The £1,700 Death Cost No One Warns You About: When folks think about financial planning, they usually picture retirement savings, paying off student loans, or maybe buying a house someday. But here’s a gut punch most people don’t see coming—the £1,700 death cost that sneaks up on families after a loved one passes away. It’s a hidden bill that hits grieving households across the UK, leaving folks scrambling at the worst possible moment. This isn’t just about funeral expenses—it’s about all the extra costs that pile up when someone dies. And with inflation squeezing wallets tighter than a pair of jeans after Thanksgiving, it’s time we talk about this openly, with both heart and hard facts.

The £1,700 Death Cost No One Warns You About

The £1,700 death cost isn’t just a number—it’s a wake-up call. Families across the UK are getting blindsided by hidden end-of-life expenses, often at the worst emotional time. But by planning ahead, having tough conversations, and knowing what support exists, we can ease the burden. This isn’t about doom and gloom—it’s about love. Taking care of business now is one of the best gifts you can leave behind for your family.

| Topic | Details |

|---|---|

| Average “hidden” death cost | £1,700 out-of-pocket for families |

| Rising funeral costs | Basic funeral: £4,141 (2023, SunLife) |

| Cost of dying overall | Average £9,658 including admin/legal fees |

| Regional variation | London funerals exceed £5,000; Wales averages £3,500 |

| Growth of direct cremations | 20%+ of funerals now “no-frills” |

| Government help | Limited support via UK Gov Funeral Expenses Payment |

| US comparison | Average US funeral: $7,848 (NFDA 2021) |

| Bigger picture | Cost-of-living crisis adds pressure on households |

What Exactly Is the The £1,700 Death Cost No One Warns You About?

The term “£1,700 death cost” comes from research showing that, on average, UK families end up paying nearly two grand in unplanned expenses after someone dies. These aren’t just the obvious funeral bills—it’s things like:

- Paying for the wake, catering, or flowers.

- Covering estate paperwork or legal fees.

- Transporting relatives for the service.

- Clearing out a house or storage unit.

According to SunLife’s Cost of Dying Report 2023, the average total “cost of dying” now stands at £9,658, while a “basic funeral” alone runs about £4,141. But because many people don’t plan far enough ahead—or underestimate the real price tag—families often get hit with that £1,700 shortfall they weren’t warned about.

Why This Hits Harder in 2025?

Let’s be real: folks in both the UK and the US are feeling the squeeze of inflation and the cost-of-living crisis. Over in Britain, gas and grocery bills have been climbing, just like in America. When you combine everyday financial stress with a surprise £1,700 funeral bill, it’s a recipe for debt, stress, and heartbreak.

And it’s not just the money. Imagine losing someone close to you—already one of the toughest emotional punches life throws—and then having to figure out how to pay for it. That’s a heavy weight, and it explains why so many families turn to loans, credit cards, or even crowdfunding just to cover basic end-of-life costs.

The Rising Costs of Funerals

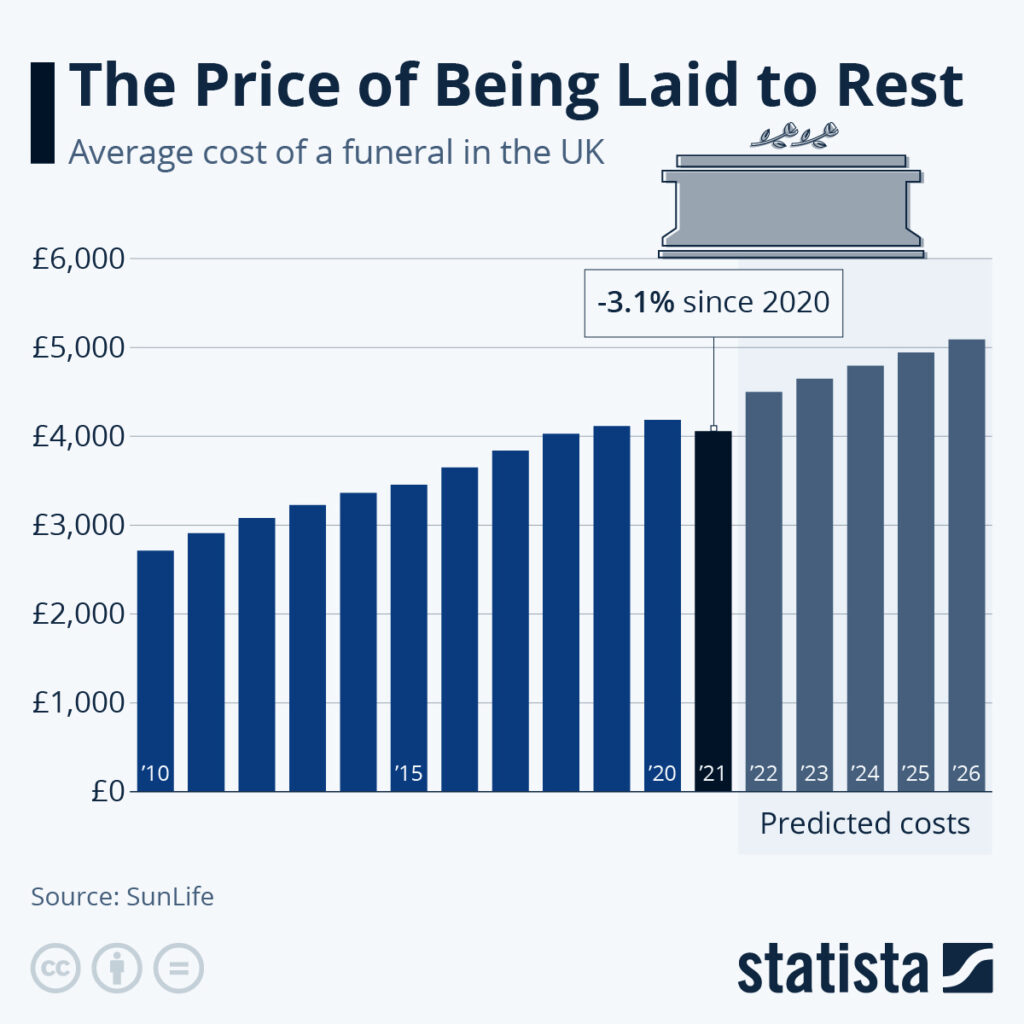

Funeral costs in the UK have climbed steadily for two decades. The data tells the story:

- 2004: A basic funeral cost about £1,920.

- 2014: That number jumped to £3,500.

- 2023: The same funeral costs £4,141—more than double in under 20 years.

- Extras (flowers, catering, headstone): Can add £2,500–£3,000.

- Professional/legal fees: Average around £2,500.

That’s how you end up at nearly £10,000 when all is said and done. And here’s the kicker: one in five families say they experience financial hardship paying for it.

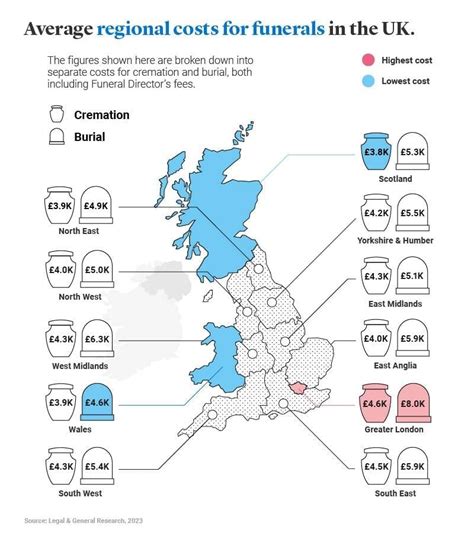

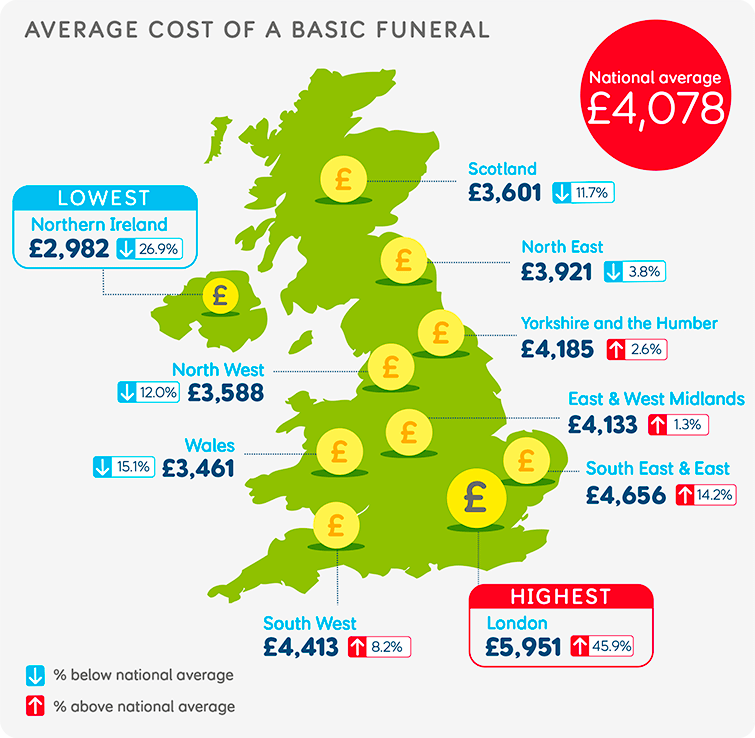

Regional Differences

Not all funerals are created equal. For example:

- London: Among the most expensive, with funerals averaging over £5,000.

- Wales: Typically cheaper, around £3,500.

- Northern Ireland & Scotland: Prices fall somewhere in between, but still rising every year.

These regional gaps show that where you live can add hundreds—or even thousands—to your final bill.

Real-Life Examples

- Sarah from Manchester: When her dad passed suddenly, she expected to spend maybe £4,000. Instead, she ended up paying almost £6,000, including legal paperwork and catering for family members who traveled in. The shortfall? Right around £1,700—which she put on a credit card.

- James in Birmingham: He chose a direct cremation for his mom. The cost was just under £1,200, which felt manageable. But he admits it still felt “cold,” with no family gathering to celebrate her life.

- Helen in London: Facing bills topping £5,500, she turned to an online crowdfunding page. Dozens of friends and strangers chipped in, highlighting how common it’s become to seek community help for funeral costs.

Historical and Cultural Context

Funerals weren’t always this expensive. In earlier generations, communities often handled much of the process themselves—neighbors built coffins, services were simple, and costs were minimal. Today, with professionalized funeral industries, regulations, and added services, the costs ballooned.

Cultural expectations also play a role. Families often feel pressured to “do it properly” with flowers, catering, cars, and memorials—even if that means taking on debt. Social media has only amplified this pressure, with people comparing funerals like they do weddings.

How Families Cope?

When the money just isn’t there, people get creative—or desperate. Families report paying funeral costs by:

- Dipping into savings (if they have any).

- Putting it on credit cards.

- Taking out personal loans.

- Selling belongings or property.

- Asking friends and strangers for help via crowdfunding.

In fact, 20% of funerals are now “direct cremations”—a stripped-down, no-service option popularized in recent years because it’s cheaper. While it takes some financial pressure off, many people feel it robs them of closure or cultural traditions.

Practical Tips: How to Prepare and Protect Your Family From The £1,700 Death Cost No One Warns You About

So, how do you avoid leaving your loved ones with a surprise bill? Here’s a simple, step-by-step guide:

Step 1: Talk About It (Yes, Really)

Death is taboo in many households. But having an open conversation now can save heartache later.

Step 2: Research Funeral Plans

- Prepaid funeral plans let you lock in today’s prices.

- Compare providers at sites like MoneyHelper UK.

Step 3: Consider Life Insurance

A modest life insurance policy can cover funeral costs and a bit more. In the US, even $10,000 policies are marketed as “final expense” insurance.

Step 4: Put Your Wishes in Writing

Don’t just talk—write down what kind of send-off you’d want. That clarity reduces both emotional and financial strain.

Step 5: Explore Government Support

- In the UK, certain families may qualify for the Funeral Expenses Payment.

- In the US, Social Security offers a small death benefit, but most help comes from state-level programs.

Quick Checklist

- Talk with family about wishes.

- Research funeral plan providers.

- Consider life insurance or final expense coverage.

- Write down funeral preferences.

- Keep documents accessible.

- Know what support is available locally.

Why This Matters for Professionals Too?

If you’re in finance, healthcare, or HR, this isn’t just about personal planning. It’s about:

- Employers: Supporting grieving staff with bereavement leave and resources for financial guidance.

- Financial advisors: Encouraging clients to plan realistically, not just for retirement but also for end-of-life costs.

- Healthcare professionals: Understanding the financial stress on families can improve compassionate care and communication.

International Comparison: UK vs. US

It helps to zoom out and see how the UK compares with other countries.

- United States: According to the National Funeral Directors Association, the average funeral with burial costs $7,848 (around £6,200). Cremation averages $6,970. Like in the UK, families often underestimate costs and face unexpected bills.

- Australia: Funerals average between AUD $4,000–$15,000 (£2,000–£8,000), depending on the region and style of service.

- Japan: Funerals are among the most expensive in the world, averaging ¥2–3 million (£11,000–£17,000).

These comparisons show that while the UK isn’t the most expensive, the pressure still feels overwhelming—especially when combined with today’s cost-of-living struggles.

DWP £250 Support for UK Families Confirmed – Payment Date, Eligibility, and Payment Rules

UK DWP £300 Winter Fuel Payment in October 2025 – Check Eligibility Criteria & Payout Dates

£200 Cost-of-Living Support in UK October 2025 – Will you get it? Check Eligibility