$600 Tariff Refund Checks: If you’ve been hearing buzz about the $600 tariff refund checks possibly hitting American pockets this November 2025, you’re not alone. This potential rebate has stirred quite a conversation across the U.S., prompting many to ask: Do I qualify? When will this check arrive? This comprehensive guide will walk you through everything you need to know about the American Worker Rebate Act of 2025, the eligibility criteria, rebate mechanism, and practical advice for taxpayers from everyday families to seasoned professionals.

Table of Contents

$600 Tariff Refund Checks

The $600 tariff refund checks proposed under the American Worker Rebate Act of 2025 aim to repay American families for tariff-related price increases through substantial rebates. Though the bill currently remains stalled, its intent reflects growing concern over inflation and consumer costs. Staying informed, prepared, and cautious can help families maximize their chances of benefiting once action is taken.

| Topic | Details |

|---|---|

| Amount per adult and dependent child | Minimum $600 per individual, up to $2,400 for a family of four |

| Current bill status | Introduced, referred to Senate Finance Committee; stalled with minimal progress |

| Eligibility | U.S. citizens and residents under income caps ($150K joint filers, $75K singles) |

| Funding source | Tariff revenue collected from imports, surged to $31.3B in Sept 2025 |

| IRS stance | No stimulus or tariff rebate checks distributed in 2025 as of now |

| State relief programs | Inflation relief and tax rebates active in states such as NY, PA, GA, CO |

| Official source | Congress.gov – American Worker Rebate Act |

What Are the $600 Tariff Refund Checks?

The $600 tariff refund checks come from an initiative known as the American Worker Rebate Act of 2025, introduced by Senator Josh Hawley from Missouri. The legislation proposes giving out rebates funded by revenue collected from tariffs imposed on imported goods, primarily those tariffs enacted during the Trump administration. The plan calls for distributing at least $600 per adult and dependent child in qualifying households, making it possible for a family of four to receive up to $2,400 in direct rebate payments.

The rebate aims to compensate consumers for the increased prices caused by tariffs, which are essentially taxes on imported goods. These tariffs have had a tangible impact on the cost of everyday items—everything from clothing to electronics and household goods.

However, it’s important to understand that as of November 2025, this bill has stalled in Congress and no rebate checks have officially been authorized or sent out. The idea remains a proposal, but it’s one of the most talked-about financial relief efforts in the country.

Why Tariffs Matter and Their Economic Impact?

Tariffs are essentially taxes on goods imported into the U.S. The government uses them to protect domestic industries by making foreign products more expensive. While tariffs can boost certain sectors, they also tend to push up retail prices for consumers. The tariff hikes imposed over the last few years have led to noticeable inflation on many household goods.

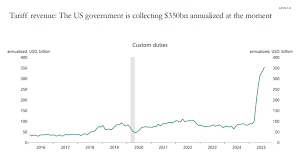

Through 2025, tariff revenue progressively rose from about $8.96 billion in January to a record $31.3 billion in September alone. This surge in collection underscores how much extra cost has been added to imports. The rebate checks aim to recycle some of this money back to consumers, who have been absorbing higher prices.

Studies estimate that these tariffs are costing average American families around $2,400 per year—roughly the size of the rebate checks proposed. This makes the rebate a targeted response to ease the financial burden on households facing cost-of-living pressures.

Who Qualifies for the $600 Tariff Refund Checks?

Senator Hawley’s bill sets clear eligibility limits that target working families with moderate to low incomes:

- Eligible recipients include U.S. residents and citizens who meet income limits.

- Income thresholds are set at:

- $150,000 for married couples filing jointly,

- $112,500 for heads of household,

- $75,000 for single filers.

- Those earning above these limits face a phaseout, meaning the rebate amount decreases progressively as income rises.

- Both adults and dependent children in qualifying families receive the rebate.

- Individuals with outstanding federal debts or tax issues may have their rebate adjusted or withheld.

This structured eligibility aligns with earlier stimulus programs (such as those in 2020) to focus support where it is most impactful.

How Does the Government Collect and Use Tariff Revenue?

Tariffs are collected at U.S. ports of entry by Customs and Border Protection. The collected funds enter the federal treasury and contribute to:

- General government budgets,

- Funding infrastructure and public services,

- Supporting domestic industry subsidies,

- Proposed rebates like those in the American Worker Rebate Act.

With tariff revenues hitting upwards of $31 billion monthly, repurposing a portion as rebates signals an effort to balance trade policy impacts by compensating consumers directly affected by price inflation.

How and When Will the $600 Tariff Refund Checks Be Delivered?

Since the bill has not cleared Congress, no rebates have officially been disbursed. But if the bill passes, here’s what to expect based on existing IRS processes:

- Most rebates would be issued via direct deposit to recipients’ bank accounts, which is faster and reduces fraud risk.

- Paper checks might still be mailed to those without direct deposit information, but the IRS plans to phase out such checks starting in late 2025.

- The IRS typically processes direct deposits in under 21 days once all paperwork is verified.

- The rebate would show as a tax credit or direct payment related to tariff revenues.

- Because the act ties directly to tariff revenues, the timing and size of payments are contingent on ongoing tariff collections and legislative approval.

Practical Advice for Potential Recipients

If you want to be ready to qualify for the rebates, follow these steps:

- File your federal tax returns timely. This ensures the IRS can verify your income and eligibility.

- Update your bank info with the IRS so you can receive direct deposits.

- Verify your eligibility by comparing your income to the thresholds.

- Beware of scams. The IRS has issued warnings about fraudsters pretending to offer checks or asking for personal data.

- Stay informed on state-level relief programs offering inflation rebates or tax credits, which are available in several states.

- Watch official websites regularly: IRS.gov, Congress.gov, and state tax department pages for updates and instructions.

State-Level Relief Programs: Filling the Gap

While the federal rebate is stalled, states are stepping in with their own inflation relief programs:

- New York, Pennsylvania, Georgia, Colorado, and others have launched one-time inflation rebates varying from $100 to $1,000 depending on income, age, and residency.

- These programs relieve cost pressures locally while national legislation is debated.

- State rebates often require no action or simple tax filing, with payments sent out automatically or through state online claims portals.

These efforts help families cope with inflation in the absence of a federal rebate.

Historical Precedent: What Past Rebate Checks Tell Us

Looking back to previous stimulus and rebate efforts provides insight:

- The 2008 stimulus payments and the COVID-19 checks in 2020-21 were effective in stimulating consumer spending quickly.

- Electronic delivery through direct deposit proved the fastest and safest method.

- Many people were unaware or delayed claiming their rebates due to lack of filing or outdated bank info.

- Scams were widespread during stimulus distribution, highlighting the need for caution.

This context underscores how important preparation and vigilance are for potential recipients of upcoming rebates.

Tracking Legislative Progress and Advocating for Consumers

Want to track the bill or influence its passage? Here’s how:

- Use Congress.gov to check the bill’s status and follow Senate and House committee actions.

- Follow your senators and representatives on social media for updates.

- Contact your local offices to voice support or concerns about tariff policies and consumer relief.

- Join consumer organizations lobbying for fair trade policies and rebates.

- Staying informed and active increases accountability and improves chances for timely relief.

Financial Preparation Tips in Uncertain Times

While waiting for potential rebates:

- Keep a detailed budget factoring in ongoing inflation pressures.

- Maintain or build an emergency savings fund covering 3-6 months.

- Tackle high-interest debt when possible to reduce financial strain.

- Track your income and ensure documentation is accurate for rebate eligibility.

- Remain skeptical of unsolicited calls or emails about guaranteed checks.

Preparing financially helps manage uncertainty regardless of political outcomes.

Challenges and Controversies Surrounding the Tariff Refunds

The tariff refund initiative faces serious hurdles:

- Federal courts have questioned the legality of some tariffs, potentially affecting revenue flows.

- There’s debate over how much rebate money should go to importers, businesses versus consumers.

- Political divisions make passing the bill difficult, with concerns about budget impact and broader trade policy.

- The complexity of collecting and disbursing rebates accurately and fairly is a significant administrative challenge.

Understanding these challenges helps temper expectations and encourages proactive engagement.

November $2000 Stimulus Check For Everyone In 2025: Check Payment Date & Eligibility

$400 Inflation Refund Checks Announced – Payments Have Already Started!

IRS 2026 Update: New Tax Brackets and Higher Deductions Could Change Your Refund