New Tax Offset Payment: that headline is lighting up news feeds and dinner table conversations across the country. With inflation hitting Aussie households hard and essentials like food, rent, and fuel taking up more of the paycheck, the federal government has announced a Cost of Living Tax Offset. This is being pitched as a way to give relief to workers and families without permanently reshaping the tax system. But here’s the real question: how much money are you actually going to save, and does it make a meaningful dent in your bills? Let’s unpack the details in plain, conversational terms, but with enough depth to satisfy the pros who want to understand the full implications.

New Tax Offset Payment

The New Tax Offset Payment for 2025–26 is a short-term lifeline for low and middle-income earners. Worth up to $1,200, it won’t solve the cost-of-living crisis, but it provides breathing room for households struggling with rising costs. Smart households will use it to pay down debt, cover essentials, or build savings — not just for splurges. It’s temporary, it’s targeted, and it’s a reminder that while policy can help, long-term financial security often comes down to personal planning.

| Aspect | Details |

|---|---|

| Policy | Cost of Living Tax Offset (2025–26, one-off) |

| Who Qualifies | Aussie taxpayers earning up to AUD 144,000 |

| Relief Amount | Max AUD 1,200 for incomes between $48,001 – $104,000 |

| Smaller Benefit | Up to AUD 265 for incomes ≤ $37,000 |

| Phase-Out Range | Benefit tapers from $104,001 → $144,000 |

| Automatic | Applied when lodging 2025–26 tax return |

| Beneficiaries | Around 10 million taxpayers |

| Official Source | Parliamentary Budget Office |

What is the Cost of Living Tax Offset?

Think of the Cost of Living Tax Offset as a coupon for your taxes. It’s a one-time credit applied directly to your tax bill for the 2025–26 financial year. Unlike a wage increase or permanent tax cut, it doesn’t change your income or your tax bracket. Instead, when you lodge your tax return, the ATO applies the offset automatically, lowering your payable tax or boosting your refund.

This setup has advantages and drawbacks:

- Pro: It’s simple — no application, no extra paperwork.

- Pro: It directly targets taxpayers, meaning it avoids administrative complexity.

- Con: You won’t feel the benefit until tax time, unlike direct cash payments that arrive mid-year.

It’s important to stress that this is temporary. It’s a one-off designed to ease pressures in a specific year, not a long-term structural fix to the cost-of-living crisis.

How Much Do You Get?

The offset works on a sliding scale, rewarding those in the low-to-middle income brackets the most.

- Up to $37,000 taxable income → Up to $265 offset

- $37,001 – $48,000 → $265 plus 8.5 cents for every dollar over $37,000

- $48,001 – $104,000 → Maximum benefit of $1,200

- $104,001 – $144,000 → Tapers off by 3 cents for every dollar over $104,000

Real-Life Examples

- Childcare worker earning $52,000 → Full $1,200 offset

- Tradie making $110,000 → Roughly $1,020 offset

- Part-time uni student working $20,000 → Offset capped at $265

- IT consultant earning $150,000 → No offset

This tiered design ensures relief is concentrated on the middle-income group, often described as “the squeezed middle” — households earning enough to be ineligible for welfare but struggling with high living costs.

Why New Tax Offset Payment Matters in 2025?

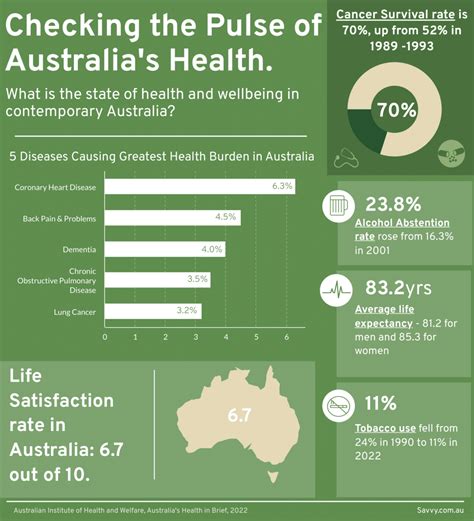

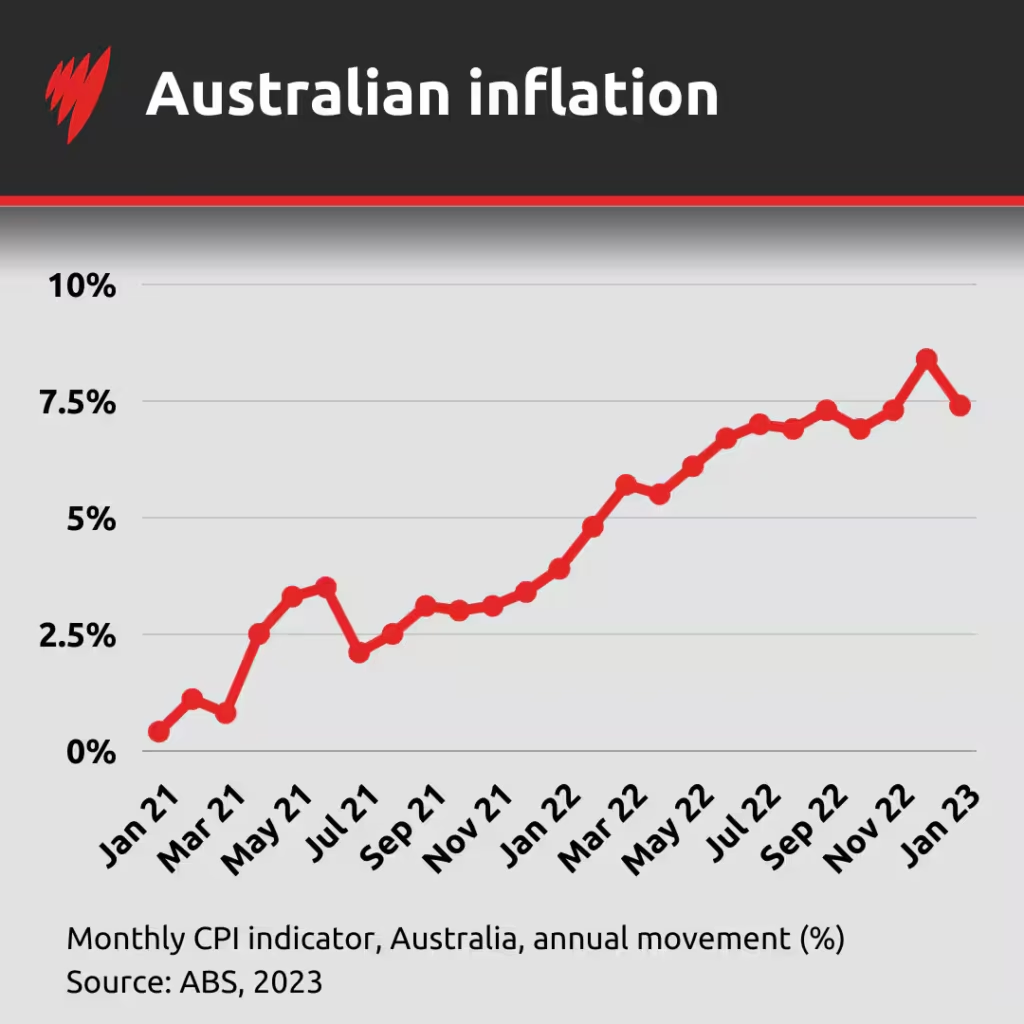

The timing isn’t random. Inflation has been running hotter than a summer in Arizona. The Australian Bureau of Statistics (ABS) recorded a 3.8% CPI rise in 2024, with everyday essentials leading the surge.

Here’s what that means in practice:

- Groceries: Up around 7% in two years — milk, bread, and veggies cost more.

- Housing: Rents in Sydney and Melbourne have jumped double-digits in many suburbs.

- Utilities: Despite rebates, electricity bills remain stubbornly high.

- Transport: Fuel costs are rising again, hitting regional Australians especially hard.

For families living paycheck to paycheck, $1,200 could cover three to four months of groceries or offset multiple utility bills. While it won’t erase inflation, it can reduce immediate pressure on household budgets.

Historical Context: Tax Offsets in Australia

The Cost of Living Offset isn’t the first of its kind.

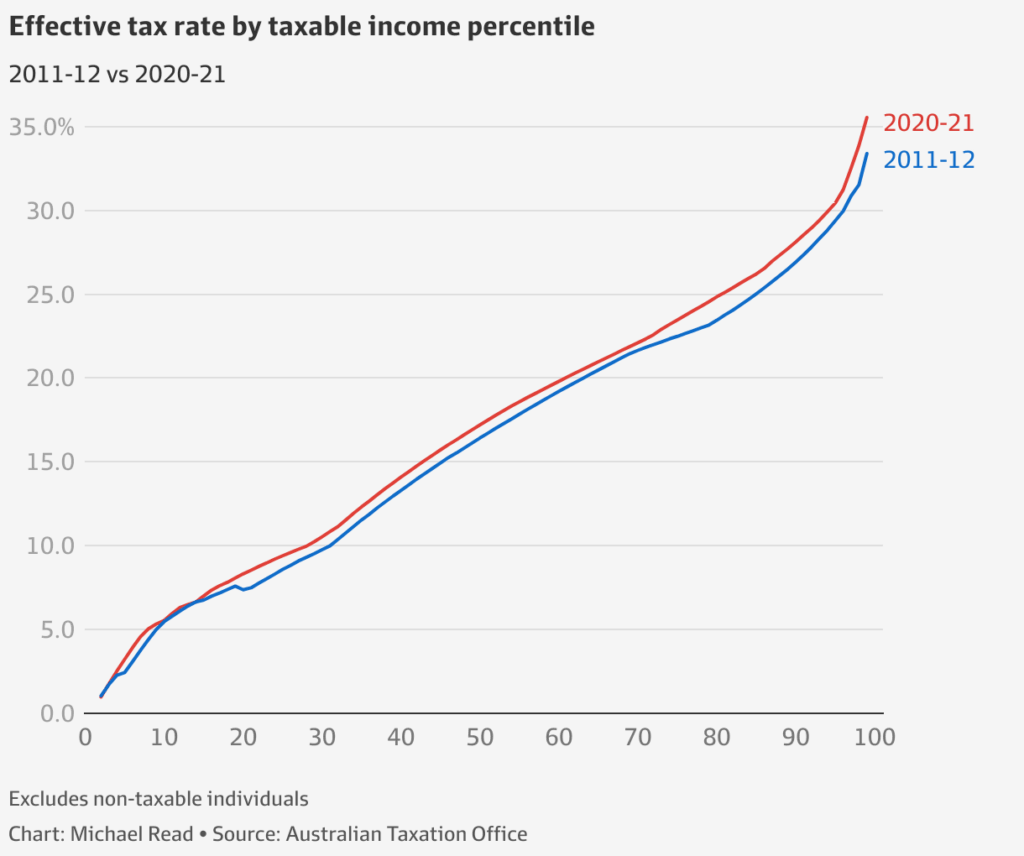

- Low and Middle Income Tax Offset (LMITO): Introduced in 2018, it peaked at $1,500 and was claimed by more than 10 million taxpayers annually before ending in 2022.

- Low Income Tax Offset (LITO): Still in play, though scaled down, providing up to $700 for the lowest earners.

These measures show a pattern: governments frequently use tax offsets as quick, targeted tools. They’re politically popular because they put cash back in voters’ pockets without rewriting the entire tax code.

Expert Opinions: Support and Criticism

Not everyone is cheering.

- Supporters: Economists in favor argue that middle-income earners have carried the brunt of tax revenues for years and deserve a break. They see this offset as a fair and efficient way to deliver short-term relief.

- Critics: Groups like ACOSS argue the policy misses the most vulnerable — people who don’t pay enough income tax to benefit. They call for direct cash transfers or increased welfare payments instead.

- Budget Hawks: Some analysts warn that one-off payments can be inflationary. With $12 billion (estimated) flowing back into households, demand could stay strong, potentially making the Reserve Bank’s job harder in reducing inflation.

This tug-of-war between short-term relief and long-term structural reform sits at the heart of the debate.

How to Maximize the New Tax Offset Payment?

Getting the offset is automatic, but you can take steps to ensure you land in the sweet spot:

1. Understand Your Tax Bracket

If your income hovers around $48,000 or $104,000, consider salary packaging or superannuation contributions to stay in the optimal band.

2. Keep Records

Work uniforms, job tools, mileage, and home office expenses all qualify as deductions. More deductions + offset = bigger refund.

3. File on Time

Lodging late delays your refund. File on time, or hire a registered tax agent.

4. Spend It Smartly

Don’t blow it on gadgets. Instead:

- Pay off high-interest debt

- Build an emergency fund

- Cover annual expenses like rego or insurance

- Invest in upskilling or training

Think of it not just as a windfall, but as a tool for long-term financial health.

Case Studies: Who Really Benefits?

- Single Parent in Melbourne (income: $60,000): Offset covers three months of after-school care, easing childcare pressure.

- Couple in Brisbane (combined income: $120,000): Each earns under $104k, so together they receive $2,400. That could pay for six months of groceries.

- Retiree with casual income ($25,000): A smaller $265 offset, but enough to cover rising pharmacy costs.

- Young grad in Sydney ($85,000): Full $1,200, which could help offset rising rents in inner-city apartments.

Broader Economic Impact

The offset will benefit around 10 million Australians and cost the federal budget billions. Treasury argues the measure is temporary and targeted, but critics question whether the money could be better spent on permanent tax reform.

There’s also the inflation question. By boosting disposable income, households may spend more, which could delay the Reserve Bank’s timeline for bringing inflation back to its 2–3% target. The government counters that because the offset is once-off, the impact on demand will be short-lived.

Global Comparisons

Looking overseas gives perspective.

- United States: Americans received stimulus checks during COVID and benefit from refundable credits like the Earned Income Tax Credit (EITC). These provide immediate cash, not delayed refunds.

- Canada: Provides GST/HST rebates directly into bank accounts, targeting low-income households.

- Australia: Prefers tax offsets, which are easy to administer but less immediate.

This reflects a philosophical difference: direct cash payments vs. tax-based relief.

Australia Minimum Wage Hike September 2025 – Check Worker Eligibility Criteria and Payment Details

Australia Pension Boost Starting 1st October 2025 – Check New Rates and Payment Dates

Centrelink $750 October Bonus 2025: Check Eligibility Criteria and Payment Dates