Social Security Payments of $3,831, $4,018, $5,108: When folks talk about Social Security payments in October 2025, the numbers $3,831, $4,018, and $5,108 keep getting tossed around. And let’s be real — it’s confusing. Some headlines make it sound like everyone’s about to cash $5,000 checks from Uncle Sam, but that’s not how it works. The truth is, those amounts represent the maximum retirement benefits available depending on when you start claiming Social Security. For most people, the actual benefit will be much lower. Still, understanding these numbers is crucial if you want to squeeze the most out of the program you’ve been paying into your whole working life.

Social Security Payments of $3,831, $4,018, $5,108

So, who gets $3,831, $4,018, or $5,108 from Social Security in October 2025? Only a select few with strong earnings histories and the patience to delay benefits. For most Americans, the reality is closer to $1,900/month. The bottom line: Social Security is an important piece of your retirement puzzle, but it won’t cover everything. The smart move is to plan ahead, work longer if you can, delay claiming when possible, and supplement Social Security with savings and investments.

| Fact | Details |

|---|---|

| Maximum benefit at Full Retirement Age (FRA) in 2025 | $4,018/month |

| Maximum benefit at age 70 (delayed retirement) in 2025 | $5,108/month |

| Maximum benefit at age 62 (early retirement) in 2025 | Around $2,710/month |

| Amount $3,831 | Not official SSA max; likely tied to early filing benchmarks |

| Average Social Security retirement check in 2025 | Around $1,900/month |

| Annual COLA adjustment for 2025 | Projected at ~3.2% |

| Who qualifies for the max? | Workers who earned the taxable wage base for 35+ years |

| Official resource | Social Security Administration |

How Social Security Works?

Social Security is the backbone of retirement for millions of Americans. You and your employer have been paying into it through payroll taxes (that FICA line on your paycheck) for years. Once you retire, those contributions turn into a monthly check.

But — and here’s the catch — your benefit isn’t the same as your neighbor’s. It depends on:

- Your earnings history – the system looks at your top 35 years of earnings.

- When you retire – claiming early reduces your monthly check, while delaying increases it.

- Cost-of-Living Adjustments (COLA) – these annual increases keep benefits in line with inflation.

The Numbers Explained: Social Security Payments of $3,831, $4,018, $5,108

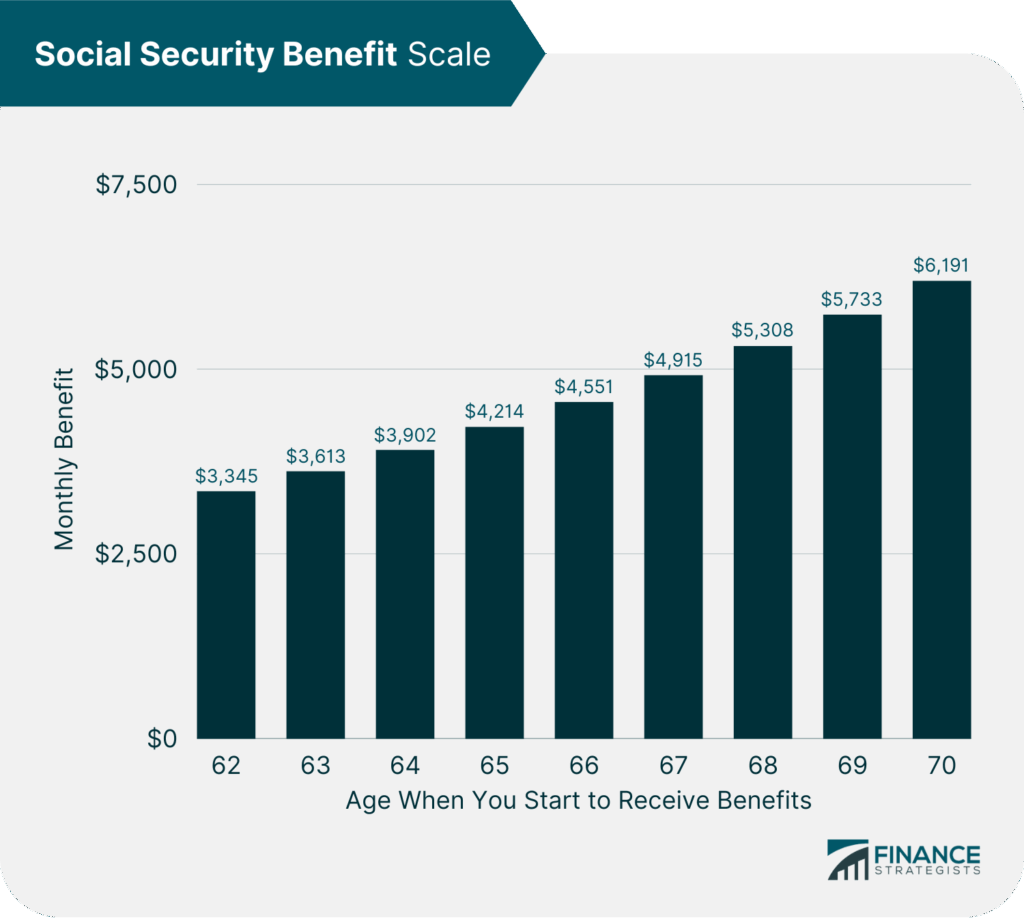

$4,018 at Full Retirement Age

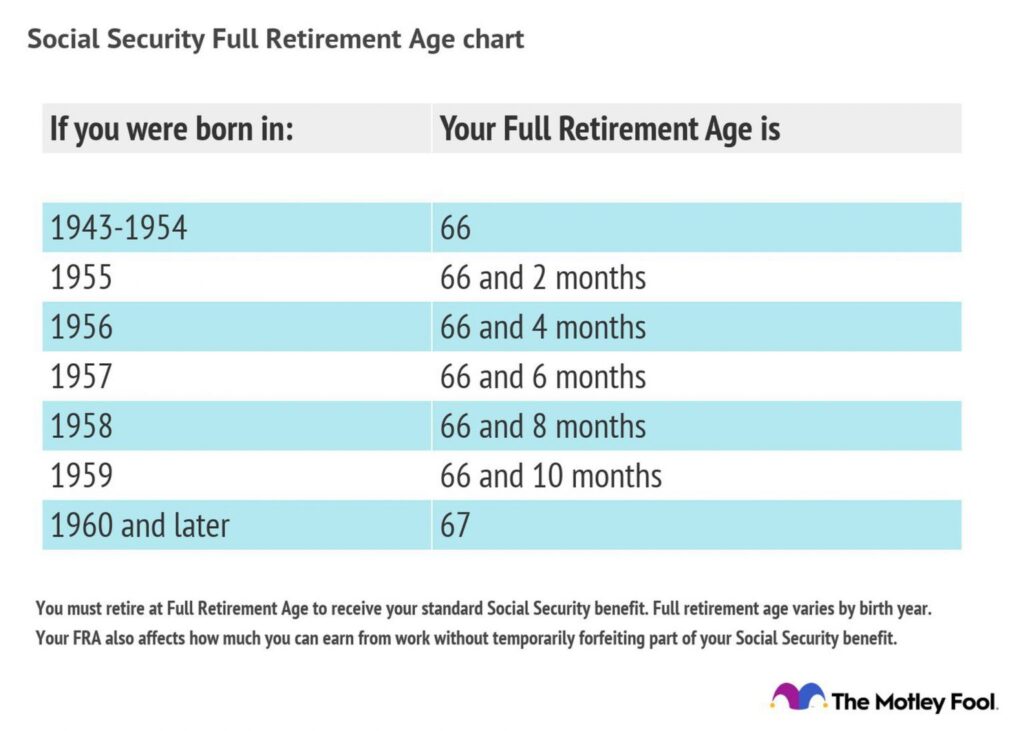

If you retire at your Full Retirement Age (67 for most workers born after 1960), the maximum monthly benefit in 2025 is $4,018.

$5,108 at Age 70

Wait until age 70 to claim, and you’ll snag the highest possible check: $5,108/month. That’s because benefits grow about 8% per year between FRA and 70, thanks to delayed retirement credits.

$3,831 — The Oddball Number

This figure appears in online chatter but doesn’t show up in SSA’s official tables. It may represent an estimate for earlier filing ages, but the key takeaways are $4,018 at FRA and $5,108 at 70.

Early Retirement: Claiming at 62

Can’t wait until 67 or 70? You can file at 62, but your benefit shrinks. In 2025, the maximum check at 62 is about $2,710/month — a huge cut compared to waiting.

- Claim at 62 → ~$2,710

- Claim at 67 → $4,018

- Claim at 70 → $5,108

That’s a nearly 90% difference between the earliest and latest claiming strategies.

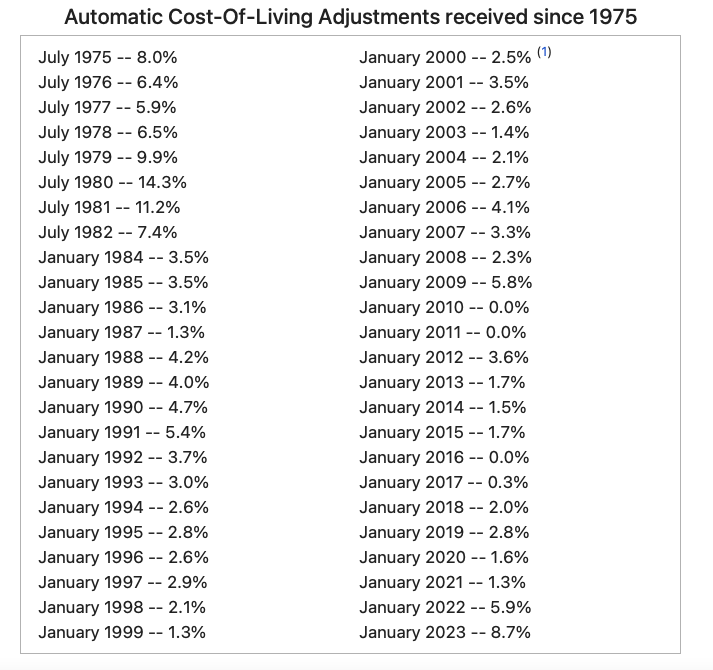

COLA: Why Benefits Keep Rising

The Cost-of-Living Adjustment (COLA) is Social Security’s built-in inflation guard. Each year, benefits are adjusted using the Consumer Price Index for Urban Wage Earners (CPI-W).

- 2023 COLA: 8.7% (record-high due to inflation)

- 2024 COLA: 3.2%

- 2025 COLA: Projected around 3.2%

This means that retirees don’t lose purchasing power as groceries, gas, and rent creep up. Without COLA, today’s $5,000 check might only feel like $3,000 in a decade.

Who Qualifies for the Maximum Benefits?

Here’s the hard truth: very few people actually get the max. To qualify for $5,108 in 2025, you’d need:

- 35+ years of earnings at or above the taxable wage base (which is $174,900 in 2025).

- Zero “gap years” where you earned nothing.

- The discipline (and savings) to delay claiming until age 70.

Most Americans don’t hit those benchmarks. Instead, the average retirement benefit in 2025 is about $1,900/month.

Historical Perspective: How Benefits Grew

Looking at history shows how much Social Security has changed:

- In 2000, the maximum FRA benefit was just $1,433.

- By 2010, it rose to about $2,300.

- In 2025, it hits $4,018 at FRA and $5,108 at 70.

This growth reflects higher taxable wage bases and annual COLAs. Social Security has always evolved with the economy.

Spousal and Survivor Benefits

Not everyone realizes that Social Security extends beyond your own work history.

- Spousal benefits: A lower-earning spouse can claim up to 50% of the higher earner’s FRA benefit.

- Survivor benefits: Widows and widowers may receive up to 100% of the deceased spouse’s benefit.

- Divorced spouse benefits: If you were married 10+ years, you may qualify for benefits on an ex-spouse’s record.

These benefits can make a huge difference in retirement planning for couples.

Taxes on Social Security

Yep, Uncle Sam can tax your Social Security too. If your combined income is above:

- $25,000 (single)

- $32,000 (married)

… then up to 85% of your benefits may be taxable.

This surprises many retirees. It’s why smart planning around withdrawals from IRAs or 401(k)s is critical — you don’t want to bump yourself into a higher tax bracket.

Myths About Social Security Payments of $3,831, $4,018, $5,108

Myth 1: Social Security will be gone by 2034

Reality: The trust fund may face shortfalls, but payroll taxes will still cover about 75% of benefits. Congress will likely act before cuts occur.

Myth 2: Everyone gets the same check

Reality: Benefits vary widely based on earnings history and claiming age. The $5,108 figure applies to only a tiny percentage of retirees.

Myth 3: COLA always keeps up with inflation

Reality: COLA is tied to CPI-W, which doesn’t always reflect seniors’ true costs (like healthcare).

Practical Tips to Maximize Your Benefits

- Work at least 35 years — every missing year adds a zero to your calculation.

- Increase earnings — even late-career raises help.

- Delay claiming if you can — waiting until 70 maximizes your check.

- Check your SSA statement annually — errors happen. Correct them ASAP.

- Coordinate with your spouse — timing claims strategically can boost household income.

- Plan for taxes — withdrawals and income affect benefit taxation.

Retirement Beyond Social Security

Social Security is only designed to replace about 40% of your pre-retirement income. That’s why financial pros always stress building other sources:

- 401(k) or IRA savings

- Employer pensions (if you’re lucky enough to have one)

- Part-time work or side hustles

- Investments (real estate, brokerage accounts)

Think of Social Security as the foundation of your retirement house — you still need walls and a roof.

Social Security COLA Hike 2026 – Experts Predict Major Boost Amid Rising Inflation

Say Goodbye to Paper Checks: Social Security Payments Transition to Digital Next Week

Social Security Just Changed at 69 – Here’s How It Could Drastically Impact Your Retirement

Checklist: Getting Retirement-Ready

- Review your SSA account annually

- Calculate benefits at 62, 67, and 70 using the SSA estimator

- Decide if you’ll claim early, on time, or delay

- Coordinate with your spouse

- Talk with a tax advisor about minimizing taxable benefits

- Build up savings to cover what Social Security won’t