$1,200 OAS, $100 CPP, and $800 GIS Direct Deposit Payments: When you hear about $1,200 OAS, $100 CPP, and $800 GIS Direct Deposit Payments in October 2025, you might wonder if that’s really going to land in your bank account. It’s a big question for seniors across Canada, because these three programs—OAS, CPP, and GIS—form the backbone of retirement income for millions of people. And while the numbers sound generous, there’s more to the story. The actual amount you receive depends on your age, income, and work history. In this article, we’ll break everything down in plain English, with a friendly, conversational style but also the authority of real expertise. Whether you’re a senior planning your next budget, a family member helping mom or dad, or just curious about how these payments work, this guide is for you.

$1,200 OAS, $100 CPP, and $800 GIS Direct Deposit Payments

The buzz about $1,200 OAS, $100 CPP, and $800 GIS Direct Deposit Payments in October 2025 is understandable. For many seniors, these programs make the difference between struggling and living with dignity. While the headline numbers may not apply to everyone, the reality is that OAS, CPP, and GIS provide a stable, indexed, and reliable income stream for retirees. By knowing the rules, filing taxes on time, and planning smartly, you can maximize what you receive and make retirement a little easier.

| Benefit | Amount (Example) | Eligibility | Payment Date (Oct 2025) | Official Info |

|---|---|---|---|---|

| OAS (Old Age Security) | $1,200* | Age 65+, Canadian resident, lived in Canada 10+ years | October 29, 2025 | Government of Canada OAS |

| CPP (Canada Pension Plan) | $100 | Based on contributions, age 60+ | October 29, 2025 | Government of Canada CPP |

| GIS (Guaranteed Income Supplement) | $800 | Low-income seniors receiving OAS | October 29, 2025 | Government of Canada GIS |

Note: $1,200 OAS is higher than the standard maximum; the actual OAS in 2025 is expected to be around $727–$800 per month. The $1,200 figure likely reflects combined benefits or top-ups.

Old Age Security (OAS) – The Backbone of Retirement

OAS is a monthly pension that kicks in at age 65. Unlike CPP, you don’t need to have worked or paid into it. Instead, it’s based on your residency in Canada.

- Eligibility: Must be 65 or older and have lived in Canada at least 10 years since turning 18.

- Full pension: Requires 40 years of Canadian residency.

- Partial pension: Calculated as 1/40th of the full amount for each year lived in Canada after age 18.

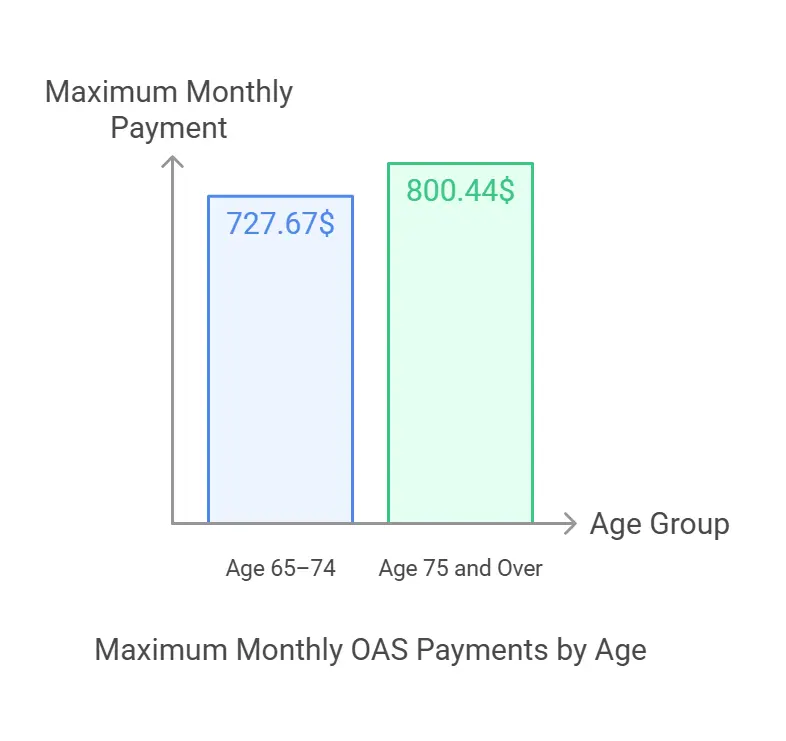

OAS Amounts (as of 2025):

- Ages 65–74: About $727.67/month.

- Ages 75+: About $800.44/month (a 10% bump introduced in 2022).

Clawback alert: If your net income exceeds about $90,000, you’ll start losing OAS under the “recovery tax.” The clawback fully wipes out OAS at around $148,000 income.

Canada Pension Plan (CPP) – You Get What You Put In

CPP is a contributory plan. You and your employer both pay into it during your working years. When you retire, your benefit is based on your contributions, adjusted for average wages.

- Eligibility: Can start at 60 (reduced), wait until 65 (standard), or delay until 70 (increased).

- Average CPP in 2024: Around $758/month.

- Maximum CPP in 2025: Could be about $1,350/month for those who always contributed the maximum.

But many Canadians get less, because they had years of part-time work, caregiving, or lower wages. That’s why $100 CPP in this example makes sense—it reflects a limited contribution history.

Guaranteed Income Supplement (GIS) – The Safety Net

GIS is for seniors with low income who are already receiving OAS. It’s a non-taxable monthly benefit.

- Eligibility: Based on income from your tax return (yours, or combined with your spouse’s).

- Maximum GIS in 2024: About $1,065/month for a single senior, less if you’re married.

GIS is reviewed every July, based on your previous year’s tax filing. That means if your income changes, your GIS changes too.

Case Study: Singles vs Couples

Example 1: John, single senior, age 70

- OAS: $800

- CPP: $200

- GIS: $850

- Total monthly income: $1,850

Example 2: Martha and Bill, married couple, both age 68

- OAS (each): $727

- CPP (each): $300

- GIS (combined, reduced for couples): $1,000

- Total monthly income: $3,054 (about $1,527 each).

This shows how marital status affects GIS. Couples receive less per person than singles.

Payment Date – October 2025

For October 2025, the payment date is:

- October 29, 2025 for OAS, CPP, and GIS.

Direct deposit means same-day payment. Paper cheques can take up to a week, depending on Canada Post.

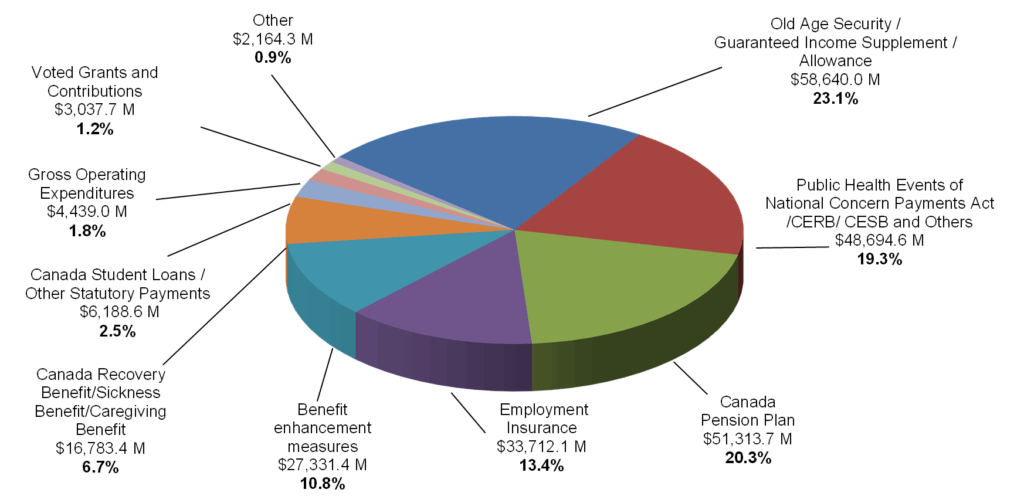

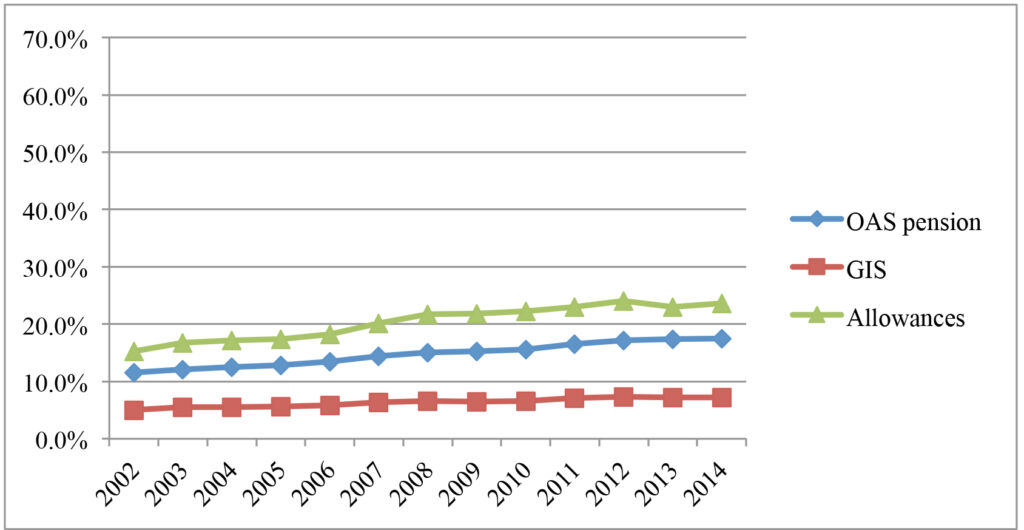

Historical Growth of Benefits

Over the years, these payments have steadily increased:

- OAS in 2010: About $516/month.

- OAS in 2025: About $727–$800/month.

- CPP in 2010 (average): About $500/month.

- CPP in 2025 (average): About $758/month.

- GIS max for singles in 2010: About $700/month.

- GIS max for singles in 2025: Over $1,065/month.

This steady rise is due to inflation indexing and policy changes like the OAS 10% boost at age 75.

Taxes and Clawbacks

Here’s how taxation works:

- OAS: Taxable. Can be clawed back for higher incomes.

- CPP: Taxable, added to your regular income.

- GIS: Non-taxable. Does not affect your tax bracket.

Pro tip: If your income is close to the OAS clawback threshold, consider RRSP withdrawals before 65 to reduce taxable income later.

Step-by-Step: How to Check Eligibility for $1,200 OAS, $100 CPP, and $800 GIS Direct Deposit Payments

- Check your age and residency. Must be 65+ and lived in Canada 10+ years for OAS.

- Review your work history. CPP depends on your contributions.

- File your taxes. GIS is calculated automatically from your tax return. No taxes filed = no GIS.

- Apply online. CPP requires an application. OAS may be automatic but confirm via My Service Canada Account.

- Set up direct deposit. Faster, safer, and avoids postal delays.

Practical Money Tips for Seniors

- Delay CPP if possible. Waiting until 70 means a 42% increase.

- Budget smartly. Use free online tools like Mint or Excel spreadsheets.

- Don’t skip taxes. Even if you owe nothing, filing keeps your benefits active.

- Check provincial top-ups. Ontario’s GAINS, Alberta’s Seniors Benefit, and Quebec credits add extra dollars.

- Ask for help. Community centers, Service Canada offices, and financial advisors can guide you through the paperwork.

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule

Canada $2988 OAS Per Month for these Seniors: Check Eligibility and Payment Date

Canada $2616 Caregiver Credit (CCC) in 2025; How to Claim it? Check Eligibility & Payment Date

Future Outlook – Aging Canada

By 2030, nearly 1 in 4 Canadians will be 65 or older. This means OAS, CPP, and GIS spending will keep rising. The government is reviewing sustainability, but most analysts expect gradual adjustments like:

- Raising income thresholds.

- More supplements for very old seniors.

- Possible increases in CPP contribution rates for younger workers.