Canada CRA $2,600 Direct Deposit: If you’re a Canadian resident wondering about the CRA $2,600 direct deposit payment in October 2025, you’re not alone. Each year, the Canada Revenue Agency (CRA) delivers a mix of benefits that together can add up to around $2,600 or more. This combined payout supports vulnerable groups like low-income workers, families with children, seniors, and people with disabilities by helping them manage daily expenses amid rising costs. Whether you’re new to federal benefits or a seasoned recipient, this comprehensive guide breaks everything down in clear, easy-to-follow language. You’ll walk away knowing exactly what payments to expect, who qualifies, when the deposits hit the bank, and how to ensure you get the maximum amount you’re entitled to.

Canada CRA $2,600 Direct Deposit

These combined CRA payments totaling up to $2,600 in October 2025 form a vital financial pillar for many Canadians. From workers and families to seniors and people with disabilities, CRA’s benefits programs provide critical support to balance the rising cost of living. Staying proactive—filing taxes on time, updating information, and using online tools—ensures you get what you deserve, exactly when you need it. Keep this guide handy as a reference to confidently navigate your CRA benefits and take control of your financial well-being in 2025.

| Feature | Details | More Info |

|---|---|---|

| Total Payment Amount | Up to $2,600 or more in combined federal benefits | CRA Official Site |

| Payment Dates (October 2025) | October 3, 10, 16, 20, 29 (varies by benefit) | CRA Payment Dates |

| Eligibility Requirements | Canadian residency, age limits, income thresholds | |

| Typical Eligible Groups | Low-income workers, families, seniors, people with disabilities | |

| Tax Filing Requirement | Filed 2024 federal income tax return |

What Is the Canada CRA $2,600 Direct Deposit Exactly?

The CRA $2,600 direct deposit in October 2025 is not a single payment, but rather the total of multiple benefits Canadian residents receive throughout the month. These payments come from several major federal programs designed to assist different population groups.

Key benefits often included in this combined amount are:

- Canada Workers Benefit (CWB)

- GST/HST Credit

- Canada Child Benefit (CCB)

- Canada Disability Benefit

- Ontario Trillium Benefit

- Old Age Security (OAS)

- Canada Pension Plan (CPP)

Each benefit has its own eligibility rules, payment schedule, and amount, but together they can provide significant financial support.

Why These Payments Matter to Canadians?

Canada’s social safety net, administered largely by the CRA, helps millions of people meet basic living expenses. With inflation affecting essentials like groceries, gas, and housing, timely and adequate government support is crucial.

Programs like the Canada Workers Benefit encourage workforce participation by topping up earnings for low-income workers, while the Canada Child Benefit helps families cover child-related costs. Disability and senior benefits provide much-needed financial relief to vulnerable populations. These benefits contribute to lifting people out of poverty, reducing inequality, and sustaining overall economic stability.

Detailed Breakdown of October 2025 Benefits

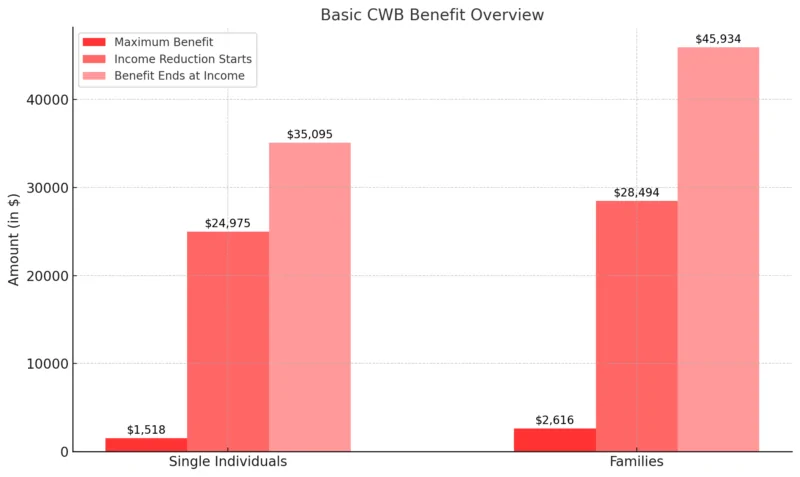

Canada Workers Benefit (CWB)

This refundable tax credit helps low-income workers by providing a financial top-up. The CRA pays an advance (50% of the total) quarterly to spread relief throughout the year.

- Eligibility: Must be 19 or older by December 31, 2024, Canadian resident, earning below provincial thresholds.

- Payment: Up to $1,633 for singles and $2,813 for families, including disability supplements.

- October Payment Date: October 10, 2025.

GST/HST Credit

A non-taxable quarterly payment that offsets the Goods and Services/Harmonized Sales Tax paid by low to moderate-income individuals and families.

- Eligibility: Must be at least 19 years old or have a spouse/child, and a Canadian resident for tax purposes.

- Payment: Up to $130 per quarter for singles, up to $170 for couples.

- October Payment Date: October 3, 2025.

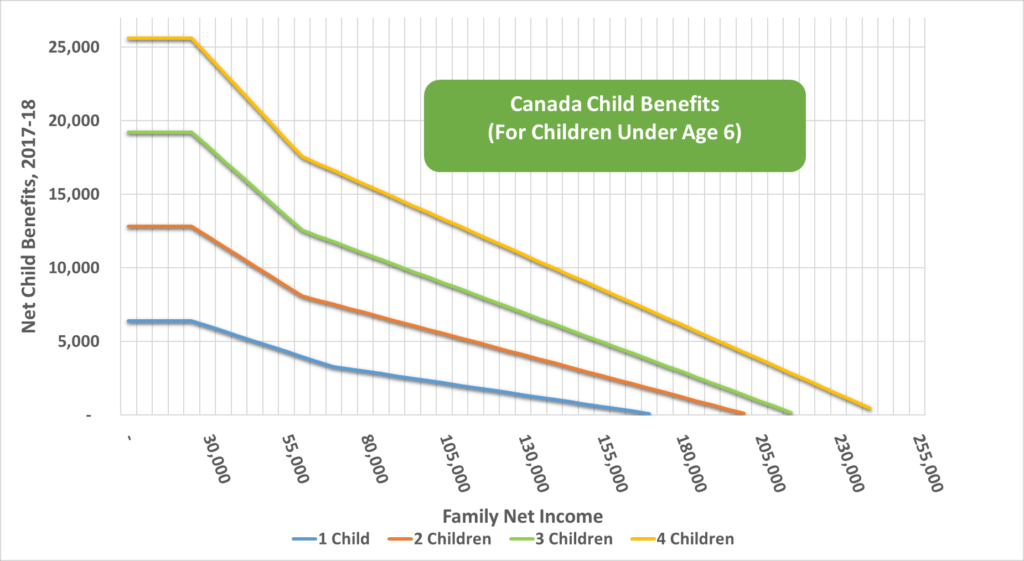

Canada Child Benefit (CCB)

Monthly tax-free payments support families raising children under 18, with additional supplements for children with disabilities.

- Eligibility: Must be the primary caregiver living with children under 18, income-based.

- Payment Date: October 20, 2025.

Canada Disability Benefit

Introduced recently, it provides monthly support to Canadians aged 18-64 with approved disability tax credit certificates.

- Payment: About $200 per month.

- Eligibility: Canadian resident with Disability Tax Credit approval, filing 2024 tax returns.

- October Payment Date: October 16, 2025.

Ontario Trillium Benefit

This combines credits for energy, property, and sales taxes for Ontario residents.

- Payment Date: October 10, 2025.

Old Age Security (OAS)

Monthly pension supports seniors aged 65 and older who meet residency requirements.

- Payment: Around $740 to $814 monthly, inflation-adjusted.

- October Payment Date: October 29, 2025.

Canada Pension Plan (CPP)

A retirement pension for contributors over age 60 who have made sufficient contributions.

- Payment: Up to approximately $1,433 monthly.

- October Payment Date: October 29, 2025.

October 2025 Payment Schedule at a Glance

| Benefit | Payment Date |

|---|---|

| GST/HST Credit | October 3, 2025 |

| Canada Workers Benefit | October 10, 2025 |

| Ontario Trillium Benefit | October 10, 2025 |

| Canada Disability Benefit | October 16, 2025 |

| Canada Child Benefit | October 20, 2025 |

| Old Age Security (OAS) | October 29, 2025 |

| Canada Pension Plan (CPP) | October 29, 2025 |

Having your direct deposit info up to date with the CRA will speed up payment delivery and reduce hassles.

How to Make Sure You Get the Maximum Canada CRA $2,600 Direct Deposit?

Here are clear steps to optimize your CRA payments:

- File your 2024 taxes on time: CRA uses this data to calculate benefits, so missing the deadline can delay payments.

- Keep your personal info updated: Changes in marital status, dependents, address, or income can impact your eligibility.

- Enroll in direct deposit: Guarantees your money hits your account fast and safely.

- Apply for missed benefits: If you qualify but didn’t apply, especially for disability programs, you can often apply retroactively.

- Report significant income changes: Benefit amounts depend on income, so keep CRA informed.

- Use CRA online services: CRA My Account and mobile apps help track payments and update info quickly.

How Income Changes and Tax Filing Impact Your Benefits?

Your benefits are income-tested, meaning they adjust based on your reported yearly income. A rise in income may reduce future payments, while a decrease might increase them. Filing your taxes promptly keeps CRA informed, helping to avoid overpayment or underpayment.

Incomplete or late tax filing often results in delayed or missed benefit payments. The CRA calculates eligibility strictly from your last filed returns.

Common Mistakes to Avoid

- Missing the April 30 tax-filing deadline.

- Forgetting to update direct deposit or contact info.

- Not applying for benefits you qualify for.

- Ignoring CRA correspondence about benefits qualification or audits.

Avoid these pitfalls to make sure your payments remain timely and accurate.

Technology Makes Benefit Management Easy

The CRA’s My Account portal and mobile app empower Canadians to manage their benefits effortlessly. You can check payment dates, update information, and communicate with CRA agents from the comfort of your phone or computer.

Additional Support and Resources

For personalized help, the CRA offers:

- Multilingual support lines.

- Community outreach for vulnerable populations.

- Detailed online resources and videos.

Canada’s $2,000 CRA Direct Deposit in October 2025 – Is it true? Check Eligibility

CRA Raises Retirement Age in 2025 – Say Goodbye to Retiring at 67, Here’s the New Limit

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date