Canada’s New GST/HST Rebate: The Canada GST/HST Rebate for October 2025 is officially confirmed, and millions of Canadians will see their next quarterly payment on Friday, October 3, 2025. This payment is part of a long-running program by the Canada Revenue Agency (CRA) that helps offset the impact of federal and provincial sales taxes. For many families, the GST/HST credit is not just “extra money” — it’s a key piece of their monthly budget. Whether it helps buy groceries, cover rising hydro bills, or stretch a student’s loan money a little further, these quarterly payments play an important role in keeping Canadians financially balanced in tough times.

Canada’s New GST/HST Rebate

The Canada GST/HST Rebate for October 2025 is confirmed for Friday, October 3, 2025. Eligible Canadians will see their quarterly payments land either by direct deposit or cheque, depending on how they’re registered. With maximum amounts of $533 (single), $698 (couples), and $184 per child, the credit offers meaningful relief for millions of households. Though it won’t solve Canada’s affordability crisis alone, it helps cover everyday essentials at a time when every dollar counts.

| Detail | Confirmed Info |

|---|---|

| Payment Date | Friday, October 3, 2025 |

| Quarterly Schedule | Jan 3, Apr 4, Jul 4, Oct 3, 2025 |

| Maximum Annual Amounts (July 2025–June 2026) | – $533 if single- $698 if married/common-law- $184 per child under 19 |

| Eligibility | Based on 2024 tax return and family net income |

| Provincial Differences | Applies across Canada; relief more valuable in higher-tax HST provinces |

| Official Source | CRA – GST/HST Credit |

What Is the GST/HST Credit?

The GST/HST credit is a tax-free quarterly payment meant to reduce the burden of consumption taxes (GST or HST) for low- and modest-income Canadians. Unlike income-based benefits such as Employment Insurance or the Canada Child Benefit, this credit is tied to what you spend rather than what you earn.

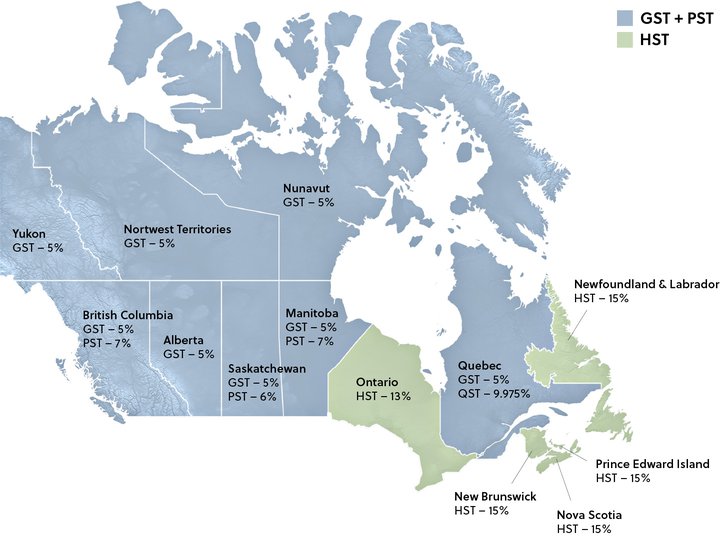

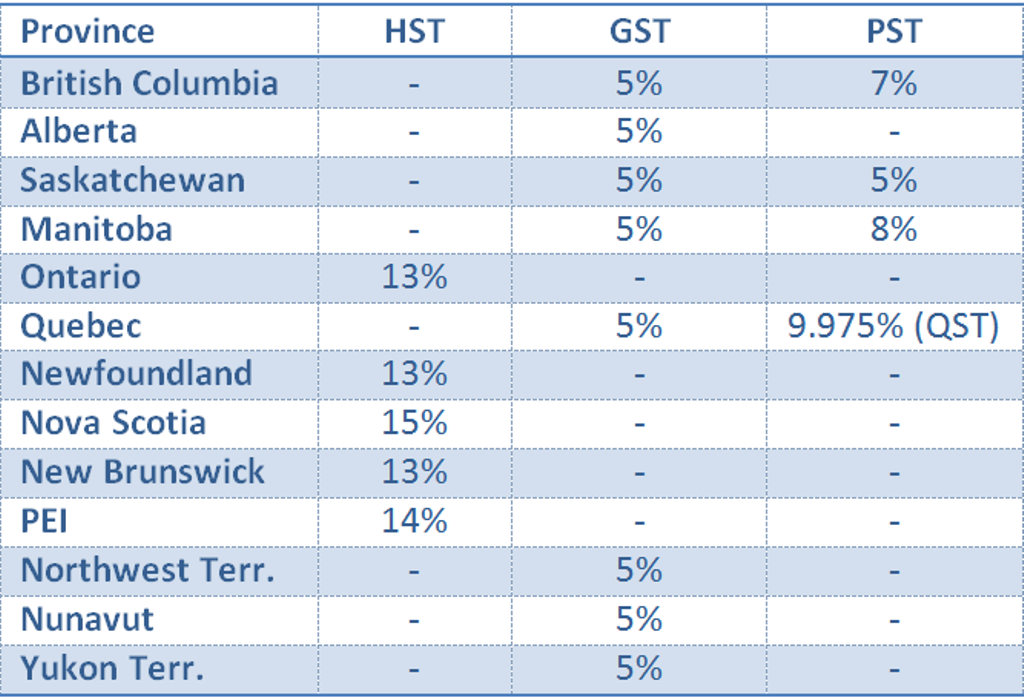

Canada’s Goods and Services Tax (GST) is a 5% federal tax applied to most goods and services. Some provinces have harmonized their sales taxes with the federal GST to create a single Harmonized Sales Tax (HST), ranging from 13% to 15%. While everyone pays these taxes when shopping, the credit ensures that lower-income Canadians get some of that money back.

In short, it’s Canada’s way of making sales taxes less regressive and more equitable.

October 2025 Canada’s New GST/HST Rebate Date

The next GST/HST rebate will be issued on Friday, October 3, 2025. This falls on the first Friday of the month, which is typical for the CRA’s quarterly credit schedule.

- Direct deposit: Payments appear in your bank account the same day.

- Paper cheques: Expect a delivery window of 5–10 business days depending on your postal code.

Filing your taxes early and enrolling in direct deposit through CRA My Account or your bank ensures you never miss a payment.

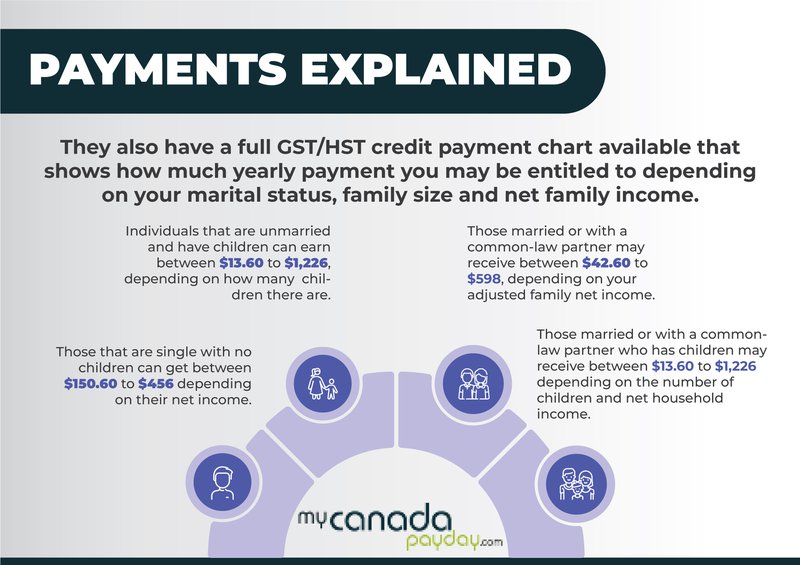

How Much Will You Get?

The maximum yearly amounts for July 2025–June 2026 are:

- $533 – Single adult

- $698 – Married or common-law couple (combined, not each)

- $184 per child under 19

Payment Example

- A single mom with two kids could receive $901 annually, or $225.25 each quarter.

- A retired couple with modest income and no children could get $698 annually, or $174.50 quarterly.

Income Phase-Out

Not everyone qualifies for the full amount. The credit begins to shrink as your family income climbs.

- Single adults earning over $55,000 typically see their credit reduced to zero.

- Couples with children may remain eligible up to $65,000–$70,000 family income, depending on household size.

The CRA calculates this automatically using your 2024 tax return.

Provincial Differences

The GST/HST credit is uniform across Canada, but its impact is felt differently:

- HST Provinces (13–15% total tax): Ontario, Nova Scotia, New Brunswick, Newfoundland & Labrador, Prince Edward Island. Residents here pay more sales tax overall, so the rebate feels like a stronger offset.

- GST + PST Provinces: British Columbia, Saskatchewan, Manitoba, Quebec. These provinces keep their provincial sales tax separate from the GST.

- GST-only (5% tax): Alberta, Yukon, Northwest Territories, Nunavut. Residents pay the lowest total sales tax, so while the rebate is smaller in relative terms, it still provides meaningful relief.

Historical Context

The GST was first introduced in 1991, replacing the hidden Manufacturer’s Sales Tax. It was controversial but created transparency in how Canadians paid taxes on consumption.

The GST credit was designed alongside it to soften the blow for lower-income households. Over time:

- 2000s: Payments were indexed to inflation.

- 2010s: Provinces like Ontario and the Atlantic regions adopted HST.

- 2023: The federal government introduced a one-time Grocery Rebate, which doubled the credit temporarily to help Canadians struggling with food inflation.

Today, while there’s no extra “boost,” the regular quarterly GST/HST credit continues to serve as a stable form of tax relief.

Filing Your Taxes: The Key to Eligibility

You must file your 2024 tax return to be considered for GST/HST credits in 2025–26. Even if you have zero income, the CRA uses your return to determine eligibility.

Commonly Overlooked Groups

- Students: Many don’t realize filing gives them access to the credit, even with part-time income.

- Seniors: Retirees on OAS/GIS may miss out if they skip filing.

- Newcomers: Must file a return as a resident, or submit Form RC66 to apply for benefits.

Failing to file means missing out on hundreds of dollars.

How It Works With Other Benefits?

The GST/HST credit is just one piece of the Canadian benefit puzzle:

- Canada Child Benefit (CCB): Monthly tax-free payment to parents.

- Climate Action Incentive Payment (CAIP): Quarterly credit to offset carbon pricing.

- Old Age Security (OAS) & Guaranteed Income Supplement (GIS): Monthly supports for seniors.

Together, these programs create a layered system of relief. For example, a low-income family with two children in Ontario could receive GST/HST credit, CCB, CAIP, and provincial top-ups, amounting to thousands annually.

How Canadians Use the Canada’s New GST/HST Rebate?

While the payments may seem modest, surveys show Canadians use them in practical, everyday ways:

- Covering a week of groceries (especially staples like milk, bread, eggs, and meat).

- Paying monthly utility bills, such as electricity, gas, or internet.

- Helping students with textbooks or transit passes.

- Supporting parents with school supplies or extracurricular fees.

For many households, it’s not “spare change”—it’s survival money.

Watch Out for Scams

The CRA warns Canadians to be on guard. Scammers prey on benefit recipients every quarter.

Red flags include:

- Emails or texts claiming “Click here to claim your GST rebate.”

- Calls threatening jail or fines if you “don’t repay.”

- Requests for payment via gift cards, Bitcoin, or e-Transfer.

Legitimate CRA communications never demand immediate payment this way.

Professional Insight: Why It Matters

According to Statistics Canada, more than 11 million Canadians received GST/HST credits in 2024.

Economists note that:

- Credits are progressive: they target households most affected by inflation.

- They provide immediate relief: most recipients spend the funds right away on essentials, stimulating the economy.

- They reduce inequality: sales taxes hit everyone equally at checkout, but rebates restore fairness.

With grocery costs rising 20% since 2020, programs like the GST/HST credit are lifelines for families and individuals struggling with affordability.

Step-by-Step Guide: Ensuring You Get Canada’s New GST/HST Rebate

- File your taxes on time (April 30, 2025, for most Canadians).

- Enroll in direct deposit via CRA or your bank.

- Report marital changes (marriage, separation, divorce).

- Add new dependents (birth, adoption, guardianship).

- Check CRA My Account regularly for updates and payment history.

Following these steps avoids delays and ensures you receive the credit you’re entitled to.

CRA Confirms $742 OAS Boost Coming in 2025 – Are you eligible to get it? Check Here