DWP Clamps Down on Winter Fuel Payments: If you’re a retiree living in the UK, or someone interested in social welfare policies, you’ve probably heard the buzz: the Department for Work and Pensions (DWP) is tightening the rules around Winter Fuel Payments in 2025. This change means that some pensioners will have to pay back the benefits they received, sparking a lot of questions and concerns among the elderly community and their families. But what exactly is happening? Why is the government making this move? And how does it impact millions of pensioners across the UK? In this comprehensive guide, we’ll unpack everything—covering the history, the current changes, how to prepare, and practical steps anyone affected should take. Let’s get started.

DWP Clamps Down on Winter Fuel Payments

The UK’s move to restrict Winter Fuel Payments to lower-income pensioners reflects the ongoing challenge of balancing social support and fiscal responsibility. While these changes aim to focus help where it’s most needed, they also highlight the importance for pensioners to stay informed. Being proactive—reviewing your income, planning your finances, and maximizing energy efficiency—can make a real difference during the cold months ahead. Stay warm, stay prepared, and ensure you’re making the most out of the support available.

| Topic | Details | Source |

|---|---|---|

| What is the Winter Fuel Payment? | A yearly tax-free benefit to help pensioners cover heating bills | gov.uk |

| 2025 Changes | Higher-income pensioners must repay the benefit via tax system | gov.uk |

| Income Threshold | Full repayment required if taxable income exceeds £35,000 | gov.uk |

| Benefit Range | Up to £300 per household | |

| When Does It Happen? | Payments made Nov-Dec 2025; recovery occurs in the following tax year |

The Basics of Winter Fuel Payment

The Winter Fuel Payment (WFP) is a government benefit introduced in 1997 to help older people with their heating costs during England’s coldest months. It’s designed to provide a financial boost so pensioners don’t have to choose between heating and other essentials. This benefit is tax-free, paid directly into bank accounts, and usually arrives between November and December each year

How Much Do You Get?

The amount varies depending on circumstance, but typically ranges from £100 to £300 per household. Those aged 80 or over and living alone receive higher payments compared to those in households with multiple recipients. The payment amount can also increase in particularly cold winters through Cold Weather Payments, adding further support.

Who Qualifies For DWP Clamps Down on Winter Fuel Payments?

To be eligible, you must meet certain criteria:

- Be above the state pension age at the start of the qualifying week (the third week of September).

- Have lived in the UK for at least one day during the qualifying week.

- Have not opted out or been excluded due to reasons like imprisonment or receiving long-term hospital care.

- For those living abroad, eligibility depends on having a genuine and sufficient link to the UK, such as work or family connections.

A Quick Look Back: How the Payment Evolved

Since its inception, the scheme has undergone significant changes:

- 1997 Introduction: The payment was originally a flat £20 per year, targeted at pensioners aged 60 and above

- Early Increases: The amount increased over the years, reaching £100 in 1999, then back to £200 in 2000, with additional benefits for those over 80 and living alone.

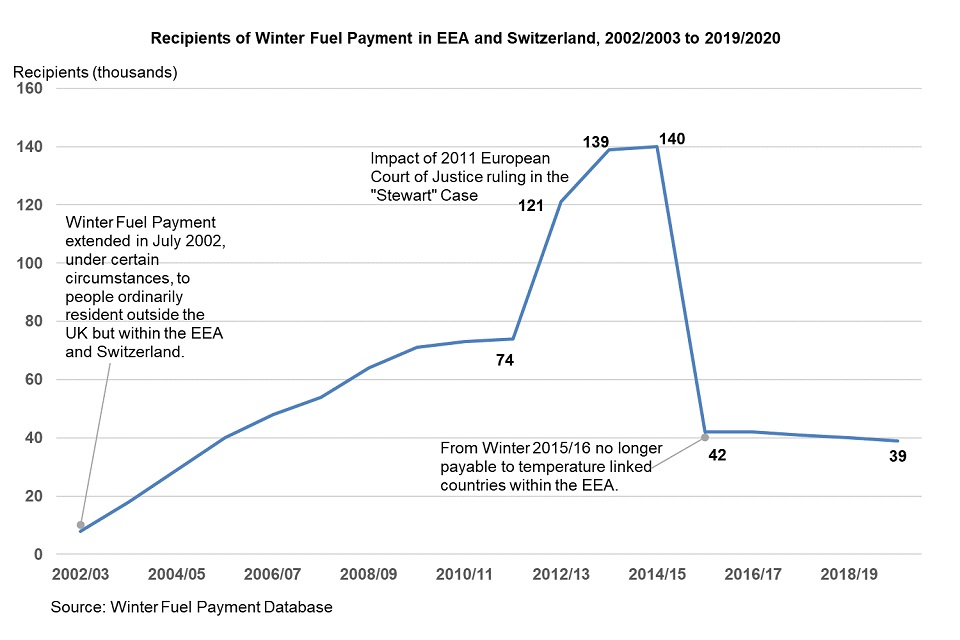

- Expansion of Eligibility: Over time, the scheme expanded to include more countries within the European Economic Area (EEA), such as Ireland and the Netherlands, until the UK’s departure from the EU in 2020 introduced new eligibility rules.

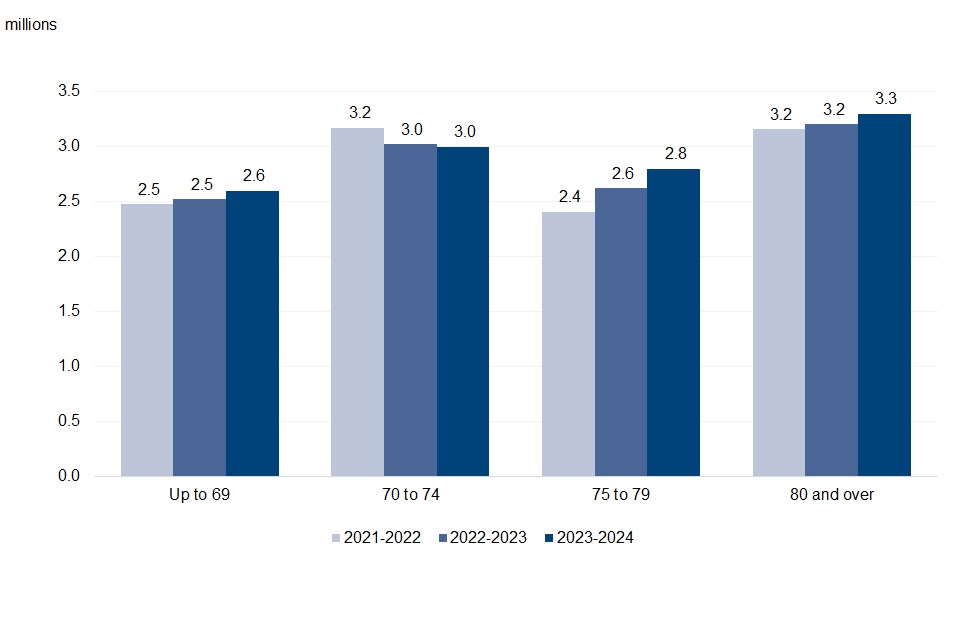

- 2011/12: The benefit cost was over £2 billion, paid to around 12.7 million people.

- 2024/25: The scheme was initially means-tested, and a policy change was announced for the 2025/26 winter.

What’s Changing As DWP Clamps Down on Winter Fuel Payments?

The biggest news in 2025 is the shift from universal to means-tested support. Historically, the scheme was largely universal—most pensioners received the benefit regardless of income. Now, the government is transitioning to restrict payments to only those on certain means-tested benefits, primarily Pension Credit.

The Key Details

- Income Threshold: Pensioners with a taxable income exceeding £35,000 will be required to repay the winter fuel amount through the tax system.

- Benefit Range: Payments will still range from £100 to £300, but only for those below the income cap.

- Impact: Approximately 2 million pensioners will have their payments recovered, according to government estimates.

How Will Recovery Work?

- If your income exceeds the threshold, HMRC will recoup the amount automatically through tax codes or self-assessment forms.

- There’s no upfront opt-in or opt-out — the system will identify those with high incomes and recover funds accordingly.

- The recovery is not a one-time event; it will occur during the 2025/26 tax year after the payments are distributed in late 2025.

Why the Change?

The policy aims to target support more effectively by narrowing eligibility and ensuring funds go to the most vulnerable. It also helps reduce government expenditure on support for higher-income pensioners who can afford to heat their homes without extra help.

Why DWP Clamps Down on Winter Fuel Payments Matters?

With the cost of living soaring — particularly energy prices that have increased by over 20% in recent years — the Winter Fuel Payment has been a vital lifeline for millions. The scheme has historically helped diminish fuel poverty among older adults and vulnerable households during harsh winters.

However, the new income restrictions mean many will have to give the money back, potentially leading to financial stress. For example, a pensioner earning £40,000 a year overseeing their household heating costs might receive the payment but then be asked to repay it when filing taxes. This could impact their budgeting and cause unwelcome surprises during the cold months.

Impact on the Budget and Social Wellbeing

This change raises concerns among advocacy groups and public health officials. According to research, proper heating during winter significantly reduces the risks of cardiovascular illnesses, hypothermia, and mental health issues linked to cold stress. Reducing or eliminating support for higher earners might inadvertently put some at risk, especially in colder regions.

How to Prepare and Respond For DWP Clamps Down on Winter Fuel Payments?

If you or a loved one are affected by these new rules, here are practical steps to stay ahead:

1. Review Your Income and Benefits

Gather documents like pension statements, bank statements, and tax assessments. If your taxable income is over £35,000, you should prepare for repayment — check your income against the threshold.

2. Understand Your Eligibility & Timing

- Automatic Payments: Expect to receive your benefit between November and December.

- Repayment: HMRC will automatically recover the amount during the 2025/26 tax year.

- Opt-Out: If you prefer not to receive the benefit to avoid potential repayment, you must declare this before the deadline, usually in September.

3. Maximize Energy Savings

Beyond government support, reducing energy use helps lower bills:

- Install energy-efficient bulbs.

- Use programmable thermostats to control heat.

- Seal drafty windows and doors.

- Wear warm clothing indoors.

- Use electric blankets or hot water bottles.

4. Explore Other Support Options

The UK government also offers:

- Cold Weather Payments.

- Pension Credit.

- Universal Credit.

The Historical Context and Why It Matters

Understanding the background of the Winter Fuel Payment helps clarify why it’s a significant part of social policy. The scheme was established in 1997 as a universal benefit to aid pensioners, regardless of income, recognizing their specific heating needs during winter.

Initially, payments were modest (£20), but over time they increased to reflect inflation and rising energy costs. The policy was aimed at reducing fuel poverty among the elderly, especially as energy prices surged.

DWP £250 Support for UK Families Confirmed – Payment Date, Eligibility, and Payment Rules

UK DWP £300 Winter Fuel Payment in October 2025 – Check Eligibility Criteria & Payout Dates

DWP’s £812 Cost-of-Living Boost Coming in October 2025, Check List of Eligible, Payment Date

Major Policy Changes Over the Years:

- 2003/04: Expansion to include residents of some other European countries.

- 2011/12: The scheme cost over £2 billion and supported millions.

- 2024/25: Introduction of means testing, and now further restrictions in 2025.

The recent change—making the benefit receipt-dependent on income—marks a historic shift toward targeted support rather than universal benefits.