$648.91 Canada Child Benefit Tax: The $648.91 Canada Child Benefit Tax in November 2025 has caught the attention of many Canadian parents who are curious about how much they’ll receive, when they’ll get it, and whether they qualify. In this guide, we’ll take a deep dive into what the Canada Child Benefit (CCB) is, how it’s calculated, why the $648.91 figure appears, and how you can make sure you’re getting every dollar you deserve. This isn’t just another government summary — it’s written by someone who’s worked with benefit systems and tax filings on both sides of the border. You’ll find clear, fact-based explanations and practical examples that make the CCB easy to understand.

Table of Contents

$648.91 Canada Child Benefit Tax

The $648.91 Canada Child Benefit amount you’ve seen online represents a typical monthly payment from earlier years or for partially reduced cases. For November 2025, the official payment date is November 20, and the maximum benefit is approximately $666.41/month for each child under six. As long as you file taxes, live in Canada, and are the primary caregiver, you’ll receive the CCB automatically. It’s one of the most reliable and impactful family-support programs in North America — and one that every eligible parent should take advantage of.

| Item | Detail |

|---|---|

| Payment Date (November 2025) | November 20, 2025 |

| Maximum Monthly Benefit (Child under 6) | $666.41 (≈ $7,997 per year) |

| Older Reference ($648.91) | Historical or partially reduced benefit |

| Eligibility | Resident of Canada, primary caregiver, filed tax return |

| Provincial Top-Ups | Additional provincial benefits (e.g., Ontario, Alberta) |

| Sources | Canada Child Benefit – Canada.ca |

What Is the Canada Child Benefit (CCB)?

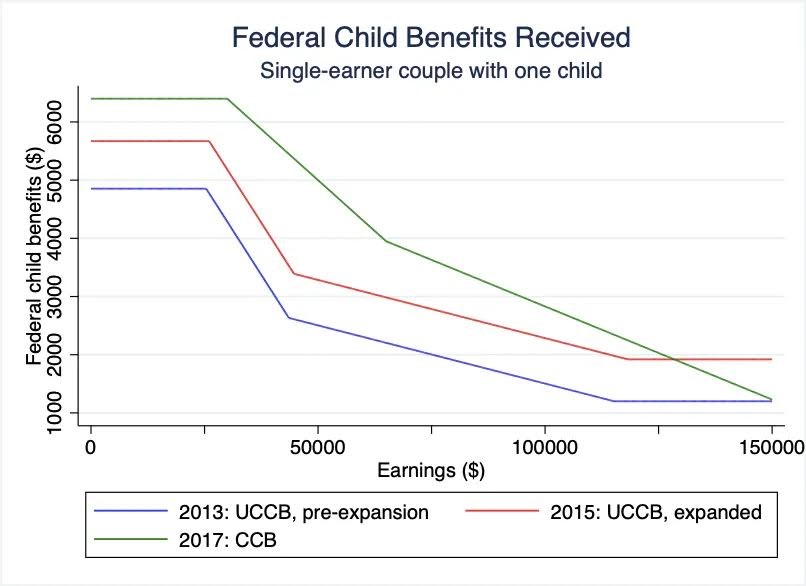

The Canada Child Benefit is a tax-free monthly payment from the Government of Canada designed to help families with the cost of raising children under 18. Administered by the Canada Revenue Agency (CRA), it replaces several older programs like the Universal Child Care Benefit (UCCB) and National Child Benefit Supplement. In simple terms, it’s free financial help for parents. You don’t pay tax on it, and you can use it for anything — groceries, daycare, school supplies, or savings. The goal is to make life a little easier for working families, single parents, and caregivers managing child-related costs. For professionals, think of it as a progressive, income-tested social transfer that’s automatically adjusted for inflation each year.

When Is the Payment Date in November 2025?

The CRA issues CCB payments every month, typically around the 20th. For November 2025, payments will be made on Thursday, November 20, 2025.

If you’re signed up for direct deposit, you’ll receive the funds on that day. Paper cheques may take several extra business days to arrive, depending on Canada Post’s schedule.

If the 20th falls on a weekend or federal holiday, payments are usually sent on the prior business day.

Direct deposit is highly recommended — it’s faster, safer, and easier to track through your online CRA account.

Understanding the $648.91 Canada Child Benefit Tax

The figure $648.91 comes from a previous benefit year’s monthly maximum for a child under six. As of the July 2025–June 2026 benefit year, the maximum annual payment is $7,997 per child under 6, which equals roughly $666.41 per month.

The older $648.91 figure may still appear on financial blogs, calculators, or CRA notices from earlier years. It can also reflect families whose benefits are slightly reduced based on their income level.

Updated Payment Rates for 2025–2026

| Child’s Age | Maximum Annual Payment | Monthly Equivalent | Taxable? |

|---|---|---|---|

| Under 6 | $7,997 | $666.41 | No |

| 6–17 | $6,748 | $562.33 | No |

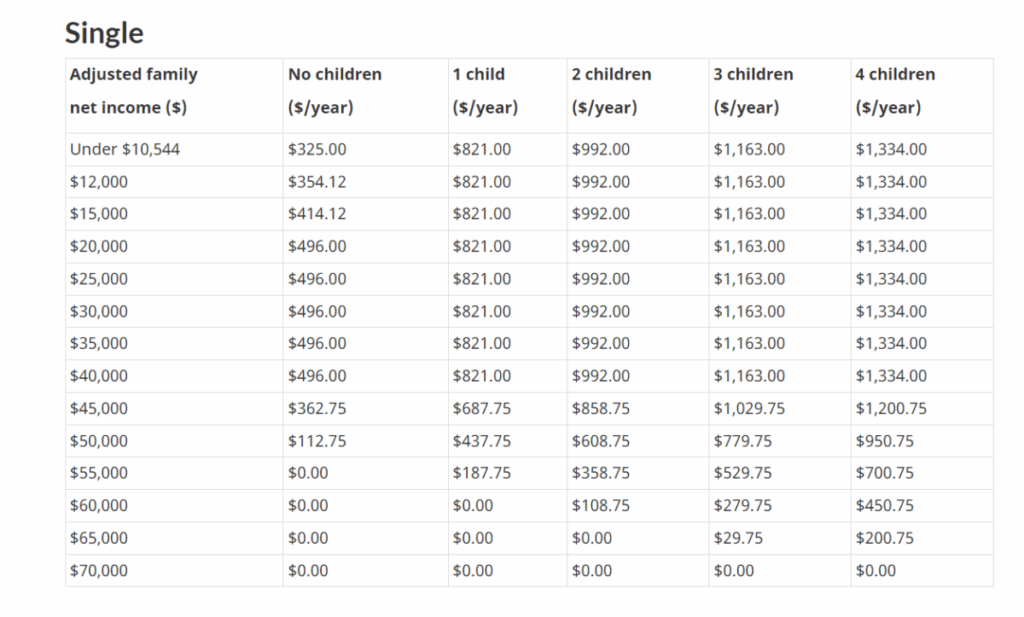

Your payment is based on your Adjusted Family Net Income (AFNI) from your previous year’s tax return (2024 return for 2025–26 benefits). Lower-income families receive the full benefit, while higher-income families get a reduced amount.

Historical and Inflation Context

The CCB was launched in July 2016 under Prime Minister Justin Trudeau’s government. Since then, it has been indexed annually to inflation. That means as living costs rise, the benefit gradually increases.

For example:

- 2016: $6,400 per child under 6

- 2020: $6,765

- 2024: $7,787

- 2025: $7,997

The steady growth helps parents keep up with rising costs in childcare, food, and housing — a critical measure during inflationary periods.

How the CCB Is Calculated?

The calculation formula is based on:

- The number of children under 18.

- The age category of each child.

- Your Adjusted Family Net Income (AFNI) from the previous tax year.

- Reduction rates applied for income over specific thresholds.

For 2025–26, if your AFNI is under $37,487, you’ll receive the full maximum amount.

Once income exceeds that threshold, the benefit begins to phase out at these approximate rates:

- 7% of income over $37,487 for one child

- 13.5% for two children

- 19% for three or more children

This structure ensures that those who need the benefit most receive the largest support.

Eligibility: Who Qualifies for the Canada Child Benefit

You qualify for the CCB if you meet all of these requirements:

- You live with a child under 18.

- You are primarily responsible for their care and upbringing.

- You are a Canadian resident for tax purposes.

- You and your spouse or partner file tax returns each year.

- You or your spouse have a valid Social Insurance Number (SIN).

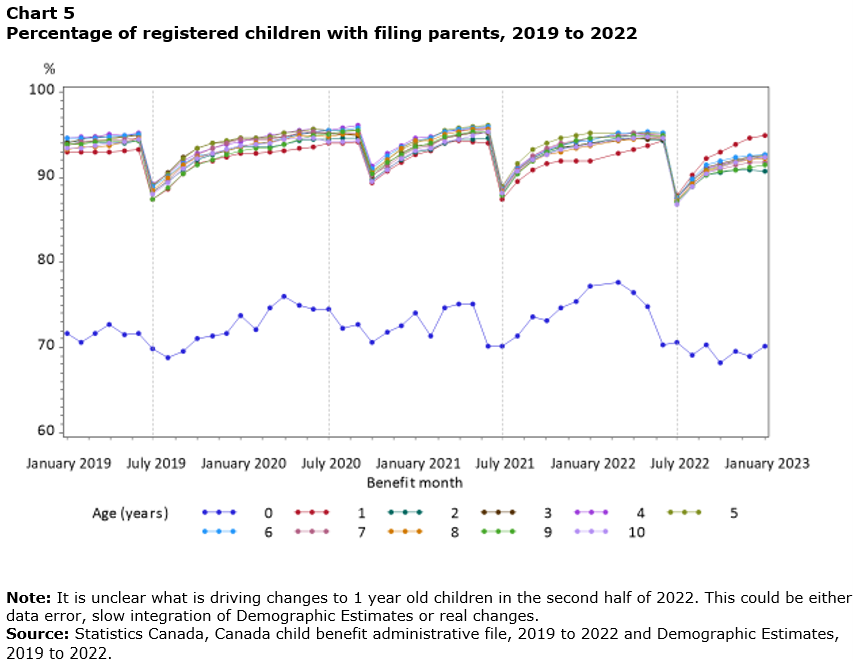

Even if you have little or no income, filing your tax return ensures the CRA has accurate information to calculate your payments.

Newcomers to Canada can apply once they have been residents for at least 18 months and hold valid immigration or residency status.

How to Apply for $648.91 Canada Child Benefit Tax?

There are two main ways to apply:

- Automatic enrollment: If you register your child’s birth in your province, you can use the Automated Benefits Application (ABA) service to automatically apply for CCB.

- Manual application: Complete Form RC66 – Canada Child Benefits Application and send it to the CRA with supporting documents.

Provincial and Territorial Top-Ups

In addition to the federal benefit, many provinces and territories provide extra payments:

| Province/Territory | Program | Maximum Yearly Top-Up |

|---|---|---|

| Ontario | Ontario Child Benefit | Up to $1,607 |

| Alberta | Alberta Child and Family Benefit | Up to $1,410 |

| British Columbia | BC Family Benefit | Up to $1,750 |

| Quebec | Family Allowance | Based on income |

| Nova Scotia | Child Benefit | Up to $1,275 |

| Saskatchewan | Child Benefit | Variable |

These amounts are automatically included if you qualify for the federal CCB, meaning you don’t need to apply separately in most provinces.

Comparison: CCB vs. U.S. Child Tax Credit

| Feature | Canada Child Benefit | U.S. Child Tax Credit |

|---|---|---|

| Structure | Monthly tax-free payment | Yearly refundable credit |

| Max amount | $7,997 (under 6) | $2,000 per child |

| Income-based reduction | Yes | Yes |

| Frequency | Monthly | Annual |

| Administration | Canada Revenue Agency (CRA) | Internal Revenue Service (IRS) |

This comparison shows how Canada’s benefit provides smoother financial support throughout the year, while the U.S. version is more of a lump-sum refund.

Real-Life Example

Imagine a family of three living in Edmonton — two parents and one 4-year-old child. Their 2024 Adjusted Family Net Income is $45,000.

- Maximum annual benefit: $7,997

- Income above $37,487: $7,513

- Reduction: 7% × $7,513 = $526

- New annual benefit: $7,471

- Monthly payment: $622.58

So their November 2025 payment would be about $623, not the full $666, which explains where figures like $648.91 come from.

How to Fix or Track Missing Payments?

If your payment doesn’t show up:

- Wait five business days after the payment date.

- Log into CRA My Account to confirm status.

- Verify your bank account details for direct deposit.

- If still missing, call the CRA at 1-800-387-1193.

Common reasons for delay include:

- Late or missing tax returns.

- Updated marital or custody status not reported.

- Banking changes not updated with CRA.

- CRA verification requests.

Budgeting Tips for Using Your CCB Wisely

Financial advisors often suggest using your CCB in a way that builds long-term stability.

Here are smart strategies:

- Create a child fund: Set up an automatic transfer into a savings account or Registered Education Savings Plan (RESP).

- Cover essentials first: Use the payment for daycare, groceries, or health costs before discretionary spending.

- Build an emergency cushion: If possible, save one month of benefit payments in case of late deposits.

- Track payments: CRA’s My Account provides annual statements that can help you plan for next year’s taxes and benefits.

Using your CCB strategically can set your family up for long-term success — and teach kids early lessons about money management.

The Future of the Canada Child Benefit

Government analysts project that the CCB will continue to grow through 2026 and beyond, keeping pace with inflation.

The next indexation (July 2026) could raise payments by another 2–3%, depending on economic conditions.

Experts see the CCB as one of the most effective poverty-reduction programs in Canada’s history, lifting nearly 435,000 children out of poverty between 2016 and 2022, according to Statistics Canada.

Canada Extra GST Payment In November 2025 – Know Amount, Eligibility & Dates

Canada CRA Benefits Payment Dates For November 2025: Check Payment Amount, Eligibility

Pension Boost Canada in November 2025: Check Expected CPP and OAS Pension Increase in 2025