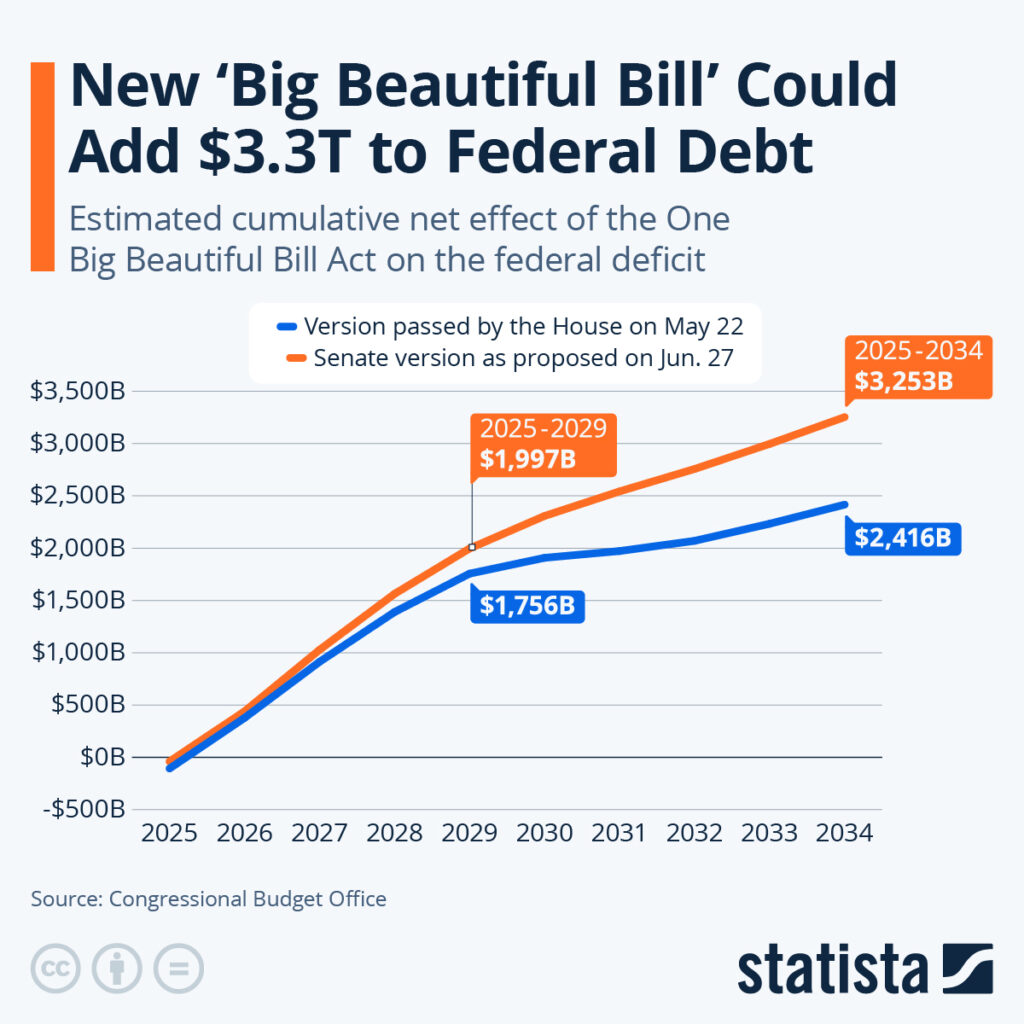

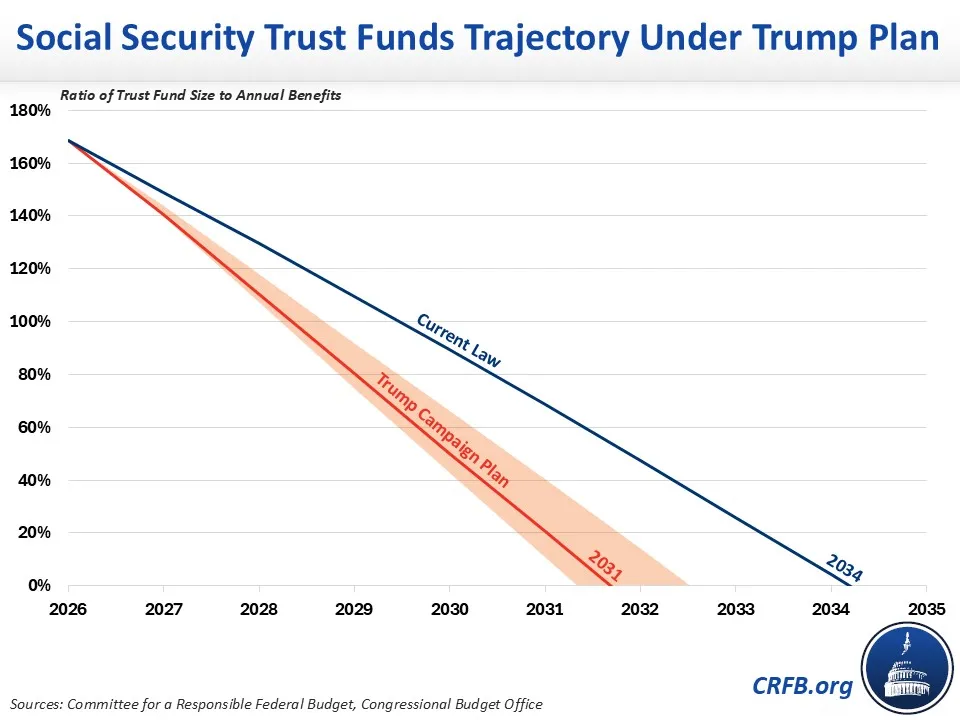

7 Years Until Social Security Cuts: Social Security is a lifeline for millions of Americans, especially seniors relying on it as their monthly paycheck after retirement. But there’s hard news on the horizon: benefits are projected to face steep cuts—about 24 percent—in just 7 years, around late 2032. For many retirees, this cut could mean losing nearly $18,100 annually from their benefits, causing serious financial strain. A critical reason this timeline is moving faster than expected is due to President Donald Trump’s “One Big Beautiful Bill” (OBBBA) passed in 2025. While it delivered significant tax relief to seniors, it inadvertently accelerated Social Security’s financial challenges. This article breaks down what’s happening, why it matters, and what Americans can do now to prepare, whether they’re nearing retirement or still in the workforce.

7 Years Until Social Security Cuts

Social Security is vital but faces unprecedented challenges. Trump’s One Big Beautiful Bill gave seniors tax relief but moved the schedule for benefit cuts closer by lowering funding. Without action, cuts up to 24% start in 7 years, affecting millions. Planning early—checking benefits, saving aggressively, delaying claims, and advocating for reform—is essential. By understanding the system and the stakes, Americans can better navigate what’s coming.

| Topic | Details |

|---|---|

| Social Security Cuts Timeline | Expected in 7 years (late 2032) |

| Estimated Benefit Cut | Approx. 24% reduction in Social Security benefits |

| Annual Impact | Up to $18,100 cut per retired couple |

| Medicare Impact | About 11% cut in Medicare Hospital Insurance payments |

| Trump’s Bill Impact | Accelerated insolvency timeline by about 1 year; introduced major senior tax breaks |

| Tax Relief Under OBBBA | 88% of seniors pay no federal tax on Social Security benefits |

| Effective Years of Tax Relief | Tax relief applies from 2025 through 2028 |

| Who Benefits Most | Seniors aged 65+ with increased income tax deductions |

| Official Reference | Social Security Administration |

What Is Social Security and Why Should You Care?

Social Security, created in 1935 by President Franklin D. Roosevelt, was designed as a financial safety net to support retired workers, disabled individuals, and survivors of deceased workers. Today, it’s the backbone of retirement income for over 65 million Americans.

Funded through payroll taxes—where workers and employers each pay 6.2% of wages up to a certain cap—Social Security pools money into trust funds that pay monthly benefits to recipients. It has reduced poverty among seniors dramatically since its inception.

Why Are There 7 Years Until Social Security Cuts?

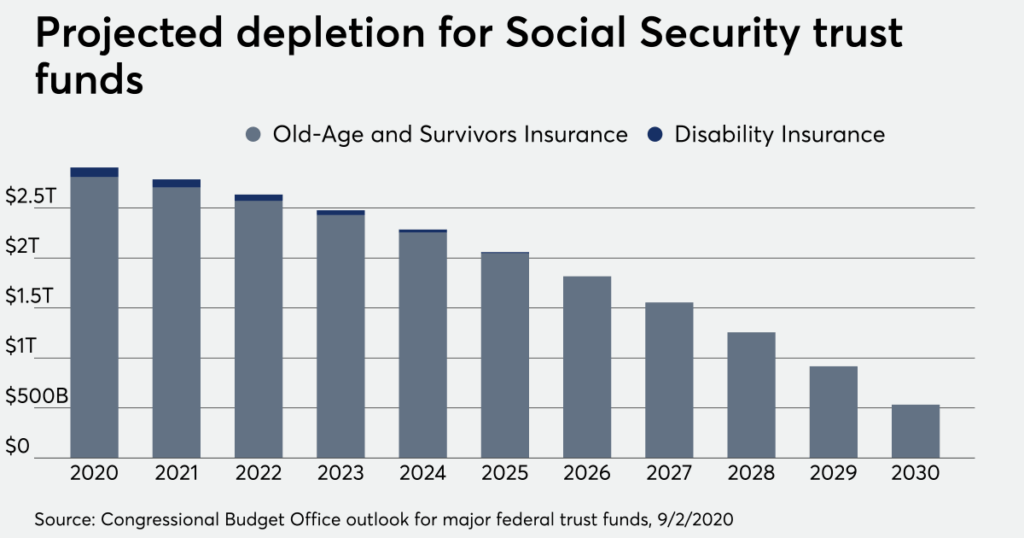

The Social Security trust funds, which pay out retirement and disability benefits, are projected to run out of reserves by late 2032. After that, the program can only pay benefits from current tax revenue—which is insufficient to cover full obligations. As a result, automatic cuts of roughly 24% in benefits will kick in to balance the books.

The root causes include:

- The large baby boomer generation retiring, increasing beneficiaries.

- Longer life expectancy meaning people collect benefits for more years.

- Declining birth rates leading to fewer workers contributing per retiree.

- Reduced income to the trust funds due to tax cuts and lower wage growth.

Trump’s “One Big Beautiful Bill” and Its Impact

Signed into law on July 4, 2025, President Trump’s OBBBA brought sweeping tax cuts and perks for seniors:

- 88% of seniors pay no federal income tax on their Social Security benefits.

- Additional standard income tax deductions of $6,000 for individuals 65+ and $12,000 for couples.

- Eliminated tax on overtime pay and tips through 2028.

- Generally lowered tax burdens for seniors and working families.

While these were immediate wins for retirees—they keep more hard-earned cash—the bill has helped reduce the funds flowing back to Social Security’s trust funds. The Social Security Administration’s actuaries estimate the bill accelerated the trust fund depletion by about one year, pushing benefit cuts closer to 2032 instead of 2033.

Understanding the Cost of 7 Years Until Social Security Cuts

If the trust fund runs dry and cuts occur:

- A typical retired couple could lose up to $18,100 annually in Social Security benefits.

- Medicare’s Hospital Insurance parts could see around an 11% reduction in funding.

- These changes can impact housing, food, healthcare, and overall quality of life for millions who rely on these programs.

Proposals and Solutions to Fix Social Security

Policymakers have been actively discussing ways to shore up Social Security for decades. Some key ideas in the current 2025 debate include:

Increasing Payroll Taxes

Currently, workers and employers each pay 6.2% on wages up to $176,100 (2025 cap). Proposals suggest:

- Raising the payroll tax rate slightly (e.g., from 12.4% combined to 12.6% or more).

- Increasing or eliminating the wage cap so higher earners pay Social Security taxes on more income.

- Broadening the definition of taxable self-employment income to cover more workers.

Adjusting Benefits

- Reducing benefits for higher-income retirees by taxing a larger share of their benefits.

- Increasing the retirement age gradually, reflecting longer life expectancies while protecting lower-income workers.

- Changing the benefit formula to calculate benefits based on a longer earnings history, encouraging longer work lives.

- Expanding or modifying survivor and spouse benefits for fairness and poverty protection.

New Benefit Structures

- Introducing early retirement disability benefits for those unable to work due to health reasons but who don’t qualify for current disability programs.

- Expanding child and student benefits for children of disabled or deceased workers.

These proposals aim to balance cuts and revenue increases to extend Social Security solvency for 75+ years while protecting the vulnerable.

How Social Security Works: The Tax Side

Social Security is mostly funded by payroll taxes:

- Workers pay 6.2%, employers pay 6.2% (total 12.4%).

- Self-employed workers pay the full 12.4%.

- Taxes apply up to a wage limit ($176,100 in 2025).

- The One Big Beautiful Bill reduced federal taxes on Social Security income but didn’t affect payroll taxes directly.

Understanding this funding mechanism helps explain why tax relief targeted at seniors’ incomes indirectly reduces the revenue pool, pushing insolvency closer.

What Can You Do to Prepare for Social Security Cuts?

1. Check Your Social Security Statement

Set up an online account at the Social Security Administration website to review your earnings and estimated benefits regularly.

2. Maximize Retirement Savings

Build other income sources by contributing to 401(k)s, IRAs, or other investments to supplement Social Security income.

3. Consider Delaying Benefits

Delaying claiming Social Security until age 70 can increase monthly benefits, partly offsetting cuts.

4. Stay Informed & Advocate

Follow legislative news and support policies that strengthen Social Security. Voting and advocacy matter.

5. Work with Financial Advisors

Tailored advice ensures your retirement plan accounts for these changes.

Real Voices: Facing the Future

Mary from Ohio sums it up: “Social Security is my main income. The idea of losing a quarter of it by 2032 scares me. I’m saving what I can but it’s tough.”

John, still working construction at 56, says: “I’m thinking about waiting to claim my benefits to get more later. It’s a hard call, but better safe.”

Clearing Up Myths

Myth: Social Security will disappear.

Truth: Benefits will be cut but not eliminated.

Myth: Only seniors pay Social Security taxes.

Truth: Almost all employed Americans and employers contribute through payroll taxes.

Myth: Raising retirement age fixes everything.

Truth: It helps but is not a silver bullet.

Social Security COLA Hike 2026 – Experts Predict Major Boost Amid Rising Inflation

Social Security Just Changed at 69 – Here’s How It Could Drastically Impact Your Retirement

$4,983 Direct Deposit Expected in October 2025 – Check Eligibility and Full Payment Schedule