SSS Pension Payment Dates: If you’re looking for the SSS pension payment dates for October 2025, you’ve come to the right place. Getting your pension on time is crucial—whether you rely on it for your daily needs or are just planning ahead for your retirement. In this guide, we’ll break down the entire payment schedule, clear up eligibility criteria, toss in some must-know facts, and give you practical tips to keep your pension game strong. No corporate jargon here, just straightforward info delivered in a friendly, expert style. Whether you’re a retiree, a professional navigating financial planning, or even a first-timer eyeing your future pension, this article has got you covered.

SSS Pension Payment Dates

Being on top of your SSS pension payment dates and eligibility isn’t just about getting your money on time, it’s about securing peace of mind for your future. Whether you’re kicking back in retirement or still planning your exit from the workforce, understanding these details helps you stay informed, avoid surprises, and maximize your benefits. Remember, the government’s shift to electronic payments and enhanced service programs is designed to make your life easier and safer. Embrace these tools, keep your contributions updated, and keep that pension hustle going strong.

| Topic | Details | Reference Link |

|---|---|---|

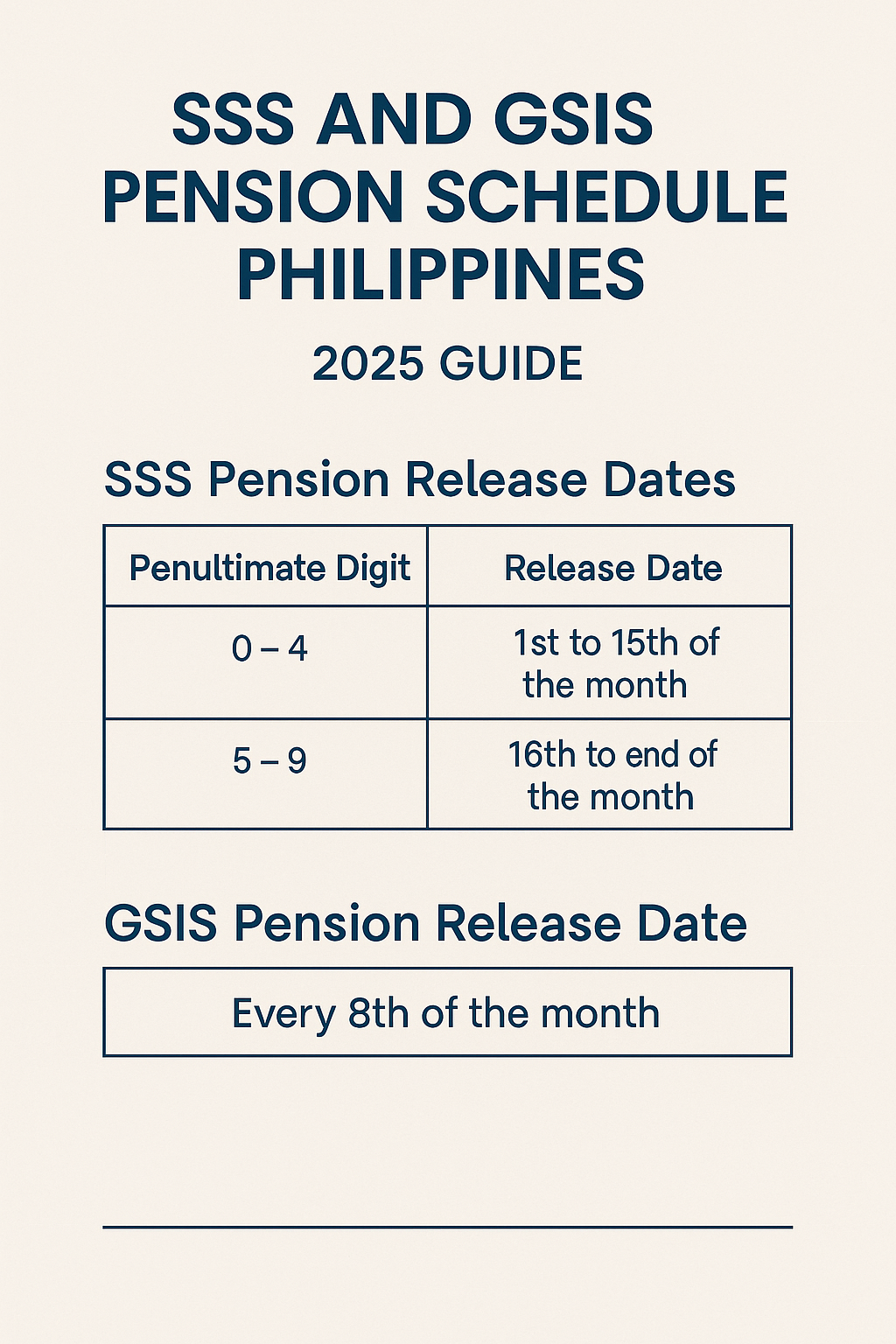

| Pension Payment Dates | October 1-15 for SSS numbers ending 0-4; October 16-31 for 5-9 | SSS Official |

| Eligibility Criteria | Minimum 120 contributions; Age 60+ for regular retirement | |

| Monthly Pension Increase | 33% pension hike rollout started September 2025, over 3 years | |

| Payment Methods | Direct deposit, UMID ATM, e-wallet | SSS Payment Info |

| COLA Adjustment 2025 | 2.5% Cost-of-Living Adjustment for Social Security benefits |

What are the SSS Pension Payment Dates for October 2025?

The Social Security System (SSS) pension payment for October 2025 is set up to avoid delays by staggering payments—this means you’re more likely to get what’s rightfully yours on time without the hassle. To keep things smooth and fair, payments are released in two waves based on the last digit of your SSS number:

- Numbers ending in 0 to 4 will see payments between October 1 and October 15, 2025.

- Numbers ending in 5 to 9 will get theirs from October 16 to October 31, 2025.

These payments come through safe and secure electronic methods including PESONet, UMID ATM withdrawals, or transfers to e-wallets like GCash and PayMaya. No more waiting for paper checks in the mail, which means faster access and reduced risk of lost payments.

Why This Schedule Matters?

Simplicity and reliability. Imagine stressing about your payment being late especially when bills are due—this staggered system puts that worry to bed.

Who Qualifies? Eligibility Criteria Explained

Getting your pension isn’t just about hitting a certain age—you’ve got to meet some solid basics first:

- Contributions: You must have contributed at least 120 monthly contributions to SSS. Think of these as monthly “deposits” you’ve made over your working years.

- Age Limit:

- 60 years old or older for regular retirement pension.

- Early retirement is possible at age 50, but with reduced benefits.

- Updated Contribution Record: To avoid any hiccups, make sure your contribution records are complete and up-to-date. That means no pending or missed payments.

- Other Benefits: Even if you’re getting other types of SSS support like disability or survivor benefits, you can still qualify for pension increases if you meet the criteria.

Understanding these serve as your golden ticket to drawing funds securely every month.

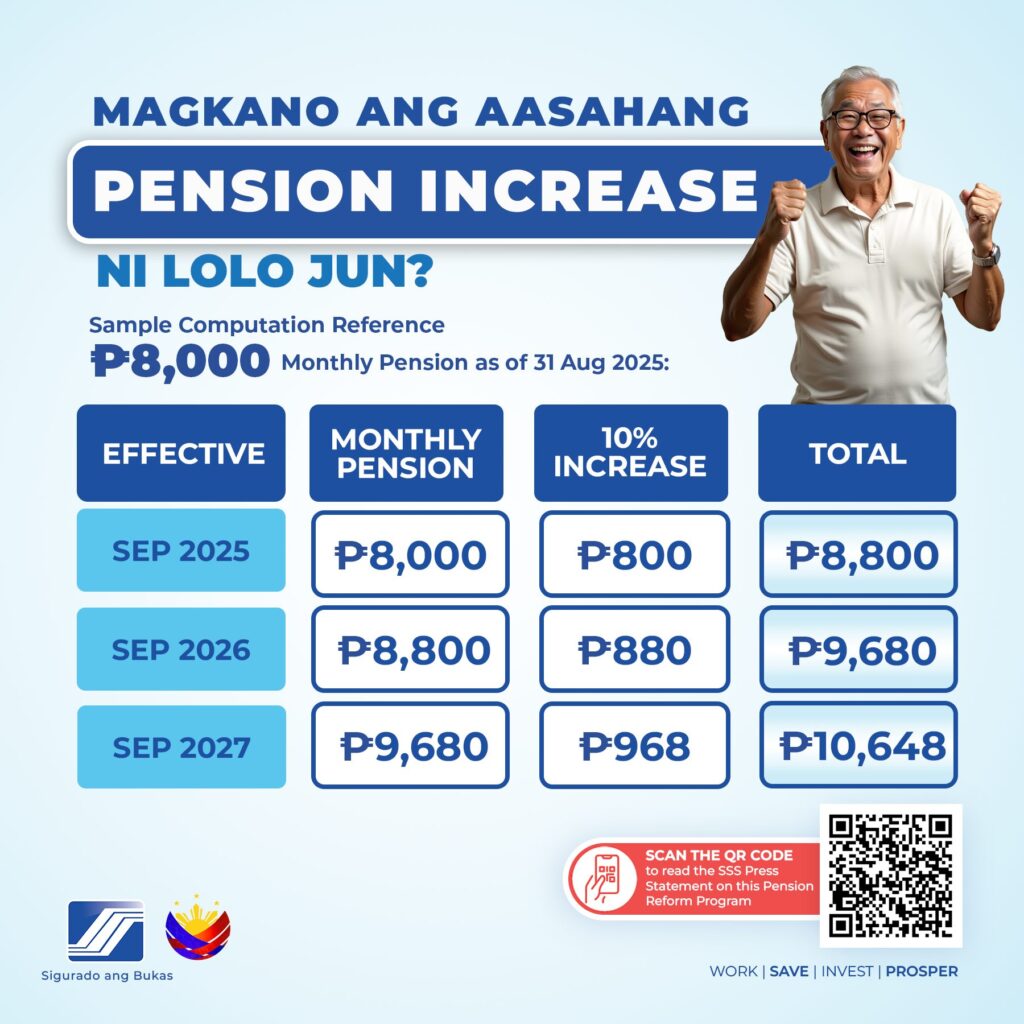

How Much Will You Get? The 2025 Pension Boost Breakdown

Money talks—and in 2025, the SSS is upgrading how much it puts in your pocket. Thanks to new pension reforms starting September 2025, retiree pensions will get a 33% hike spread out over three years. That means more cash for essentials, healthcare, or just a bit more freedom to enjoy your golden years.

Additionally, Social Security benefits in the U.S. are up by 2.5% cost-of-living adjustments (COLA) in 2025, helping retirees maintain their purchasing power amid inflation.

For instance:

- If you were getting $1,500 a month before, expect roughly an increase of about $495 over the coming years due to this hike.

- This change is historic for the SSS, ensuring financial support keeps pace with the rising cost of living.

Step-by-Step: How to Check Your SSS Pension Payment Dates and Stay Updated

Wanna avoid any payment glitches? Here’s a quick DIY guide:

- Log in to the SSS Online Portal: Verify your payment schedule and contributions.

- Use Mobile Apps: Most pensioners use apps like GCash or UMID for direct pension deposits.

- Set Calendar Reminders: Mark your payment dates based on your SSS number to always know what day your cash drops.

- Keep Contribution Receipts: Regularly updated contributions help avoid delayed or reduced pension amounts.

- Contact SSS Helpdesk: If confused, the SSS hotline and official website provide clear assistance for pensioners.

Introducing the ₱8980 One-Time Direct Payment for Seniors

In addition to the regular pension, October 2025 will also see a one-time ₱8980 direct payment to SSS members aged 60 and above with the required contributions. This is a financial boost aimed at helping seniors cover unexpected expenses like medical bills or household costs.

The payment is automatically credited through secure channels, so eligible members don’t need to apply separately. Just ensure your bank or e-wallet details are up-to-date in the SSS system.

This is part of the broader 2025 reforms aimed at improving the quality of life and financial security for Filipino seniors.

Common Challenges and Misunderstandings to Watch For

Many pensioners face roadblocks or confusion around their benefits. Here are some tips to dodge common pitfalls:

- Mistaking Eligibility: Some think just being of retirement age is enough—but you need those contributions complete!

- Delayed Payments: Mostly due to incomplete records or wrong bank info. Always double-check your account details with SSS.

- Underpayment Concerns: Missed contributions mean smaller checks. Make voluntary contributions if you have gaps.

- Tax Rules Misunderstood: SSS pensions can be taxable; seek guidance from a tax professional on reporting your income.

- Not Updating Contact Info: Change of address or phone? Inform SSS ASAP to avoid missed notices or communications.

How to Maximize Your SSS Pension Benefits

Want the most bang for your buck? Consider these expert tips:

- Consistently Pay Contributions: Don’t skip months—even if self-employed or freelance.

- Work Longer if Possible: More contributions over time equal a bigger pension.

- Combine Benefits: If you qualify for other government or private retirement plans, coordinate benefits carefully.

- Plan Tax Strategy: Consult with financial advisers about how your pension impacts tax and estate planning.

- Stay Informed: Regularly visit official sites and reach out to local SSS branches for updates.

A Closer Look at Retirement Benefit Payment Methods

When it comes to receiving your pension, the SSS offers flexible options tailored to your needs:

- Monthly Pension or Lump Sum: Members can choose between receiving their benefit monthly or taking an advance lump sum of the first 18 months’ pension, discounted at a preferential interest rate.

- Unified Multipurpose ID (UMID) Card: If you have a UMID card enrolled as an ATM, your pension will be credited there automatically.

- Disbursement Account Enrollment Module (DAEM): If you don’t have a UMID card, you can enroll a preferred bank account through the SSS online portal to receive your pension directly.

- Checks: In special cases such as incarceration, pension payments may be issued via checks.

- Deductions: Outstanding SSS loans (salary or calamity loans) are deducted from the pension benefits to settle debts.

This flexibility ensures retirees receive their money conveniently and securely.

Philippines Raises Retirement Age in 2025 – Here’s What It Means for Everyone Over 65

₱18,500 GSIS Pension Hike Coming 2025; Are You One of the Beneficiaries? Check Eligibility

SSS ₱8980 Direct Payment in October 2025 – These 60+ Seniors will get it, Check Eligibility

Quick Comparison: SSS Pension Versus Other Retirement Plans

| Feature | SSS Pension | 401(k)/IRA (USA) | Private Pensions |

|---|---|---|---|

| Eligibility | 120 contributions + age 60+ | Varies by plan | Plan-specific rules |

| Contributions | Mandatory monthly contributions | Voluntary | Depends on employment contract |

| Payment Frequency | Monthly | Varies (usually monthly) | Usually monthly or lump sum |

| Benefit Increase | 33% hike over 3 years + COLA | Market-dependent | Varies, sometimes inflation-adjusted |

| Access to Funds | After retirement eligibility | Usually after age 59½ | Often post-retirement |

Understanding your SSS pension in relation to other retirement options helps in planning a secure financial future.