Social Security Just Changed at 69: If you’ve been following retirement news lately, you’ve likely heard: Social Security just changed at 69. Or more accurately, the U.S. is considering moving the Full Retirement Age (FRA)—the age when you can get your full benefit—from 67 to 69. That may not sound like much at first glance—just two extra years. But for millions of Americans, this could mean smaller monthly checks, longer working lives, and bigger savings needs. Whether you’re 25, 45, or closing in on 60, this proposed change will likely shape how you plan for the future.

Social Security Just Changed at 69

The talk of Social Security just changing at 69 is more than political noise—it’s a direct signal to every American worker that the rules of retirement are shifting. While raising FRA may help extend Social Security’s solvency, it also means younger workers will bear the cost with smaller checks and longer working years. The takeaway? Don’t depend on Social Security alone. Use it as one leg of the stool—alongside personal savings and other income streams. Start planning now, and you’ll stay ahead of whatever changes Washington throws your way.

| Topic | Details |

|---|---|

| Proposed Change | Raise Full Retirement Age (FRA) from 67 to 69 |

| Impact on Benefits | Could reduce lifetime Social Security payouts by 12–14% |

| Current Early Claiming Age | 62 (with reduced benefits) |

| Maximum Benefit Age | 70 (with delayed retirement credits) |

| Why the Change? | To extend Social Security’s solvency, which faces a shortfall by 2033 |

| Who’s Affected Most | Younger workers (born after 1975), lower-income earners, and people in physically demanding jobs |

| Official Resources | Social Security Administration |

Social Security 101: Why FRA Matters

Social Security is often misunderstood. It’s not a personal savings account; you don’t have a pot of money waiting with your name on it. Instead, today’s workers pay payroll taxes (6.2% each from you and your employer), and that money funds benefits for today’s retirees.

Your Full Retirement Age (FRA) is critical because it sets your baseline:

- Claim before FRA → permanent reduction.

- Claim at FRA → full benefit.

- Claim after FRA (up to 70) → permanent increase (about 8% per year).

If FRA rises from 67 to 69, the penalty for retiring early gets steeper. Someone claiming at 62 under FRA 67 gets about 70% of their benefit. Under FRA 69, that same person would only get about 65%. That’s a lifetime cut.

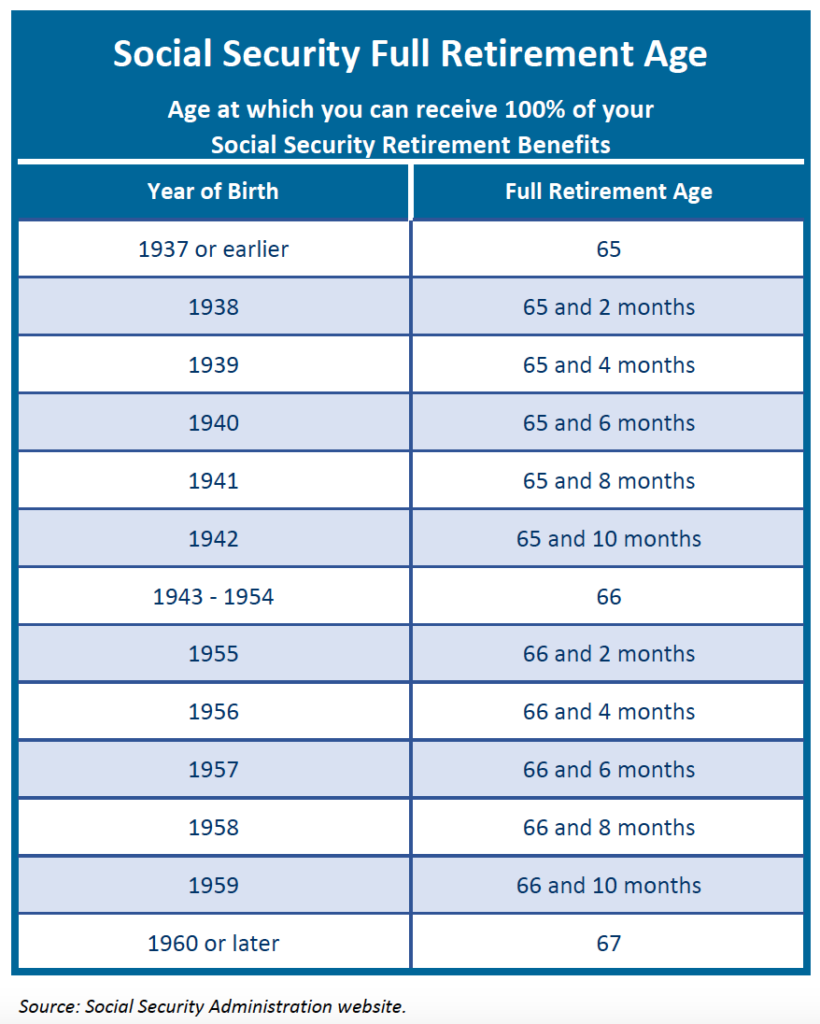

A Look Back: FRA Then and Now

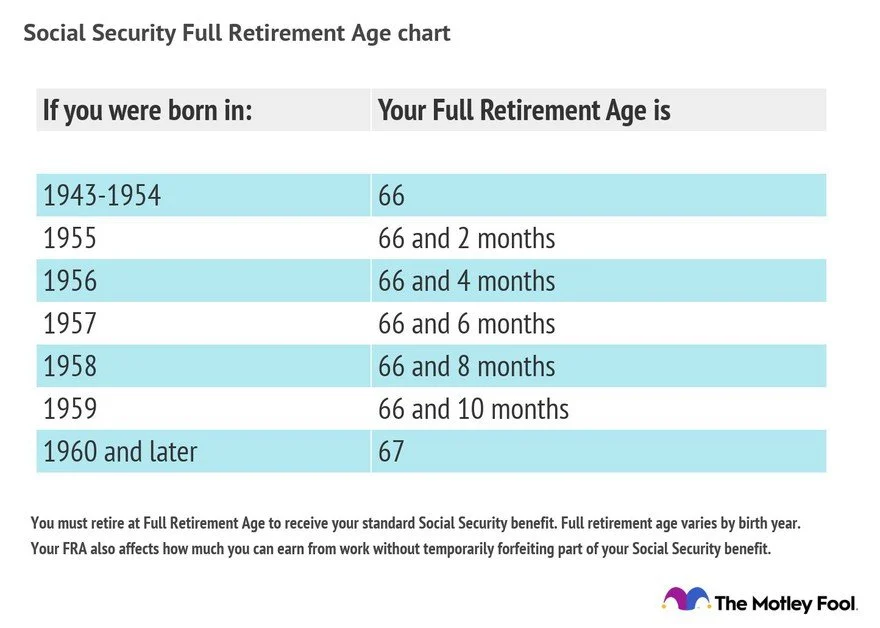

When Social Security launched in 1935, the FRA was 65. At that time, U.S. life expectancy was around 61 years. In other words, most people wouldn’t even live long enough to claim.

Fast-forward: by the 1980s, Americans were living longer, healthier lives. In 1983, Congress raised the FRA to 67, phased in slowly over two decades.

Today, the average American lives to about 77 years. Many live well into their 80s. But here’s the catch: those extra years aren’t evenly distributed. Higher-income, white-collar workers often outlive lower-income, blue-collar workers by 5–10 years. That makes raising FRA feel unfair to groups already facing shorter lifespans.

How Social Security Just Changed at 69?

Here’s the math in practice:

Suppose your FRA benefit (at 67) is $2,000/month.

- Retire at 65 (FRA = 67): about $1,733/month.

- Retire at 65 (FRA = 69): about $1,550/month.

That’s $183/month less. Over 20 years, you’d lose nearly $44,000—and that’s before adjusting for inflation or COLA increases.

For middle-class retirees who depend on Social Security for 40–50% of their income, that loss is significant. For lower-income retirees who rely on it for 80–90%, it’s devastating.

Generational Impact: Who Feels It Most

Different age groups will feel this change very differently:

- Baby Boomers (1946–1964): Mostly insulated. Many are already retired or close.

- Gen X (1965–1980): The “in-between” group. Younger Gen Xers may face a phased-in FRA hike.

- Millennials (1981–1996): Squarely in the crosshairs. FRA 69 would almost certainly apply.

- Gen Z (1997–2012): No doubt—they’ll retire under the new FRA unless reforms change again.

For younger workers, this could mean rethinking everything from savings rates to how long they stay in the workforce.

Life Expectancy and Fairness

The fairness question looms large. According to Brookings, men in the top 10% of income live about 13 years longer than men in the bottom 10%. Women show similar gaps.

That means raising FRA disproportionately hurts lower-income workers. A corporate lawyer who lives to 90 may get decades of full benefits. A factory worker who dies at 74 may get very few—or none at all.

Misconceptions About Social Security Age Changes

Let’s tackle some myths:

- “Social Security will disappear.” False. Even if the trust fund runs dry in 2033, payroll taxes will keep funding about 75% of benefits.

- “If FRA rises, I’ll lose all benefits.” Nope. You’ll still collect, just at reduced levels if you claim early.

- “I can just wait until 62 and get the same deal.” Wrong. FRA sets the baseline. Early retirement becomes even costlier if FRA rises.

Real-Life Stories

Maria the Nurse: At 63, her knees can’t take hospital shifts anymore. With FRA at 69, retiring early cuts her checks significantly. She’ll likely depend more on her children or dip into savings faster.

David the Millennial: At 35, he’s juggling student loans and rent. If FRA is 69, he’ll need to save an extra $250/month for 30 years to cover the gap—something hard to pull off in today’s economy.

James the Executive: At 58, he’s in good health and has multiple retirement accounts. FRA at 69 won’t faze him much—he can afford to wait. This highlights the inequality baked into the change.

Policy Alternatives: Other Fixes on the Table

Lawmakers have other options besides hiking FRA:

- Raise or eliminate the payroll tax cap – Currently, income above $168,600 isn’t taxed for Social Security. Lifting the cap would bring in billions.

- Means testing – Cutting or reducing benefits for wealthy retirees.

- Small payroll tax increases – Even a 0.1% hike per year could close much of the gap.

- Adjust COLA formula – Switching to a less generous inflation measure.

Each has trade-offs, but most experts agree a mix of reforms is the only way to keep the system solvent without overburdening one group.

What Retirement Could Look Like in 2050?

If FRA rises to 69 and nothing else changes, expect:

- More Americans working into their 70s—out of necessity, not choice.

- Delayed retirements affecting job opportunities for younger workers.

- Greater reliance on personal savings, 401(k)s, and IRAs.

- Wealthier retirees enjoying long, comfortable retirements—while lower-income workers face shortened or nonexistent ones.

What You Can Do Right Now About Social Security Just Changed at 69?

You can’t control Washington, but you can control how you prepare.

1. Know Your Benefits

Log into SSA.gov and review your benefit estimates. Check different claiming ages—62, 67, 69, 70.

2. Save More Aggressively

Even small amounts compound. Example: $100/month at 7% return grows to $121,000 in 30 years.

3. Diversify Income Streams

Don’t rely solely on Social Security. Consider side hustles, rental property, or dividend stocks.

4. Plan for Bridge Jobs

Think part-time consulting, tutoring, or gig work in your 60s. It keeps income flowing without the grind.

5. Invest in Your Health

Healthy people not only work longer but also collect benefits longer. Preventive care is retirement planning.