AT&T $177M Data Breach Settlement: If you’ve been an AT&T customer in the past decade, you’ve probably seen headlines about the $177 million data breach settlement. It’s not just a rumor — this is a real, court-supervised legal action that could put money directly in your pocket. The telecom giant agreed to pay millions after two serious data breaches in 2024 exposed sensitive information from tens of millions of customers. Now, as part of a class-action settlement, affected individuals can claim up to $7,500 in compensation. This guide breaks everything down in plain English — what happened, who qualifies, how to file a claim, what documentation you need, and how to make sure you get every dollar you’re entitled to.

AT&T $177M Data Breach Settlement

The AT&T $177 million data breach settlement is an opportunity for customers to receive fair compensation for the exposure of their private data. More importantly, it marks a turning point for how American companies are held accountable for protecting consumer information. If you were ever an AT&T customer, don’t wait. File your claim before November 18, 2025, and take the time to secure your personal data. You’ve already paid for your phone plan — you shouldn’t have to pay again for someone else’s security failure.

| Details | Information |

|---|---|

| Settlement Amount | $177 million total |

| Maximum Payout | Up to $7,500 per person |

| Data Breach Years | 2024 (March and July incidents) |

| Number of Affected Customers | Approximately 73 million |

| Claim Filing Deadline | November 18, 2025 |

| Opt-Out/Objection Deadline | October 17, 2025 |

| Final Court Hearing | December 3, 2025 |

| Expected Payment Date | Early 2026 (after final approval) |

| Official Settlement Site | AT&T Data Incident Settlement |

| Settlement Administrator | Kroll Settlement Administration, LLC |

| Mailing Address | P.O. Box 5324, New York, NY 10150-5324 |

| Main Sources | CBS News, Investopedia, AT&T Official Statement |

What Happened in the AT&T $177M Data Breach Settlement?

In March 2024, security researchers discovered that personal data tied to AT&T users had been posted for sale on dark-web forums. The information included names, birth dates, account numbers, addresses, and even Social Security numbers.

Then in July 2024, AT&T confirmed another breach involving a different batch of customers. This second breach impacted users who thought their accounts were safe because they’d left AT&T years earlier.

The leaks affected current and former customers of AT&T, Cricket Wireless, and affiliated brands. AT&T has since stated that the exposed data was not obtained from its core systems but from third-party vendors. Still, the breaches led to widespread lawsuits across several states.

To resolve those claims, AT&T agreed to a $177 million nationwide settlement, without admitting wrongdoing, to reimburse affected customers and strengthen its cybersecurity systems.

Who Qualifies for the Settlement?

You could be eligible for compensation if you meet the following criteria:

- You were a current or former AT&T customer between 2015 and 2024.

- You received a notice of eligibility from AT&T or the settlement administrator.

- Your personal data was confirmed as part of the 2024 data breaches.

- You file a valid claim by November 18, 2025.

According to AT&T’s legal filing, impacted customers will be notified by email or mail. These messages come from [email protected] — so don’t delete them.

If you were affected by both breaches, you can receive up to $7,500 total ($5,000 from the first and $2,500 from the second).

How to Apply for the AT&T $177M Data Breach Settlement?

Here’s a simple, step-by-step guide to filing your claim:

Step 1. Visit the Official Website

Go to attdataincidentsettlement.com. This is the only official website administered by Kroll Settlement Administration. Avoid any other sites claiming to “speed up” your claim.

Step 2. Check Your Eligibility

Use your name, contact details, and claim number (if provided in your notice) to verify whether your information was part of the breach.

Step 3. Choose the Type of Claim

There are two payment options:

- Documented Loss Claim: For those who can show actual financial harm (identity theft, fraud, or costs like credit monitoring). The maximum payout is $7,500.

- Flat-Rate Claim: For affected users without documentation. The payout will likely range from $25 to $200, depending on the total number of approved claims.

Step 4. Gather Proof (if applicable)

For a documented claim, collect:

- Receipts or invoices for identity protection or credit monitoring

- Bank or credit card statements showing unauthorized charges

- Police or fraud reports

- Proof of time spent fixing related issues

Step 5. Submit the Claim

You can file online or by mail.

Mailing address:

AT&T Data Incident Settlement

c/o Kroll Settlement Administration LLC

P.O. Box 5324

New York, NY 10150-5324

Claims must be submitted or postmarked by November 18, 2025.

Step 6. Wait for Processing

Once the court grants final approval (expected December 3, 2025), payments will start to go out in early 2026. You’ll be notified if additional information is needed.

Understanding the Legal Timeline

| Event | Deadline |

|---|---|

| File Objections or Opt-Out | October 17, 2025 |

| Submit Claim Form | November 18, 2025 |

| Final Approval Hearing | December 3, 2025 |

| Payment Distribution | Early 2026 |

If you do nothing, you’ll lose the right to compensation and give up your right to sue AT&T separately in the future.

What Documentation Works Best?

For the higher-tier payment, your claim will stand out if you include clear, traceable documentation. Examples of strong evidence include:

- Copies of emails from AT&T notifying you about the breach

- Bank letters showing account compromises

- Transaction receipts from credit-repair services

- Time logs of calls or communications related to fraud resolution

Even if your losses were small, combine all proof to create a compelling claim file. The settlement administrator will review all claims carefully before issuing payments.

Common Mistakes to Avoid When Filing

- Missing the deadline. Late submissions are automatically rejected.

- Using fake or incorrect documents. Falsified claims can disqualify you entirely.

- Filing through unofficial websites. Only use the official Kroll link.

- Forgetting to include your contact info. Always double-check your email and mailing address.

It’s worth taking your time to fill everything out correctly. Once submitted, it can’t be edited.

Why AT&T $177M Data Breach Settlement Matters for Consumers?

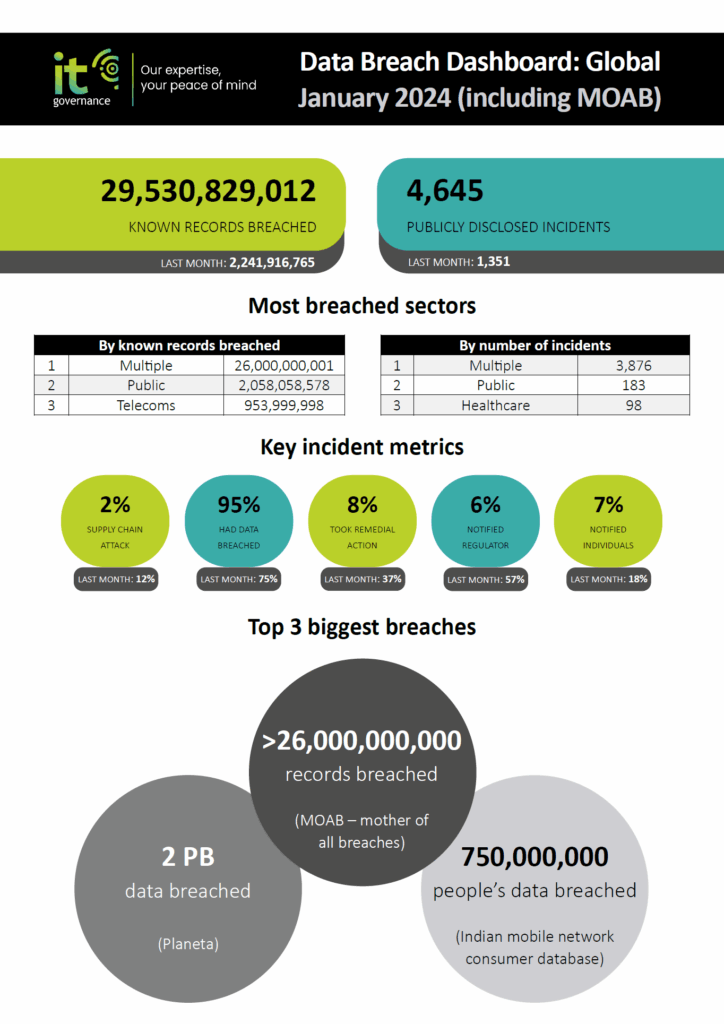

The AT&T settlement is part of a growing wave of data privacy accountability in the U.S. Over the past five years, Americans have seen record numbers of corporate data breaches. According to the Identity Theft Resource Center, there were more than 3,200 reported breaches in 2024, exposing the data of 350 million people.

This means nearly every American has likely had some personal data compromised at least once. Settlements like AT&T’s show that companies are being held responsible — and customers are finally getting a chance to be made whole.

Protecting Yourself After a Data Breach

Even if you weren’t directly affected, the AT&T case should remind everyone to take data privacy seriously.

Follow these tips to protect your identity:

- Freeze your credit. You can do this for free at Equifax, Experian, and TransUnion.

- Use strong passwords and a password manager. Avoid reusing the same password across multiple accounts.

- Turn on two-factor authentication (2FA). Especially for online banking, email, and telecom accounts.

- Check your credit reports regularly. Visit AnnualCreditReport.com to get one free report per bureau each year.

- Set up account alerts. Most banks and credit cards allow you to get instant notifications for suspicious activity.

These steps may sound simple, but they are effective at stopping most identity theft before it starts.

Avoiding Scams Related to the Settlement

Unfortunately, scammers often use big settlements to target victims again. Be aware of these warning signs:

- Fake claim websites: Only use attdataincidentsettlement.com.

- Emails from unknown senders: Official messages come from [email protected].

- Phone calls asking for payment: No one will call or charge you to help file a claim.

- Texts promising faster payouts: Those are phishing attempts — don’t click any links.

If you get a suspicious message, report it to the Federal Trade Commission (FTC) via reportfraud.ftc.gov.

Tax Implications of the Settlement

For most people, these payments will not count as taxable income if they reimburse actual financial losses. However, flat-rate payments or interest portions could be taxable. The IRS generally treats reimbursements as non-taxable, but if you receive more than you lost, you may owe taxes on the difference. Keep all settlement letters and payment receipts for your 2026 tax records.

What If You Miss the Deadline?

If you miss the November 18, 2025 claim deadline, you’ll lose the right to compensation and won’t be able to bring your own lawsuit against AT&T for the same breach.

That’s why it’s critical to act early. Even if you don’t think you were directly impacted, submit a claim anyway — the verification process will confirm your eligibility automatically.

Broader Impact on the Telecom Industry

This case will likely reshape how major telecoms handle customer data. Experts predict increased investment in zero-trust security, real-time threat detection, and AI-driven encryption systems.

According to Michael C. Jones, a cybersecurity advisor based in Washington, D.C.:

“Telecom companies are sitting on a gold mine of customer data, and hackers know it. The AT&T settlement shows that weak data oversight now comes with real financial consequences.”

Other providers are watching closely. Similar lawsuits against T-Mobile and Verizon are already in progress, and industry analysts expect more settlements in the coming years.