Canada $15,630 Disability Tax Credit: If you’ve been hearing buzz about the Canada $15,630 Disability Tax Credit in 2025, you’re not alone. This tax break is one of the biggest ways Canadians living with disabilities—or their families—can save serious cash at tax time. But let’s be real: government programs can sound complicated, full of paperwork and fine print. Don’t stress—I’ll break it down like we’re sitting at a coffee shop, talking plain English, so you’ll walk away knowing exactly what this is, who qualifies, and how to get it. Now, here’s the scoop: the $15,630 figure isn’t free money handed out, it’s the maximum non-refundable tax credit a family can claim for a child under 18 with a qualifying disability. For adults, the base amount is lower (about $9,872 for the 2024 tax year), but the process of applying is basically the same.

Canada $15,630 Disability Tax Credit

The Canada $15,630 Disability Tax Credit in 2025 is one of the most valuable tax breaks for families and individuals with disabilities. It doesn’t hand you free cash, but it lowers your tax bill and can unlock other powerful benefits like the Child Disability Benefit and the RDSP. Yes, the forms and rules can feel overwhelming, but with the right prep—and a supportive doctor—you can maximize your savings and even claim refunds from past years. Don’t leave money on the table.

| Topic | Details |

|---|---|

| Program | Disability Tax Credit (DTC) – administered by the Canada Revenue Agency (CRA) |

| Max Amount (2024) | $15,630 for minors (base $9,872 + child supplement $5,758); $9,872 for adults |

| Who Qualifies | Canadians with a severe and prolonged disability (12+ months) certified by a medical practitioner |

| Form Needed | T2201 Disability Tax Credit Certificate |

| Claim Process | Apply with Form T2201 → CRA approval → Claim on tax return (line 31600, 31800, or 32600) |

| Retroactive Claims | Up to 10 years of credits can be reassessed |

| Extra Benefits | Child Disability Benefit, Registered Disability Savings Plan (RDSP) eligibility |

| Official Source | Canada.ca – Disability Tax Credit |

What Exactly Is the Disability Tax Credit (DTC)?

Think of the DTC as a tax break designed to help offset the extra costs of living with a disability. It doesn’t mean you’ll get a $15,630 check in the mail, but it lowers the amount of federal income tax you owe.

For kids under 18, parents or guardians can tack on a supplement, pushing the total up to that magic $15,630 number. For adults, the base amount applies. If you don’t owe much in taxes yourself, the unused portion can even be transferred to a spouse, parent, or caregiver.

A Quick History & Context

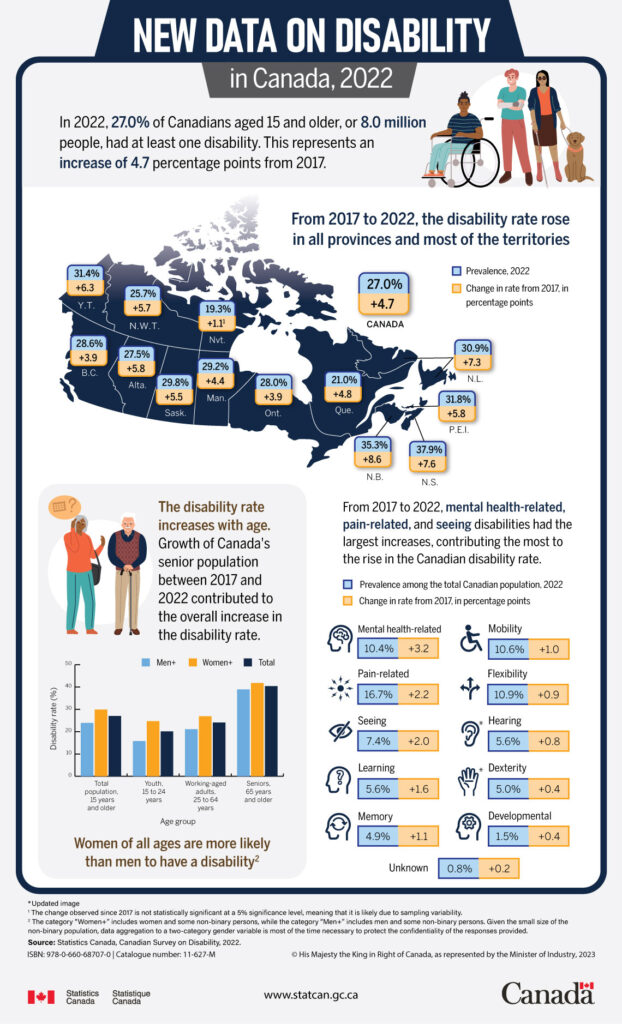

The Disability Tax Credit has been around since the 1980s, but over the years the rules have evolved to become more inclusive. Initially, it was mainly for those with mobility issues. Today, it covers a wide range of impairments, including mental health conditions, developmental disorders, and life-sustaining therapies like dialysis or insulin.

Every year, the amounts are adjusted for inflation. For example:

- 2020: Adult amount $8,576; Child supplement $5,003.

- 2024: Adult amount $9,872; Child supplement $5,758.

- 2025 (projected): Slight increase once inflation indexing kicks in.

This steady increase shows the government recognizes the rising costs families face.

Who Can Qualify for the Canada $15,630 Disability Tax Credit?

The CRA doesn’t hand out approvals lightly. You have to meet specific requirements. Here’s a breakdown:

Physical Disabilities

- Severe mobility restrictions (e.g., paralysis, severe arthritis, cerebral palsy).

- Conditions requiring assistive devices or life-sustaining therapy (ventilators, dialysis, insulin).

Developmental & Learning Disabilities

- Autism spectrum disorder (ASD).

- Attention deficit hyperactivity disorder (ADHD) if severe enough to restrict daily functions.

- Intellectual disabilities requiring ongoing support.

Mental Health Conditions

- Severe depression or anxiety that prevents daily functioning.

- Schizophrenia, bipolar disorder, PTSD when symptoms cause prolonged impairment.

Other Long-Term Impairments

- Chronic illnesses like Crohn’s disease or epilepsy if symptoms are severe and prolonged.

- Speech, hearing, or vision impairments.

Example: A child with autism who needs daily support at school often qualifies. An adult with schizophrenia who requires constant medication and supervision may also be eligible.

Step-by-Step Guide: How to Claim the Canada $15,630 Disability Tax Credit

Here’s how you move from application to tax savings:

Step 1: Get Form T2201

Download the Disability Tax Credit Certificate (T2201) from the CRA. Fill out Part A with your details.

Step 2: Visit Your Doctor

Your medical practitioner completes Part B, describing the impairment and its impact. The more detailed, the better.

Step 3: Submit to CRA

- Online: Upload through My CRA Account.

- Mail: Send it to your regional tax centre.

Step 4: CRA Review

The CRA reviews your application. Processing can take weeks to months. Sometimes they ask for additional details.

Step 5: Claim It on Your Taxes

If approved, you’ll receive a Notice of Determination. Claim it on:

- Line 31600: For yourself

- Line 31800: If transferring to a family member

- Line 32600: For spouse/common-law partner

Step 6: Retroactive Claims

This is where families can unlock big refunds. If your disability began years ago, CRA allows reassessment for up to 10 previous tax years. You need to check the box on the T2201 form or request CRA to reassess old returns.

Why the $15,630 Matters?

That number can sound confusing, so let’s put it into perspective:

- Parents with a qualifying child could save about $2,344 federally (15% of $15,630).

- Adults can save about $1,481 federally (15% of $9,872).

- Add provincial credits and the total savings grow:

- Ontario: Extra ~$5,540 provincial disability amount.

- British Columbia: Extra ~$8,500.

- Quebec: Has its own separate calculation but still offers significant credits.

Real-Life Scenarios

- Adult Claiming: John, diagnosed with multiple sclerosis, qualifies for the adult disability amount. His federal tax bill drops by nearly $1,500 every year.

- Child Claiming: Sarah’s parents claim $15,630 for their 10-year-old with autism, saving about $2,344 federally, plus provincial credits worth another $3,000.

- Transfer to Caregiver: If Sarah’s parents don’t owe much tax, they transfer the credit to a grandparent who helps financially.

- Retroactive Claim: A family gets approved in 2025 but their child’s disability began in 2017. CRA reassesses eight past years, resulting in a refund of nearly $20,000.

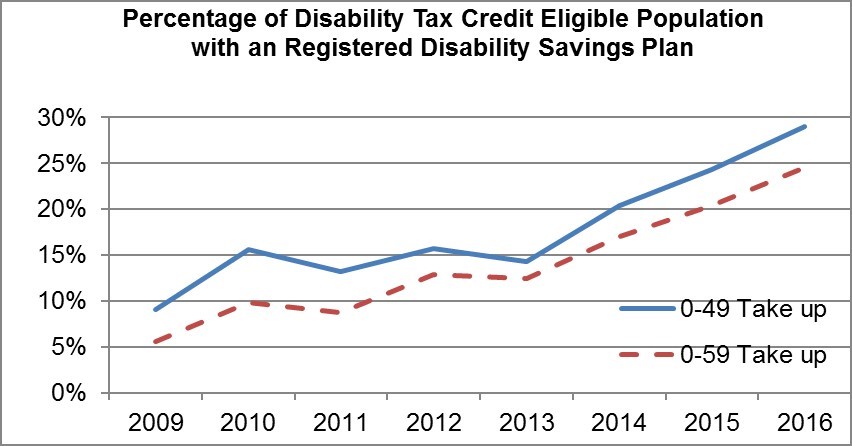

Extra Benefits Unlocked by the DTC

Approval for the DTC can open doors to other benefits:

- Child Disability Benefit (CDB) – A monthly tax-free payment to families with children under 18 who qualify for the DTC.

- Registered Disability Savings Plan (RDSP) – A savings plan with government grants and bonds (up to $70,000 lifetime in grants and $20,000 in bonds).

- Provincial/territorial programs – Some social assistance and health programs require DTC eligibility as proof of disability.

CRA Denials & Appeals

Not every application gets approved. According to CRA data, roughly 30% of applications are denied or delayed because forms are incomplete or vague.

If denied:

- You can request a review by submitting new medical information.

- You can file a formal objection within 90 days of the CRA’s decision.

- If needed, appeals can even go to the Tax Court of Canada.

Tip: The strongest applications include specific examples of how daily life is affected. Instead of “Patient has trouble walking,” your doctor might write “Patient cannot walk more than 50 meters without support.”

DIY vs. Professional Help

Some families apply on their own, while others hire disability tax consultants or accountants.

- DIY: Free, and CRA provides guides. Works well if your doctor fills out the form clearly.

- Professional Help: Some firms take a percentage (up to 30%) of your refund. Be cautious of high fees—always read the fine print.

If you’re comfortable with forms and your doctor is supportive, DIY is often best. If you’ve been denied before or have a complex case, professional help might make sense.

Common Mistakes to Avoid

- Submitting vague medical forms.

- Not reapplying when CRA approval expires.

- Forgetting to request retroactive reassessments.

- Confusing the DTC with CPP Disability or EI sickness benefits.

Practical Tips

- Always keep a copy of your T2201 form.

- Talk to your doctor in advance so they know what CRA is looking for.

- Use CRA’s online services to track your application.

- Double-check if your approval makes you eligible for CDB or RDSP—don’t leave money on the table.

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date

Canada Wage News: $17.65/Hour Pay Raise; Is Your Province on the List?

Canada October $3555 Widow Pension Support For these Canadians – Check Eligibility and Claim Process