Retirement at 69: Gather ‘round, folks—America’s talking about retirement at 69, and whether it’s a good idea or a straight-up bummer for hardworking citizens coast to coast. This hot topic might change the way millions of people plan for their golden years and shake up the future of Social Security like never before. Let’s break it down in plain English—whether you’re flipping burgers, crunching numbers, or running a big-shot company, this could impact your wallet, your bedtime stories, and even how you think about “the good life” after work. So hang tight, we’re diving deep into what’s up with this plan: why it’s controversial, what it means for the American dream, and how you can roll with the punches.

Retirement at 69

Retirement at 69 could fundamentally alter the American retirement landscape, particularly for workers with physically demanding jobs or limited savings. While the plan aims to keep Social Security solvent, it risks deepening inequality and putting pressure on vulnerable populations. The best bet? Prepare early, save more, and stay informed as the conversation continues in Washington.

| Topic | Data/Stats | Career/Professional Impact | Reference Link |

|---|---|---|---|

| Retirement Age Proposed | 69 years | All working Americans | SSA.gov Official site |

| Lifetime Benefit Reduction | Up to $420,000 per person for 257 million Americans | Hardest on manual and service jobs | |

| Full Retirement Age Now | 67 years | Early retirees lose 30% benefits | SSA Official |

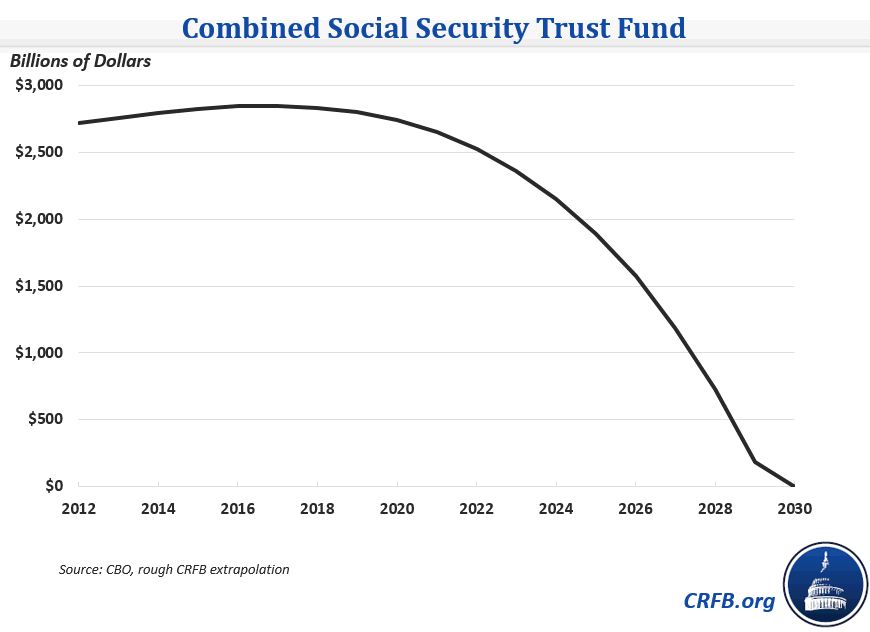

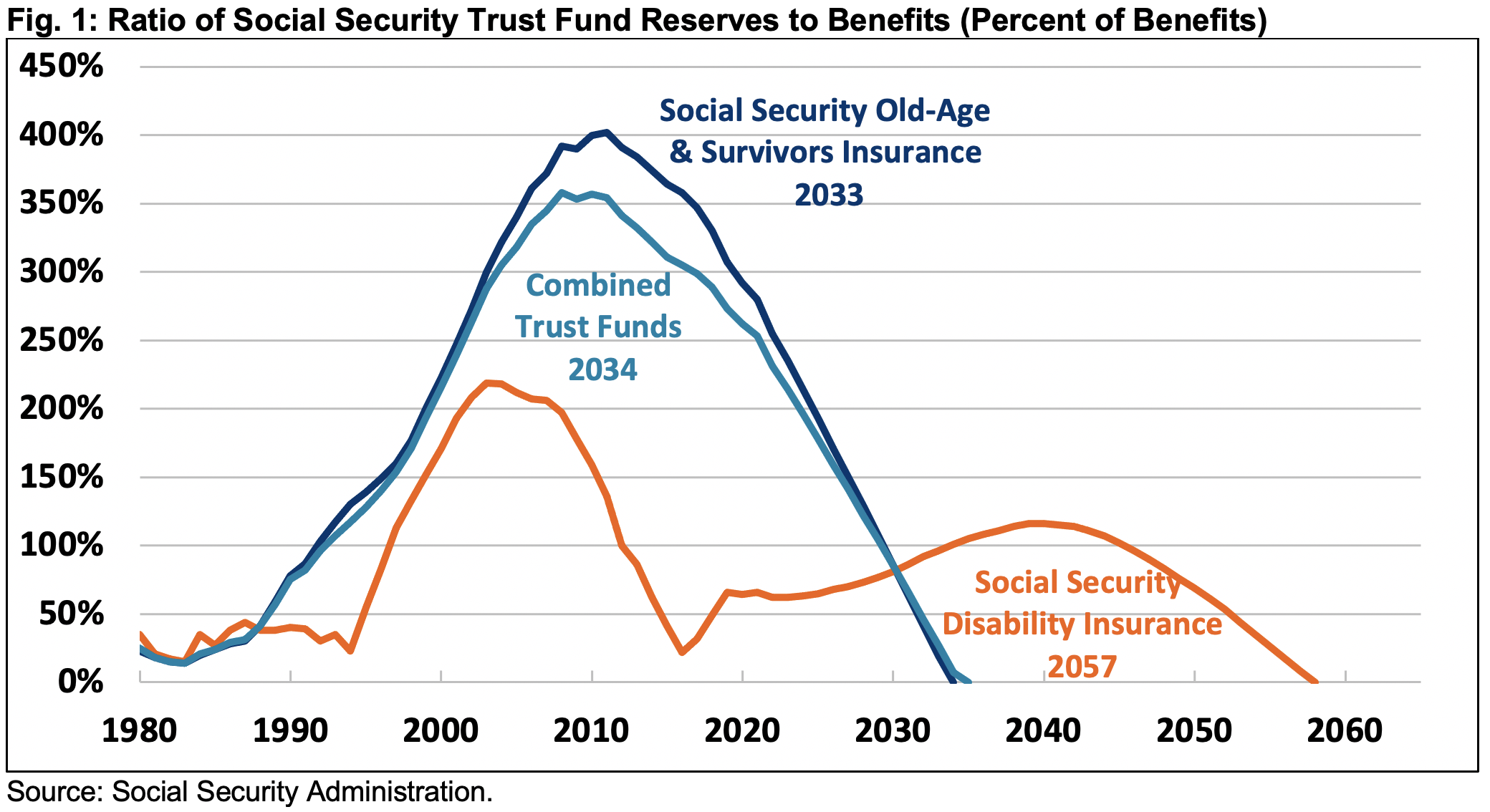

| Social Security Trust Fund Crisis | Projected insolvency in 2033 | Nationwide retirement insecurity | |

| Survivors’ & Disability System Pressure | Increased claims expected if retirement age rises | System overload risk | |

| Alternate Fixes | Raise income cap, tie age to life expectancy | Wealthier pay more, slow changes |

What’s Happening with Social Security?

Here’s the straight talk: America’s Social Security system—the classic paycheck insurance for millions—might be running low on cash in the next decade. With folks living longer, retiring earlier, and having fewer kids who pay payroll taxes, Uncle Sam’s social safety net is feeling the heat.

- Trust Fund Set to Run Dry: The Social Security trust fund could run out of money by 2033, which means benefit checks might shrink unless Washington comes up with a fix.

- Retirement Age Change: To keep things afloat, some lawmakers want to raise the full retirement age from 67 to 69.

A Quick History of Retirement Age in America

Did you know the Social Security full retirement age wasn’t always 67? When it started back in 1935, the full retirement age (FRA) was 65. This was based largely on pragmatic judgments—65 was the common retirement age in about half of the existing state pension systems then and was manageable from an actuarial standpoint.

Then, in 1983, Congress decided to gradually increase the FRA from 65 to 67 to reflect longer life expectancies and better health among older Americans. The change was phased in over more than 30 years and is now fully applied to those born in 1960 or later.

Early retirement benefits also have a long history: starting in 1956 for women and 1961 for men, workers could claim reduced benefits as early as age 62. This system of early reduced benefits alongside a rising FRA was designed to balance financial sustainability with flexibility for workers.

Why Consider Raising the Retirement at 69?

Supporters say bumping up the retirement age is no wild idea—it’s about keeping Social Security alive for the next generation. Here’s why:

- People Live Longer: Back in the day, most folks didn’t see their 80s. Now, seniors are living longer, healthier lives, which means they collect benefits longer. Raising the age would restore balance between years worked and years retired.

- Financial Sustainability: Postponing retirement eases pressure on Social Security’s budget. That means more workers paying in, fewer years taking out.

- Encourages Workforce Participation: Older workers stay in the game longer, adding skills and experience to teams everywhere.

How Raising Retirement Age Impacts the Economy and Businesses?

It’s not just retirees feeling the heat. Businesses might see older employees clocking more hours, delaying openings for younger workers. But experts argue that keeping seasoned workers on the payroll could boost overall productivity and reduce early retiree costs associated with healthcare and disability.

Longer working lives can also increase consumer spending by seniors, which supports business growth and tax revenues. On the flip side, industries heavily reliant on physical labor might face challenges with older workforces requiring accommodations.

How Does It Affect Americans?

The impact isn’t equal—it depends on job type, health, and life expectancy.

The Hard Truths

- Manual laborers, healthcare staff, and service workers take the hardest hit. These jobs wear on your body, and most people in them can’t keep working into their late 60s. That means slashed benefits if they retire early.

- If you retire at 62, checks shrink a whopping 30% below full benefits at 67. If 69 becomes the rule, those early retirees lose even more, with lifetime reductions up to $420,000 per person according to the Congressional Budget Office (CBO).

- Many forced early retirees might turn to disability benefits, risking a new crisis—overburdened systems and backlog nightmares.

Unequal Impact

- White-collar and high-income professionals might adjust easily. But folks with shorter life expectancies—like those behind the counter, hauling bricks, or driving trucks—might never see full retirement, or enjoy it for less time.

What About Inflation and Rising Costs?

Another kicker: the cost of living keeps climbing, while wages for many Americans stagnate. That means your paycheck covers less each year. Add in the possibility of delayed retirement and smaller checks, and the dream of a comfortable retirement feels further away for many. This underscores the need for smart personal finance planning.

How Does the U.S. Compare Globally?

The U.S. retirement age is on the lower side compared to many developed nations:

- Germany and the UK are planning or have raised retirement ages to 68 and beyond.

- Sweden adjusts its retirement age automatically based on life expectancy.

- France recently faced massive protests trying to push retirement age higher.

So the U.S. isn’t alone in facing this challenge, but the debate remains vigorous.

What Are People Saying? Public Opinion and Politics

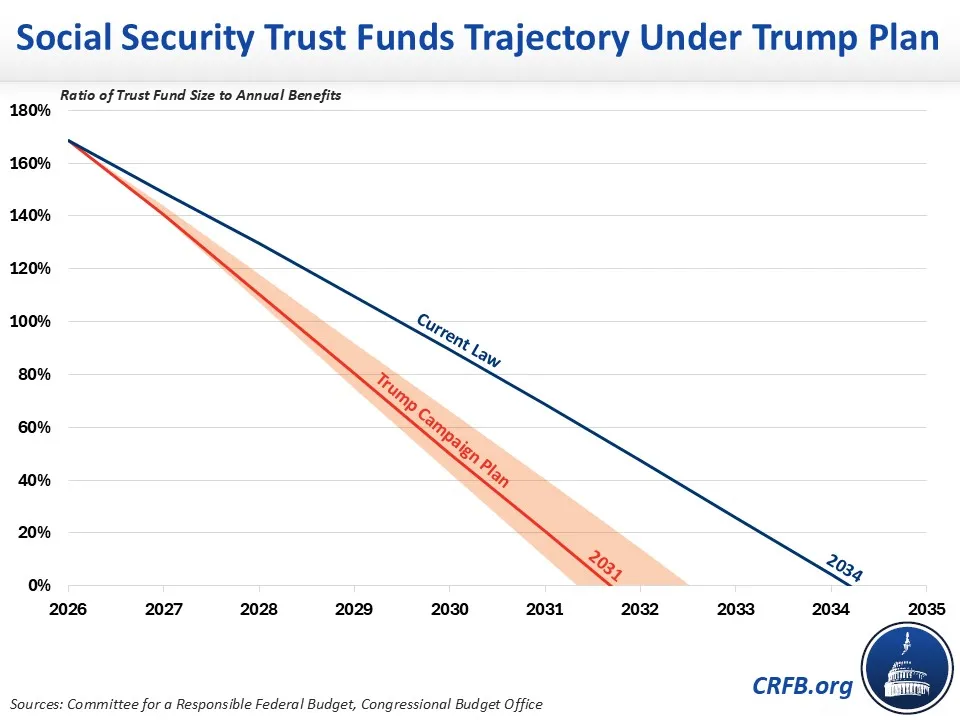

Many Americans, especially older workers and those in physically demanding jobs, oppose raising the retirement age. Polls indicate strong resistance, partly because the change would hit lower-income workers the hardest. Politicians like those in President Trump’s administration state a commitment to protecting Social Security benefits, but the funding crisis keeps the pressure alive.

Personal Stories: Facing Retirement Challenges

Take Joe, a 60-year-old factory worker in Ohio. Decades on the line have wrecked his back—working till 69 feels impossible. He worries about paying bills if his benefits shrink.

Then there’s Linda, a 45-year-old corporate analyst. She can push her career longer but worries about an uncertain future. These stories show why the debate is so heated: different lives, same system.

How to Prepare for Retirement at 69: A Step-by-Step Guide

1. Beef Up Your Savings

- Increase your 401(k) contributions by 2-3% to help offset potential benefit cuts.

- Consider Roth IRAs or Health Savings Accounts (HSAs) to diversify income streams.

2. Know Your Benefits

- Regularly check your Social Security statement online at SSA.gov.

- Use SSA calculators to estimate benefits at various retirement ages.

3. Plan for Different Scenarios

- For those with physical jobs, early retirement with savings and disability protection might be critical.

- Consult a financial advisor to build a tailored plan that fits your life.

4. Stay Informed

- Track policy changes through official sources and trusted news outlets.

- Political shifts can impact benefit rules, taxes, and retirement planning.

The Future Outlook: What’s Next?

Retirement at 69 isn’t carved in stone but remains a serious option to address Social Security’s funding gap. Experts suggest multiple reforms—including tax cap changes and tying retirement age to life expectancy—will likely be part of the conversation.

The goal? A sustainable, fair system that balances solvency with protecting vulnerable Americans.

Federal Workforce Collapse? Over 150,000 Employees Exit in One Stunning Week

US $4,983 Direct Deposit In October 2025 – Check Eligibility and Expected Payment Date