$750 + $890 Double CPP Payment: If you’ve been hearing buzz about a $750 + $890 double Canada Pension Plan (CPP) payment dropping in November 2025, it’s time to set the record straight. Let’s break down what’s really going on with the Canada Pension Plan this fall, cut through the noise, and get you the facts you need—without the confusion. Whether you’re a retiree relying on CPP or a pro looking to stay informed with the latest in Canadian social benefits, this guide’s got your back. For starters, there is no official double CPP payment scheduled for November 2025. Despite rumors swirling online, the Government of Canada has confirmed that CPP benefits will be paid on the usual schedule, with no extra or bonus payouts of $750 and $890 combined. Let’s dive into the details of CPP payments, who’s eligible, when payments happen, and explain why the “double payment” story is mostly hype.

Table of Contents

$750 + $890 Double CPP Payment

The $750 + $890 double CPP payment rumor circulating for November 2025 is a myth. The Canada Pension Plan remains a dependable and structured retirement income source, with payments scheduled as usual on November 26, 2025. Understanding the CPP’s workings, eligibility, and how to maximize benefits through timing and contributions can help you secure a comfortable retirement.

| Topic | Details |

|---|---|

| CPP Payment for November 2025 | Scheduled for Wednesday, November 26, 2025 |

| Maximum Monthly CPP Payment 2025 | $1,433 (for individuals aged 65+ with maximum contributions) |

| CPP Eligibility | Workers aged 60-70 who have contributed to CPP through employment or self-employment |

| No Double Payment | No official bonus or additional $750 + $890 CPP payment in November 2025 |

| Other Benefits in November | Canada Child Benefit (Nov 20), Old Age Security, Disability Benefits align with payment dates |

What Is the Canada Pension Plan (CPP)?

The Canada Pension Plan is a federal government program designed to provide a steady income stream for Canadian workers and their families when they retire, become disabled, or in the event of death. Most working Canadians outside Quebec contribute automatically during their career. Think of it like a safety net: you and your employer chip in money all the while you’re working, and in exchange, you get payouts that help replace part of your income later.

The monthly payouts depend on how much you contributed, how long you contributed, and when you start receiving benefits. The maximum payment for 2025 is about $1,433 per month at age 65 for those with full contributions throughout their career.

CPP Enhancement: What You Need to Know

In recent years, the government introduced CPP Enhancement, aimed at increasing retirement benefits gradually through higher contributions from workers and employers. This boosted the potential retirement income for today’s workers starting in 2019, with full effect expected by 2025.

If you contributed more under the enhanced plan, your CPP payments could be higher than the old maximum depending on your earnings and contribution years. It’s important to check your CPP Statement of Contributions through the My Service Canada Account to see your exact situation.

Why the $750 + $890 Double CPP Payment Rumors?

Social media and some news sites have been hyping a “double CPP payment,” mentioning numbers like $750 and $890. Here’s the real deal:

- There is no double or bonus payment announced by the Canada Revenue Agency (CRA) or Service Canada.

- The confusion often stems from multiple government benefits being paid in the same month — for example, November sees payments for:

- Canada Pension Plan (CPP)

- Old Age Security (OAS)

- Canada Child Benefit (CCB)

- Canada Disability Benefit (CDB)

- Provincial benefits such as Ontario Trillium Benefit

Those living on multiple benefit streams may get more funds in their bank accounts in November, but it is not a “double CPP” payout. It’s just a mix of different payments landing within days or weeks of each other.

CPP Payment Date for November 2025

The official CPP payment date for November 2025 is Wednesday, November 26, 2025. On this day, monthly CPP payments will be deposited via direct deposit for most recipients, or sent by mail for others. The same date applies to related benefits including disability and survivor pensions.

Receiving the funds on the scheduled business day allows pensioners to plan their finances confidently without surprises.

Who Is Eligible for CPP?

Here’s what you need to qualify for the CPP Retirement Pension:

- You must be at least 60 years old.

- You must have made at least one valid contribution to the CPP. Contributions are typically made through employment or self-employment earnings in Canada.

- Even if you worked in Quebec, you may be eligible through coordination between CPP and Quebec Pension Plan (QPP).

- If you are working while receiving CPP, you may also qualify for the CPP Post-Retirement Benefit, which adds to your retirement income based on your ongoing contributions.

- CPP Retirement Pension eligibility is flexible: you can start collecting between ages 60 and 70, with earlier payments reduced and later payments increased.

- Survivors and disabled contributors have specific eligibility and benefits criteria under CPP rules.

For robust financial planning, it’s good to confirm your exact eligibility and contribution history on the My Service Canada Account portal.

How Much Can You Expect to Get?

- The maximum monthly CPP payment in 2025 is $1,433 at age 65 for full contributors.

- The average new retiree CPP payment is about $808 per month.

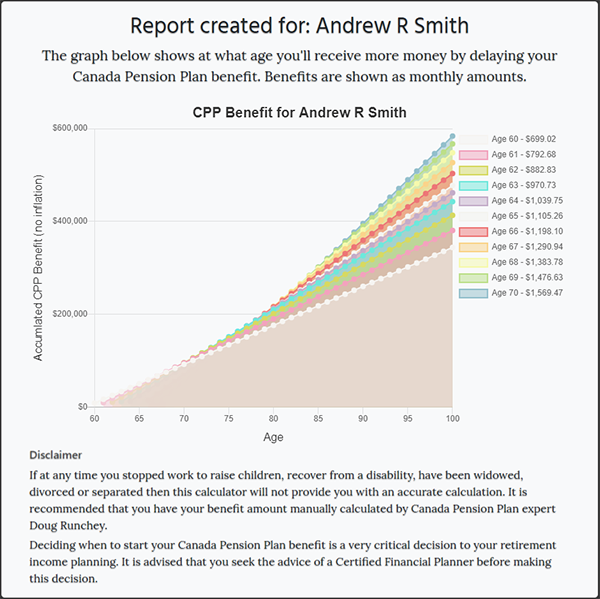

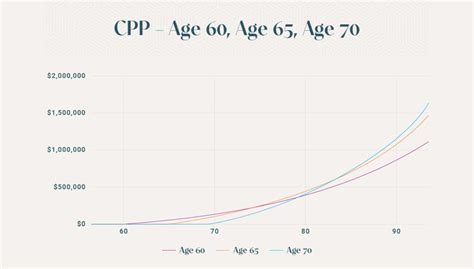

- If you start taking CPP benefits early (between ages 60 and 65), your monthly payments will be reduced by 0.6% for each month before age 65, totaling up to a 36% reduction at age 60.

- Delaying CPP payments until age 70 results in a 0.7% monthly increase above age 65, up to a 42% boost.

- Your CPP benefit is calculated based on how much and how long you contributed while working in Canada.

Combining CPP with Other Retirement Income

For many retirees, CPP alone is just one part of their retirement income.

Additional sources include:

- Old Age Security (OAS): A monthly benefit based on residence in Canada, payable typically from age 65.

- Registered Retirement Savings Plans (RRSPs): Personal savings that supplement government benefits.

- Employer Pension Plans: Workplace pensions that complement CPP.

- Guaranteed Income Supplement (GIS): Provides extra income support to low-income seniors.

Understanding how these income streams work together helps retirees budget and enjoy a secure retirement.

Impact of Inflation on CPP Payments

CPP benefits are adjusted annually based on the Consumer Price Index (CPI) to keep pace with inflation. For 2025, CPP payments increased by approximately 3.5% to help maintain retirees’ standard of living amid rising costs.

This inflation protection helps preserve your purchasing power over your retirement years.

Practical Tips to Maximize Your CPP Benefits

- Delay taking CPP if your health and finances allow; waiting until 70 significantly boosts monthly payments.

- Keep working and contributing to CPP as long as possible, especially if your earnings are high.

- Regularly review your CPP Statement of Contributions online to verify your expected benefits.

- Apply for CPP benefits online through My Service Canada Account to speed up processing.

- Plan your retirement with an understanding of how CPP fits with other incomes like OAS, RRSPs, and employer pensions.

Protect Yourself from Scams

Scams targeting CPP and retirement benefits increase around payment times. Remember:

- The Government of Canada will never ask for personal information by unsolicited calls, emails, or texts.

- Verify any CPP-related notifications only via official sources like Canada.ca or Service Canada.

- If contacted suspiciously claiming to be from CPP/CRA, hang up and report the incident.

Step-by-Step Guide to Understanding CPP Payments

- Verify Your Eligibility: Must be ≥ 60 years old and have at least one valid CPP contribution.

- Apply for Benefits: Apply online via My Service Canada Account or call Service Canada.

- Choose Payment Start Age: 60 to 70 years, with corresponding adjustments to monthly amounts.

- Monitor Payment Dates: CPP payments are made monthly, typically the third-to-last business day.

- Keep Information Updated: Bank details and address should be current.

- Watch for Official Announcements: Avoid misinformation from unofficial sources.

- Financial Planning: Factor CPP with other income streams for smooth retirement finances.

Canada Cost of Living Increase in November 2025 – Check How much? Payment Date

Canada $1700+$650 CRA Double Payment in November 2025: Check Payment Date & Eligibility Criteria

Canada CRA Payment Dates Coming in November 2025, Official Schedule for Various Federal Benefits