UK DWP £300 Winter Fuel Payment: If you’re living in the UK and curious about the popular £300 Winter Fuel Payment from the Department for Work and Pensions (DWP) this October 2025, you’re in the right place. Whether you’re a senior looking for some extra help with those rising heating bills or a professional advising clients, this guide breaks down everything you need with a friendly yet expert voice. The Winter Fuel Payment is a government cash boost designed to help older adults in the UK keep warm during the cold winter months. For 2025, payments range between £100 and £300, depending on your age and circumstances in the qualifying week of September. Knowing who qualifies, when payments will be made, and how to claim can save you time, confusion, and money.

UK DWP £300 Winter Fuel Payment

The UK DWP Winter Fuel Payment for October 2025 remains a vital financial lifeline, giving millions of older adults between £100 and £300 to help with rising heating costs. Knowing eligibility rules, payment timing, income thresholds, and claiming procedures ensures you or your loved ones don’t miss out on this essential support. Amid today’s energy price crises, this payment is more important than ever for protecting senior health and wellbeing during the coldest months.

| Feature | Details | More Info |

|---|---|---|

| Payment Amount | £100 to £300, depending on age | gov.uk Winter Fuel Payment |

| Eligibility Age | Born on or before 21 Sep 1959 | DWP Eligibility |

| Qualifying Week | 15 to 21 September 2025 | |

| Income Cap | £35,000 annual income (above this repayment required) | |

| Payment Start Date | Mid-November 2025 | |

| Deadline to Claim | March 31, 2026 | |

| Payment Delivery | Automatic for most, into state pension or benefit accounts | |

| Exclusions | Full-week hospital or prison stay, certain care home cases |

What Is the Winter Fuel Payment?

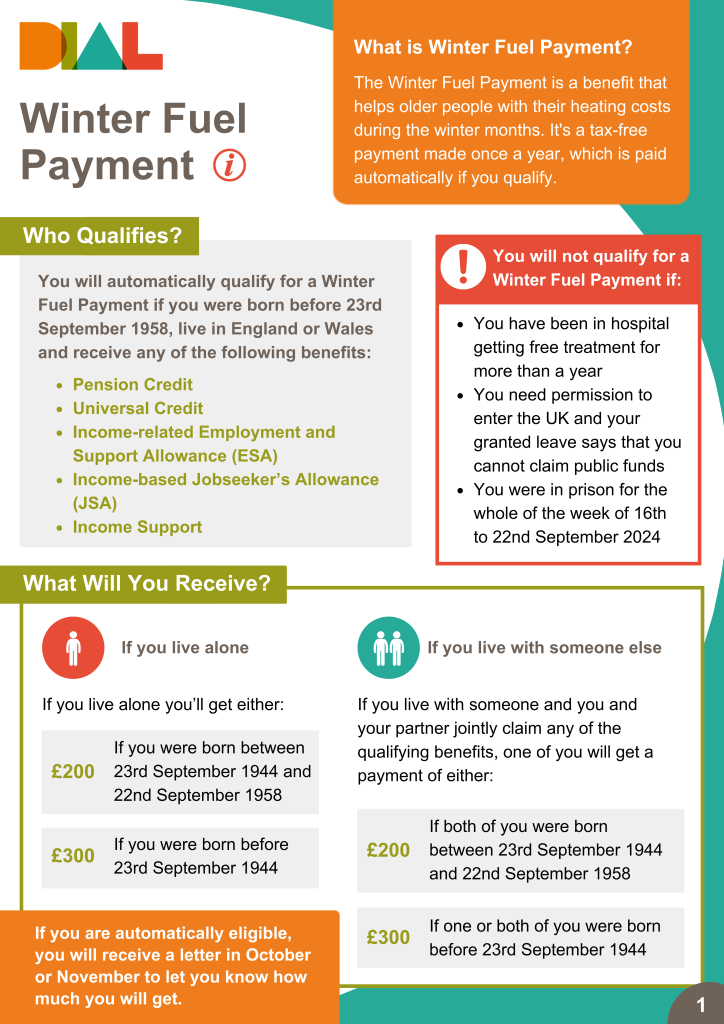

The Winter Fuel Payment is a tax-free, lump sum payment from the UK government’s Department for Work and Pensions (DWP) to help older adults with the extra cost of heating their homes during winter. It comes at a crucial time when energy bills can skyrocket, helping people avoid financial strain just to stay warm.

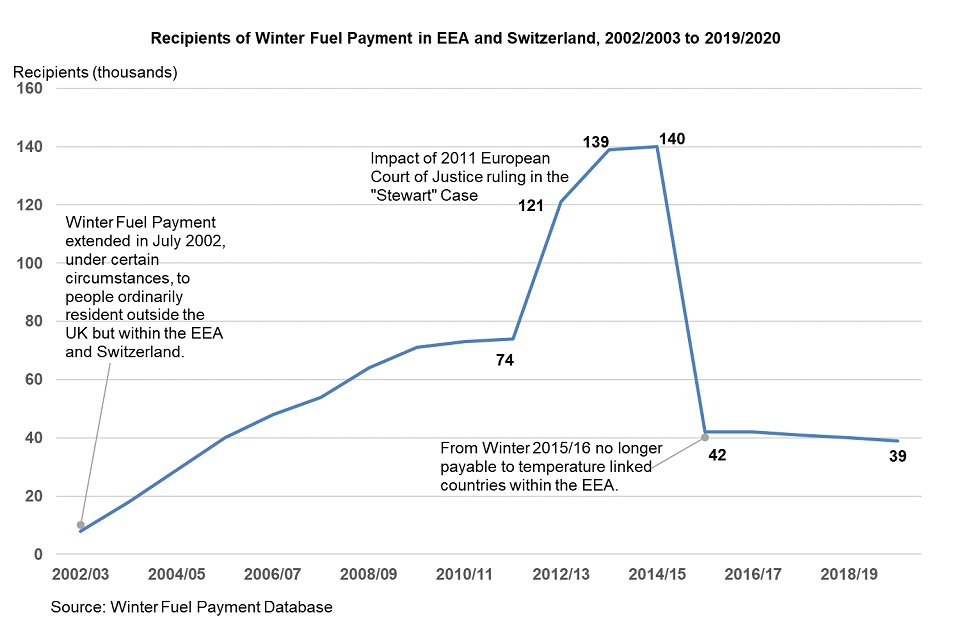

The program started in 1997 under then Chancellor Gordon Brown as a universal benefit, providing pensioners a small fixed payment to ease winter fuel costs. Since then, it has undergone multiple adjustments to target assistance more effectively, adapting to economic circumstances and policy goals.

In 2025, eligible seniors may receive between £100 and £300, depending largely on their age and household circumstances during the qualifying week.

Eligibility Criteria for 2025

Who exactly can claim this support? To qualify:

- You must have been born on or before September 21, 1959, making you at least 66 years old at the qualifying week in September.

- You must have been living in the UK during the qualifying week of September 15 to 21, 2025, specifically in England, Wales, or Northern Ireland.

- The payment is not available in Scotland, which runs a separate fuel support scheme.

- There is an income cap of £35,000 per year. If your income exceeds this, the payment will be reclaimed via the tax system.

- People who were in hospital or prison for the full qualifying week or those residing in certain care homes receiving income-related benefits are excluded.

This means that most pensioners, including those receiving a state pension or other qualifying benefits, will automatically qualify unless they fall into one of the exclusion categories.

How Is the Payment Calculated Exactly?

The amount you get depends on your age and household living arrangements:

- If you are 80 years or older during the qualifying week, you receive the maximum £300 payment.

- For those between state pension age and 79, payments are typically:

- £200 for a single individual,

- £300 for couples living together where both qualify.

- Households with more than one eligible person don’t get multiple full payments, but payments may be split.

- Earnings above £35,000 per year trigger a reclaim through HM Revenue & Customs (HMRC), so you may have to pay some or all of the payment back through your taxes.

Historical Background and Policy Evolution

Understanding where the Winter Fuel Payment came from shines a light on why it matters so much today.

- 1997: Launched by Chancellor Gordon Brown as a universal benefit. Originally, it was a flat £20 payment regardless of income or age.

- 1999-2000: Increased to £100.

- 2000-2001: Raised further to £200.

- 2003-2004: An extra £100 was introduced for those aged 80 or above, making the maximum payment £300.

- Over the next decade, the payment cost the government billions and helped millions of pensioners with winter heating bills.

- In recent years, to balance fiscal responsibility and targeted support, eligibility and payment rules shifted toward means testing. For 2024, the payment was limited to pensioners receiving Pension Credit or certain benefits, cutting out nearly 10 million pensioners.

- However, following strong public and political backlash, the government reversed this policy for winter 2025-2026, expanding eligibility but introducing an income cap of £35,000, above which the payment will be reclaimed through taxes.

- Parliamentary debates around the Winter Fuel Payment highlighted concerns over elderly health risks during cold weather, such as strokes and pneumonia, underscoring its importance for public health.

Real-Life Examples: Who Gets What?

Understanding exactly what you might be entitled to can be confusing. Here are some real-life examples:

- Marjorie, 82, lives alone in Wales: She will receive an automatic payment of £300 in November, helping her cover rising heating costs without worries.

- John and Anne, both 78, married and sharing a home in England: They share a combined household payment of £300.

- Tom, aged 70, lives with his 65-year-old spouse: Tom qualifies, so they get a household payment of £200.

- Susan, 85, earns £40,000 annually: She will receive the payment but must repay it partially or entirely through income tax due to the income threshold.

Scotland Residents: What’s Different?

If you live in Scotland, the UK Winter Fuel Payment scheme does not apply. Instead, you could be eligible for a different scheme called the Winter Heating Assistance run by the Scottish Government. This program provides financial help to vulnerable households during winter months and operates under different rules.

Why UK DWP £300 Winter Fuel Payment Matters More Than Ever: The Energy Cost Crisis

Energy bills have soared due to global supply chain issues, inflation, and geopolitical tensions. Older adults on fixed incomes often face difficult choices between heating their homes or other essentials like food and medication.

The Winter Fuel Payment is a critical lifeline, offering thousands of pounds in total to help mitigate fuel poverty. Without it, many seniors could freeze in winter or face severe financial hardship.

When and How Will You Get Paid?

Payments generally start dropping into accounts from mid-November 2025 and can continue up to the end of March 2026. For most, the payment is automatic, deposited in the same account that receives the state pension or qualifying benefits.

The DWP sends letters in October or November, letting you know how much you will get and any steps required on your part.

If you don’t get the payment automatically, you should fill out a claim form called WFP1, available at gov.uk.

Stay Alert: How to Avoid Winter Fuel Payment Scams

Fraudsters may target pensioners around this time, posing as DWP officials to steal personal or financial information.

The government will never ask you to pay to receive the Winter Fuel Payment or request bank details via email or phone. Always verify any suspicious communication through official channels.

If in doubt, contact the DWP directly or seek help from support organizations like Citizens Advice or Age UK.

Extra Help and Resources

- Citizens Advice: Provides free advice on benefits, including Winter Fuel Payment.

- Age UK: Offers tailored help for older adults on money management and benefits.

- HM Revenue & Customs (HMRC): For queries related to the income threshold and tax reclaim.

DWP £250 Support for UK Families Confirmed – Payment Date, Eligibility, and Payment Rules

DWP £500 One-Off Support in October 2025 – Eligibility Criteria and Payment Dates

New UK Driving Rule Change for Seniors Begins from 1 October 2025 – Check Revised Rules