$2100 Social Security Payment: If you’ve seen headlines about a $2,100 Social Security payment in October 2025, you might be scratching your head and asking: “Wait, is every 65-year-old going to get that much?” The answer is not that simple. Social Security isn’t a flat paycheck. Instead, it depends on your lifetime earnings, when you start collecting, and a little thing called COLA (Cost-of-Living Adjustment). This guide will clear up the confusion, break down the facts, and show you who might really see that kind of payment in October 2025 — plus what steps you can take to maximize your own benefits.

$2100 Social Security Payment

The hype about a $2,100 Social Security payment in October 2025 is partly true, but it’s not a blanket rule. Some retirees with strong earnings and smart timing may see that number, while many will receive less — or more. October 2025 is unique mainly for SSI recipients, who will get two checks that month. For everyone else, the key is understanding how your earnings, COLA, and claiming decisions shape your benefit. The bottom line: Social Security is personal. Use SSA’s tools, stay informed, and plan carefully to make the most of your retirement income.

| Topic | Details |

|---|---|

| Rumored $2,100 Payment | Some retirees could see $2,100 in October 2025, but not all. |

| Average Retirement Benefit (2024) | $1,907/month – expected to rise slightly in 2025 due to COLA. |

| Payment Schedule | Social Security: 2nd, 3rd, or 4th Wednesday depending on birthday. SSI: 1st of month (or early if weekend/holiday). |

| Special October 2025 Note | SSI recipients will get two payments (Oct 1 & Oct 31). |

| Max SSI (2025) | $967 individual, $1,450 couple |

| Max Social Security (2025) | Nearly $4,983/month for high earners claiming at 70. |

| Eligibility for $2,100 | High earnings record, claiming at full retirement age, and no reductions. |

| Official Source | Visit SSA.gov for calculators and updates. |

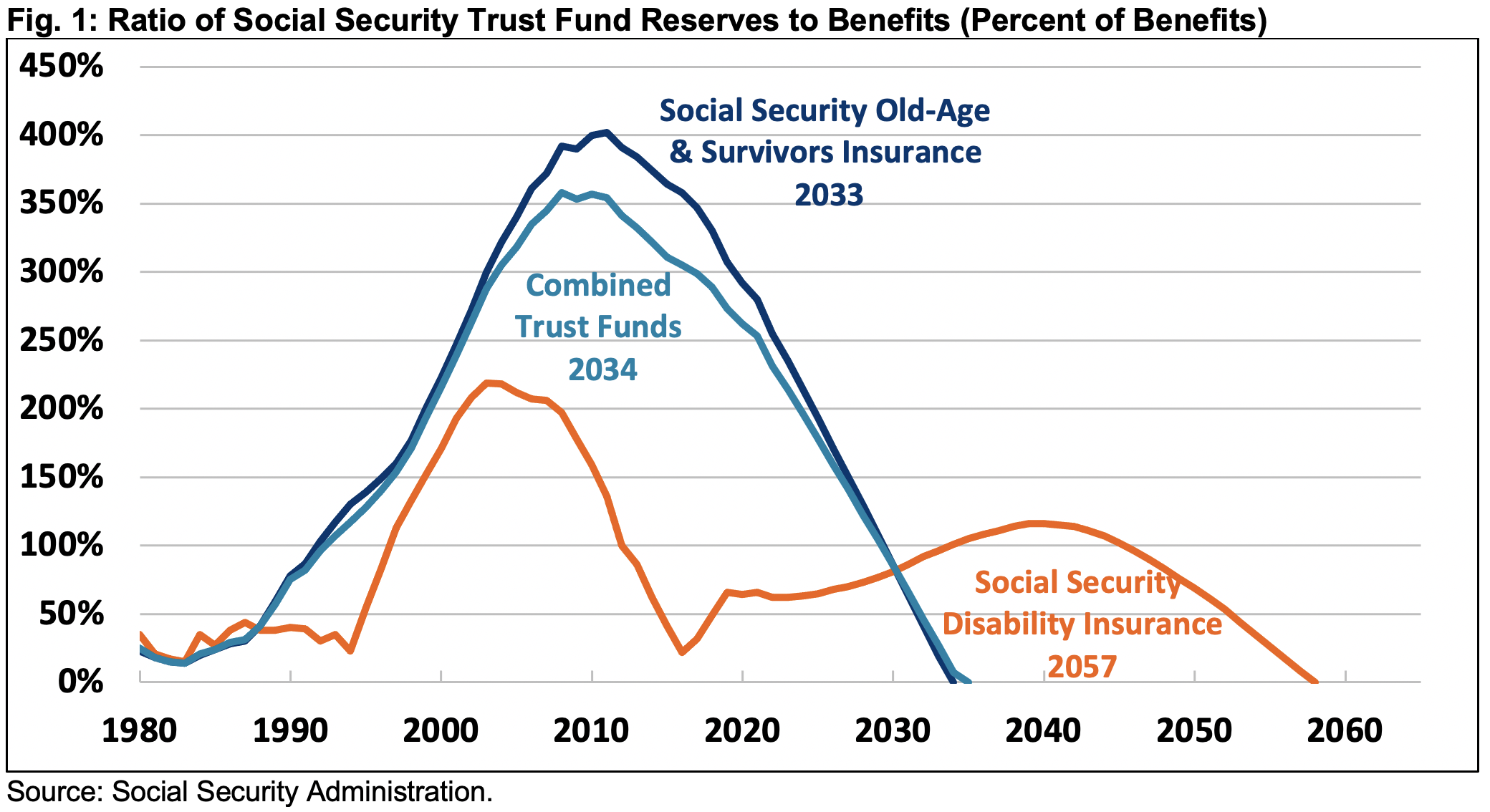

A Quick Look Back: Social Security Then vs. Now

When Social Security first rolled out in 1935, it was a modest safety net. By 1940, the average check was just $22.60 a month. Fast-forward to today, and millions of Americans rely on Social Security as their main source of retirement income.

- 1960s: Average benefit was around $80 per month.

- 1990s: Retirees were pulling in about $600 per month.

- 2024: Average benefit is $1,907 per month, with the maximum benefit for someone who delays until 70 being over $4,800.

That’s a huge jump, but so have living expenses — especially for seniors managing healthcare, housing, and groceries. That’s where COLA comes in to keep payments somewhat in line with inflation.

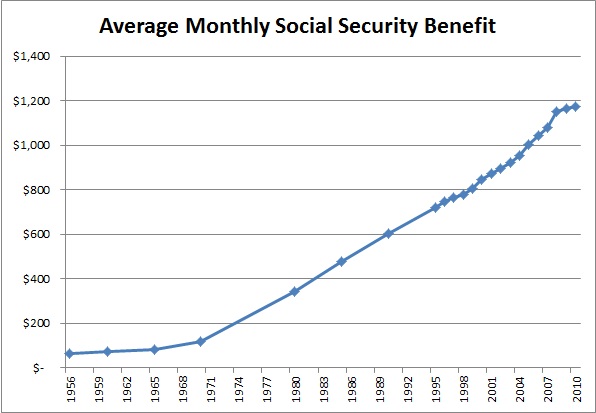

How COLA Shapes Social Security?

COLA stands for Cost-of-Living Adjustment. It’s how Social Security keeps pace with rising prices. Each year, the government looks at the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to decide if benefits need a boost.

- 2023 COLA: 8.7% (one of the biggest in decades, thanks to high inflation).

- 2024 COLA: 3.2%.

- 2025 COLA (estimated): Analysts expect 2.5%–3%.

For example, if you’re receiving $2,050 in 2024, and COLA is 3%, your payment in 2025 would rise to about $2,111. That’s how some retirees hit that magic $2,100 mark in October 2025.

Important: COLA applies automatically — you don’t have to apply for it.

October 2025: What Makes It Special?

October 2025 isn’t just another month for Social Security and SSI recipients. Here’s why:

- Regular Retirement Benefits – Paid on your designated Wednesday, based on your birthday.

- SSI Benefits – Paid on the 1st of each month. But since November 1, 2025, falls on a Saturday, the November payment will be issued early on October 31.

That means SSI recipients get two checks in October. It’s not a bonus — just a timing shift — but for folks on tight budgets, it can be helpful for managing bills.

Who Could Actually See $2100 Social Security Payment?

Not every retiree will, but here are the likely groups:

1. High-Earning Workers

If you consistently earned at or near the taxable wage base ($168,600 in 2024, slightly higher in 2025), your benefits will be significantly higher than average.

2. Claiming Near Full Retirement Age (FRA)

For people born in 1960 or later, FRA is 67. If you start at 65, your payment is reduced. But with strong earnings, it could still land in the $2,100 ballpark.

3. Delayed Retirement Credits

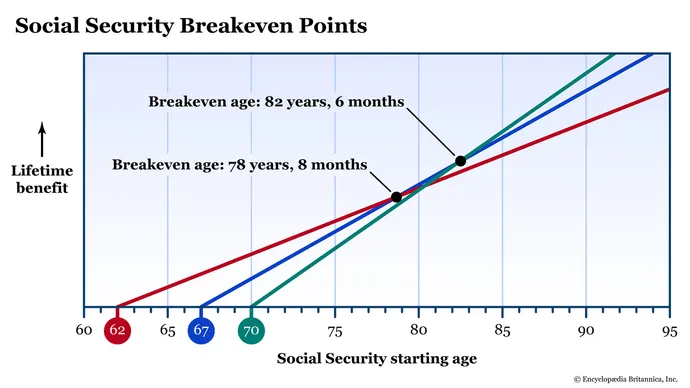

For every year you delay past FRA, your benefit grows about 8% until age 70. Some who wait see nearly $5,000/month in 2025.

4. No Benefit Reductions

If you work while collecting before FRA and earn more than $22,320 in 2024 (adjusted in 2025), your benefits may be reduced temporarily. Avoiding that keeps your check higher.

Real-Life Examples

- Mary, 65, Nurse: She worked 35+ years, averaging $75,000/year. Claims at 65 in 2025 and receives about $2,050/month, boosted slightly by COLA.

- James, 70, Engineer: He waited until 70, maxed out his credits, and earned near the taxable wage base for years. His 2025 check? About $4,900/month.

- Sarah, 65, Retail Worker: Lower earnings history and early claiming leaves her with around $1,300/month.

These case studies show why not everyone can expect $2,100. It depends heavily on your personal history.

Why Planning Matters?

Social Security is designed to replace about 40% of your pre-retirement income, according to the Center for Retirement Research at Boston College. That means you’ll need savings, pensions, or part-time work to cover the rest.

Without proper planning, many retirees are shocked to realize Social Security alone doesn’t stretch far enough.

Practical Tips to Boost Your Benefits

Work Longer

Every additional year at a good income can replace a low-earning year in your record.

Delay Claiming if Possible

Waiting until FRA or later is one of the simplest ways to guarantee higher payments.

Monitor COLA

Follow COLA announcements each fall to plan your budget for the following year.

Coordinate With Spousal Benefits

If married, timing your claim alongside your spouse can maximize household income.

Use SSA’s Tools

Log into your my Social Security account for personalized estimates.

Senate Democrats Demand Answers as Social Security Chief Sparks Retirement Age Confusion

October Social Security Payments: Why You Might Get Two SSI Checks This Month

Goodbye Taxes? New U.S. Law Could Make 90% of Social Security Payments Tax-Free by 2026

What Experts Are Saying About $2100 Social Security Payment

Financial planners consistently emphasize longevity risk — the risk of outliving your money. Since Social Security is guaranteed for life, maximizing the benefit by waiting or planning smartly can be one of the best hedges against running out of money.

According to the National Institute on Retirement Security, two-thirds of retirees rely on Social Security for half or more of their income. For lower-income households, it often makes up 90% or more.

That’s why chasing the biggest possible check is more than just bragging rights — it’s financial survival.