$8,844 Canada WEPP Benefit: Ever wonder what happens if your employer suddenly goes bankrupt and you’re left hanging without your paycheck? That’s a tough spot for any worker. Thankfully, Canada’s Wage Earner Protection Program (WEPP) is designed to step in during these difficult times. If you lost wages due to your employer’s insolvency in October 2025, you could be eligible for up to $8,844 — a critical financial cushion to help you stay on your feet. This article breaks down everything you need to know about the Canada WEPP Benefit for October 2025 — from eligibility rules and how to claim to important dates and real-world examples. Whether you’re an employee navigating sudden job loss or a professional advising clients, this guide offers practical, friendly advice while giving you the facts you need to secure your benefits confidently.

$8,844 Canada WEPP Benefit

The Canada Wage Earner Protection Program is a crucial part of the country’s commitment to protecting workers during sudden financial hardships caused by employer bankruptcy or insolvency. With a maximum benefit of $8,844 in 2025, it offers peace of mind and financial support when it’s needed most. If your employer’s insolvency has left you unpaid, don’t wait — gather your documents, apply through official channels, and secure the money you’ve earned. Keep this guide handy, bookmark the official resources, and stay informed to navigate your WEPP claim smoothly.

| Topic | Details | Source/Link |

|---|---|---|

| Maximum WEPP Benefit for 2025 | $8,844 | Canada.ca |

| Key Eligibility | Employment ended due to employer insolvency | Service Canada |

| Payment Date for October 2025 | Payments typically processed weeks after application | |

| Interaction with Other Benefits | Can be combined with EI if eligible |

What is the Wage Earner Protection Program (WEPP)?

WEPP is a government safety net to protect employees from losing their wages due to employer insolvency. It was created to fill a major gap in Canada’s insolvency system—before WEPP, most workers owed wages by bankrupt employers received very little or nothing at all.

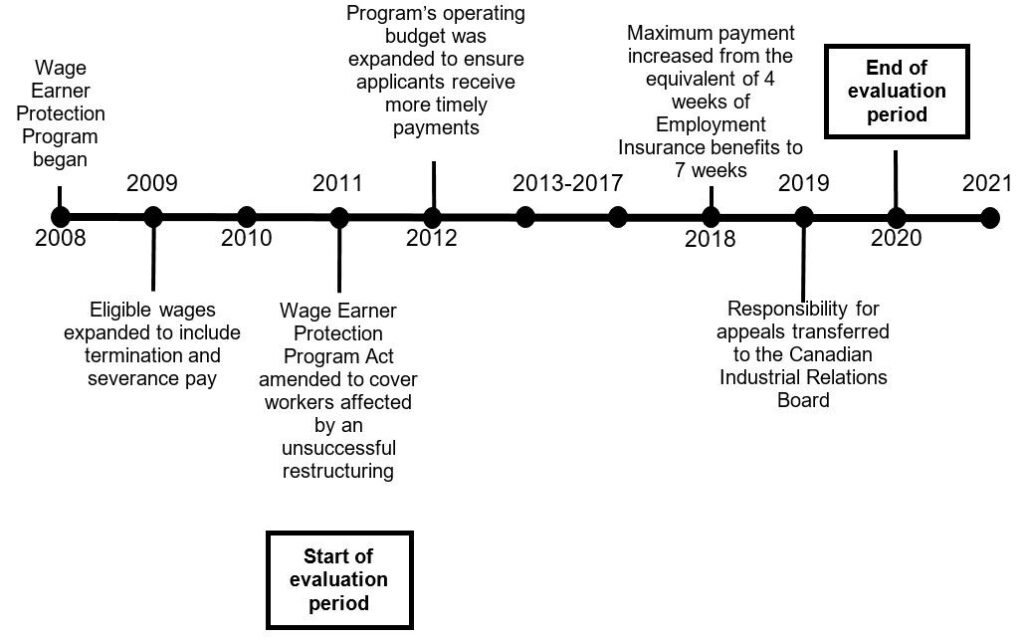

The Wage Earner Protection Program Act, passed in 2005 and coming into force in 2008, was part of broader insolvency reforms aimed to ensure laid-off workers got priority payments during bankruptcies or receiverships. The program compensates unpaid wages, vacation, severance, and termination pay up to a maximum amount, preventing employees from falling through the cracks.

Before WEPP, only about 5% of workers managed to recover a small fraction of unpaid wages. Since its introduction, WEPP has issued hundreds of millions in payments and significantly shortened waiting times compared to previous bankruptcy processes—making it a vital financial relief for Canadian workers.

How Does the $8,844 Canada WEPP Benefit Work in October 2025?

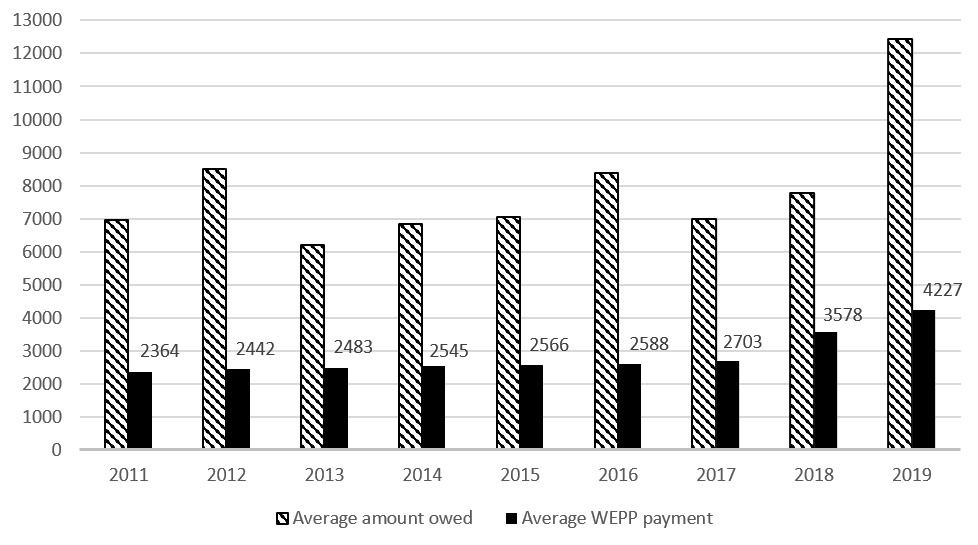

Maximum Payment: $8,844

In 2025, the maximum payment under WEPP is $8,844, representing 7 times the weekly insurable earnings under the Employment Insurance Act. This sum covers unpaid wages, vacation pay, severance, and termination pay owed by insolvent employers.

Payment Timing for October 2025

Although payments depend on when the employer’s insolvency proceedings finalize and when the employee applies, payments related to cases in October 2025 are typically processed within a few weeks after claim approval. To track payment schedules and deadlines, use official resources.

Who is Eligible for the $8,844 Canada WEPP Benefit?

Here are the core eligibility criteria:

- You must have been an employee of a company that declared bankruptcy, receivership, or insolvency.

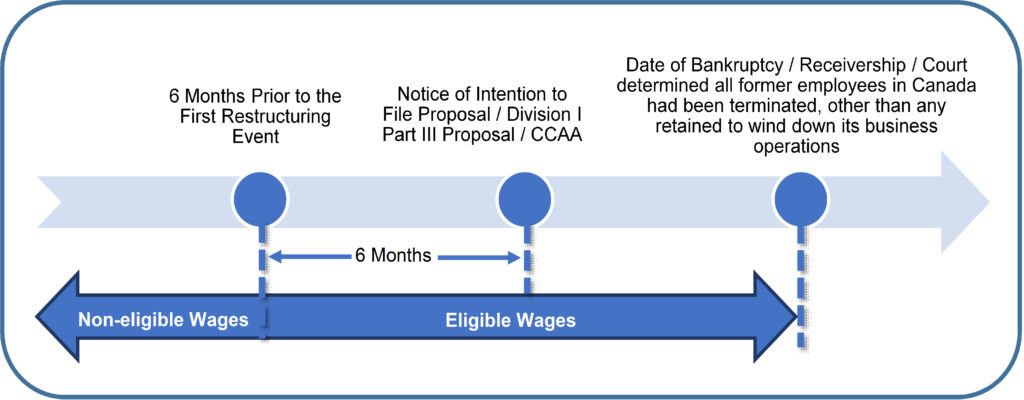

- Your employment ended due to the employer’s insolvency within the last six months before the filing.

- You are owed wages (including vacation, severance, and termination pay) from that employer.

- Officers, directors, managers with financial authority, or controlling shareholders are usually not eligible.

Importantly, eligibility also extends to part-time, temporary, seasonal, and some contract workers with unpaid wages from insolvent employers.

WEPP Eligibility and Interaction with Other Benefits

WEPP benefits are designed specifically for insolvency-related unpaid wages and can be received alongside Employment Insurance (EI) benefits, provided you qualify for both. However, WEPP does not replace EI or social assistance; it rather complements these programs.

WEPP payments also have priority status, meaning workers are more likely to receive their owed wages before other creditors during bankruptcy proceedings. This priority is part of the program’s effort to protect worker rights financially.

How to Apply for $8,844 Canada WEPP Benefit: A Step-by-Step Guide

Taking action sooner rather than later can speed up your benefits:

- Collect Documentation: Secure pay stubs, termination letters, your employment contract, and proof of your employer’s financial insolvency. These documents support your claim.

- Submit Your Application Online: Use the official Service Canada WEPP claim page. The process is straightforward, and the website provides step-by-step instructions.

- Mind the Deadlines: Claims generally must be filed within 4 months of your last paid day.

- Follow Up: Monitor your claim through Service Canada’s online portal or call their support for updates.

- Receive Payments: Successful applicants usually get payments via direct deposit within weeks.

Real-World Example: WEPP in Action

Consider Tony, a warehouse worker in Vancouver. His employer declared bankruptcy unexpectedly in September 2025. Tony was worried about missing rent payments and bills. After applying to WEPP in October, he received nearly all the wages owed to him, totaling $7,987. This payment relieved immediate financial stress and gave him time to find new work.

Stories like Tony’s illustrate the real impact of the WEPP — from coast to coast, it helps thousands of workers weather the financial storm caused by employer insolvency.

What If Your Claim is Denied or Delayed?

Claims can sometimes be denied due to insufficient documentation or eligibility issues. If that happens:

- Submit a request for reconsideration, providing any additional proof or clarifications.

- Seek help from legal experts, unions, or workers’ advocates who specialize in employment or insolvency law.

- Explore alternate remedies such as creditor claims in bankruptcy courts.

Understanding your rights and options ensures you can fight for fair treatment.

Important Timelines & Deadlines to Remember

- Most claims must be made within 4 months of your employment’s end date.

- Insolvency processes can stretch for months or longer, so applying early is key.

- Keep current on government announcements and deadlines around October 2025 for specific insolvency cases.

Missing key deadlines can result in lost benefits, so mark your calendar.

WEPP’s Legal Framework and Government Oversight

The WEPP program operates under the Wage Earner Protection Program Act (WEPPA). This law was passed to give laid-off workers priority to unpaid wages during employer bankruptcies. It complements Canada’s Bankruptcy and Insolvency Act and the Companies’ Creditors Arrangement Act.

Employment and Social Development Canada (ESDC) administers the program through Service Canada, working with trustees, receivers, and courts to verify claims and deliver payments.

Regular program evaluations show WEPP aligns well with government priorities and continues to serve Canadian workers effectively, reducing unpaid wage losses dramatically since its 2008 launch.

Who Can Benefit Besides Traditional Employees?

WEPP accommodates a wide range of workers affected by insolvency:

- Part-time workers

- Temporary or seasonal employees

- Some contractors and gig economy workers — if they have unpaid wages owed by an insolvent employer, they might qualify.

This flexibility reflects the modern workforce, ensuring protections keep pace with changing work arrangements.

Canada’s $2,000 CRA Direct Deposit in October 2025 – Is it true? Check Eligibility

Canada $15,630 Disability Tax Credit in 2025 – How to get it? Check Claim Process

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date