 31.

You only need to turn 65 during the year — not before January 1. - Check your net income.

Look at Line 23600 of your return. If you’re under the threshold, you’re golden. - Compute your reduction (if needed).

Subtract the threshold and multiply by 15%. Subtract from the max credit. - Enter the result on Line 30100.

CRA’s software does this automatically if you use certified programs like TurboTax or Wealthsimple Tax. - Transfer unused amounts to your spouse.

Use Schedule 2 if you don’t need the full credit to reduce your tax.

Common Mistakes People Make

- Not filing taxes at all because they think “I owe nothing.” You still need to file to claim credits!

- Forgetting to transfer unused credits to a spouse.

- Confusing OAS clawback with Age Amount clawback. They’re different rules.

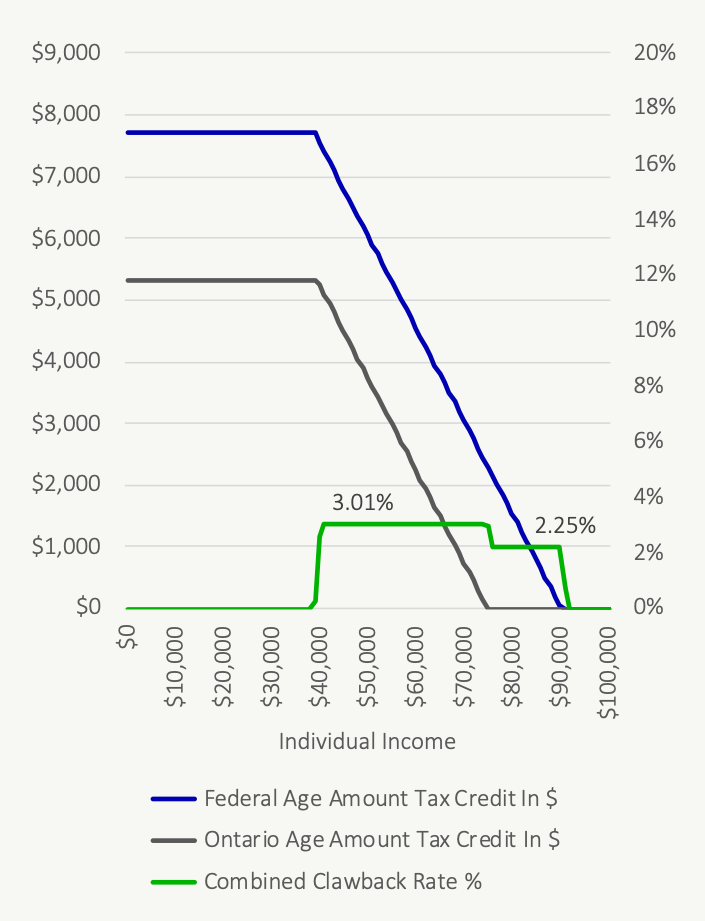

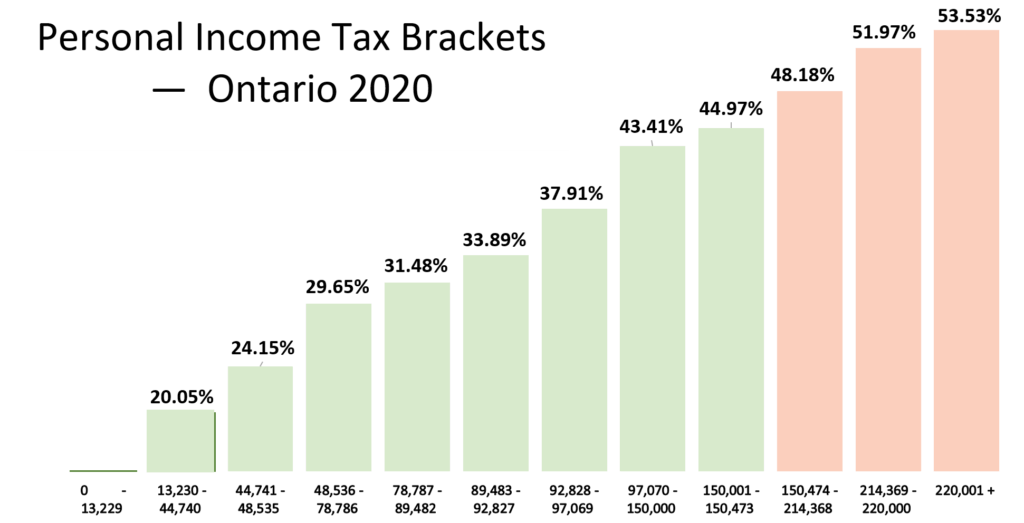

- Overlooking provincial versions. Some provinces (like Ontario and BC) add their own bonus amounts.

- Using outdated numbers. Always check CRA’s website each tax season.

Pro Insight: Smart Tax Planning for 2025 and Beyond

Tax pros often suggest a few strategies to maximize this credit and stay below the clawback:

- Split pension income. This reduces one spouse’s net income, potentially preserving the Age Amount.

- Contribute to an RRSP early in the year. Lower taxable income helps you keep the credit.

- Use Tax-Free Savings Accounts (TFSA) for investment growth — TFSA income doesn’t affect net income for clawback purposes.

- Track medical and charitable credits. Stacking these with the Age Amount can further cut your bill.

Real-Life Examples

| Person | Age & Income | Result |

|---|---|---|

| Linda, 67 | $40,000 | Full Age Amount ($8,790 2024 / ~$9,028 2025). |

| Frank, 70 | $90,000 | Partial credit after clawback (~$1,950 left). |

| Nora, 66 | $110,000 | Over limit → no federal Age Amount. |

| Harold, 65 | $35,000 but low tax owed | Can transfer unused portion to spouse. |

Canada OAS Payment Increased to $1,615 in October 2025: Who will get it? Check Payment Date

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule

Canada $2988 OAS Per Month for these Seniors: Check Eligibility and Payment Date

Final Thoughts

At the end of the day, the Age Amount Tax Credit is one of those underrated perks that can make a real difference for seniors — especially when paired with smart income planning. Don’t let misleading posts about a “$8,396 October payment” throw you off. The credit exists, it’s valuable, and if you play it right, it can trim over a thousand bucks off your tax bill.

If you’re turning 65 soon, make it a priority to plan your income sources, review your RRSPs, and use CRA-approved tools or a tax advisor. Little moves today can save you hundreds tomorrow.