Winter Fuel Payments for Pensioners Under Review: Winter Fuel Payments for pensioners have long been a lifeline for older households struggling with heating costs during cold UK winters. But now, with new rules introduced by the Department for Work and Pensions (DWP), some retirees are being asked to repay what they’ve received. That shift has left many scratching their heads: why would the government hand out money, then take it back? Don’t worry—we’ll break it down. This article is written to feel conversational, like sitting with a trusted neighbor who knows their stuff. At the same time, it’s authoritative, based on professional knowledge and government data, so you know you’re getting the facts straight.

Key Highlights

The Winter Fuel Payment is still a vital support tool for pensioners across the UK, but the new clawback rules mean some will need to stay extra vigilant. Whether you’re a retiree budgeting for heating costs, or a professional advising clients, the key lessons are clear: check your income, report changes promptly, and know your rights. With energy prices unpredictable and government policies shifting, staying informed is the best way to avoid unpleasant surprises.

| Key Point | Details |

|---|---|

| What is it? | A tax-free payment designed to help pensioners with heating bills. |

| Eligibility | Those born before 22 September 1959 (for the winter 2025–26 season). |

| Amount | Between £100 and £300, depending on age and living situation. |

| New Rule | If your taxable income is over £35,000, HMRC claws back the payment via the tax system. |

| Overpayments | Repayment may be required if you were paid in error, failed to report changes, or exceeded the threshold. |

| Extra Support | Cold Weather Payments, Warm Home Discount, and Pension Credit may also help. |

| Official Guidance | Gov.uk Winter Fuel Payment |

What Are Winter Fuel Payments?

The Winter Fuel Payment is one of the most recognized government benefits for older people in the UK. Introduced in 1997 by the Labour government, its original purpose was to combat “fuel poverty”—a term describing when people can’t afford to heat their homes adequately.

The payment ranges from £100 to £300, depending on your age and living arrangements. It usually arrives in November or December, right when energy bills spike. Unlike some benefits, it’s tax-free, and most people receive it automatically if they meet the age and residency requirements.

The New Repayment Rule: Why Now?

So, why is the government suddenly clawing money back? In short: cost and targeting.

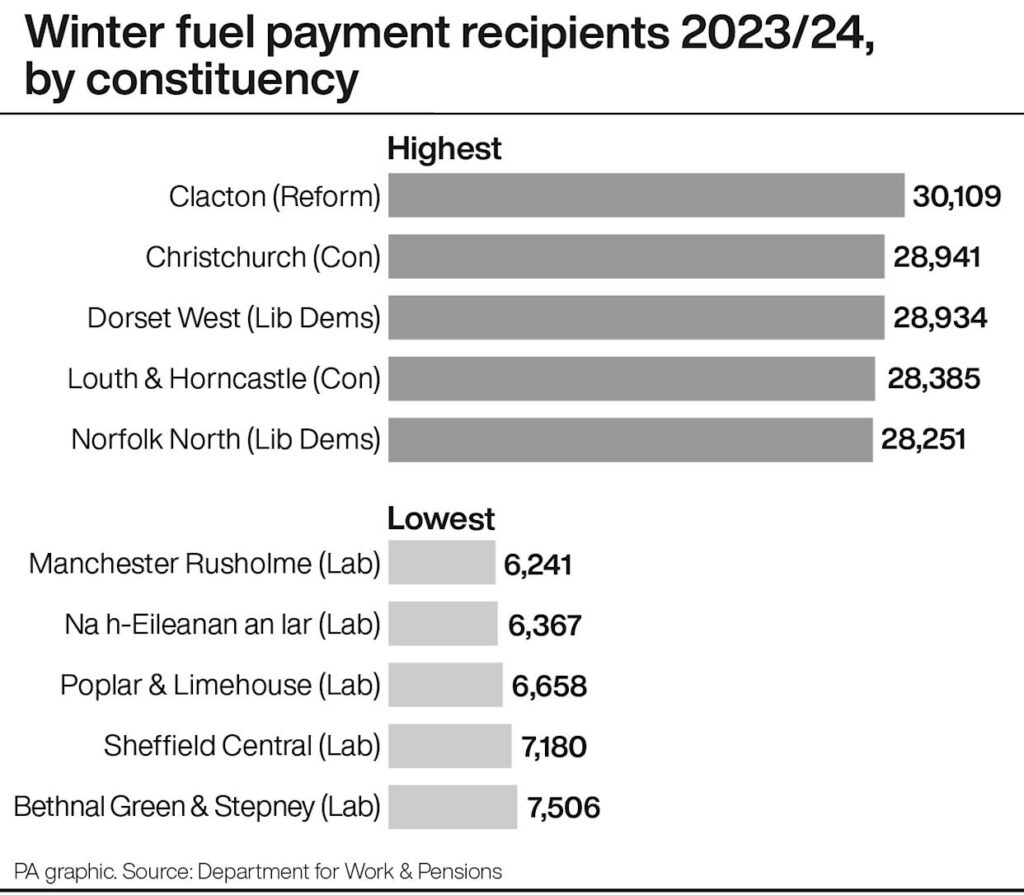

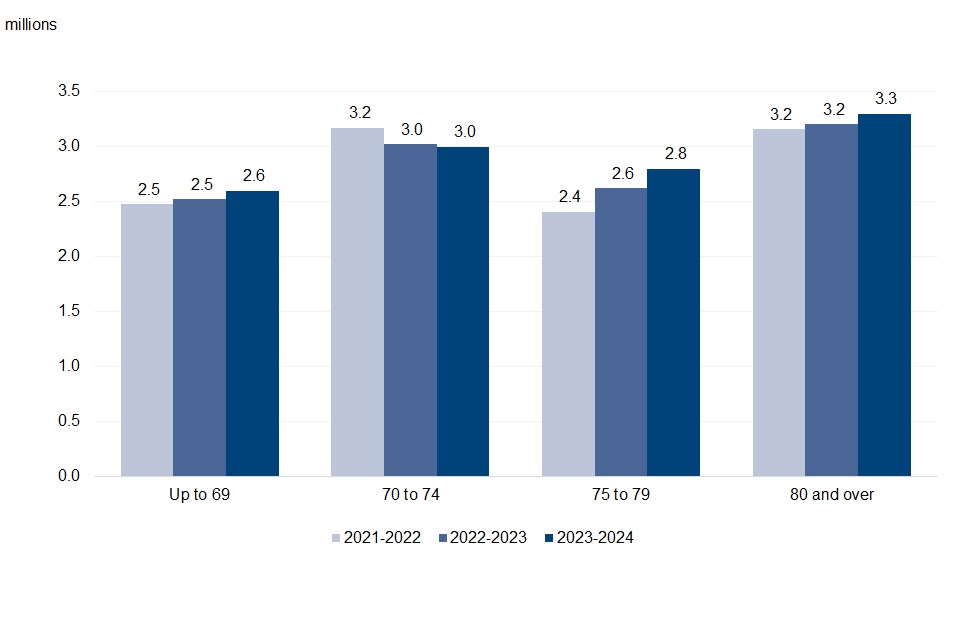

- In winter 2023–24, around 11.4 million pensioners received the payment, costing about £2 billion annually).

- With energy costs high and government budgets stretched, officials want to focus payments on those who need them most.

The new rule says that if your taxable income is over £35,000, HMRC will recover the money through your tax code or Self-Assessment return. This doesn’t mean you won’t get the payment—it means it won’t stick.

Who Might Have to Repay?

There are three main scenarios where repayment comes into play:

- Income Threshold Breach

If your taxable income exceeds £35,000, the payment will be clawed back. Example: if you’re a retired lawyer with £40,000 in pensions and investments, you’ll still get the Winter Fuel Payment but see it deducted later in your taxes. - Overpayment Errors

Sometimes, DWP systems pay out in error. If they later discover you weren’t eligible, they’ll send a letter asking for repayment. - Failure to Report Circumstances

If you didn’t notify DWP of changes—like moving abroad to a non-eligible country, or living with someone who affects your entitlement—you could be billed.

How Much Do You Get?

Here’s a simplified breakdown of payments for winter 2025–26:

- Born before 22 September 1940 → Up to £300.

- Born between 23 September 1940 and 22 September 1959 → Up to £200.

- Living with another eligible pensioner? Payment may be split.

- On Pension Credit? You’ll likely still get the maximum.

Payments are made directly to your bank account, often alongside your state pension.

Real-Life Scenarios

It helps to see how this plays out in practice:

- Mary, 72, retired nurse

- Income: £22,000.

- Result: Receives £200, keeps it, no clawback.

- Alan, 80, retired solicitor

- Income: £42,000.

- Result: Receives £300, but HMRC claws it back via tax.

- Raj and Sunita, both 68

- Combined income: £29,000.

- Result: Household gets around £200–£300, no clawback.

- Peter, 67, living abroad in Spain

- Result: Not eligible, repayment demanded if already paid.

These examples underline how eligibility and income affect outcomes.

Historical Context

Winter Fuel Payments have evolved over the years:

- 1997: Introduced, set at £20.

- 2000s: Payments expanded up to £300 for older pensioners.

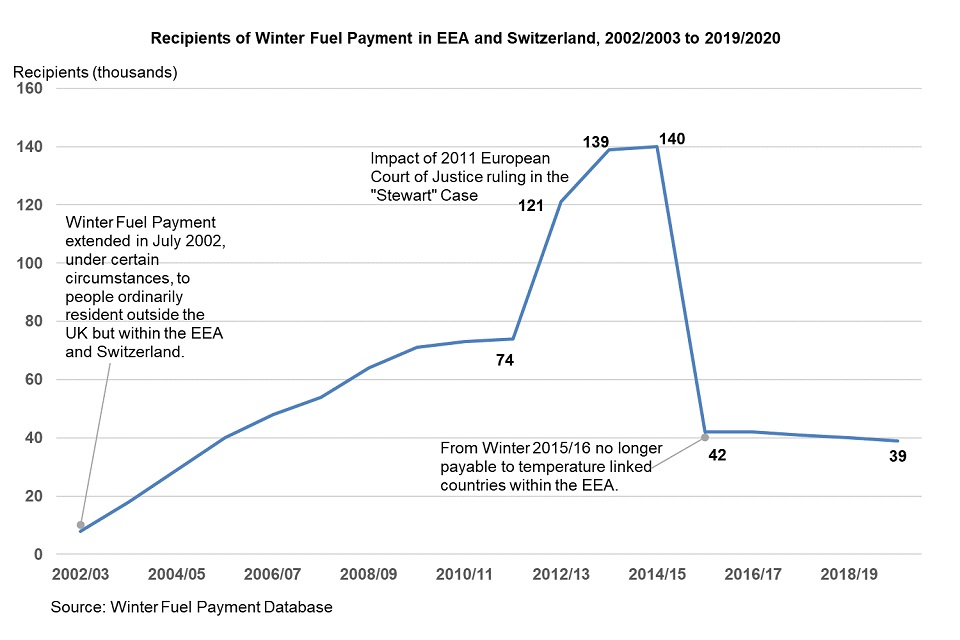

- 2010s: Eligibility tightened for those abroad.

- 2025: Introduction of the £35,000 clawback threshold.

This history shows a steady shift from universal support toward more means-tested policies.

Winter Fuel Payments for Pensioners Under Review: The Future of Winter Fuel Payments

The debate over Winter Fuel Payments isn’t going away anytime soon. With the UK facing an aging population—by 2035, nearly 1 in 4 Britons will be over 65—the cost of supporting pensioners will continue to rise. Policymakers are already hinting at further reforms, possibly linking payments more closely to means-testing or regional energy costs. For pensioners and professionals alike, the key is to expect change, stay informed, and prepare for tighter eligibility in the years ahead.

Other Benefits That Help With Heating

Winter Fuel Payments aren’t the only help available. Pensioners should also look at:

- Cold Weather Payments – £25 for each 7-day period when temps drop below 0°C.

- Warm Home Discount – £150 off electricity bills for low-income households.

- Pension Credit – A top-up that also unlocks access to other benefits.

Public Opinion and Controversy Over Winter Fuel Payments for Pensioners Under Review

Unsurprisingly, the repayment rule hasn’t gone down smoothly.

- Age UK called it “deeply unfair,” arguing that £35,000 doesn’t stretch far in today’s economy.

- Some pensioners see it as confusing—getting a payment, then losing it through taxes feels like mixed messaging.

- MPs from across the political spectrum have debated whether it creates unnecessary complexity for older citizens.

At the heart of the debate is fairness: should wealthy pensioners keep receiving the same support as those just scraping by?

Professional Advice and Implications

For professionals—financial advisors, accountants, or social workers—these changes have real implications:

- Income Planning: Advising clients on structuring withdrawals to stay below the £35,000 threshold.

- Tax Advice: Preparing clients for PAYE code changes or Self-Assessment adjustments.

- Support Guidance: Helping older people apply for Pension Credit or Warm Home Discount.

For example, an advisor might encourage clients to consider pension drawdown timing to manage taxable income.

DWP Clamps Down on Winter Fuel Payments; Pensioners Will Have to Give It Back

UK DWP £300 Winter Fuel Payment in October 2025 – Check Eligibility Criteria & Payout Dates

DWP £250 Support for UK Families Confirmed – Payment Date, Eligibility, and Payment Rules

Step-by-Step Guide: What To Do

Here’s a checklist for pensioners (or their families):

Step 1: Check Your Eligibility

Were you born before 22 September 1959? Did you live in the UK during the qualifying week (15–21 September 2025)?

Step 2: Check Your Income

Under £35,000? Keep the payment. Over £35,000? Expect repayment via HMRC.

Step 3: Report Any Changes

Moved house? Started a new pension? Inform DWP immediately.

Step 4: Keep Documentation

Save letters, statements, and tax notices. They’ll help if disputes arise.

Step 5: Seek Help

If you’re confused, call the Winter Fuel Payment Centre or reach out to Age UK.