$2250 OAS Boost: If you’ve been hearing chatter about a “$2250 OAS Boost in October 2025”, you’re not the only one. Retirees and their families across Canada — and even folks in the U.S. who keep an eye on Canadian policy — are asking whether this big payday is for real. With so many posts, videos, and articles circulating online, it’s easy to get confused.

The truth? There’s no official sign of a lump-sum $2250 boost this October. Instead, OAS (Old Age Security) will continue its regular inflation adjustments. That’s good news if you’re already receiving benefits, but it’s not the jackpot some headlines make it out to be. Let’s break it down clearly, with facts, history, and advice you can actually use.

$2250 OAS Boost

The rumored $2250 OAS Boost in October 2025 is not real. Instead, seniors will see a modest inflation-based increase, with payments arriving on October 29, 2025. For those aged 65–74, that means about $740/month, while seniors 75+ will get around $814/month. The big lesson? Retirement planning is about facts, not Facebook rumors. Stick to official sources, explore GIS, and talk with professionals to maximize your income. That’s how you make OAS work for you.

| Point | Details |

|---|---|

| Rumor | A one-time $2250 OAS Boost in October 2025 is being widely discussed online. |

| Reality | No official confirmation of any such boost. OAS only rises with inflation, through quarterly adjustments. |

| Payment Date (Oct 2025) | October 29, 2025 – official OAS deposit date. |

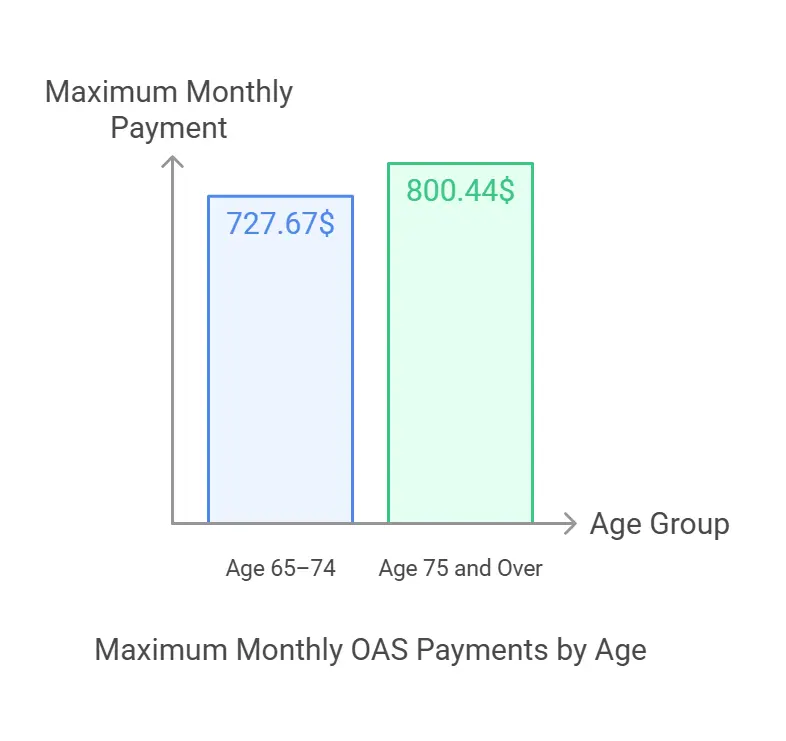

| OAS Monthly Max (2025) | Ages 65–74: approx. $740.08; Ages 75+: approx. $814.09 (source: Canada.ca). |

| Inflation Adjustment | For October 2025, expected rise is about +0.7% compared to July. |

| Official Source | Government of Canada – OAS Payments |

What is OAS and Why It Matters?

OAS (Old Age Security) is Canada’s cornerstone retirement benefit. It’s similar to Social Security in the U.S., but with some differences. You don’t have to work a specific number of years or pay into it directly. Instead, it’s based on how long you’ve lived in Canada after turning 18.

The basics:

- Available starting at age 65.

- Monthly payment adjusted every quarter for inflation.

- Increases at age 75 to provide additional support to older seniors.

It matters because more than 7 million Canadians rely on OAS as part of their retirement income, according to the latest government reports. For many households, OAS covers essentials like food, heating, and prescription costs.

A Brief History of OAS

The OAS program launched in 1952 with a maximum monthly payment of just $40. At that time, it was a game-changer for seniors living on very modest means. Over the decades, OAS has been reformed and expanded, including the Guaranteed Income Supplement (GIS) for low-income seniors and the 75+ increase introduced in 2022.

Today, OAS has become one of Canada’s most important social safety nets. It ensures seniors don’t have to depend solely on personal savings or workplace pensions, which many Canadians simply don’t have.

Where Did the “$2250 OAS Boost” Rumor Come From?

This rumor likely started from a combination of speculation and online content farms. Over the last few years, similar stories have spread about “one-time payments” or “special boosts” to retirement benefits.

What’s really happening:

- OAS adjusts every January, April, July, and October.

- The October 2025 increase is projected to be around 0.7%.

- No lump sum has been announced by the Government of Canada.

So if you’re expecting a sudden $2250, the math doesn’t add up. For example, a 0.7% increase on $740 is just over $5 per month — not thousands.

October 2025 OAS Payments: The Facts

Here’s what the October 2025 OAS payment looks like in real numbers:

- Ages 65–74: Maximum monthly payment around $740.08.

- Ages 75+: Maximum monthly payment around $814.09.

- Guaranteed Income Supplement (GIS): For seniors with very low income, GIS can add up to $1,072.93 per month for singles or more for couples (source: Government of Canada).

Payment will be deposited on October 29, 2025. If you’re set up for direct deposit, it will hit your bank automatically.

Comparing OAS to U.S. Social Security

For American readers, here’s how OAS compares to Social Security:

- OAS: Based on residency in Canada. Everyone who qualifies gets the same maximum, adjusted for how long they lived in Canada.

- Social Security: Based on work history and payroll contributions in the U.S. The more you earn, the more you can receive later.

Both systems use COLA (Cost of Living Adjustments). In 2024, U.S. Social Security COLA was 3.2%. Canada spreads adjustments quarterly, so smaller increases happen four times a year instead of one larger annual bump.

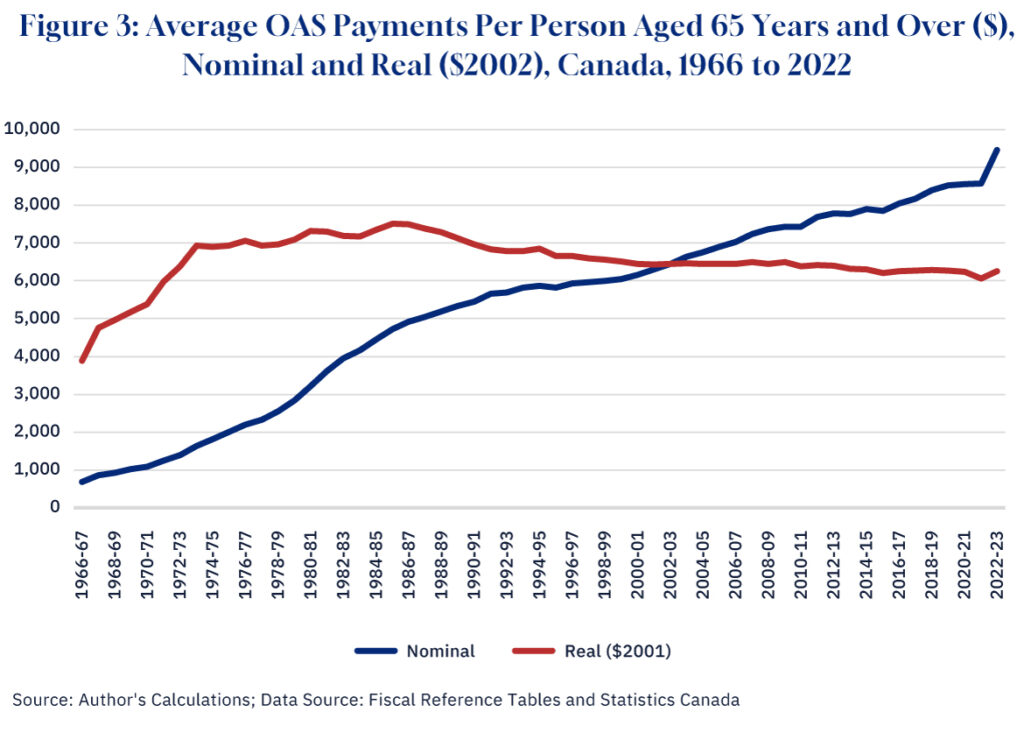

How Inflation Affects OAS?

Inflation is measured using the Consumer Price Index (CPI). It reflects changes in the cost of everyday items like groceries, rent, and fuel.

- In 2024, Canada’s average inflation rate was about 2.8%.

- For October 2025, OAS adjustments reflect the inflation over the summer.

- This means payments increase just enough to keep pace with the cost of living, not provide extra income.

Even small increases matter. A bump of $5–10 a month might not sound like much, but for retirees on fixed incomes, it helps cover things like utilities or medication.

Practical Advice: How to Maximize $2250 OAS Boost

Since there’s no lump sum coming, the real focus should be on making the most of OAS. Here’s how:

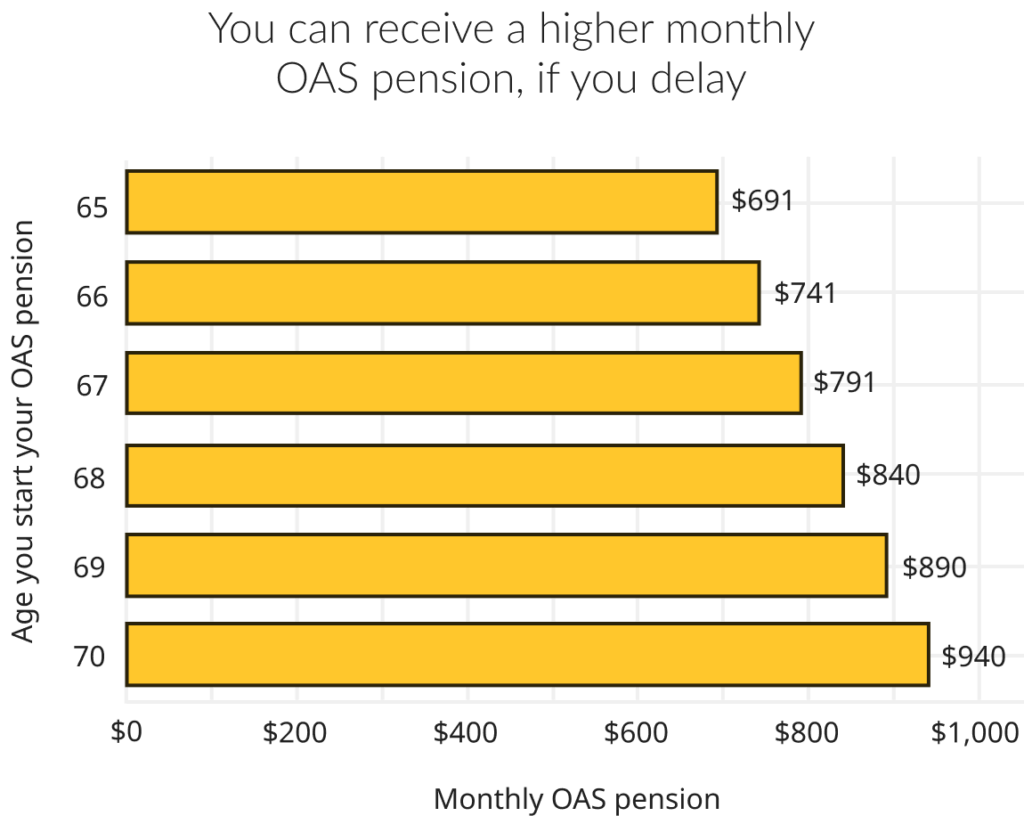

1. Delay OAS if Possible

Every month you delay after 65 increases your OAS by 0.6%. Waiting until 70 means a 36% higher monthly payment for life.

2. Apply for GIS

If your income is low, the Guaranteed Income Supplement (GIS) can significantly boost your monthly income. It’s non-taxable and specifically designed to help the most vulnerable seniors.

3. Avoid Clawbacks

The OAS recovery tax (commonly called the “clawback”) applies if your income exceeds about $90,997 in 2025. Work with a financial planner to manage income withdrawals to avoid losing part of your benefit.

4. Budget Realistically

Plan your retirement budget around actual OAS numbers, not rumors of big payouts. Treat any increases as small adjustments, not windfalls.

5. Stay Updated

Check the Government of Canada payment calendar for official dates and amounts.

Example: Mary and Joe

Mary, 68: She thought the $2250 boost was real and started planning a vacation. When she learned it was false, she adjusted her budget and applied for GIS, which added real monthly income to her OAS.

Joe, 76: Already receives the higher OAS for seniors over 75. He delayed drawing on his RRSP until 71 to avoid triggering a clawback, boosting his monthly income while preserving his benefit.

Both learned the same lesson: build your plans on facts, not internet rumors.

Professional Insight

Financial advisor Janet Lawson explains:

“Retirement planning is all about certainty. Rumors about lump sums or surprise boosts create false expectations. Instead, focus on the tools we know exist: delaying OAS, using GIS, and tax planning. That’s where the real financial wins are.”

Watch Out for Scams

Sadly, misinformation opens the door for scams. Seniors are often targeted with fake emails, texts, or calls claiming they must “apply” for their $2250 bonus.

Remember:

- Service Canada will never ask for your Social Insurance Number (SIN) or banking info by text or email.

- Always verify payment details on the official OAS website.

CRA Approved $742 OAS Boost in October 2025: Check Payment Date & Eligibility

$742 OAS Boost Confirmed by CRA for October 2025: Check Eligibility & Payment Schedule