CRA Raises Retirement Age: Retirement in the U.S. and Canada is always a hot topic, and whenever a new change hits the system, folks get nervous. So when you hear headlines like “CRA Raises Retirement Age in 2025 – Say Goodbye to Retiring at 67, Here’s the New Limit,” it’s bound to catch your attention. But what’s fact, what’s fiction, and how does it affect your wallet, career, and golden years? Let’s break it down. The truth is, the Canada Revenue Agency (CRA) doesn’t set the retirement age. Instead, retirement rules are tied to programs like the Canada Pension Plan (CPP) and Old Age Security (OAS). In the U.S., similar discussions revolve around Social Security. Right now, Canadians can start CPP as early as 60, wait until 65 for the standard amount, or push it to 70 for extra dough. OAS kicks in at 65. Rumors about raising the age to 67 are swirling, but no official law has locked that in just yet.

CRA Raises Retirement Age

The bottom line? CRA hasn’t raised the retirement age to 67 in 2025—but the conversation about pushing it higher is real. Whether you’re in Canada or the U.S., don’t bank on the system alone. Plan ahead, delay benefits if possible, and treat retirement like a personal strategy game. The earlier you prepare, the smoother your ride into your golden years.

| Point | Details |

|---|---|

| Current Retirement Age | CPP: 65 (early at 60, late at 70); OAS: 65 |

| Rumors About 2025 | No confirmed change to age 67; speculative discussions only |

| U.S. Context | Full Social Security retirement age: 66–67, depending on birth year |

| Financial Planning Tip | Delaying CPP to 70 boosts benefits by 42% |

| Official Source | Government of Canada – CPP & OAS Info |

Why People Think CRA Raises Retirement Age?

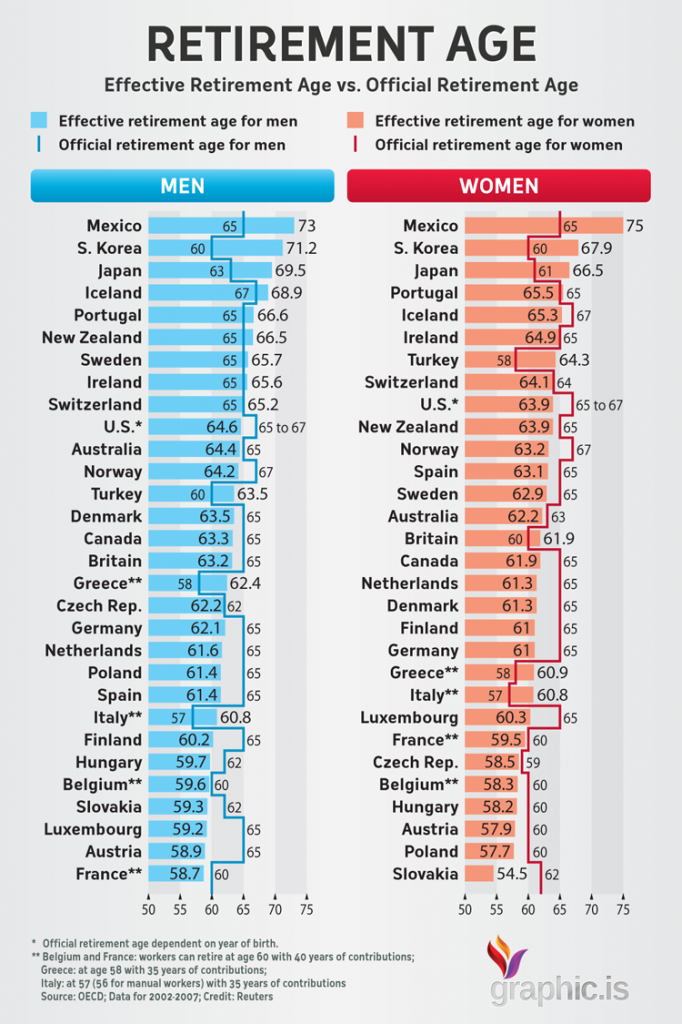

Here’s the deal: governments across North America are sweating about longer life spans and shrinking worker-to-retiree ratios. Translation? More people are collecting benefits, fewer are paying into the system. In the U.S., Social Security has already inched its full retirement age from 65 to 66–67, depending on when you were born. In Canada, discussions about moving OAS from 65 to 67 sparked under past governments, but got rolled back.

Economists warn that as folks live longer (average life expectancy in Canada is 81.9 years; in the U.S. it’s about 76.4 years), the system might need adjusting. That’s why you see clickbait headlines about retirement changes—they play on very real financial pressures.

What’s the Current Law in 2025?

- CPP: Standard start at 65, but flexible between 60–70.

- OAS: Starts at 65, no changes confirmed.

- U.S. Social Security: 66–67 depending on your birth year.

So if you were worried about being forced to wait until 67 in Canada—take a deep breath. You’re safe… for now.

Practical Advice for Navigating Retirement

Retirement isn’t just about an age—it’s about a plan. Here’s how you can roll with whatever the government throws your way:

1. Know Your Numbers

Check your CPP statement (in Canada) or Social Security account (in the U.S.). These tell you exactly how much to expect at different ages. Many people are shocked to see the difference between claiming early and waiting, so get familiar with your personal statement.

2. Consider Working Longer—But On Your Terms

Working past 65 doesn’t have to mean grinding at the same 9–5. Many folks pivot to consulting, freelancing, or part-time gigs. Not only does it keep income flowing, but studies show it keeps your brain sharp and socially connected.

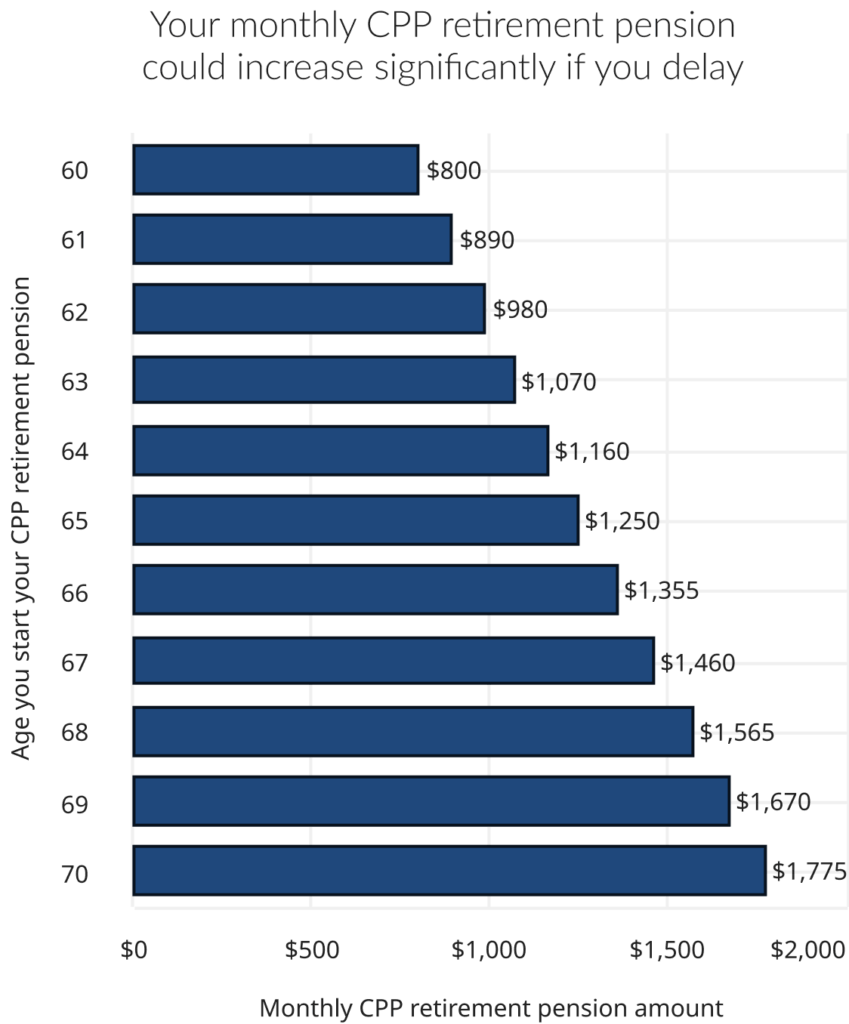

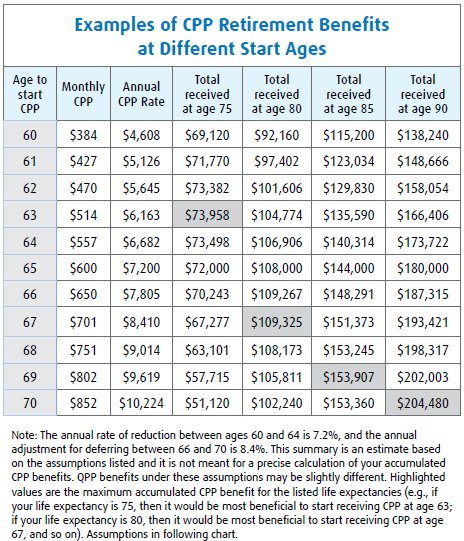

3. Delay Benefits If You Can

In Canada, delaying CPP until 70 can pump your payments by 42%. In the U.S., every year you delay Social Security past your full retirement age adds about 8% until 70. That’s serious cheddar that stacks up over decades.

4. Diversify Your Income

Don’t rely solely on government programs. Build your 401(k), RRSP, or TFSA. The more streams of income you have, the less policy changes mess with your future. Even small side hustles—like online teaching, selling crafts, or consulting—add resilience.

Example: How Waiting Pays Off

Let’s say you’re a Canadian with a CPP benefit of $1,000/month at age 65:

- At 60: You’d only get about $640/month (a 36% cut).

- At 70: You’d snag about $1,420/month (a 42% boost).

Same math applies in the U.S.—start early and you lose out, wait it out and you rake in more. Over a 20-year retirement, that difference adds up to tens of thousands of dollars.

The Career Angle: What Professionals Should Know

For folks still in their 40s and 50s, here’s the straight talk: plan for flexibility. Policy changes happen. But the real winners are those who keep building skills, maintain networks, and stay employable. Think of retirement not as an “end date,” but as a “shift date.”

Pro tip: More companies are offering phased retirement—you scale back hours instead of cutting the cord cold turkey. It’s a win-win: you earn, they keep your expertise.

Case Studies: Real-Life Retirement Decisions

Case Study 1: Retiring Early

Linda, 62, in Toronto, decided to start CPP at 60. She thought she’d enjoy the extra freedom, but with reduced monthly income, she now regrets not waiting. Her advice? “If you’re healthy and can work longer, don’t rush it.”

Case Study 2: Waiting Until 70

James, 68, from Calgary, kept working part-time and delayed CPP. At 70, his benefit is now 42% higher, and he combines it with his RRSP withdrawals. He says the wait was worth it: “I sleep better knowing I’ve got steady income for life.”

Case Study 3: Phased Retirement in the U.S.

Maria, 64, in New York, shifted to consulting instead of fully retiring. She earns enough to delay Social Security until 70, and the extra 8% boost per year made her financial outlook much brighter.

Case Study 4: Blended Strategy

Robert, 65, in Vancouver, took CPP early but delayed OAS to balance income with taxes. He worked part-time and invested aggressively, creating a flexible approach that gave him security without relying on just one system.

Global Perspective: How Other Countries Handle It

- Germany: Gradually raising retirement age to 67 by 2031.

- UK: State pension age is 66, rising to 67 between 2026–2028.

- Japan: Facing one of the oldest populations, encouraging work past 65.

- Australia: Pension age is increasing to 67 by 2023.

Comparing these systems shows Canada and the U.S. aren’t alone—retirement ages are trending up worldwide. This makes proactive planning more important than ever.

Advanced Planning Tips for Professionals

- Tax Planning: Understand how taxes will hit CPP, OAS, or Social Security. In Canada, high-income retirees could face an OAS clawback. In the U.S., Social Security benefits can be taxable depending on your income.

- Healthcare Costs: In the U.S., Medicare starts at 65, but you’ll need supplemental coverage. In Canada, healthcare is public, but out-of-pocket costs for drugs and dental still matter.

- Longevity Risk: Plan as if you’ll live longer than average. Running out of money at 85 is far scarier than having extra cash.

- Estate Planning: Don’t ignore wills, powers of attorney, and trusts. Your retirement plan should include what happens after you’re gone.

Canada’s New GST/HST Rebate for October 2025 Confirmed – Check Amount & Payment Date

CRA Disability Check October 2025: Check Benefit Amount, Eligibility & Payment Date

CRA Confirms $742 OAS Boost Coming in 2025 – Are you eligible to get it? Check Here