$7,997 Canada Child Benefit 2025: The $7,997 Canada Child Benefit (CCB) 2025 is one of the most talked-about government support programs for Canadian families this year. While the number sounds exciting, not every household will actually receive the full amount. The program is carefully structured to support families raising children, especially those with lower to moderate incomes. This guide breaks down eligibility, payment schedules, clawback rules, and even comparisons to U.S. benefits. Whether you’re a new parent, a seasoned pro, or just curious about how Canada supports its families, this article is your one-stop resource.

$7,997 Canada Child Benefit 2025

The $7,997 Canada Child Benefit 2025 is one of the most impactful support programs for families in Canada. It provides meaningful financial assistance to households raising children, with the largest benefits flowing to low- and moderate-income families. By understanding eligibility, clawback rules, and the payment process, parents can ensure they maximize their benefit. Filing taxes, staying organized, and budgeting smartly are the keys to making the most of the CCB.

| Point | Details |

|---|---|

| Maximum CCB (Under 6 years) | $7,997 per year (July 2025 – June 2026) |

| Maximum CCB (6–17 years) | $6,748 per year |

| Eligibility | Resident of Canada, primary caregiver, filed taxes, income thresholds apply |

| Income Threshold for Full Benefit | Full amount if AFNI ≤ $37,487 (for one child) |

| Reductions | Gradual clawback starts above threshold, larger cuts at higher income levels |

| Payment Schedule | Monthly, around the 20th of each month |

| Official Info | Canada Revenue Agency (CRA) |

What Is the Canada Child Benefit (CCB)?

The CCB is a tax-free monthly payment issued by the Canada Revenue Agency (CRA) to families raising children under 18. The purpose is simple: to ease the cost of raising kids, which is no small feat in today’s economy.

For the 2025–2026 benefit year:

- Families with kids under 6 can receive up to $7,997 per child.

- Families with kids aged 6–17 can receive up to $6,748 per child.

That’s money directly deposited each month — not a tax credit you have to wait for.

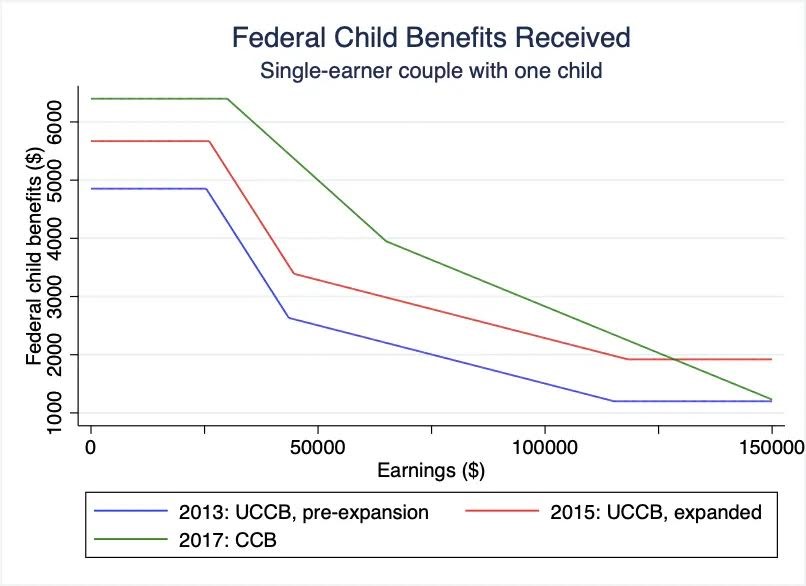

The History of the CCB

The Canada Child Benefit was launched in 2016, replacing several fragmented programs like the Universal Child Care Benefit (UCCB) and Canada Child Tax Benefit (CCTB). The shift was designed to simplify benefits and target support toward families most in need.

Since then, the CCB has been indexed to inflation. Each year, amounts rise slightly to keep up with the cost of living. According to Statistics Canada, the program played a massive role in reducing child poverty — dropping from 11% in 2015 to under 5% in 2020.

Who Actually Gets the Full $7,997 Canada Child Benefit 2025?

The maximum benefit isn’t for everyone. It’s based on your Adjusted Family Net Income (AFNI) — essentially your total household income after adjustments.

- Families with AFNI ≤ $37,487 (for one child) receive the full benefit.

- Between $37,487 and $81,222, benefits shrink gradually at a 7% clawback rate.

- Over $81,222, an additional 3.2% clawback applies, further reducing payments.

Example Scenarios

- Single parent with $30,000 income and one child under 6 → full $7,997.

- Couple earning $70,000 with two kids (ages 3 and 10) → partial benefits, perhaps $12,000 total.

- Family earning $200,000+ → likely phased out entirely.

This system ensures the biggest support goes to those who need it most.

Eligibility Checklist

To qualify for the CCB in 2025, you must meet all the following conditions:

- Child is under 18 years old.

- You are the primary caregiver (responsible for the child’s daily care).

- You live in Canada for tax purposes.

- You or your partner are a Canadian citizen, permanent resident, protected person, or eligible temporary resident.

- You file your tax return every year, even if your income is $0.

- Your income is within the eligible thresholds.

Special Situations

- Shared custody: payments may be split evenly between both parents.

- Foster care: some months may not qualify, since other allowances apply.

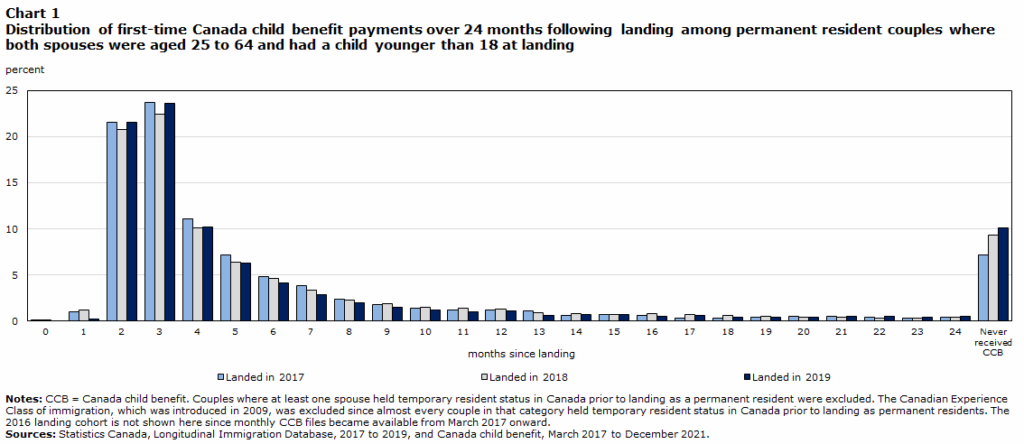

- Newcomers to Canada: must provide proof of immigration status, proof of residency, and the child’s birth certificate.

Payment Schedule for 2025

The CRA pays the CCB monthly, around the 20th. For the July 2025 – June 2026 benefit year, expect deposits on:

- July 20, 2025

- August 20, 2025

- September 19, 2025

- October 20, 2025

- November 20, 2025

- December 19, 2025

- January 20, 2026

- February 20, 2026

- March 20, 2026

- April 20, 2026

- May 20, 2026

- June 19, 2026

Step-by-Step: How to Apply for $7,997 Canada Child Benefit 2025

- File your taxes — both parents must file, even if they had no income.

- Apply through CRA My Account or submit Form RC66 (Canada Child Benefits Application).

- Provide documents if requested: proof of status, residency, or child’s birth.

- Wait for approval — CRA usually processes within 8 weeks.

- Set up direct deposit to receive payments quickly.

Why the CCB Matters?

The cost of raising a child in Canada is estimated between $10,000–$15,000 annually (MoneySense). For many households, the CCB covers essentials like food, rent, clothing, and education.

Beyond household budgets, the CCB has been hailed as one of Canada’s most successful anti-poverty measures. It not only puts money into parents’ pockets but also supports the economy by boosting consumer spending.

Real-Life Case Studies

- Case 1: New Immigrant Family

A couple moves to Canada in 2023, files taxes in 2024, and applies for CCB in 2025. With one child under 6 and an income of $28,000, they qualify for the full $7,997. - Case 2: Middle-Class Couple

Two parents earn $80,000 combined with two kids. They receive a reduced benefit, around $10,000, which helps cover daycare and sports fees. - Case 3: High-Earning Family

A family with a $200,000 AFNI is phased out. While they won’t receive CCB, they may still benefit from other credits like RESP grants.

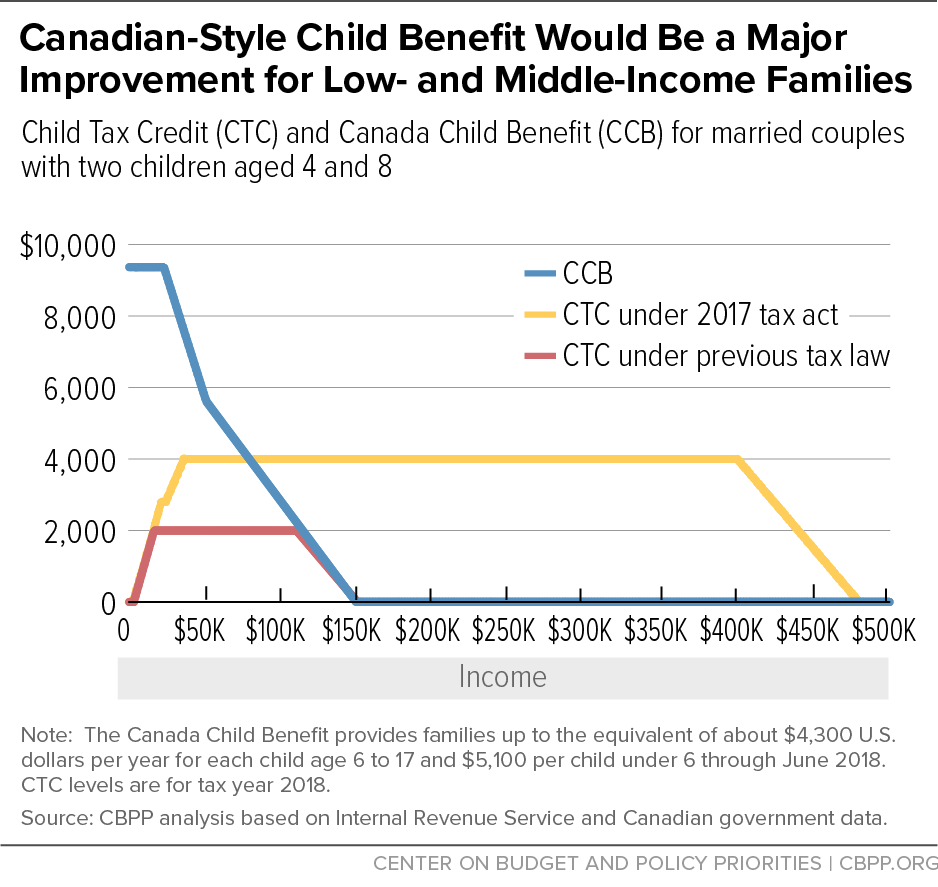

CCB vs. U.S. Child Tax Credit

For comparison:

- U.S. Child Tax Credit (CTC): up to $2,000 per child, partially refundable, income-tested.

- Canada CCB: up to $7,997 per child under 6, fully tax-free.

Canada’s benefit is far larger, but tightly income-tested, making it more targeted toward middle- and low-income families.

Misconceptions About the CCB

- “You need to reapply every year.” False. Once approved, it renews automatically if taxes are filed.

- “It counts as taxable income.” Wrong. The CCB is fully tax-free.

- “High earners get the same as everyone else.” Nope. The benefit phases out at higher income levels.

Practical Advice from Experts

- File early: delays in filing mean delays in benefits.

- Budget smartly: treat the CCB as predictable income — many parents set aside part of it for RESPs (Registered Education Savings Plans).

- Keep your info updated: changes in custody, marital status, or residency must be reported to CRA right away.

- Check CRA My Account: track payments, letters, and benefit amounts online.

CRA $680 One-Time Payment Coming for these People – Check Eligibility, Payment Dates

CRA Disability Check October 2025: Check Benefit Amount, Eligibility & Payment Date

CRA Confirms $742 OAS Boost Coming in 2025 – Are you eligible to get it? Check Here