Say Goodbye to Paper Checks: If you’re one of the few folks still getting your Social Security payments via paper checks, listen up — starting September 30, 2025, those paper checks are going outta the picture for good. That’s right, the Social Security Administration (SSA) is officially making the switch to fully digital payments. Whether you’re a retiree, survivor, or someone getting disability benefits, the way you get paid is changing, and it’s happening fast!

Say Goodbye to Paper Checks

The Social Security Administration’s move to digital payments marks a new era — one where payments are safer, faster, and more efficient. If you’re still receiving paper checks, don’t wait to switch! Get online, call the SSA, or get help from someone you trust to update your payment method before September 30, 2025. This ensures your benefits arrive on time, every time, without the risks and delays of mail. It’s easy, it’s smart, and it’s the future.

| Item | Details |

|---|---|

| Deadline | September 30, 2025 |

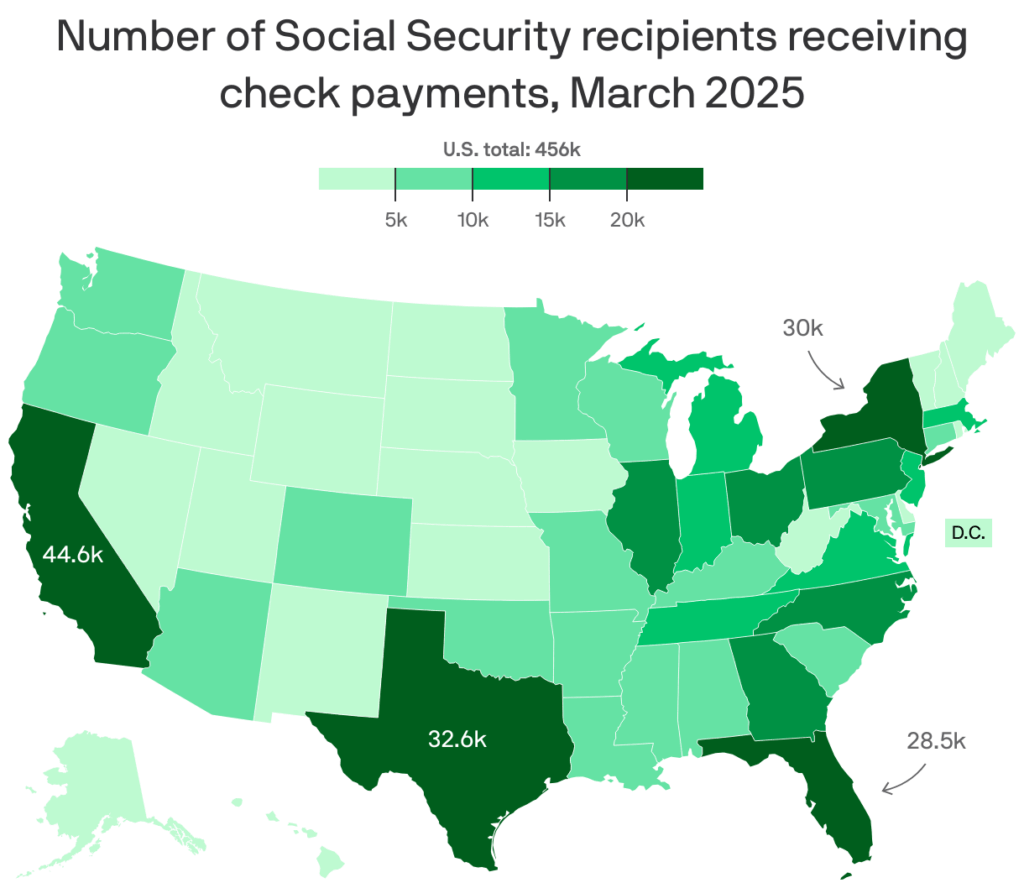

| Who is affected? | Less than 1% of Social Security beneficiaries still receiving paper checks |

| Payment options after Sept 30 | Direct Deposit (bank account) or Direct Express® prepaid debit card |

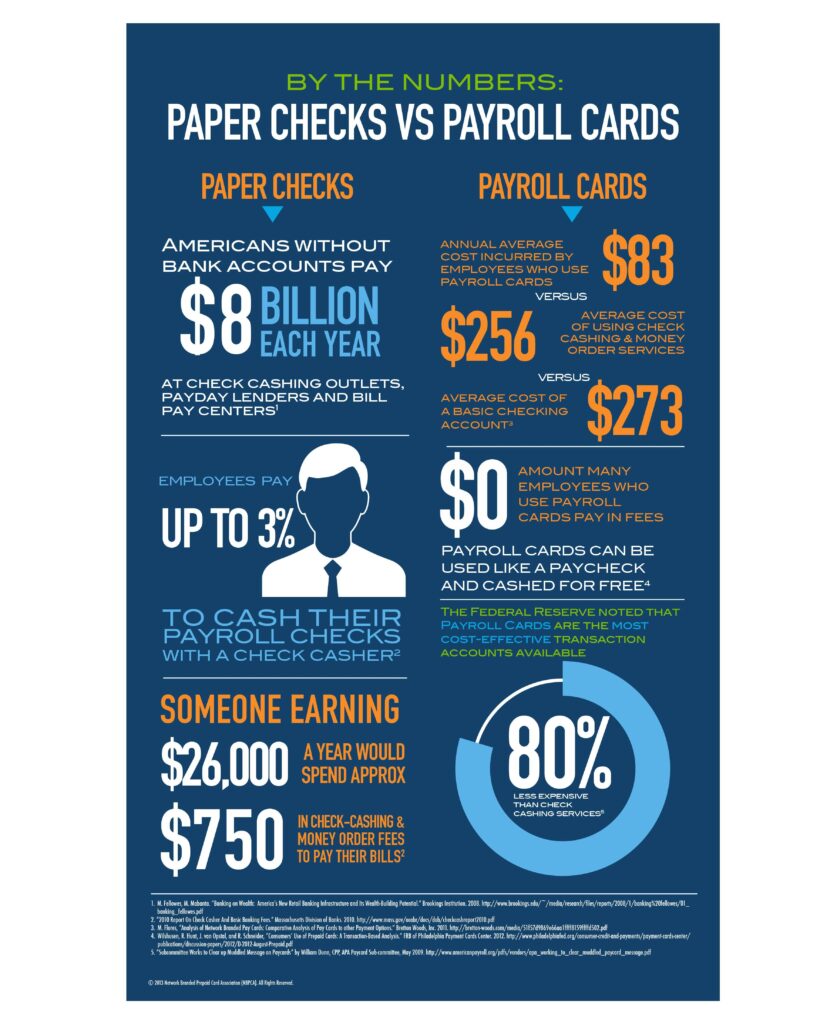

| Cost savings for government | Paper checks cost ~50 cents each; electronic payments cost less than 15 cents |

| Security advantage | Paper checks 16x more likely to be lost, stolen, or altered compared to digital payments |

| Where to update info | Online at ssa.gov/deposit or phone assistance |

| Waiver option | Available for those who cannot switch, through U.S. Treasury (1-877-874-6347) |

Why This Transition Matters?

From October 1 onward, all Social Security payments will be made electronically. You’ll no longer see that paper check in your mailbox; payments will be deposited directly into your bank account or onto a prepaid debit card called Direct Express®. This change wraps up the government’s ongoing effort to modernize payments, improve security, speed things up, and save some serious cash.

Only around 1% of beneficiaries still receive paper checks, making this the last call to move online and get on board before the deadline. Don’t wait until the last minute—switching over now means you’ll avoid any hassle or delay in getting your money.

A Quick History of Social Security Payments

Did you know that the Social Security Administration has been issuing paper checks for payments since the program’s start back in 1935? For over 85 years, paper checks have been a familiar sight for millions across the U.S. While they served well for decades, times have changed with technology advancement.

The Social Security Act was signed into law in 1935 by President Franklin D. Roosevelt, but it wasn’t until January 31, 1940, that the first monthly payment was issued—$22.54 to Ida May Fuller of Vermont. She had only contributed $24.75 over three years but ended up collecting nearly $23,000 in benefits until she passed away at 100 years old. This marked the start of the monthly Social Security checks sent to retirees, survivors, and dependents.

Since then, more than $7.4 trillion has been paid out in benefits, making the transition to digital payments a big step in the program’s evolution.

Why Say Goodbye to Paper Checks?

This change is about making life easier, safer, and faster for everyone. Here’s the lowdown:

- Faster Payments: Electronic transfers (EFTs) process way quicker than paper checks, eliminating delays caused by mail.

- More Secure: Paper checks can get lost, stolen, or tampered with, making them much riskier. Electronic payments are safer and reduce fraud chances.

- Cost Savings: Each paper check costs the government about 50 cents to issue, while electronic payments cost under 15 cents. This shift could save millions annually.

- Convenience: No more trips to the bank or waiting for mail. Your money lands right in your account or on your Direct Express card.

- Environmental Impact: Going paperless reduces waste, which is better for the planet.

This sweeping change was prompted by an executive order issued in March 2020 (under President Trump), mandating all federal payments be digitized to cut unnecessary costs, delays, and fraud risks.

How to Make the Switch?

Step 1: Check if You’re Still Getting Paper Checks

Think about whether your benefit payment arrives as a paper check in the mail or digitally. Paper check recipients are the ones being asked to act now.

Step 2: Choose Your Electronic Payment Method

- Direct Deposit: Link your Social Security benefits to your personal bank checking or savings account to receive payments electronically.

- Direct Express® Card: If you don’t have a bank account or prefer not to use one, the Direct Express card is a prepaid debit card designed specifically for federal benefits.

Step 3: Update Your Payment Information

- Log in or create your personal account at my Social Security.

- Follow the prompts to update your payment preference.

- Or call SSA at 1-800-772-1213 for assistance.

- To get a Direct Express card, visit usdirectexpress.com or call 1-800-333-1795.

Step 4: Confirm Your Switch

After updating, watch for your first electronic payment. It should arrive on your usual payment date without disruption.

What if You Can’t Switch?

Certain individuals may not have access to banking services or the means to receive electronic payments. These “unbanked” Americans represent about 4.6% of the U.S. population and often rely on check-cashing services or alternative methods to manage cash.

For these folks, the government will continue issuing paper checks—but only if you file a waiver with the U.S. Treasury, explaining your circumstances. The waiver hotline is 1-877-874-6347.

Exceptions are granted on a case-by-case basis, but the burden is on recipients to prove eligibility for paper checks going forward. Temporary checks for new claimants are no longer available, so this program targets keeping vulnerable populations supported during this change.

Benefits Beyond Convenience

Digital payments unlock more than just convenience. They can transform how recipients manage finances:

- Improved Financial Planning: Digital payments make tracking income easier with bank statements and online account access.

- Reduce Risk of Fraud: Paper checks are prone to theft or alteration. Electronic payments lower security risks and protect your money.

- Environmentally Friendly: Less paper means less waste, helping the environment.

- Automatic Bill Payments: Payments deposited electronically can be used for automatic bill pay to avoid late fees.

Potential Challenges and Solutions

This shift isn’t without its hurdles:

- Limited Internet or Tech Access: Some recipients may struggle with online accounts or phone support.

- Lack of Banking: The Direct Express card addresses those without bank accounts, but education is key.

- Security Concerns: Users must protect their login info and beware of phishing scams.

SSA has ramped up outreach, offering notifications, direct mail inserts, and phone support to ease this transition. If help is needed, contacting a local SSA office or a trusted family member for assistance is recommended.

$4,983 Direct Deposit Expected in October 2025 – Check Eligibility and Full Payment Schedule

IRS Confirms $7,830 EITC Refund for 2025 – Check Exact Payout Dates & Who Gets It

Social Security COLA Hike 2026 – Experts Predict Major Boost Amid Rising Inflation

Why This Development is Important Professionally?

For financial advisors, social workers, and government employees, this transition means helping clients or constituents adapt to new payment systems. Familiarity with the process and deadlines ensures no disruption in benefits and helps spread clear information.

Being proactive in assisting people switch to electronic payments is crucial in your role if you work directly with seniors or vulnerable populations.