$628 Canada Grocery Rebate: If you’ve been hearing buzz about a $628 Canada Grocery Rebate coming in November 2025, you’re not alone. This topic is catching attention across neighborhoods, homes, and online forums as Canadians look for ways to ease the pinch from rising grocery bills. So, what’s the deal with this rebate? Is it really happening, and how do you check if you’re eligible or when you’ll get paid? This article breaks everything down in friendly, plain English—whether you’re just curious or need the details like a pro.

Table of Contents

$628 Canada Grocery Rebate

The $628 Canada Grocery Rebate in November 2025 is a genuine government-backed financial relief designed to ease grocery expenses for millions of Canadians. If you qualify, you’ll receive the rebate automatically via CRA’s GST/HST credit system, without any extra hassles. For many, this rebate is a welcome boost to combat food inflation and manage household budgets during unpredictable times.

| Aspect | Details |

|---|---|

| Program | Canada Grocery Rebate 2025 |

| Administered By | Canada Revenue Agency (CRA) |

| Payment Date | Around mid-October to November 2025 |

| Eligibility Criteria | Based on 2024 tax return and GST/HST Credit eligibility |

| Payment Amount Range | $234 for singles; up to $628 for families with 4 children |

| Payment Type | One-time, automatic, tax-free |

| Delivery Method | Direct deposit or mailed cheque |

| Official Website | www.canada.ca |

| Who Benefits | Low- and modest-income individuals and families |

What Is the $628 Canada Grocery Rebate?

Picture this: groceries keep getting more expensive, and families across the country feel the squeeze. To help out, the government steps in with financial relief called the Canada Grocery Rebate—a one-time, tax-free payment made to cushion the impact of food inflation. It’s handled by the Canada Revenue Agency (CRA) and linked to the GST/HST Credit system, so if you qualify, the rebate automatically lands in your bank account or mailbox. No extra forms, no lengthy applications.

This rebate was first introduced in 2023, aimed at helping low- and modest-income families manage the soaring costs of everyday essentials. Due to ongoing inflation, the rebate has been extended into 2025, with payments expected around October or November.

Why the Grocery Rebate Matters?

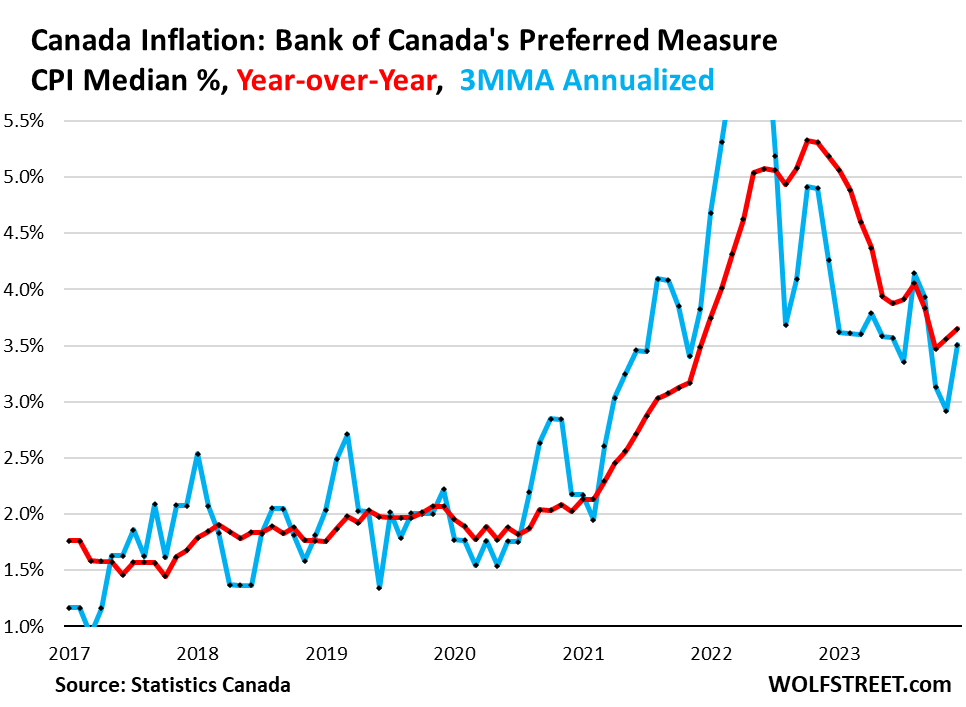

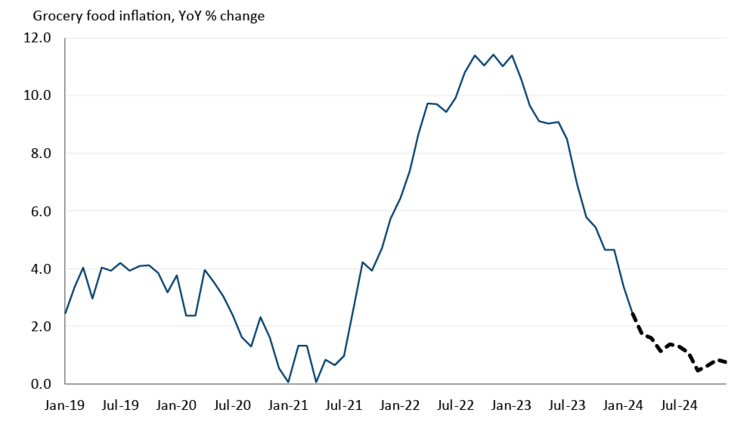

Inflation hasn’t been kind to grocery budgets. Canadians have seen steady price increases in fruits, vegetables, meats, and staples. According to Statistics Canada, food prices have increased by around 3.5% in August 2025 compared to the previous year, impacting families disproportionately. The government’s rebate is a direct financial boost to make life a little easier, especially before winter’s extra expenses hit.

Grocery inflation affects people differently depending on their location, family size, and income. For households living paycheck to paycheck, even small price spikes can force tough choices about which essentials to buy each week.

Historical Context: A Response to Rising Food Prices

Food price inflation has been steadily rising in Canada for several years, driven by supply chain disruptions, climate impacts on crops, and global economic pressures. In 2020, food inflation was around 1.6% annually; by mid-2025, it moved up to around 3.5% according to the Consumer Price Index (CPI) for food purchased from stores.

The average family of four is expected to spend about $16,833.67 in 2025 on food, an increase of roughly $800 compared to last year. Categories like meat and vegetables are seeing price jumps of 4% to 5%, while bakery and dairy goods also rise steadily.

This rebate program is part of a broader strategy of targeted financial relief—including energy rebates, tax credits, and child benefits—designed to ease the cost-of-living crisis in a measured way.

Who Is Eligible for $628 Canada Grocery Rebate?

Eligibility hinges on a few key factors:

- You must be a resident of Canada.

- You need to have a filed 2024 tax return.

- You should qualify for the GST/HST credit based on income and family size.

- Individuals aged 19 and over, or younger individuals living with family.

If you meet these conditions, you’re likely in the mix for the rebate. Remember, there’s no separate application; it’s automatic once your tax info is processed.

How Much Can You Expect?

The amount depends mainly on household size and income. Here’s the typical breakdown:

- Single individual with no kids: Around $234

- Families with two children: Approximately $450

- Families with four children: Up to $628

This amount is a one-time payment—helping stretch those grocery dollars a bit further in challenging times.

When Will You Get Your Payment?

The payments are generally sent between mid-October and mid-November 2025. Those with direct deposit will see the money arrive faster, while mailed cheques could take about a week to ten days longer. The CRA aligns this rebate with the GST/HST credit schedule for smooth processing.

How to Check the Status of Your Rebate?

Wondering if your payment has hit your account yet? Here’s how to keep tabs:

- Log in to your CRA My Account online. This portal shows all your benefits and credits.

- Under the “Benefits and Credits” or “Payments” section, look for the Grocery Rebate entry.

- You can also monitor your bank account around expected dates if signed up for direct deposit.

- Check for any CRA messages or updates about payments.

If you don’t have a CRA My Account, setting one up now can streamline future access to payments and other tax-related info.

What to Do If You Missed the Rebate?

Sometimes, payments don’t reach everyone who qualifies—due to missed tax filing, bank info errors, or other reasons. If you suspect you missed your rebate:

- Ensure your 2024 tax return was filed on time.

- Confirm your direct deposit info is up to date with CRA.

- Contact CRA directly by phone or through My Account to inquire.

- Keep an eye on future announcements; sometimes catch-up payments are made after program review.

How This Rebate Compares to Other Relief Programs?

Canada’s grocery rebate stands out because it is automatic and tax-free. Unlike broader stimulus checks or temporary unemployment benefits, this program targets food costs directly. Some U.S. states have introduced grocery assistance programs, but Canada’s nationwide approach is unique in scale and integration with tax credits.

Financial experts highlight the importance of such targeted rebates in keeping disposable income stable, noting that direct rebates can have immediate impacts on living standards and poverty reduction.

Practical Advice: Making the Most of Your Rebate

Getting some extra cash is great, but stretching it effectively is even better. Here are some tips:

- Use the rebate specifically for groceries or essential household items.

- Shop smart: Look for discounts, buy seasonal produce, and consider store brands.

- Plan meals ahead to reduce food waste and maximize ingredient usage.

- Avoid impulse buys—stick to a list when possible.

These simple strategies help maximize the rebate’s value in your household budget.

Real-Life Impact of $628 Canada Grocery Rebate

Take Sarah from Toronto, a single mom of three, who said the rebate helped cover extra fresh produce during a tough budget month. Or Mike, a retiree in Alberta, who used his payment to stock up on pantry essentials and reduce his grocery store trips. These stories underscore the rebate’s role as more than just a number—it’s real relief.

Canada Grocery Rebate Amount for October 2025 – Check Eligibility & Payment Details

Grocery Rebate Canada – $628 is coming to all eligible in October 2025; Is it true?

Economic Outlook and Food Prices Moving Forward

While the rebate helps in the short term, food inflation is expected to keep moving. Experts forecast overall food price increases of about 3%-5% in 2025. Meat and vegetables tend to see the steepest rises due to production costs and supply limitations.

Consumers are advised to stay informed about monthly food prices and use inflation calculators to plan their personal budgets. Resources like Statistics Canada’s Food Price Data Hub provide up-to-date data for households to adjust spending.