Canada Grocery Rebate Amount: Hey folks! Feeling the pinch of rising grocery prices? You’re definitely not alone. Many Canadians have been facing sticker shock at the checkout counter, and that’s where the Canada Grocery Rebate steps in to ease the burden. In this comprehensive guide, we’ll break down the Canada Grocery Rebate amount for October 2025, explain who qualifies, when to expect the payment, and how to check your status—all in down-to-earth, easy-to-follow terms. Whether you’re just trying to make your grocery bill manageable or a financial pro tracking the latest federal aid, this article delivers the details with some expert know-how and friendly advice.

Canada Grocery Rebate Amount

The Canada Grocery Rebate for October 2025 is a well-timed, tax-free boost for Canadian families battling grocery inflation. From $234 for singles to upwards of $628 for bigger families, this program offers much-needed relief, especially when paired with smart budgeting and timely tax filing. Mark October 3, 2025, on your calendar and check your CRA account to ensure you don’t miss out on this vital support.

| Feature | Detail |

|---|---|

| Rebate Amount Range | $234 for single adults up to $628 for larger families |

| Payment Date | October 3, 2025 |

| Eligibility | Canadian residents, GST/HST credit recipients, filed 2024 tax returns |

| Payment Method | Direct deposit or cheque |

| Taxable Status | Tax-free |

| Official Source | Canada Revenue Agency |

Why the Canada Grocery Rebate Amount Matters?

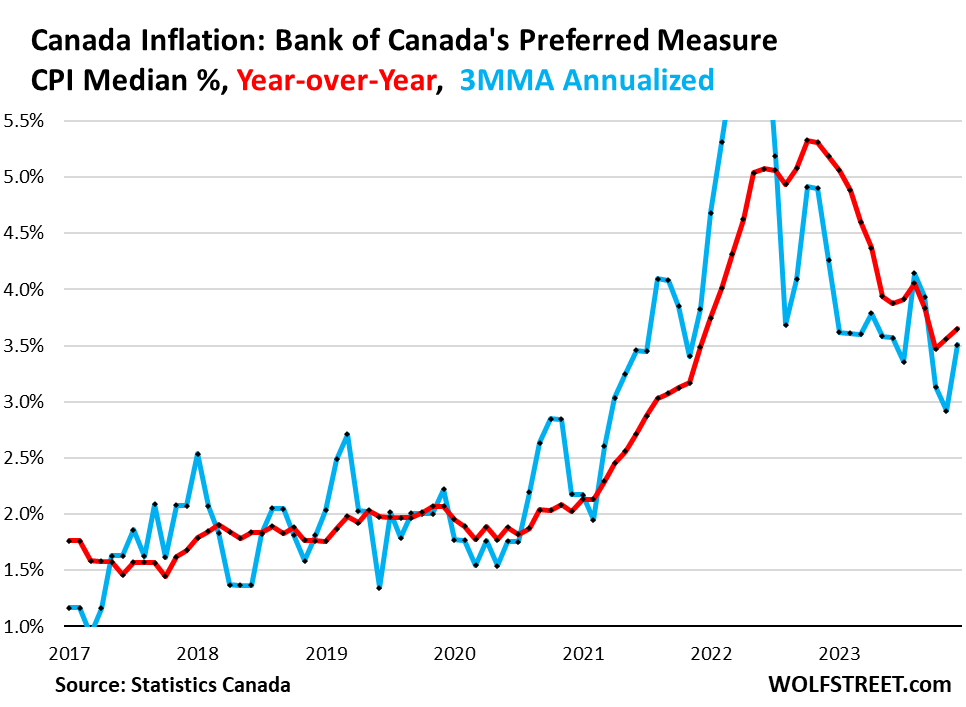

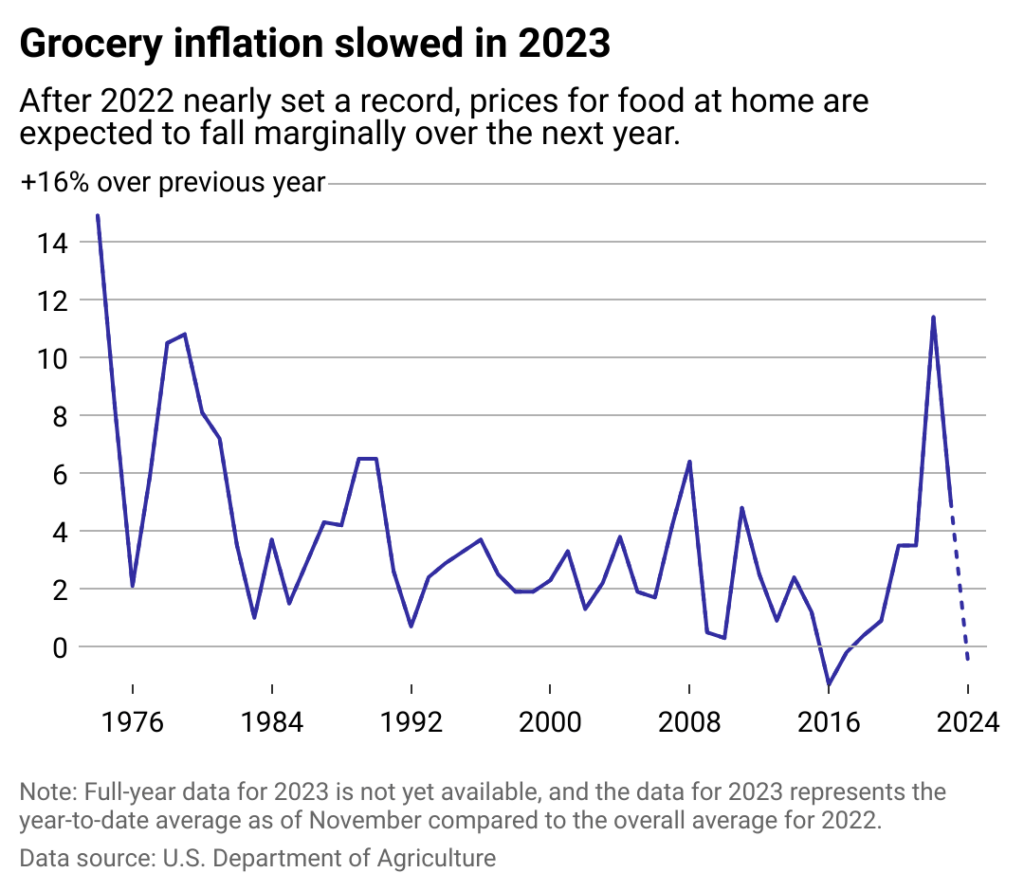

Food prices have been climbing steadily across the country, with inflation rates for groceries hitting highs not seen in over two decades. According to Statistics Canada data, food inflation for 2024 averaged around 7%, pushing the cost of staples and fresh produce well beyond many budgets.

The Canada Grocery Rebate was launched to help ease these pressures. It’s a tax-free payment made to Canadian residents who meet income and family size criteria, designed to lighten the financial load when you load up your cart.

What Is the Canada Grocery Rebate?

The Canada Grocery Rebate is a government action to directly support low- and modest-income households struggling with grocery bills. This payment is bundled with the quarterly GST/HST credit, making it seamless and simple for most Canadians to receive.

The amount you get depends on your family size and income, ensuring that help is targeted where it’s needed most. No extra forms or applications—just file your taxes on time and CRA does the rest.

History and Background of the Grocery Rebate

The Canada Grocery Rebate was introduced in 2023 as a response to soaring food inflation affecting millions. It was first announced in the federal budget and made official by Bill C-46 (the Cost of Living Act, No. 3) receiving Royal Assent in May 2023.

The government’s goal was clear: provide targeted, temporary relief to Canadians most affected by rising grocery prices without disrupting Canada’s fiscal responsibility. Initially set up as a one-time payment, the rebate showed such positive impact that it has become a recurring feature integrated with the GST/HST credit.

Former Deputy Prime Minister Chrystia Freeland highlighted in 2023 that the rebate would support about 11 million Canadians, easing the financial squeeze for families, singles, and seniors alike by helping with those grocery bills that can quickly add up. The program continues to be crucial as food inflation remains a burden for many households.

Breaking Down the GST/HST Credit Connection

Since the rebate is linked to the GST/HST credit, make sure you understand this credit first. The GST/HST credit is a tax-free quarterly payment for low- and modest-income Canadians designed to offset some of the taxes they pay on goods and services.

The grocery rebate rides alongside this credit and shares the same eligibility rules. So, if you qualify for GST/HST credit, chances are you’ll also receive the grocery rebate.

Who Qualifies for the Canada Grocery Rebate Amount?

To cash in on the rebate for October 2025, you need to:

- Be a Canadian resident for tax purposes.

- Have filed your 2024 income tax return—critical since CRA uses this data to verify eligibility.

- Fall under certain income thresholds, which vary based on your family setup. For example:

- Single individuals making less than roughly $49,000.

- Families or couples with incomes generally up to $52,000 to $58,000, with higher limits for more children.

- Seniors on Old Age Security (OAS) or Guaranteed Income Supplement (GIS) often qualify automatically.

Keep your contact and banking info up to date with CRA to avoid missing out.

How Much Can You Expect in Your Wallet?

Here’s a snapshot of approximate rebate amounts for October 2025:

| Household Type | Approximate Rebate Amount |

|---|---|

| Single adult, no children | $234 |

| Single parent with 1 child | $387 |

| Couple, no children | $306 |

| Family with 2 children | $467 |

| Family with 3+ children | $548 to $628+ |

This amount is paid tax-free and won’t affect other benefits like the Canada Child Benefit or provincial supplements. It’s a targeted financial bump to help offset grocery bills.

When & How Do You Get Paid?

Your money hits the bank on October 3, 2025, alongside the GST/HST credit payment. If you opt for direct deposit, expect your funds the same day or shortly after. If you get a cheque, allow 5-10 business days for delivery.

Heads up: If you owe any federal taxes or benefits overpayments, payments may be adjusted.

Budgeting Tips to Maximize the Canada Grocery Rebate Amount

While the rebate helps, it’s always smart to make your dollars stretch—here’s how:

- Shop the sales: Stock up on sale items and use coupons when possible.

- Buy in bulk: For non-perishables, bulk buys save money.

- Plan meals: Save food and cash by meal prepping with rebate money in mind.

- Use free budgeting tools like Canada’s Financial Consumer Agency for tracking grocery expenses.

Provincial and Territorial Top-Ups

Some provinces also offer top-up programs or other food assistance — worth looking into if you qualify, as combined support can significantly ease grocery budgets.

More info can typically be found on provincial government websites or local social services.

How the Grocery Rebate Supports Food Security?

The rebate not only helps families directly with everyday costs but also plays a role in overall food security by stabilizing household budgets, so fewer people have to rely solely on food banks or community charity programs. Many local organizations report seeing fewer emergency food assistance requests because families can manage their grocery expenses better with such government support.

Protecting Yourself Against Grocery Rebate Scams

When payments like these hit the news, scammers often try to take advantage by sending fake emails or texts claiming to be from CRA. Remember:

- The CRA never asks for personal info or payments by text or email.

- Only provide information through official CRA websites or your CRA My Account portal.

- Beware of phishing attempts asking for bank details or Social Insurance Numbers (SIN).

How to Check Your Payment Status?

- Sign in to your CRA My Account online portal.

- Navigate to the “Benefits and Credits” or “Payments” section.

- Look for entries titled “Canada Grocery Rebate – October 2025.”

- Review the payment status and amount.

If it’s not showing up 10 business days after October 3, double-check that your 2024 tax return was filed and processed and that your banking or mailing info is current. Contact CRA if things still look off.

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date

Canada’s $2,000 CRA Direct Deposit in October 2025 – Is it true? Check Eligibility

CRA Confirms $742 OAS Boost Coming in 2025 – Are you eligible to get it? Check Here

Has this been confirmed by cra?