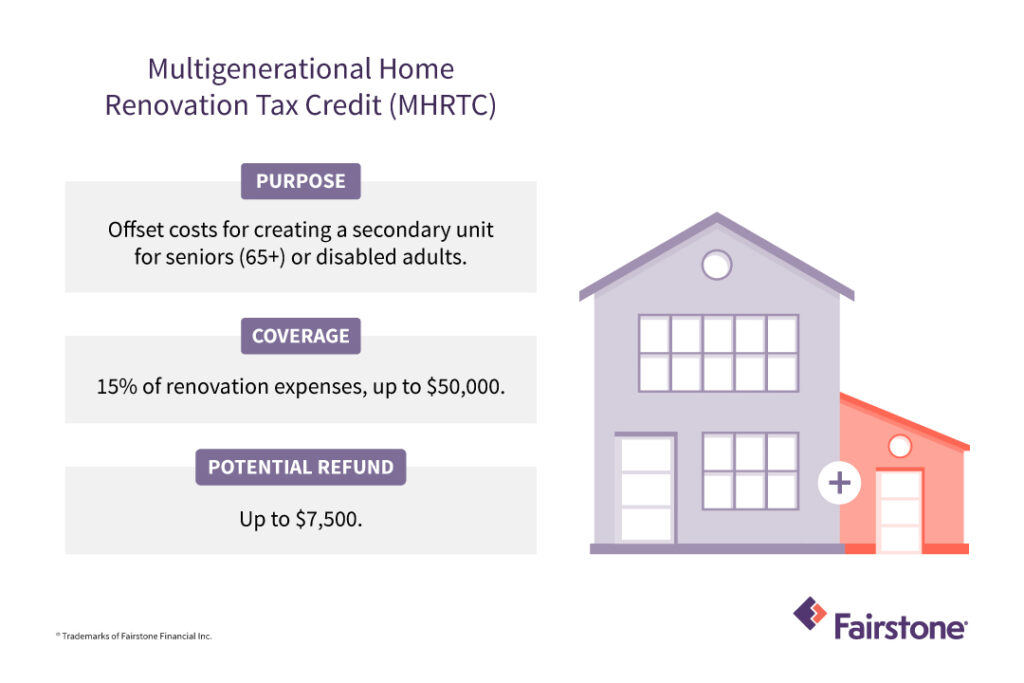

$7500 Canada Tax Credit: If you’ve been hearing buzz about the $7,500 Canada Tax Credit coming through in 2025, you’re right on time to get the lowdown. This tax credit, officially called the Multigenerational Home Renovation Tax Credit (MHRTC), is designed to help families across Canada create extra living spaces to support seniors and adults with disabilities at home. And hey, it’s a refundable credit, which means you can get money back even if you don’t owe taxes—nice, right? Let’s break it down in a straightforward way, so whether you’re a first-time home renovator, a seasoned tax pro, or just a curious soul who wants to help family, you’ve got all the facts to navigate this credit like a pro.

Table of Contents

$7500 Canada Tax Credit

| Detail | Info |

|---|---|

| Tax Credit Name | Multigenerational Home Renovation Tax Credit (MHRTC) |

| Maximum Credit Amount | $7,500 (15% of up to $50,000 in qualifying renovations) |

| Eligible Renovations | Creating self-contained secondary units for seniors or adults eligible for Disability Tax Credit |

| Eligible Claimants | Seniors age 65+ and adults eligible for the Disability Tax Credit (DTC) |

| Claim Deadline | Claim on 2025 tax returns for renovations completed in the 2025 tax year |

| Payment Schedule | Refunds processed following regular CRA tax return schedule |

| Official Source | Canada Revenue Agency MHRTC |

What Is The $7500 Canada Tax Credit?

Simply put, the $7,500 Canada Tax Credit is a federal initiative designed to assist families in making their homes more suitable for aging parents or adults with disabilities by creating self-contained, accessible secondary living units. This refundable tax credit reimburses you 15% of eligible renovation expenses, up to $50,000, meaning you can get back as much as $7,500 on your taxes for qualified improvements.

This credit is more than just a financial boost. It’s an encouragement from the Canadian government to support multigenerational living—bringing together family under one roof in a way that provides dignity, care, and enhanced independence for seniors and people with disabilities. The credit is aimed at reducing the need for costly institutional care by allowing people to age in place within family homes.

Financially, the credit can significantly offset renovation costs, easing the burden for families who want to improve accessibility, privacy, and comfort in their homes. This federal tax credit is also refundable, meaning even if you owe little or no tax, you’ll still get a cash refund, making it accessible and helpful to a wide range of Canadians.

Who Qualifies for the MHRTC?

To qualify for this credit, the key requirements focus on both the person being supported and the nature of the renovation:

- Qualifying Person: The renovation must create a secondary unit for either a senior aged 65 or older or an adult eligible for the Disability Tax Credit (DTC). DTC eligibility requires certification by a medical practitioner that the person has a severe and prolonged impairment.

- Relationship: The secondary unit must be within a home owned or occupied by the qualifying person or a close relative, including spouses, parents, children, siblings, aunts, uncles, nieces, nephews, or cousins.

- Dwelling Requirements: The home must be in Canada and the renovation must create a self-contained secondary unit with a bedroom, kitchen, bathroom, and private entrance.

- Residency: The qualifying person must live in, or intend to live in, the renovated secondary unit as their principal residence within 12 months after the renovation is completed.

This ensures that the credit directly supports families providing care and accommodation for loved ones needing accessible living arrangements.

What Renovations Qualify?

Eligible renovations must create or modify a separate living unit within the existing home with all necessities for independent living. Here’s what qualifying renovations generally include:

- Construction: Adding or upgrading separate bedrooms, kitchens, bathrooms, entrances, and living areas that meet local building codes for secondary suites.

- Accessibility Features: Installing ramps, grab bars, wider doorways, or other modifications required for disability access.

- Professional Services: Fees paid to contractors, architects, electricians, plumbers, or other professionals directly related to the renovation project.

- Materials and Supplies: Construction materials such as drywall, lumber, plumbing and electrical supplies, flooring, insulation, and paint used specifically for the secondary unit.

What doesn’t qualify includes routine maintenance, repairs unrelated to the secondary unit construction, purchase of furniture or appliances, landscaping, and renovations to parts of the home not connected to the secondary dwelling.

To avoid surprises, always check with the CRA guidelines and confirm that your renovation plans meet the primary aim of creating a functional, self-contained living unit.

How to Claim Your $7500 Canada Tax Credit Step-by-Step?

Navigating tax credits can feel daunting, but here’s a user-friendly guide to help you claim the MHRTC smoothly:

- Plan Your Renovations with Eligibility in Mind: Consult with qualified contractors and ensure your renovation meets the criteria for a self-contained unit designed for seniors or disabled adults.

- Keep Detailed Records: Save all invoices, receipts, contracts, building permits, and any certifications related to the renovation. Proper documentation is crucial for your claim and any future CRA audits.

- Complete Renovations in the 2025 Tax Year: Only projects finished within the 2025 calendar year will be eligible for claiming that year’s tax return.

- File Schedule 12 on Your Tax Return: When filing your 2025 income tax return, include Schedule 12 form to calculate your eligible costs and claim your credit on line 45355. Fill in all required fields carefully and attach supporting documentation if requested.

- Submit Your Return and Expect Refund: Following usual CRA timelines, expect your tax refund based on your eligible renovations. Since the credit is refundable, you get the benefit even if you owe no taxes.

- Retain Records for Six Years: Keep all paperwork safe for at least six years in case the CRA requires verification or conducts an audit of your claim.

Why This Matters: Real-Life Examples

Case 1: The Martinez Family

Maria Martinez needed a separate living space for her 70-year-old mother in Toronto. They renovated their basement adding a fully equipped kitchen, bathroom, bedroom, and private entrance at a cost of $45,000. By applying for the MHRTC, they got back $6,750—a significant boost toward renovation expenses.

Case 2: John’s Accessibility Upgrade

John wanted to modify his home for his adult brother, who uses a wheelchair and qualifies for the Disability Tax Credit. They installed ramps, widened doors, and remodeled the bathroom for full accessibility. Total renovation expenses of $30,000 earned them $4,500 back through MHRTC, easing the financial load.

How This Tax Credit Benefits the Canadian Economy and Housing Market?

The MHRTC isn’t just a win for families—it has positive ripple effects across the Canadian economy:

- Job Creation: Boost in demand for contractors, electricians, plumbers, and suppliers fuels local employment and growth in the construction sector.

- Sustainable Housing Solutions: Encourages utilization and upgrading of existing housing stock, promoting efficient use of space rather than expansion on undeveloped land.

- Social Benefits: Supports aging in place and enhances independent living for disabled Canadians, reducing strain on healthcare and long-term care facilities.

- Property Value: Creating legal, accessible secondary units can increase home value and provide opportunities for rental income, strengthening intergenerational wealth.

According to federal forecasts, the program is estimated to contribute tens of millions in economic activity over the next five years, dovetailing with Canada’s growing trend of multigenerational households seeking affordable and safe living spaces.

Additional Tips for Homeowners Considering Renovations

- Engage Early with Professionals: Architects or renovators familiar with building codes for secondary units can help you design compliant spaces that maximize MHRTC eligibility.

- Multiple Claimants: Family members funding a portion of the renovation may each be eligible to claim up to $50,000 in qualified expenses, multiplying total household benefits.

- Check for Complementary Incentives: Some provinces or municipalities offer additional grants or rebates for energy-efficient or accessibility-related renovations.

- Plan Renovation Timing: Aim to complete renovations well before the tax filing deadline to avoid delays in claiming.

- Stay Informed on CRA Updates: Tax rules can change; verifying the latest CRA information and consulting tax professionals ensures you capture all eligible savings.

Canada Carbon Tax Rebate Coming in 2026? Check Eligibility, Payment Amount & Date

$648.91 Canada Child Benefit Tax in November 2025 – Check If You Qualify, Payment Date

Extra Tax Refund In Canada For 2025 – Will you get this refund? Check amount & Date