The $600 Rebate Program, part of the American Worker Rebate Act of 2025, is gaining momentum, offering eligible U.S. residents financial relief. This program, aimed at supporting families through tariff revenues, promises payments starting in 2026. Here’s how you can check if you’re eligible.

Table of Contents

$600 Rebate Program

| Detail/Statistic |

|---|

| $600 per eligible individual or dependent |

| $2,400 for a family of four |

| Up to $75,000 for single filers, $150,000 for joint filers |

| Rebate payments expected to begin in 2026 |

| Nonresident aliens, dependents on others’ returns |

| U.S. Department of Labor |

The $600 Rebate Program is an important financial relief measure aimed at supporting American families struggling amid economic instability. While the program’s future depends on the successful passage of legislation, it offers a potential lifeline for many. Stay informed for updates and ensure your tax information is in order for a smooth rebate process in 2026.

What is the $600 Rebate Program?

The $600 Rebate Program is a proposed initiative introduced under the American Worker Rebate Act of 2025. The primary objective is to provide financial assistance to U.S. households affected by the economic downturn, supported by tariff revenues expected to be collected beginning January 2025. The program is expected to begin issuing payments in 2026.

Background and Context

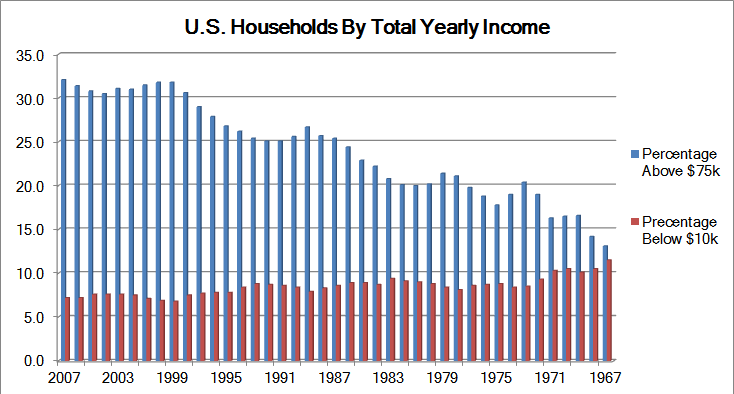

The U.S. government has struggled with inflation and economic challenges in recent years, prompting proposals for new financial relief programs. This rebate is designed to assist families, particularly those within the lower and middle-income brackets, by distributing direct financial assistance.

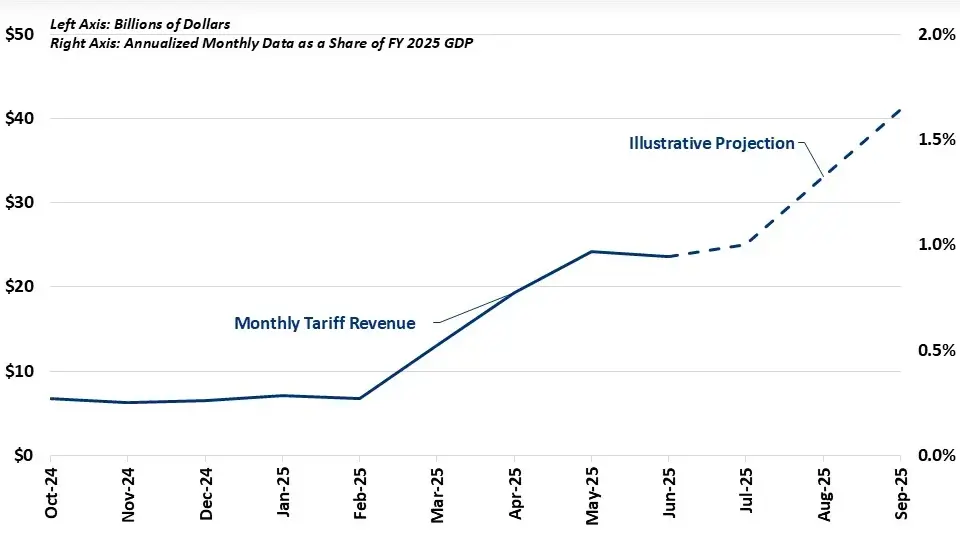

The rebate’s funding will come from tariffs imposed on imports following January 2025, as part of the broader economic strategy to stimulate domestic growth and job creation. While the program is still in the legislative phase, it has garnered significant attention due to its potential impact on American households.

Historical Context and Precedents

Financial assistance programs like the $600 Rebate Program have been implemented in various forms in the past. One of the most well-known examples is the stimulus checks issued during the COVID-19 pandemic. The most recent of those, under the American Rescue Plan, saw eligible individuals receiving payments up to $1,400.

The concept of tariffs as a funding source for domestic relief is relatively new but could set a precedent for future programs aimed at tackling economic inequality. The American Worker Rebate Act of 2025 might not be the last instance where tariff revenues are used for domestic aid, but it marks a significant step in reshaping how the U.S. addresses financial inequality.

Who Is Eligible for the $600 Rebate Program?

Eligibility for the $600 Rebate Program is primarily based on income levels, filing status, and dependent claims.

Income Thresholds for Single Filers, Married Couples, and Families

To qualify, individuals must meet specific income criteria. Single filers must have an Adjusted Gross Income (AGI) of $75,000 or less. For married couples filing jointly, the threshold rises to $150,000. Head of household filers have an AGI limit of $112,500.

For those above these income limits, the rebate will be reduced by 5% for every dollar earned over the threshold. For example, a single filer earning $80,000 would see a reduction of $250 in their rebate.

Who Is Excluded?

Certain groups are excluded from eligibility, including nonresident aliens, individuals claimed as dependents by another taxpayer, and estates or trusts. These exclusions ensure the program is targeted at working families and individuals who are directly contributing to the economy.

How Much Will You Receive?

The $600 Rebate Program provides a minimum rebate of $600 per eligible individual, with additional amounts for dependent children. A family of four, for example, could receive up to $2,400.

While this amount is fixed under the current proposal, there is potential for a higher rebate if the tariff revenues exceed projections. As such, the actual amount may vary, depending on the economic outcomes of the tariff collections.

Why Tariffs Are the Chosen Source for Funding

One of the most noteworthy aspects of the $600 Rebate Program is its reliance on tariff revenues. Traditionally, tariff revenues are used to support U.S. government operations and trade agreements. However, this program represents a novel approach to leveraging tariffs for domestic economic relief.

This strategy is tied to the broader concept of economic nationalism, which seeks to prioritize domestic production and reduce reliance on foreign goods. By using tariff revenues to fund the rebate, the government aims to use foreign trade policies to directly benefit American consumers, particularly those in need.

How Tariffs Work: A Quick Overview

A tariff is a tax imposed on imports, making foreign goods more expensive and providing a financial incentive for consumers to purchase domestically produced items. The revenue generated from tariffs is typically directed into the U.S. Treasury. In this case, the revenue will be repurposed for rebates to eligible Americans.

How Will the Payments Be Distributed?

Rebate payments are expected to begin in 2026. According to the proposed legislation, the rebate will be distributed as a refundable tax credit based on 2025 tax returns. This means eligible recipients will receive the amount as a direct deposit or check after filing their taxes.

There are also discussions of potentially offering advance payments similar to the stimulus checks distributed during the COVID-19 pandemic. However, this feature is yet to be finalized and will depend on further legislative decisions.

What Happens If You Don’t File Taxes?

The $600 Rebate Program will primarily rely on 2025 tax returns to determine eligibility. However, the government is exploring ways to include individuals who may not file taxes due to low income, disabilities, or other reasons. In these cases, special provisions may be put in place to ensure these individuals can still benefit from the rebate.

Ensuring Accurate Distribution

The Internal Revenue Service (IRS) will play a crucial role in managing the distribution of the rebates. The IRS is expected to ensure that only eligible individuals receive the rebate, utilizing tax records and other available data to verify eligibility. For those with complex tax situations or concerns about their eligibility, consulting a tax professional may be beneficial.

The Potential Impact on U.S. Households

For many families, the $600 Rebate Program could provide much-needed financial relief. According to the U.S. Department of Labor, the rebate is aimed at individuals and families in the lower and middle-income brackets, where the financial strain is often most acute.

A Lifeline for Families Struggling with Inflation

In 2025, many Americans are still dealing with the fallout from rising inflation rates, particularly in essentials like housing, food, and healthcare. The rebate offers a potential buffer for these families, helping them manage everyday costs.

A Boost for Consumer Spending

Experts predict that the rebate will not only benefit individuals directly but also help stimulate the broader economy by increasing consumer spending. This, in turn, could lead to stronger demand for goods and services, which would support businesses and job creation. While the rebate is not a cure-all for the broader economic challenges, it could provide a crucial short-term boost for the U.S. economy.

Key Takeaways and What’s Next

The $600 Rebate Program represents a significant step in addressing economic inequality and supporting American families in the wake of economic instability. The program’s progress depends on the passage of the American Worker Rebate Act of 2025, which is still under review by Congress.

If you meet the eligibility criteria, the program could provide meaningful financial relief in the coming years. For those looking to check their eligibility, it is advisable to keep an eye on official updates from the U.S. Department of Labor and the Internal Revenue Service (IRS).

Social Security Boost: How a Simple Strategy Can Increase Your Monthly Payments by $100s

$2000 IRS Direct Deposit This October? Here’s What You Need to Know About Potential Stimulus Checks

$1600 Stimulus Checks October 2025 Date: Will You get this? Check Eligibility & Payment Date

FAQs About $600 Rebate Program

Who is eligible for the $600 Rebate Program?

Eligibility is determined by income thresholds: up to $75,000 for single filers, $112,500 for heads of households, and $150,000 for married couples filing jointly. Rebate amounts are reduced for higher incomes.

When will the $600 rebate be issued?

Rebate payments are expected to begin in 2026, based on 2025 tax returns. Advance payments may also be considered.

How can I check my eligibility?

Stay updated by checking official U.S. government sources such as the Department of Labor and the IRS.

Will there be advance payments for the rebate?

Discussions are ongoing about the possibility of advance payments, but no official decision has been made. The final structure will depend on legislative developments.

Can I still qualify if I don’t file taxes?

Efforts are underway to include individuals who do not file taxes due to low income or other factors. Stay informed for official announcements regarding these provisions.