$4,983 Direct Deposit Expected: When you hear talk about a $4,983 direct deposit expected in October 2025, it probably sounds too good to be true. And you’re right to ask questions! Social Security benefits, Supplemental Security Income (SSI), and federal retirement payments can feel like a maze, with rules and schedules that make your head spin. But don’t worry—I’ll break it all down in plain, friendly language. By the end of this article, you’ll know who’s eligible, how much you might get, and when to expect that money in your bank account. We’ll dig into official data from the Social Security Administration (SSA), sprinkle in some real-life examples, and keep things light but professional. Think of it like chatting with a neighbor over coffee—except this neighbor has a decade of financial know-how and loves explaining money in a way anyone (even a 10-year-old) can follow.

$4,983 Direct Deposit Expected

The $4,983 direct deposit in October 2025 makes flashy headlines, but for most Americans, the reality is smaller monthly checks based on work history and claiming age. Still, with smart planning—like delaying retirement, correcting your earnings record, budgeting carefully, and staying alert for scams—you can maximize your Social Security benefits. Think of Social Security as a foundation, not the whole house. Combine it with savings, pensions, or part-time work, and you’ll have a sturdier financial future.

| Topic | Details |

|---|---|

| Payment Mentioned | $4,983 direct deposit (maximum Social Security retirement benefit in 2025) |

| Eligibility | High-income earners with 35+ years of max contributions, claiming benefits at age 70 |

| Payment Dates (Oct 2025) | SSI: Oct 1 & Oct 31 (advance Nov payment); Social Security: Oct 8, 15, 22, 29 depending on birthday |

| Delivery Method | Direct deposit or Direct Express® card (no paper checks after Sept 2025) |

| Authority Source | Social Security Administration |

| Average Benefit | $1,907 per month in 2025 (retired workers, SSA data) |

| Who Won’t Get $4,983 | Most Americans—only those with top lifetime earnings and delayed retirement credits |

Why Are People Talking About $4,983 Direct Deposit Expected?

Here’s the scoop: $4,983 is the projected maximum monthly Social Security retirement benefit for 2025. That number comes from SSA benefit tables, which adjust each year for cost-of-living increases (COLA). But here’s the kicker—very few people actually qualify for that much.

Think of it like the NFL draft. Sure, you could say, “The number one pick gets the biggest paycheck,” but only a handful of players ever land that spot. Most folks fall closer to the average benefit—about $1,907 per month in 2025, according to the SSA.

So why all the buzz? Because headlines love big numbers. But for most of us, the realistic question isn’t “Am I getting $4,983?” It’s “When will I get paid, and how much?”

The History of Social Security’s Maximum Benefit

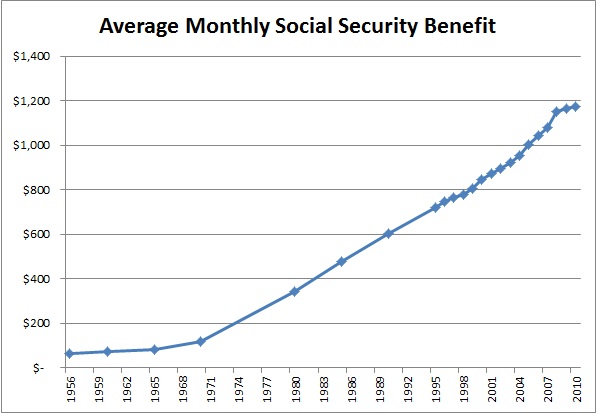

The maximum benefit has been climbing steadily for decades. For perspective:

- In 2000, the max benefit was about $1,500/month.

- In 2010, it was around $2,300/month.

- By 2020, it hit $3,790/month.

- In 2025, it’s set to reach $4,983/month (if you delay until age 70).

This growth is thanks to both rising taxable wage caps and COLA adjustments that account for inflation.

Cost-of-Living Adjustment (COLA) and Why It Matters

Each year, the SSA adjusts benefits for inflation. For 2025, experts project around a 2.5%–3% COLA increase. That may not sound like much, but for someone getting $2,000/month, that’s an extra $50–60.

Over time, COLA plays a huge role. For example, if you started with $1,500/month in 2000, COLA adjustments would’ve raised your check by several hundred dollars by 2025.

Breaking Down the October 2025 Payment Schedule

If you’re on Social Security or SSI, here’s what October 2025 looks like:

Social Security (Retirement, Disability, Survivor Benefits)

Payments are scheduled on Wednesdays, based on your birthday:

- Oct 8, 2025 → If your birthday is between the 1st and 10th

- Oct 15, 2025 → If your birthday is between the 11th and 20th

- Oct 22, 2025 → If your birthday is between the 21st and 31st

- Oct 29, 2025 → Special cases like long-term beneficiaries or combined payments

Supplemental Security Income (SSI)

Here’s where October gets interesting:

- Oct 1, 2025 → Regular SSI payment

- Oct 31, 2025 → Advance payment for November, since Nov 1 falls on a Saturday

That means SSI recipients get two checks (or deposits) in October. Pretty sweet, but remember—it doesn’t mean “extra money.” It’s just timing.

How $4,983 Direct Deposit Works (and Why It’s Mandatory)?

Starting September 30, 2025, the SSA says paper checks are history. Everyone must use:

- Direct deposit to a bank or credit union, or

- Direct Express® Debit Mastercard®, a prepaid card offered by the U.S. Treasury

This change isn’t about being fancy—it’s about security and efficiency. Paper checks can get lost, stolen, or delayed. Direct deposits hit your account instantly and are safer.

Tip: Log into your my Social Security account to double-check your banking info. Nothing worse than a missing payment because of an old account number!

Who Really Gets the $4,983 Direct Deposit Expected?

Let’s be real. Only a tiny slice of retirees qualify for the max benefit. To hit that magic $4,983 number in 2025, you need:

- 35 years of earnings at or above the taxable maximum (the “cap” on Social Security taxes each year—$168,600 in 2024 and rising annually).

- Delayed claiming until age 70, which adds delayed retirement credits (about 8% extra per year past full retirement age).

If you worked part-time, took career breaks, or claimed early at 62, you’ll see much less. That’s not a bad thing—it just means your benefit reflects your contributions.

Example 1: Jane worked 35 years making average wages, then retired at 67. Her benefit in 2025? Around $2,300/month, still a solid supplement to her savings.

Example 2: Mike earned high wages every year and delayed until 70. He qualifies for the max $4,983.

Example 3: Sarah claimed at 62. Her check is about $1,400/month—less, but she started earlier.

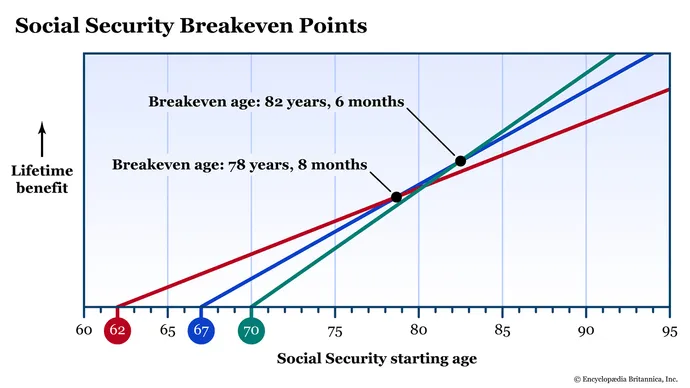

Should You Claim Early or Delay?

This is one of the biggest financial decisions you’ll ever make. Here’s a rule of thumb:

- Claim early (62–64) if: You need income now, you have health issues, or you don’t expect to live into your 80s.

- Claim at FRA (66–67) if: You want steady income and don’t want a permanent reduction.

- Delay until 70 if: You want to maximize benefits, you’re in good health, and you expect to live a long life.

Don’t Forget Taxes

Here’s the catch many folks miss: Social Security benefits can be taxable.

- If you file single and earn more than $25,000/year, up to 50% of your benefits may be taxed.

- If you earn more than $34,000/year, up to 85% of benefits may be taxable.

And depending on your state, you might owe state taxes too. States like Colorado, Minnesota, and Utah tax benefits, while others like Florida and Texas don’t.

Social Security Trust Fund Outlook

According to the 2024 Trustees Report, the Social Security trust funds are projected to be depleted by 2035 if no changes are made. At that point, the program could still pay about 83% of benefits from incoming payroll taxes.

This doesn’t mean Social Security will vanish—it means Congress will need to act (through tax increases, benefit adjustments, or both) to keep the system fully funded.

Practical Advice to Maximize Your Social Security

Even if you’ll never touch $4,983, you can still make the most of your benefits:

1. Check Your Earnings Record Regularly

Errors happen! If your employer failed to report wages, your benefits could shrink.

2. Understand Claiming Age Impact

- Claim at 62 → Permanent reduction (about 25–30% less)

- Claim at FRA (66–67) → Standard benefit

- Wait until 70 → Get the max boost

3. Balance Benefits with Health & Lifestyle

Waiting until 70 may increase your check, but if you have health issues or need money sooner, claiming earlier could make sense.

4. Factor in Spousal & Survivor Benefits

If you’re married, widowed, or divorced, you might qualify for extra benefits based on your spouse’s record.

5. Budgeting Tips

Stretch your benefits by:

- Downsizing or relocating to a lower-cost area

- Combining Social Security with retirement savings withdrawals

- Avoiding debt and high-interest loans

- Considering part-time work for supplemental income

Watch Out for Scams

Sadly, scammers love targeting Social Security recipients. Common red flags:

- Calls claiming your SSN is “suspended”

- Fake offers of extra benefits for a fee

- Phishing emails asking for your bank info

The SSA never asks for payment via gift cards or wire transfers.