Cost of Living Payout 2025: The Cost of Living Payout 2025 has been making waves, with claims that every Singaporean will receive between S$200 and S$400. But here’s the catch—it’s not as straightforward as some headlines suggest. This article will break it all down in clear, friendly language, while also giving professionals and everyday readers the context, data, and practical advice they need.

With inflation still on everyone’s mind, many households are wondering how much relief they can expect in 2025. Is this payout a repeat of last year’s Budget 2024 COL support, or something entirely new? More importantly, who really qualifies and what difference will it make to everyday living? By the end, you’ll know if you’re getting the money, how much you could receive, and what other government measures are lined up to support Singaporeans this year.

Cost of Living Payout 2025

The Cost of Living Payout 2025 headlines can be misleading. The real S$200–$400 payout happened in 2024 under the Assurance Package. In 2025, support continues through CDC vouchers, U-Save rebates, and bonuses for seniors—but there’s no repeat of the same COL payout. The bottom line? Use government payouts wisely, stay updated on new measures, and plan your finances beyond one-off bonuses.

| Topic | Details |

|---|---|

| Payout Amount | S$200–S$400 one-off COL Special Payment (Budget 2024) |

| Eligibility | Adult Singaporeans (21+), Income ≤ S$100,000 (YA 2023), not owning >1 property |

| Payout Date | September 2024 (rolled out as part of Assurance Package) |

| Beneficiaries | 2.4 million adult Singaporeans |

| Other Support in 2025 | S$600 CDC vouchers, U-Save rebates, Seniors’ Bonus (S$200–S$300) |

| Official Source | Ministry of Finance Singapore |

What Exactly Is the Cost of Living Payout 2025?

The Cost-of-Living (COL) Special Payment is part of Singapore’s Assurance Package—a multi-year support scheme designed to help Singaporeans manage inflation and the Goods & Services Tax (GST) hike.

In September 2024, more than 2.4 million adult Singaporeans received between S$200 and S$400, depending on their income level. This was a one-off measure, not a recurring payout for 2025. However, it laid the foundation for continued support in the form of vouchers, rebates, and bonuses in 2025.

Historical Context: COL Payouts in Previous Years

To really understand the 2025 situation, let’s rewind:

- 2022: The government introduced the Assurance Package to cushion the GST hike.

- 2023: Additional cash payouts and CDC vouchers were given to households.

- 2024: The COL Special Payment of S$200–S$400 was announced in Budget 2024.

By seeing this pattern, we can spot a trend: Singapore is not giving blanket, repeated cash payouts every year, but rather tailoring support depending on inflationary pressures and fiscal policies.

Why the Cost of Living Payout 2025 Was Needed?

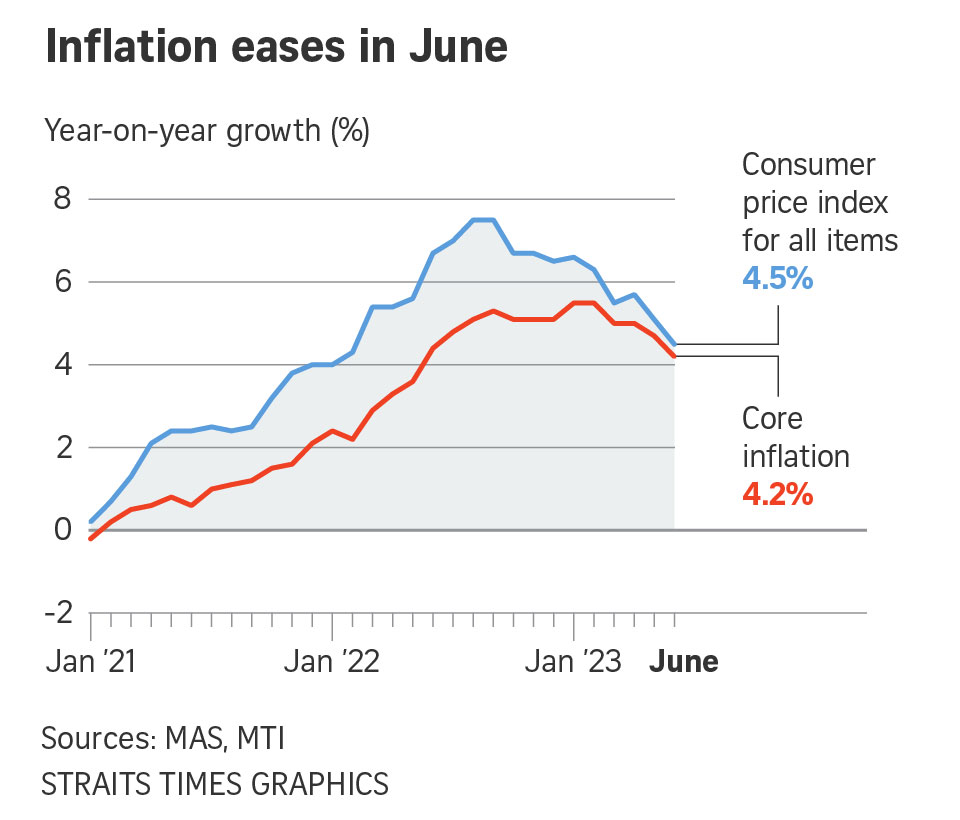

Inflation hit households hard between 2022 and 2024. According to SingStat, core inflation averaged 3.4% in 2023, and food inflation alone exceeded 5%. Think about it: your bowl of bak chor mee or nasi lemak got pricier, electricity bills soared, and transport fares nudged up.

The government stepped in with targeted financial aid to ensure that lower- and middle-income Singaporeans weren’t left behind. By design, those who earned less got more.

How Much You Can Get (Eligibility Breakdown)

| Assessable Income (YA 2023) | Payout Amount |

|---|---|

| Up to S$22,000 | S$400 |

| > S$22,000 – S$34,000 | S$300 |

| > S$34,000 – S$100,000 | S$200 |

Key Rules:

- You must be a Singapore citizen aged 21 or above.

- Your income must not exceed S$100,000 (for YA 2023).

- You must not own more than one property.

This system makes sure wealthier households don’t benefit disproportionately.

How to Claim Cost of Living Payout 2025: Step-by-Step Guide

- Check Eligibility: Log in to the GovBenefits Portal.

- Update PayNow: Link your NRIC to your bank via PayNow for instant crediting.

- Wait for Notification: You’ll get an SMS or email when the payout is credited.

- Check Your Bank Account: The payout appears as “GOVT Payment.”

- If No PayNow: You’ll receive via GovCash or a cheque.

How It Was Disbursed?

- September 2024: Money was credited automatically.

- PayNow-NRIC: Fastest method, covering majority of Singaporeans.

- GovCash: Alternative for those without PayNow.

What About 2025?

Here’s where confusion sets in. The S$200–S$400 COL Special Payment was for 2024, not 2025.

But don’t worry—2025 isn’t without support. Here’s what’s still in place:

- CDC Vouchers: Every household gets S$600 (usable for groceries, hawker centers, and participating retailers).

- U-Save Rebates: Offsets utilities for HDB households.

- Seniors’ Bonus: About 850,000 seniors received S$200–S$300 in February 2025.

- GST Vouchers: Cash payouts and MediSave top-ups continue for eligible citizens.

Impact on Families and Everyday Living

For many Singaporean families, the COL payout was more than just pocket change—it was a lifeline. A family of four living in an HDB flat might spend close to S$1,200 monthly on groceries, transport, and utilities. A payout of S$300–$400 could cover a month’s worth of electricity bills or offset rising school expenses for children.

Hawker centers and neighborhood supermarkets also saw indirect benefits, as families used payouts and CDC vouchers for everyday meals and essentials. While the payout didn’t completely erase inflation’s impact, it reduced financial anxiety for millions of households, especially those living paycheck to paycheck.

Expert Commentary & Impact

Economists from Channel NewsAsia noted that the COL payout was a short-term relief measure. While helpful, it doesn’t solve long-term cost pressures.

For lower-income families, the payout covered a month’s groceries or utilities. For middle-income earners, it was a nice bonus but not life-changing. For small businesses, CDC vouchers indirectly boosted spending at heartland shops.

Comparison with Other Countries

- United States: Americans received stimulus checks during COVID-19 (up to US$1,400 per person).

- United Kingdom: UK households got energy bill rebates to offset high gas and electricity costs.

- Singapore: Instead of blanket payouts, the focus is on targeted help for citizens most in need.

This approach reflects Singapore’s fiscal conservatism—spend wisely, give fairly, and avoid inflationary risks.

Financial Planning Tips After Receiving the Payout

A common mistake many people make is treating government payouts as “bonus money.” Instead, approach it as a financial buffer. Here are smart ways to use it:

- Pay Down Debts: Knock out high-interest credit card bills first.

- Cover Essentials: Use it to offset utilities, school fees, or groceries.

- Save or Invest: Even S$200 in your CPF or savings account compounds over time.

- Emergency Fund: Top up your rainy-day fund to cushion against medical or job-related shocks.

By being intentional with the payout, families can stretch its impact beyond just a few weeks of expenses.

Future Outlook

Will there be another COL payout in 2025 or beyond? That depends on:

- Global inflation trends (oil prices, supply chain issues).

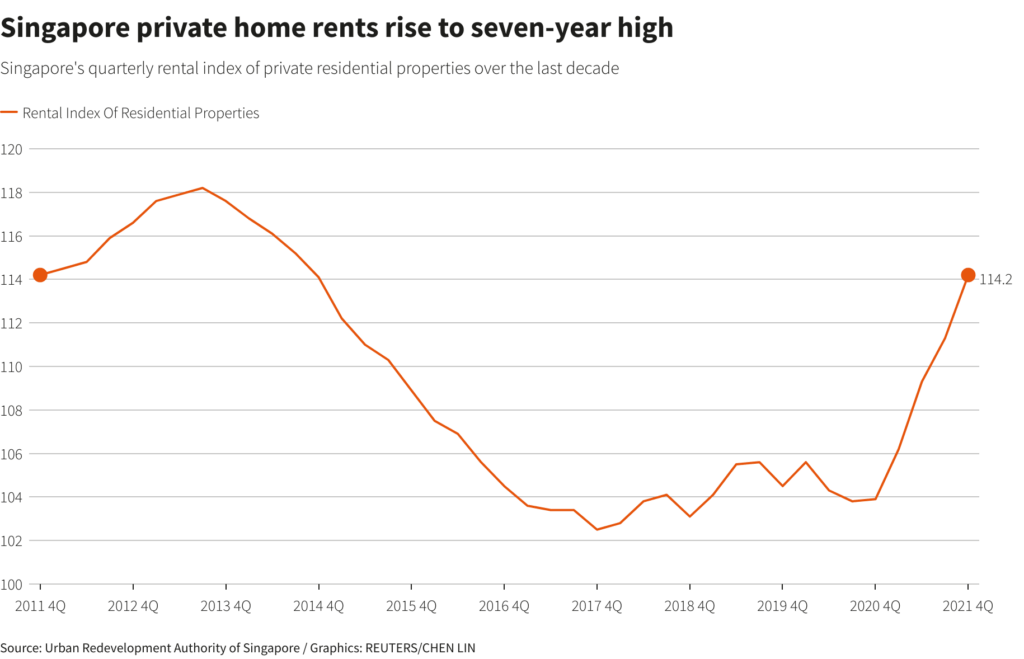

- Local cost pressures (food, housing, transport).

- Budget considerations (balancing support with sustainability).

If inflation spikes again, a COL-style payout could return. For now, Singaporeans should expect vouchers and rebates rather than large one-off cash transfers.

Practical Advice

- Don’t bank on payouts: Treat them as bonuses, not permanent income.

- Budget smartly: Use payouts for essentials—utilities, groceries, school fees.

- Plan long-term: Top up CPF, invest in savings plans, or pay down debt.

- Stay informed: Bookmark MOF’s newsroom for updates.

Real-Life Examples

- Mr. Tan, a taxi driver, earned S$28,000 in YA 2023. He got S$300, which paid for utilities and schoolbooks.

- Ms. Lee, an accountant making S$90,000, received S$200. It covered a week’s groceries—useful, but modest.