Philippines Raises Retirement Age: Retirement is one of those milestones that we all know is coming, but few of us really plan for in detail. And now, things are shifting again. The Philippines raises retirement age in 2025, sparking conversations not just in Manila, but across the globe. If you’re over 65 years old (or inching closer), you might be asking: What does this mean for me, my career, and my retirement benefits? Let’s break it down in plain English — friendly, practical, and with the facts straight. Whether you’re a professional eyeing financial security or just someone curious about how the system works, this guide will walk you through the changes, the “why” behind them, and how you can navigate retirement in today’s evolving world.

Philippines Raises Retirement Age

The bottom line is this: The Philippines raises retirement age in 2025 as part of a broader effort to strengthen pensions and adjust to longer lifespans. If you’re over 65, this might mean working a little longer, but it also comes with bigger pension checks thanks to reforms. By planning ahead — financially, physically, and professionally — you can turn this change into an opportunity instead of a setback. Retirement isn’t disappearing; it’s just getting a new look.

| Point | Details |

|---|---|

| Policy Update | Philippines raises retirement age starting 2025. |

| Current Rule | Mandatory retirement at 65 years old (government workers); optional retirement at 60. |

| Proposed Shift | Pushes retirement age beyond 65 (exact years may vary by sector). |

| Impact | Delayed pension access, longer working years, workforce participation among older adults. |

| Pension Reform | Social Security System (SSS) rolling out 10% pension increases (2025–2027). |

| Who’s Affected | Current and future retirees, especially professionals over 60. |

| Official Source | GSIS / SSS |

A Quick History: Retirement in the Philippines

Before diving into the 2025 shift, let’s rewind. Retirement age in the Philippines has long been 65 for government employees under the Government Service Insurance System (GSIS). In the private sector, companies often allowed optional retirement at 60, provided workers met service requirements.

But here’s the catch: life expectancy decades ago was much shorter. According to the World Bank, the Philippine life expectancy was just 62 years in 1980. Today, it’s about 71 years, with many Filipinos living into their 80s.

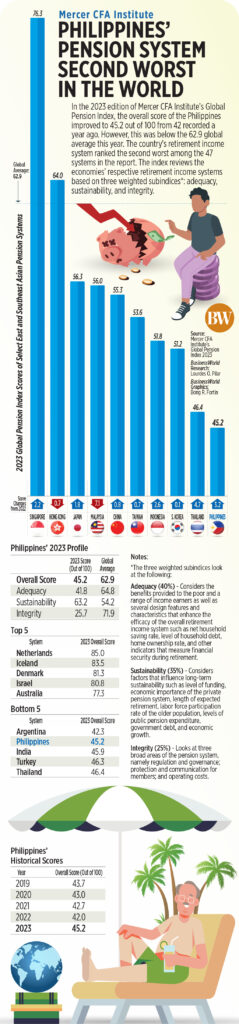

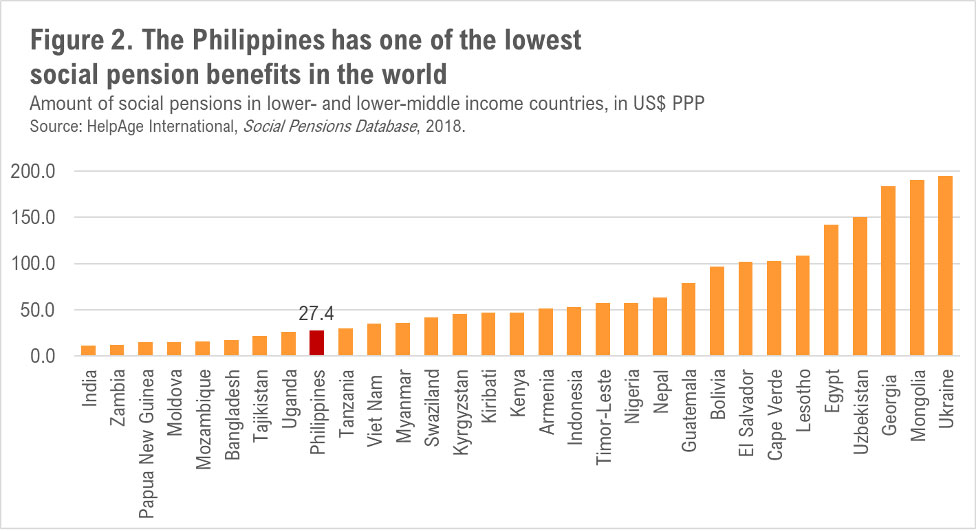

That gap — people living longer and drawing pensions for more years — is the core reason behind this reform. Without adjustments, funds like SSS could be strained as payouts extend over longer retirements.

Why the Philippines Raises Retirement Age?

There are three main drivers behind the change:

1. Longevity

People live longer, healthier lives. Retiring later helps balance individual savings with longer lifespans.

2. Pension Sustainability

According to SSS reports, payouts to retirees already account for over 70% of total benefit disbursements annually. As the number of retirees grows (projected to double by 2040), reforms are critical to avoid insolvency.

3. Workforce Needs

Industries face shortages in skilled labor. Healthcare, education, and IT sectors particularly benefit from experienced professionals staying longer in the workforce.

Countries like the U.S. (retirement at 67), Germany (67), and Japan (gradually to 70) are already ahead. The Philippines is simply catching up to the global trend.

What It Means If You’re Over 65?

So, what’s the bottom line if you’re already in your mid-60s?

- Delayed Pension Access: You may need to wait a bit longer for full benefits.

- More Work Years: Great for those still strong and wanting to earn more, but a challenge for those with health issues.

- Early Retirement Options: Some may still retire at 60–65, but benefits might be lower.

Case Study Example

- Juan, a public-school teacher, turns 65 in 2026. Under the new rule, he might need to work until 67 to qualify for full GSIS benefits. That gives him two more years of salary and contributions, boosting his pension.

- Maria, a nurse in the private sector, plans to retire at 62. She can do so, but her SSS benefits will be smaller than if she waited until the new age. If she waits, her monthly pension could be 15–20% higher.

These examples highlight the trade-offs: earlier retirement equals quicker rest, later retirement equals higher payouts.

The 2025 Pension Reform: Sweetening the Deal

The retirement age hike pairs with SSS reforms:

- 10% pension increases for retirement/disability pensions every September (2025–2027).

- 5% increases for survivor/death pensions during the same period.

- No higher contributions required from workers or employers.

This means that while you might wait longer, your eventual pension payout is higher.

Voices From the Ground

- Workers: Many professionals in their 60s are open to working longer, especially with rising costs of living and medical expenses.

- Employers: Companies value experienced staff but worry about productivity in physically demanding jobs like construction and agriculture.

- Economists: Say it’s a “necessary move” for fiscal sustainability, though warn about age discrimination and the need for workplace adjustments.

Step-by-Step Action Plan for Workers As Philippines Raises Retirement Age

Here’s your retirement prep checklist:

1. Audit Your Finances

- Request your latest SSS or GSIS statement.

- List down assets, debts, and savings.

- Use online calculators to project pension income.

2. Build Extra Income Streams

- Side hustles: freelancing, consulting, or online teaching.

- Investments: mutual funds, government bonds, or stocks.

- Rental property or small businesses as additional safety nets.

3. Prioritize Health

- Longer work = stronger body needed.

- Commit to checkups, exercise, and diet.

- Health is wealth, especially when extending careers.

4. Upskill

- Take online certifications in your field.

- Learn digital tools — many jobs now require at least basic tech skills.

- Explore leadership or mentoring roles.

5. Talk to HR

- Ask about company-specific retirement policies.

- Understand severance, retirement packages, and insurance coverage.

- Clarify re-employment rules if you want to work part-time post-retirement.

Economic Impact on the Philippines

The reform isn’t just about individuals — it has macro-level effects:

- Government savings: Extending retirement age reduces strain on pension funds by shortening the payout period.

- Workforce productivity: Experienced workers remain in industries, boosting skills transfer and mentorship.

- Consumer spending: Longer working years keep seniors earning and spending, driving economic activity.

However, challenges exist. A 2022 Philippine Statistics Authority (PSA) survey showed that over 40% of senior citizens already rely heavily on family for financial support. Extending retirement age could help reduce dependency — but only if seniors are employable.

Global Comparison

- U.S. – Retirement age: 67

- Japan – Phasing toward 70.

- Germany – 67.

- Philippines (2025) – Beyond 65, aligning with international peers but still behind the most developed nations.

Potential Challenges & Criticisms

- Older workers in manual labor may find it tough to extend work years.

- Age discrimination could rise if companies favor younger hires.

- Policy confusion – Without clear communication, retirees may panic or misplan.

- Regional disparities – Urban professionals might benefit more than rural workers who often perform physically demanding jobs.

Future Outlook

Expect further adjustments in the next 5–10 years:

- Retirement age could inch closer to 68–70.

- More digital tools for pension planning will emerge.

- Private retirement savings (through IRAs, voluntary savings, or insurance) will likely become a bigger part of the system.

- Government programs may focus on retraining older workers to stay employable.