Reports that the Government Service Insurance System (GSIS) will raise monthly pensions to ₱18,500 in 2025 have sparked excitement among retirees and widespread sharing on social media. Yet despite the attention, the state-run pension fund has not formally confirmed the figure, leaving pensioners searching for clarity about whether they are eligible for an increase.

GSIS Pension Hike Coming 2025

| Key Fact | Detail |

|---|---|

| Reported Pension Hike | ₱18,500 monthly pension by 2025 |

| Official GSIS Position | No formal announcement confirming the figure |

| Eligibility (General) | Retirees with at least 15 years of service, aged 60+ |

| Survivorship Rule | Survivors may qualify for adjusted benefits |

| Fiscal Note | Any universal hike would cost billions in state resources |

| official Website | GSIS official website |

The Role of GSIS

The Government Service Insurance System (GSIS) is the Philippines’ primary pension fund for government employees, covering retirement, disability, and survivorship benefits. With more than 500,000 pensioners and several million active members, its policies affect a large portion of the population.

GSIS operates separately from the Social Security System (SSS), which covers private sector workers. While both systems periodically adjust pensions, GSIS payouts are generally higher because of differences in contribution rates and funding mechanisms.

Where the ₱18,500 Figure Originated

The specific ₱18,500 figure has circulated widely on YouTube channels, community blogs, and social media posts since mid-2024. In most cases, no supporting GSIS resolution or government document accompanies the claim.

“Until GSIS issues a board resolution or an executive order is published, these reports should be viewed as speculative,” said Dr. Mario Rosario, a lecturer in public administration at the University of the Philippines. “The danger is that retirees may plan their finances around promises that have not yet materialized.”

Official GSIS Position

On its website, GSIS has not mentioned a ₱18,500 across-the-board increase. The most recent official action, announced in April 2025, was the removal of the cap on survivorship pensions, which raised benefits for surviving spouses and dependents.

The agency also regularly highlights programs such as pension loans and life insurance products, but none of its published updates refer to a new base pension of ₱18,500.

Past Increases: Historical Perspective

GSIS has periodically raised pensions in line with inflation and fiscal space. For example:

- In 2013, pensioners received a 5 percent across-the-board increase, subject to certain conditions.

- In 2018, adjustments were granted to those who had been retired for at least five years, ranging between ₱50 and ₱200 per month.

- In 2021, survivorship benefits were recalibrated, offering better coverage for spouses of deceased retirees.

By comparison, the SSS approved a ₱1,000 pension increase in 2017 after years of lobbying, underscoring how politically sensitive pension reform remains in the Philippines.

Inflation and Sustainability

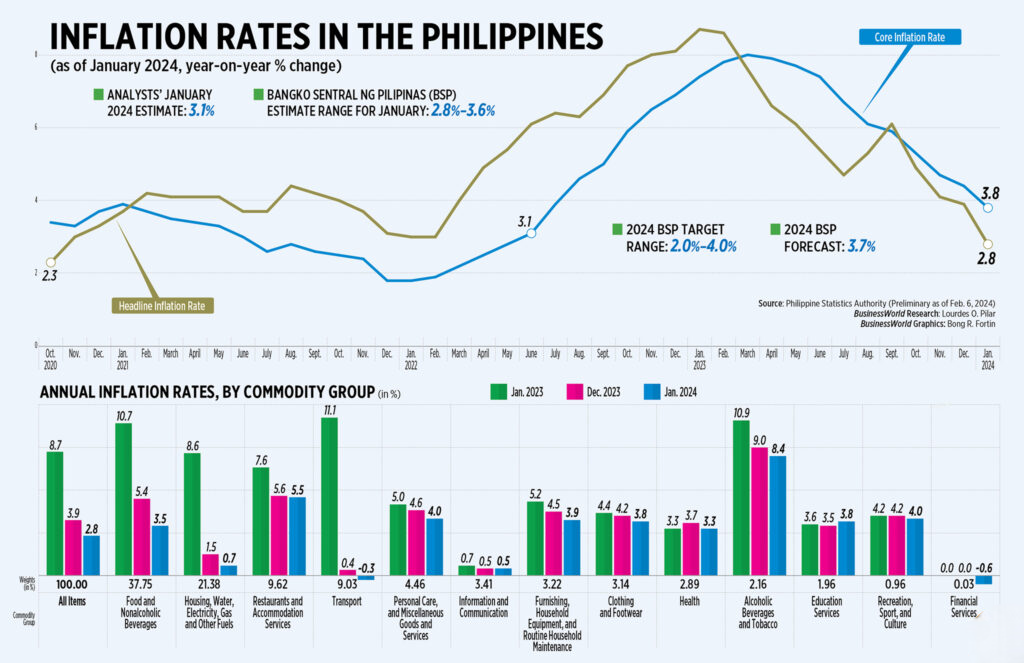

Pension reform discussions come amid rising inflation, which averaged 6.0 percent in 2023, according to the Philippine Statistics Authority. Retirees often bear the brunt of price hikes because their income is fixed.

An across-the-board increase to ₱18,500 would significantly improve retirees’ purchasing power, but analysts warn of fiscal risks. “Every ₱1,000 added to the GSIS pension base translates into billions in additional annual obligations,” said Prof. Liza Bernardo, an economist at Ateneo de Manila University.

She added that while GSIS is financially stronger than SSS due to higher government contributions, any permanent hike must be carefully modeled to avoid long-term funding shortfalls.

Human Impact: Voices From Pensioners

For many retirees, even modest increases can make a difference. Elena Cruz, a 72-year-old former public school teacher in Quezon City, said her ₱11,000 monthly pension barely covers medicine and groceries.

“If the pension really reaches ₱18,500, it would mean I could buy maintenance drugs without borrowing from my children,” she said. “But I don’t want to believe rumors until GSIS tells us directly.”

Pensioners’ groups have echoed this sentiment, urging the government to provide transparent timelines and criteria for any adjustments.

Eligibility Rules for Current Benefits

At present, GSIS eligibility follows these rules:

- Retirement Pension: At least 15 years of service and minimum age of 60, unless separated under special laws.

- Disability Pension: Coverage for work-related and non-work-related disabilities.

- Survivorship Pension: Granted to legal spouses and dependents of deceased members.

Adjustments typically apply to old-age and disability pensioners who have been receiving regular benefits for at least five years. Survivorship pensioners may also benefit if reforms are passed.

Political and Legislative Dimensions

Pension policy is also tied to politics. Lawmakers have long debated expanding pension benefits to align with cost-of-living realities. Some senators have filed bills calling for automatic inflation-linked adjustments, similar to systems in advanced economies.

Senator Grace Poe recently stated that “pensioners deserve predictability and dignity,” urging the government to institutionalize periodic increases. However, the Department of Budget and Management (DBM) has not yet set aside specific funding for an ₱18,500 adjustment in the 2025 national budget.

International Comparisons

Civil service pensioners in the Philippines generally fare better than counterparts in neighboring countries. In Indonesia, the average civil servant pension is equivalent to around ₱9,000 per month, while in Vietnam it is closer to ₱8,000.

However, retirees in wealthier ASEAN states like Malaysia and Singapore enjoy higher government-backed pensions, though these are supported by stronger fiscal systems.

Risks of Disinformation and Scams

Authorities also warn that pension rumors can open opportunities for fraud. GSIS has previously cautioned members against third-party “fixers” claiming they can fast-track pension increases for a fee.

“Only announcements posted on the GSIS website and verified media outlets should be trusted,” the agency noted in a recent advisory.

What Pensioners Should Do Now

Until official confirmation is issued, retirees are advised to:

- Check the GSIS website (www.gsis.gov.ph) for advisories.

- Call the GSIS hotline or visit the nearest branch office for official updates.

- Avoid unverified social media sources that may spread disinformation.

Waiting for Clarity

For now, pensioners remain in limbo as they await a definitive announcement. Analysts stress that any move toward a ₱18,500 base pension will require careful fiscal planning, but they acknowledge the growing pressure to provide relief amid inflation.

“Pensions are not just numbers,” said Prof. Bernardo. “They reflect how society values those who dedicated their lives to public service.”

Until an official statement is released, retirees are advised to remain cautious and continue following only verified GSIS communications.

Philippines Raises Retirement Age in 2025 – Here’s What It Means for Everyone Over 65

SSS Confirms ₱19,863 Disability Benefit for October 2025; Who Gets It and When?

₱20,000 SSS Cash Payout Coming This October 2025 – Only these people will get it, Check Date

FAQ

Is the ₱18,500 GSIS pension hike confirmed?

No. GSIS has not confirmed the increase. Reports remain speculative.

Who qualifies for GSIS pensions?

Retirees with at least 15 years of government service, aged 60 or older, plus disability and survivorship pensioners.

When will GSIS announce an official pension hike?

No date has been set. Any adjustment requires GSIS board approval and possibly legislation.