Social Security COLA Hike: If you’re retired, close to retirement, or just paying attention to how inflation affects daily life, you’ve probably heard the buzz about the Social Security COLA hike for 2026. Experts predict that next year’s cost-of-living adjustment (COLA) will likely be higher than average, thanks to stubborn inflation that continues to drive up the cost of basics like food, housing, and healthcare. COLA is more than just a number—it directly determines how much extra money lands in your Social Security check. For millions of Americans, especially those living on fixed incomes, this annual adjustment can make the difference between feeling secure or scrambling to pay monthly bills.

Social Security COLA Hike

The Social Security COLA hike for 2026 is expected to be around 2.7%–2.8%, translating into about $54 extra per month for the average retiree. While that sounds like a win, rising Medicare premiums are likely to eat away much of that increase, leaving many with only $25–$40 more in take-home pay. COLA is an important safeguard, but it won’t completely shield retirees from rising costs. The smart move? Stay informed, budget carefully, review Medicare options, and consider supplemental income sources. That’s how you turn a modest COLA into real financial stability.

| Key Insight | Details |

|---|---|

| Predicted 2026 COLA | 2.7% – 2.8% increase (average expert estimates) |

| Dollar Impact | ~$54/month added to average retiree check ($2,008 baseline) |

| Medicare Part B Premiums | Expected to rise, possibly eating up 40% of the increase |

| Net Take-Home Gain | Likely $25–$40/month for many retirees |

| COLA Formula | Based on July–September 2025 CPI-W vs. same period in 2024 |

| Official Source | Social Security Administration |

What Is COLA and Why It Matters?

The Cost-of-Living Adjustment (COLA) is Social Security’s built-in inflation guardrail. Every fall, the government reviews inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) for the months of July, August, and September.

If prices rise, so does your Social Security check. If prices stay flat or drop, there’s no COLA. This system was introduced in the 1970s, after retirees pushed Congress to protect their benefits from being eroded by inflation.

Example: If you’re receiving $1,500/month and the COLA is 2.7%, you’ll get an extra $40.50 added to your monthly check starting in January 2026.

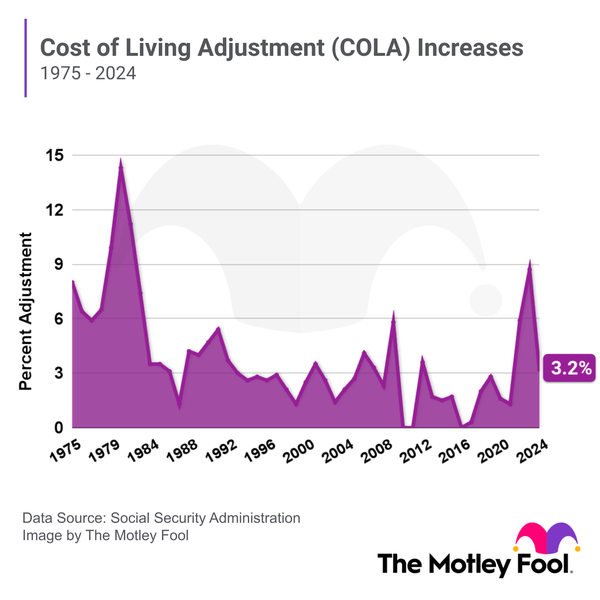

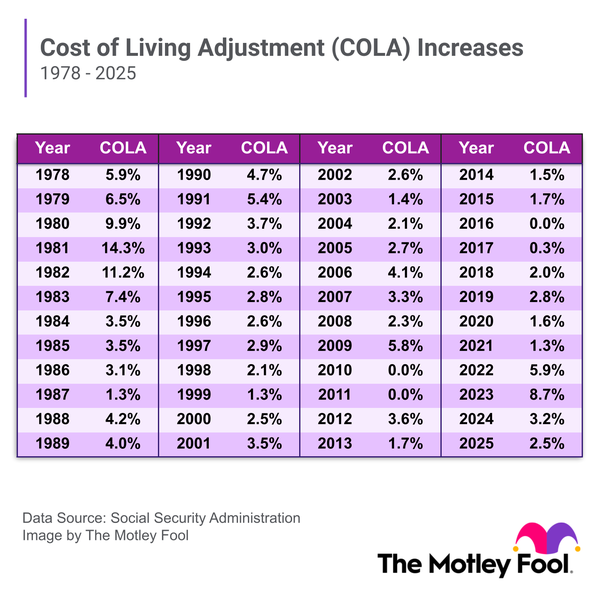

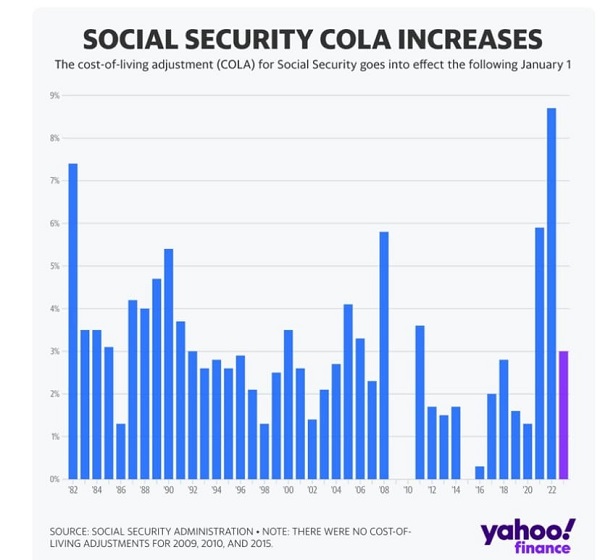

Historical Perspective: Comparing 2026 With the Past

To really understand the 2026 COLA, let’s see how it stacks up:

- 2023: 8.7% increase—the largest in four decades—driven by pandemic-related inflation.

- 2024: 3.2%, reflecting cooling prices.

- 2025: Around 3.0%, still higher than pre-pandemic norms.

- 2026 (expected): 2.7%–2.8%, back toward “normal” territory.

Before 2021, COLAs often hovered between 1% and 2%. That means even a 2.7% bump is bigger than what retirees got in many years during the 2010s.

The Social Security COLA Hike 2026 Predictions

Several respected analysts are already making forecasts:

- The Senior Citizens League (TSCL): ~2.7%.

- Mary Johnson, Social Security analyst: ~2.8%.

- MOAA (Military Officers Association of America): ~2.6%.

So, most experts agree the increase will fall in the 2.7% range, but the exact number depends on inflation in September 2025.

How Much Money Are We Talking?

With the average retiree benefit at about $2,008/month in 2025, here’s the math:

- 2.7% COLA → +$54/month ($648/year).

- 2.8% COLA → +$56/month ($672/year).

For retirees on higher benefits, the dollar increase is larger:

- $1,200/month benefit → about +$32.40.

- $1,800/month benefit → about +$48.60.

- $2,500/month benefit → about +$67.50.

That sounds good, but remember—this is before Medicare premiums come out.

Medicare Premiums: The COLA Killer

Most retirees have Medicare Part B premiums deducted automatically from their Social Security checks. And these premiums are expected to rise sharply in 2026.

According to Kiplinger, as much as 40% of the COLA bump could be lost to Medicare premiums. MarketWatch warns that for some low-income retirees, the increase may be completely wiped out.

Example:

- $1,500 benefit in 2025.

- COLA adds $40.50.

- Medicare premium rises $25.

- Net gain = $15.50.

Not exactly life-changing.

Hold Harmless Clause: A Safety Net With Limits

The “hold harmless” provision ensures that Medicare premium hikes can’t cause your Social Security check to shrink. That means your net check can’t be lower than last year’s.

However:

- It doesn’t apply to everyone (such as people who pay premiums directly).

- It doesn’t stop Medicare premiums from eating into most of your COLA increase.

Who Benefits From COLA?

It’s not just retirees:

- Retirees: Around 50 million Americans rely on COLA to protect monthly checks.

- SSDI Recipients: Disabled workers also get the adjustment.

- SSI Recipients: Some of the lowest-income Americans see a small but crucial bump.

For SSI recipients living on about $800/month, a 2.7% increase adds around $21.60. For many, that’s the difference between covering groceries or falling short.

Tax Implications

COLA increases can also affect tax liability. Up to 85% of Social Security benefits can be taxable if your income passes certain thresholds:

- $25,000 for single filers.

- $32,000 for joint filers.

A COLA bump could nudge some retirees into higher taxable ranges, leaving them owing more to the IRS.

Why COLA Doesn’t Match Retiree Reality?

The CPI-W doesn’t perfectly reflect retiree spending. It gives weight to categories like transportation and commuting, while underweighting healthcare.

But retirees spend a disproportionate amount on healthcare, prescription drugs, and housing—categories where inflation has been hotter. That means even when COLA rises, retirees may still fall behind.

According to AARP, retirees spend twice as much on healthcare compared to working Americans.

Future Outlook: What’s Next After 2026?

Economists predict inflation will continue to cool gradually, which means future COLAs may stay in the 2% range. But long-term challenges loom:

- Social Security Trust Fund may face funding shortfalls by the mid-2030s if Congress doesn’t act.

- Rising healthcare costs could continue to outpace COLAs.

- Retirees may need to rely more on savings, pensions, or part-time income to maintain living standards.

Practical Advice: How to Make the Most of Your Social Security COLA Hike

1. Review Your Medicare Plan

Each fall (Oct 15 – Dec 7), compare Medicare Advantage and Part D plans. Choosing wisely can save hundreds of dollars.

2. Adjust Your Budget

Plan for only a portion of COLA to stick around after premiums. Build a cushion for rising housing, energy, and medical costs.

3. Explore Additional Income Streams

Consider part-time work, freelancing, or monetizing a hobby. Even $200/month can offset what COLA doesn’t cover.

4. Watch for Tax Changes

If your COLA increase pushes you into a taxable bracket, adjust withholdings or plan ahead with a tax professional.

5. Stay Informed

Bookmark SSA.gov/cola for official updates each October. Reliable media like AARP, Kiplinger, and MarketWatch also provide Medicare premium updates.

Action Checklist

- Mark October 2025 for the official COLA announcement.

- Compare Medicare plans during open enrollment.

- Rework your budget to reflect smaller net increases.

- Talk to a tax pro about possible new liabilities.

- Consider ways to generate supplemental income.

$4,983 Direct Deposit Expected in October 2025 – Check Eligibility and Full Payment Schedule

Social Security Just Changed at 69 – Here’s How It Could Drastically Impact Your Retirement

$1,000 PFD Stimulus Coming for Everyone in Oct 2025 – Who will get it? Check Eligibility