New U.S. Law Could Make 90% of Social Security Payments Tax-Free: If you rely on Social Security benefits for your livelihood, 2026 is shaping up to be a landmark year. A new U.S. law, the You Earned It, You Keep It Act, promises to make nearly 90% of Social Security payments completely tax-free. That’s right — retirees could finally get to keep most of the money they’ve earned, without Uncle Sam taking a cut. This change could deliver welcome financial relief to millions of Americans and reshape the retirement landscape. Let’s dive in and unpack what this means for you, your finances, and the future of Social Security.

New U.S. Law Could Make 90% of Social Security Payments Tax-Free

The You Earned It, You Keep It Act could be one of the most significant tax changes for American retirees in decades. By almost eliminating federal taxes on Social Security benefits starting in 2026, it pledges to put more money back into the pockets of those who have contributed years of hard work to the nation’s retirement system. For middle-income seniors, this law means bigger checks, less tax hassle, and a much-needed boost to financial security. High earners will contribute a bit more, helping sustain Social Security for future generations. Stay informed, plan ahead, and get ready to embrace a brighter retirement landscape!

| Topic | Details |

|---|---|

| Law Name | You Earned It, You Keep It Act |

| Effective Date | January 1, 2026 |

| Tax Impact | Makes 90% of Social Security benefits tax-free |

| Current Taxation | Up to 85% of benefits taxable depending on income |

| Payroll Tax Wage Cap Increase | From $176,100 in 2025 to $250,000 to offset revenue loss |

| Beneficiaries | Nearly all Social Security recipients, especially middle-income seniors |

| Source / More Info | Social Security Administration |

What Is This Law, and Why Does It Matter?

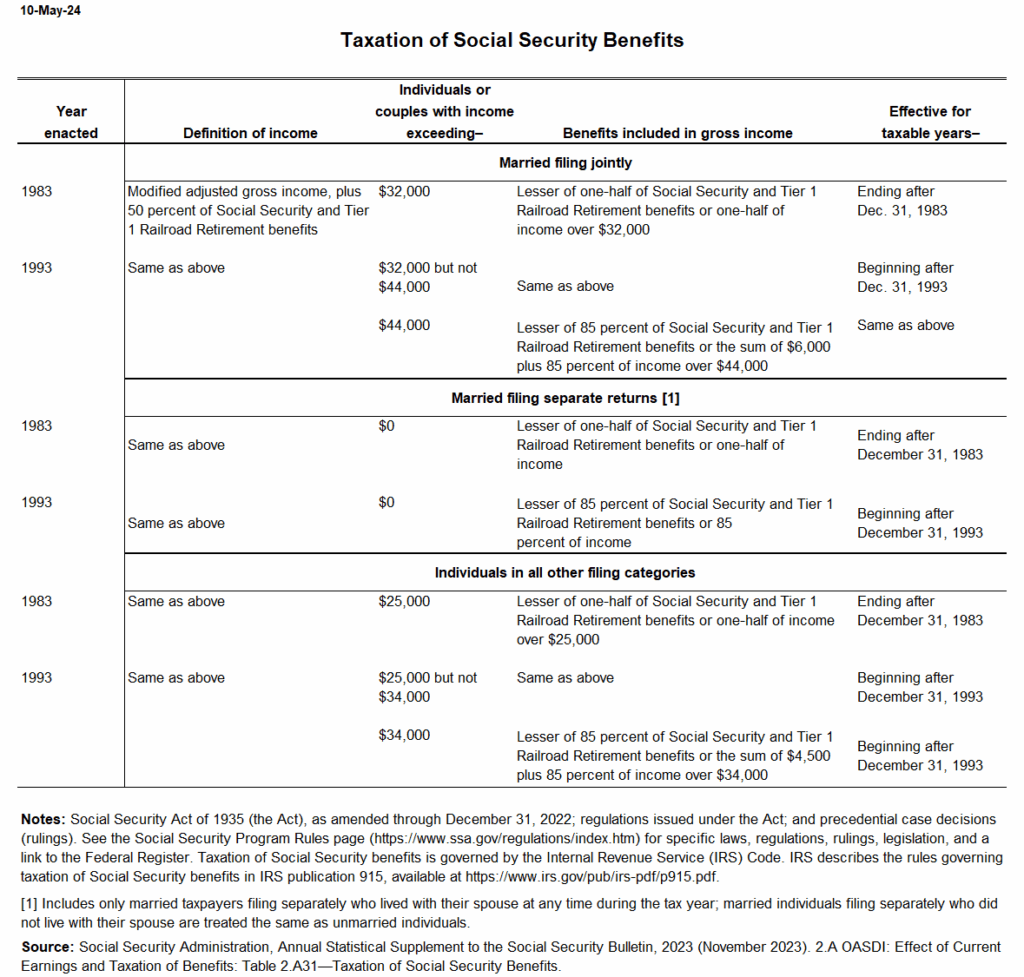

Social Security taxes on benefits have been part of the landscape since 1984. Initially introduced as a way to help fund the program’s solvency, these taxes mean many seniors currently hand over 50% to 85% of their benefits to federal income taxes depending on their combined income. That’s a lot of money for people who often live on fixed incomes.

The new You Earned It, You Keep It Act seeks to eliminate these federal taxes starting in 2026, empowering retirees to keep more of their earned benefits. To balance this loss of tax revenue, the bill raises the Social Security payroll tax wage cap — currently at about $176,100 — up to $250,000. This means wealthier earners will pay more in payroll taxes, helping keep the program financially secure while easing the load on middle- and lower-income retirees.

A Brief History of Social Security Taxation

To fully appreciate the significance of this new legislation, it helps to look back. The Social Security program was created in 1935 by President Franklin D. Roosevelt as part of the New Deal to provide a safety net for retirees, the unemployed, and disabled. Initially, Social Security benefits were not taxed.

It wasn’t until 1983, under President Ronald Reagan, that taxation of Social Security benefits was introduced as part of amendments aimed at shoring up the program’s financial solvency amid concerns of long-term sustainability. The idea was to raise additional revenue for the Social Security Trust Fund. At the time, only about 10% of beneficiaries had their benefits taxed.

In 1993, the percentage of benefits subject to taxation increased from 50% to 85% for higher-income retirees, expanding the tax base even further. Since then, Social Security benefits taxation has remained a contentious issue, viewed by many as unfair to seniors who already pay payroll taxes during their working years.

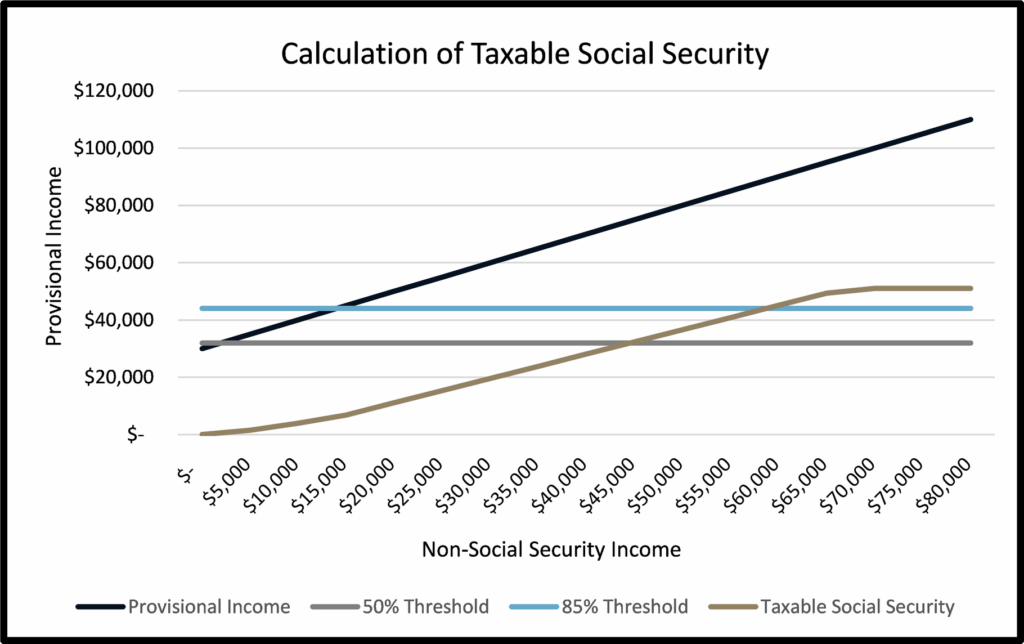

How Does Social Security Taxation Work Today?

Here’s a quick breakdown so you get the lay of the land:

- If you’re an individual with a combined income under $25,000, your Social Security benefits aren’t taxed.

- Between $25,000 and $34,000, up to 50% of your benefits are taxed.

- Beyond $34,000, up to 85% of your benefits may be taxed.

For couples filing jointly, these thresholds are slightly higher: $32,000 (no tax), $32,000 to $44,000 (50% taxed), and above $44,000 (85% taxed). So, if you’ve got other sources of income — like pensions, 401(k)s, or investment earnings — you might currently be paying significant taxes on your Social Security checks.

What Will Change for You in New U.S. Law Could Make 90% of Social Security Payments Tax-Free?

Starting tax year 2026, federal taxes on Social Security benefits will be mostly eliminated. Let’s break down what that means for different folks:

- Middle-income retirees: Most will stop paying federal income tax on their Social Security benefits entirely. It’s like getting a tax refund every year without filing!

- Low-income retirees: You already pay little to no tax on benefits, so this change just seals the deal.

- High earners: They won’t receive this tax break but will help support the system via increased payroll taxes.

Real Money Impact Example

Take Sally, a retiree making $30,000 a year in Social Security and $10,000 from a pension. Under current rules, a significant portion of her Social Security benefits may be taxed, leaving her with roughly $1,500 less to spend annually. Under the new law, she keeps that $1,500, boosting her monthly budget by over $100.

What Exactly Is the Payroll Tax Wage Cap, and Why Raise It?

Simply put, the payroll tax wage cap is the maximum amount of income subject to Social Security payroll taxes. Currently, earnings over around $176,100 aren’t taxed for Social Security. By raising this cap to $250,000, the government ensures wealthier workers pay into the program on a larger portion of their income, which helps fund the tax break for retirees.

This makes sense because Social Security is financed on a pay-as-you-go basis: today’s workers fund today’s retirees. The increased contributions from high earners help maintain the program’s solvency while easing the tax load on participants who rely solely on their benefits.

How Should Retirees and Future Retirees Prepare?

Here are some practical tips for navigating these changes:

- Stay Updated: This bill is expected to pass, but always confirm the latest status through official sources.

- Consult a Tax Advisor: Everyone’s financial situation is different. A professional advisor can help adjust tax withholding and retirement plans in anticipation of the new rules.

- Review State Tax Laws: Some states still tax Social Security benefits. Know your local rules to plan effectively.

- Adjust Budgets and Retirement Plans: Use the forecasted tax savings as an opportunity to enhance your retirement lifestyle or save more.

- Utilize Financial Tools: Websites like Fidelity’s retirement center or Kiplinger provide calculators to estimate your benefits and tax impacts.

Why Does Social Security Matter?

Social Security is a lifeline for over 65 million Americans, accounting for roughly 40% of income for about half of elderly households. It’s not just a paycheck — it’s a foundational part of retirement security, helping prevent poverty among seniors and their families.

The program’s success and sustainability are crucial for the country’s economic and social health. This new law strikes a balance between providing relief for retirees and ensuring Social Security remains robust for future generations.

October Social Security Payments: Why You Might Get Two SSI Checks This Month

7 Years Until Social Security Cuts? How Trump’s “Big, Beautiful Bill” Played a Role

$1,000 PFD Stimulus for these People – Check October 2025 Payment Date; Eligibility

What This Change Signals for the Future?

This law is a recognition of how much Americans rely on Social Security and the need to defend seniors against excessive taxation on the money they’ve earned. Policymakers are acknowledging that for many retirees, Social Security benefits are their primary, if not sole, source of income.

By adjusting the payroll tax wage cap, the system also modernizes its funding source to reflect today’s higher earners and income levels—helping ensure Social Security remains solvent for decades.

Tips for Optimizing Retirement Finances in the New Landscape

- Plan for Tax-Free Social Security: Maximize benefits by timing retirement and withdrawals from other accounts to complement the tax-free status.

- Boost Retirement Savings: Use freed-up funds from reduced taxes to grow emergency savings or invest.

- Stay Educated: Tax laws change frequently. Subscribe to newsletters from trusted financial institutions or follow updates on the Social Security website.

The goal? Smooth, comfortable retirement years without surprises.