$943 + $1,415 Social Security Benefit: If you’ve been hearing chatter about the $943 + $1,415 Social Security Benefit in October 2025, you might be scratching your head: Is Uncle Sam sending out bonus checks? Can I get both amounts? How do I claim mine? Let’s cut through the noise. This isn’t hype—it’s about average Social Security retirement benefits ($1,415) and Supplemental Security Income (SSI) payments ($943) as of October 2025. Millions of Americans depend on these checks every month. This guide will break it all down—who qualifies, how to apply, what’s new in 2025, and strategies to maximize your payments.

$943 + $1,415 Social Security Benefit

The $943 + $1,415 Social Security Benefit in October 2025 isn’t a bonus check—it’s the average SSI and retirement amounts Americans will rely on. With rising living costs, these benefits are essential. By checking eligibility, applying early, avoiding common mistakes, and planning smartly, you can maximize what you’re owed. Whether you’re preparing to retire, helping a loved one, or just planning ahead, understanding Social Security is the first step to financial peace of mind.

| Topic | Details |

|---|---|

| Benefit Amount | $943 (average SSI) + $1,415 (average Social Security retirement) in October 2025 |

| Who Qualifies | SSI = low income, elderly, or disabled; Retirement = workers with 40+ credits |

| Payment Schedule | Paid monthly, but in arrears (October → paid in November) |

| How to Apply | Online, phone, or in-person at SSA office |

| Official Site | Social Security Administration |

| 2025 Updates | End of paper checks, COLA adjustments, stronger ID verification |

Understanding the $943 + $1,415 Social Security Benefit

Here’s the breakdown:

- $943/month → Average Supplemental Security Income (SSI) benefit in 2025. This is for Americans with limited income/resources who are aged 65+, blind, or disabled. Unlike retirement benefits, SSI doesn’t depend on work history but rather on financial need.

- $1,415/month → Average Social Security retirement benefit in 2025, based on lifetime earnings and the age at which you start claiming.

Some people confuse SSI with Social Security retirement. The two programs are separate: one is need-based (SSI), the other is earned through payroll taxes.

Important Note: Most people won’t collect both full amounts. If you qualify for Social Security retirement, your SSI may be reduced. But in rare cases, you can receive a combination of both, especially if your retirement benefit is small.

According to the SSA, over 67 million Americans get Social Security monthly, and more than 7.5 million receive SSI. That’s nearly 1 in 5 Americans depending on these programs.

Why 2025 Matters: New Updates & COLA

COLA (Cost-of-Living Adjustment)

Every year, benefits rise with inflation. In 2023, COLA was a record 8.7%. For 2025, the increase is smaller, reflecting lower inflation but still providing relief from rising costs. For someone receiving $1,415, even a 3% COLA adds about $42 a month.

End of Paper Checks

Starting in 2025, no more paper checks. All benefits are paid electronically—via direct deposit or the Direct Express debit card. This prevents lost checks and speeds up payments.

Stronger ID Verification

To combat fraud, SSA rolled out stricter identity-proofing rules in 2025. Some people applying online must verify in person with documents like a driver’s license or passport.

Social Security Fairness Act

The repeal of WEP (Windfall Elimination Provision) and GPO (Government Pension Offset) in 2025 is a game changer. Retirees with government pensions—teachers, police officers, and others—will no longer see their Social Security checks reduced because of their pensions.

A Quick History of Benefits

- 1935: FDR signed Social Security into law during the Great Depression.

- 1956: Disability Insurance added, covering workers unable to work due to illness or injury.

- 1965: Medicare introduced alongside Social Security, providing healthcare for seniors.

- 1972: SSI created to help those who never worked enough to qualify for retirement benefits.

- 1975: COLA adjustments tied to inflation began.

- 2025: Benefits average $943 for SSI, $1,415 for retirement, with 100% electronic payments.

This journey shows how Social Security evolved from a basic retirement check into a multi-program safety net.

Step-by-Step: How to Claim $943 + $1,415 Social Security Benefit

Step 1: Check Eligibility

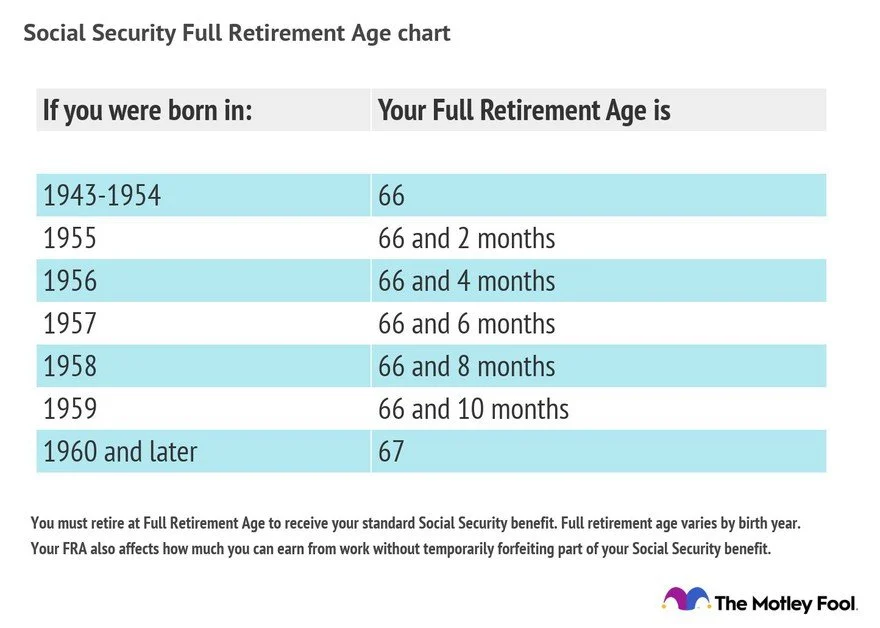

- Retirement: At least 62 years old + 40 work credits (usually 10 years of work).

- Disability: Must have a qualifying medical condition.

- Spousal/Survivor: Spouses, widows, and children may qualify based on a worker’s record.

- SSI: Must meet income and asset limits (less than $2,000 for individuals, $3,000 for couples).

Step 2: Gather Required Documents

Bring everything SSA needs:

- Birth certificate or passport

- Social Security card

- Proof of citizenship or immigration status

- Tax records (W-2 or 1099s)

- Bank account info for direct deposit

- Marriage/divorce/death certificates if applying for spousal or survivor benefits

Step 3: Apply

Three main options:

- Online: Apply at SSA.gov – easiest and fastest.

- By Phone: 1-800-772-1213.

- In Person: At your local Social Security office (appointments recommended).

Step 4: Choose Start Month

You can apply up to four months in advance. Remember, checks come a month late—October benefits are paid in November.

Step 5: Wait for Decision

SSA reviews your file and sends a letter with the decision. If approved, payments begin on your scheduled date.

Payment Schedule 2025

- SSI: Always the 1st of the month (shifted if it’s a weekend/holiday).

- Social Security Retirement/Disability: Based on your birth date:

- Born 1st–10th → Paid 2nd Wednesday

- Born 11th–20th → Paid 3rd Wednesday

- Born 21st–31st → Paid 4th Wednesday

This staggered system prevents everyone from being paid on the same day.

Real-Life Example

- John (66): Worked 35 years and retires in 2025. He receives $1,415/month.

- Mary (62): Has no work credits and applies for SSI. She qualifies for $943/month.

- Combined household benefit = $2,358/month.

For John and Mary, this income covers essentials: $1,200 for rent, $400 for groceries, $200 for Medicare premiums, and still leaves some breathing room.

Common Mistakes to Avoid

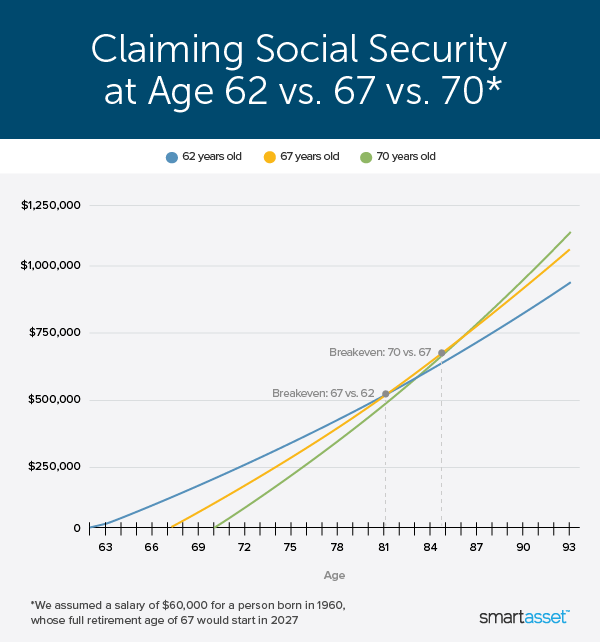

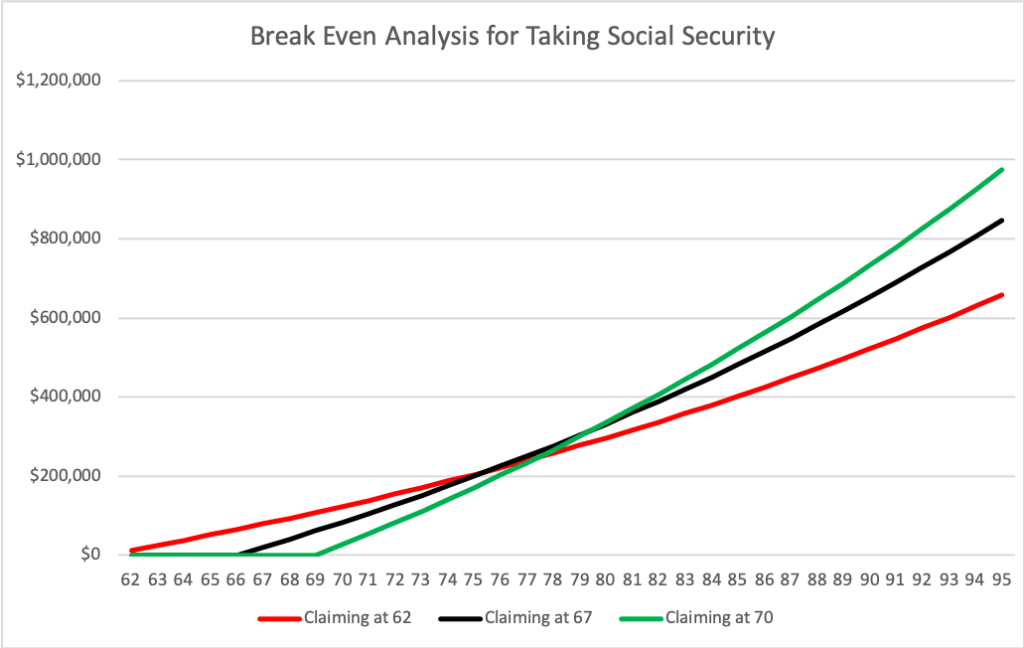

- Claiming too early: Taking retirement at 62 cuts your check by up to 30%.

- Ignoring spousal benefits: A spouse could be entitled to 50% of your benefit.

- Not reporting changes: Failing to report new income can trigger overpayments.

- Assuming you can’t work: You can work while receiving benefits, but earnings limits apply.

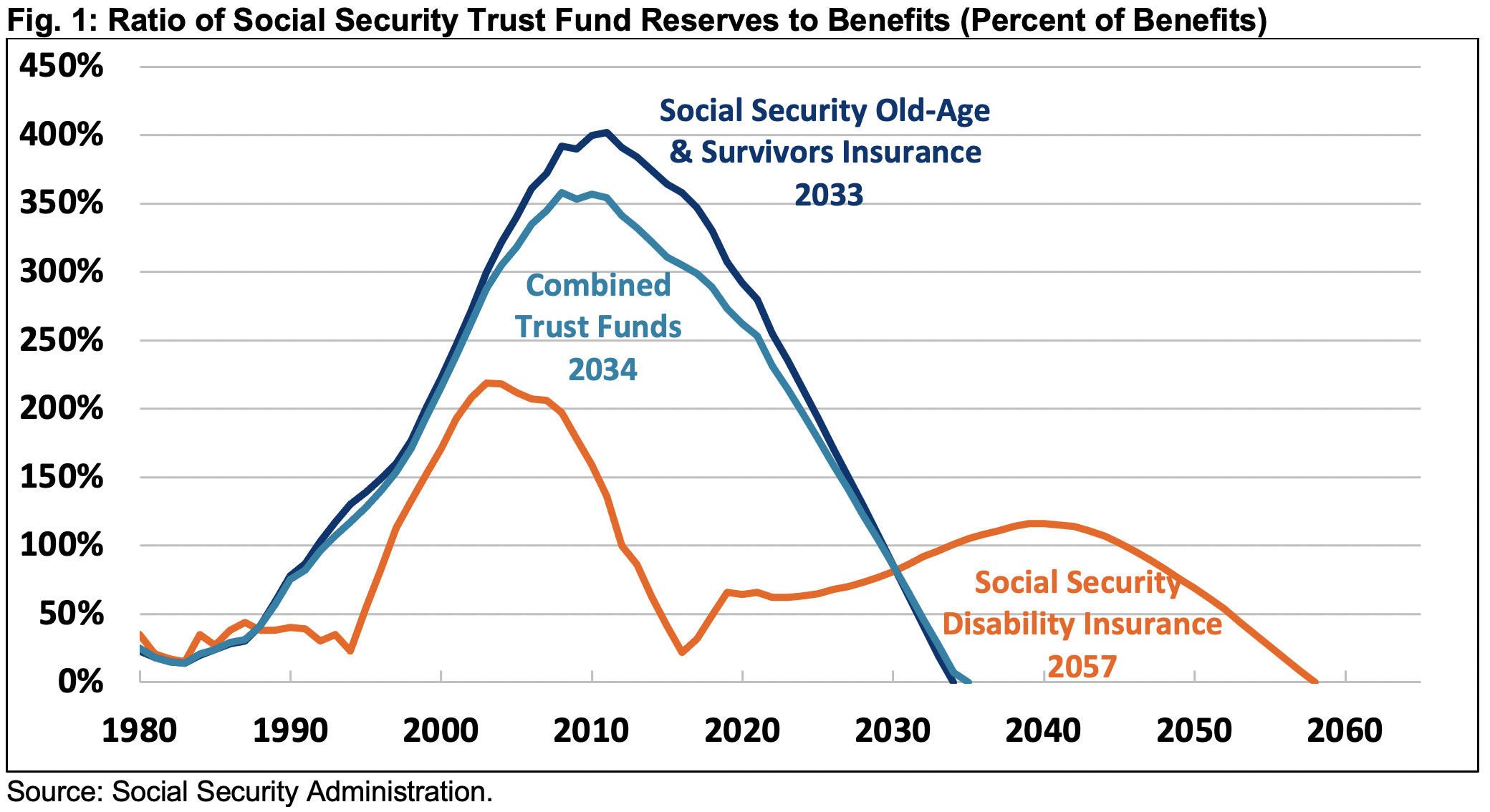

- Believing myths: Social Security isn’t going bankrupt—it may pay less after 2035 unless Congress acts, but it won’t disappear.

October Social Security Payments: Why You Might Get Two SSI Checks This Month

Say Goodbye to Paper Checks: Social Security Payments Transition to Digital Next Week

Senate Democrats Demand Answers as Social Security Chief Sparks Retirement Age Confusion

Expert Insights: Planning Like a Pro

As a retirement planner, I often remind clients: timing is everything. Claiming early might make sense if you need income immediately or have health issues, but waiting boosts lifetime benefits.

- Each year you delay after FRA (up to 70) increases benefits by about 8%.

- Spousal strategy: One spouse may claim early while the other delays to maximize household income.

- Taxes: Up to 85% of benefits can be taxable, depending on your total income.

For health care, remember that Medicare premiums often come straight out of Social Security checks. Planning around this deduction is crucial.