Canada CRA $496 GST/HST Credit: Looking for the lowdown on the Canada CRA $496 GST/HST Credit for October 2025? You’re in the right spot. This article breaks down everything about the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit that’s rolling out this October 2025 — what it is, who’s eligible, how to get it, and exactly when the cash hits your account. Whether you’re a regular working Joe or just curious about tax benefits, this guide has your back. Let’s dive in and make things simple. The GST/HST credit is a tax-free quarterly payment given by the Canada Revenue Agency (CRA) to help low- and modest-income Canadians manage the sales tax they pay on everyday stuff like groceries, gas, and clothes. Think of it as a little boost from Uncle Sam’s cousin to keep your budget in check. Payments happen four times a year, and if you qualify, the October payment is on the calendar for October 3, 2025.

Canada CRA $496 GST/HST Credit

The Canada CRA $496 GST/HST Credit for October 2025 is a vital lifeline for thousands of Canadians balancing tight budgets. This tax-free quarterly payment helps offset sales taxes on essentials and provides predictable financial relief. Filing your return on time, keeping your info updated, and signing up for direct deposit are the keys to unlocking this benefit hassle-free. With rising living costs, the GST/HST credit ensures the government puts money back in the pockets of those who need it most.

| Topic | Details |

|---|---|

| Payment Date for October 2025 | October 3, 2025 |

| Maximum Quarterly Payment | Around $130 – $170 depending on family size |

| Maximum Annual Credit | Up to $519 for singles, $698 for couples, plus $184 per child |

| Eligibility Requirements | Canadian resident for tax purposes, 19 or older, filed 2024 tax return |

| Purpose of Credit | Offset GST/HST paid on essential goods and services |

| Payment Type | Tax-free quarterly credit, automatically calculated from tax return |

| Where to Confirm Details | Official CRA GST/HST Credit Page |

What Is the GST/HST Credit?

Here’s the skinny: the GST/HST credit is a federal government program aimed at helping Canadians with lower incomes offset the money they spend on the Goods and Services Tax (GST) or Harmonized Sales Tax (HST). It’s cash that lands four times a year in your bank or mailbox, with no tax taken out. This means free money from the government to make life easier and bills lighter.

If you’ve ever felt that your tax return was just going straight to the government, this program is a partial refund on that tax bite, designed just for folks who need it most.

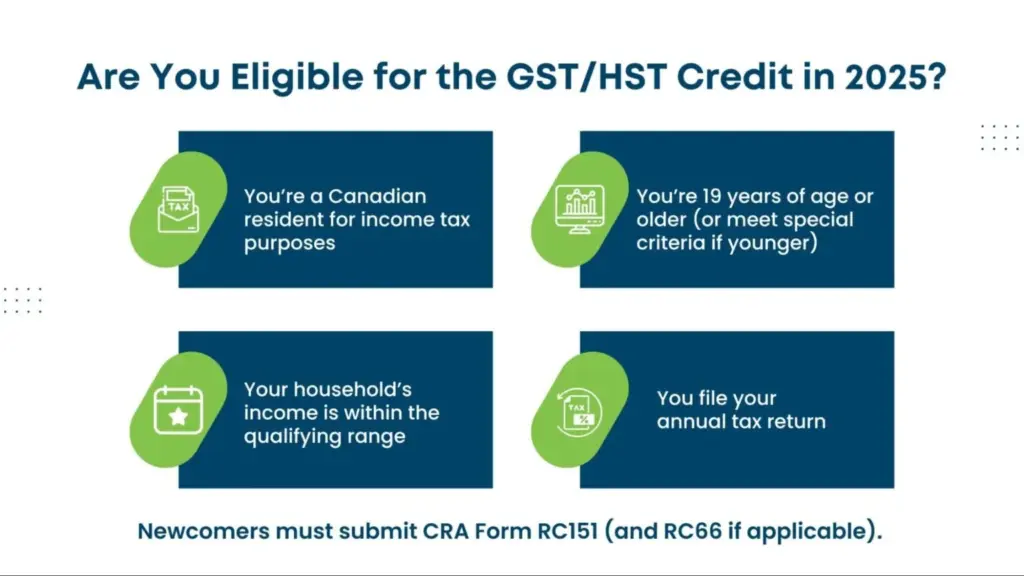

Who Is Eligible for the GST/HST Credit in 2025?

The Canada Revenue Agency keeps eligibility straightforward but with specific conditions:

- You must be a resident of Canada for income tax purposes at the end of the month before and at the beginning of the month in which the CRA makes the payment.

- You must be at least 19 years old by December 31, 2024, OR have a spouse/common-law partner or be a parent living with a child.

- You need to have filed your 2024 income tax return, even if your income is zero.

- Your household income must meet the CRA’s income thresholds. For example, single individuals earning $52,255 or more before tax in 2024 typically are not eligible.

- People who are not considered residents for tax purposes, diplomats (officers or servants of other countries), or those confined to prison for 90+ days before payment aren’t eligible.

Additionally, if your family situation changes — for instance, you gain or lose a spouse, or your child custody arrangements change — this can affect your eligibility. Parents sharing custody receive half the credit for the child, while child welfare agencies responsible for a child mean the parent cannot claim the credit for that child.

Because Canada is diverse, the CRA has comprehensive rules for those who arrive or leave the country mid-year, ensuring everyone eligible gets fair treatment according to residency and age at payment time.

How Much Money Can You Get?

The amount you get depends heavily on your family size and household income. Here’s the deal broken down:

- Singles: Up to $519 per year, paid quarterly (~$130 per quarter).

- Couples: Up to $698 per year (~$170 quarterly combined).

- Additional Amounts for Children: $184 annually per child under 19, split quarterly (~$46 per payment).

To put this into perspective, a family of four can put over $1,000 back in their pocket through this credit annually — a significant help toward the rising cost of living.

The CRA reduces the payment amount gradually as income rises beyond threshold limits. This “phase-out” ensures the credit targets those who need it most.

When will the Canada CRA $496 GST/HST Credit be Made?

The quarterly payments hit bank accounts or mailboxes four times per year:

- January 5

- April 4

- July 4

- October 3, 2025 (the next upcoming date)

Opting for direct deposit speeds up the process, getting your money safely and faster than waiting on a mailed cheque.

How to Ensure You Receive the Canada CRA $496 GST/HST Credit on Time?

Follow these simple steps to keep payments smooth and timely:

- File Your Taxes on Time: Filing your income tax return for 2024 is the foundation for eligibility. Without this, no credit payment.

- Keep Your Information Current: Marital status, number of children, and address updates with CRA help avoid payment hiccups.

- Sign Up for Direct Deposit: This avoids mail delays or lost cheques and deposits funds straight into your bank.

- Monitor Your CRA My Account: Keep an eye on your account to confirm payment details and track upcoming deposits.

- Use CRA’s Benefits Calculator: To estimate how much credit you might get, use the official online Child and Family Benefits Calculator.

Interaction with Other Tax Credits and Programs

The GST/HST credit is just one piece of Canada’s social support system. It pairs well with other benefits:

- Canada Child Benefit (CCB): Focuses directly on child-related support.

- Provincial and Territorial Supplements: Many provinces add top-up credits to the federal GST/HST credit.

- Disability Tax Credit (DTC) and Seniors Benefits: Different eligibility criteria apply, but credits can be claimed together.

- Tax Refunds and Credits: The GST/HST credit does not reduce your tax refund or eligibility for other credits like the Working Income Tax Benefit.

Knowing how these benefits blend can maximize household support and financial stability.

Real-Life Examples to Clarify

- Jane is a single mom with two kids under 19. She earns $30,000 annually and qualifies for the full GST/HST credit amount plus additional for her children — totaling just over $1,000 yearly, paid quarterly. This amount helps her with groceries, transport, and other necessities.

- Mike & Laura are a married couple with no kids earning $45,000 combined. They get a credit of up to $698 split over four payments, which reduces the sting of the Harmonized Sales Tax on their daily expenses.

- A senior couple living on a fixed income may also qualify and use this credit to offset utility bills or healthcare-related expenses, easing budget pressures.

Why the Canada CRA $496 GST/HST Credit Matters?

With inflation driving up everyday costs like groceries, fuel, and utilities, this credit is more valuable than ever. Being tax-free, every dollar from the credit is yours to spend without losing more to taxes.

For low- and modest-income families, this means tangible relief and better cash flow throughout the year. It reflects Canada’s commitment to fairness and helps bridge gaps in household budgets.

Canada Grocery Rebate Amount for October 2025 – Check Eligibility & Payment Details

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date

Canada CRA $2,600 Direct Deposit in October 2025, Eligibility & Payment Schedule

Tips to Maximize Your GST/HST Credit Benefits

- File Early and Accurately: The sooner and more accurate your tax return, the faster and more accurately the CRA can process your credit.

- Keep Records Updated: Always update marital status, address, and number of children.

- Enroll for Direct Deposit: Safer and faster than waiting for cheques.

- Stay Informed: CRA updates income thresholds annually; track changes through the official CRA website.

- Use Online Tools: CRA’s benefits calculator helps forecast expected credit amounts.