$600 OAS & CPP Coming: Rumors are buzzing online that Canadian seniors will receive a $600 OAS & CPP bonus in October 2025. TikTok videos, Facebook posts, and blog headlines all claim a “special top-up” is coming for pensioners. But before you start planning how to spend it, let’s get real — as of now, there’s no official confirmation from the Government of Canada or Service Canada about any such one-time payment. That said, there’s a lot of useful information to unpack — about Old Age Security (OAS), Canada Pension Plan (CPP), and how these payments actually work. If you understand the system, you’ll be better prepared whether a bonus happens or not.

Table of Contents

$600 OAS & CPP Coming

At the end of the day, the $600 OAS & CPP payment in October 2025 is not confirmed. What is certain is that regular OAS and CPP payments — including GIS for those eligible — will arrive as usual on October 29, 2025.

Stay proactive:

- Use your My Service Canada Account;

- Monitor Canada.ca for updates;

- Keep your information current;

- Budget based on what’s real, not rumored.

If the government ever announces an extra payment, you’ll be ready — financially and factually.

| Topic | Key Information |

|---|---|

| Rumored $600 payment | No official confirmation as of October 2025; likely misinformation |

| OAS eligibility | Age 65+, Canadian citizen or legal resident, lived in Canada ≥10 years since age 18 |

| CPP eligibility | Must have contributed during working years; can start at 60 or delay to 70 |

| Payment date (Oct 2025) | Both OAS and CPP payments will be deposited October 29, 2025 |

| Maximum OAS payment (Oct–Dec 2025) | $740.09/month (age 65–74); $814.10/month (age 75+) |

| OAS recovery tax threshold (2025) | Begins at income above $90,997; 15% clawback on excess |

| GIS supplement | For low-income OAS recipients; up to $1,105.43 (single, Oct–Dec 2025) |

| Official Source | Canada.ca |

Understanding OAS: Canada’s Cornerstone Pension

The Old Age Security (OAS) program is one of Canada’s key retirement benefits, providing monthly payments to eligible seniors aged 65 or older. Unlike the Canada Pension Plan, OAS isn’t based on work history — it’s based on residency and citizenship.

You qualify if:

- You’re 65+ years old;

- You’re a Canadian citizen or legal resident; and

- You’ve lived in Canada for at least 10 years since age 18 (20 years if living abroad).

You don’t need to have worked or contributed to CPP to receive OAS.

If you’ve lived in Canada for fewer than 40 years, you might get a partial pension, calculated as:

(Years lived in Canada ÷ 40) × Full OAS amount.

For example, if you lived in Canada 20 years, you’d receive 50% of the full OAS rate.

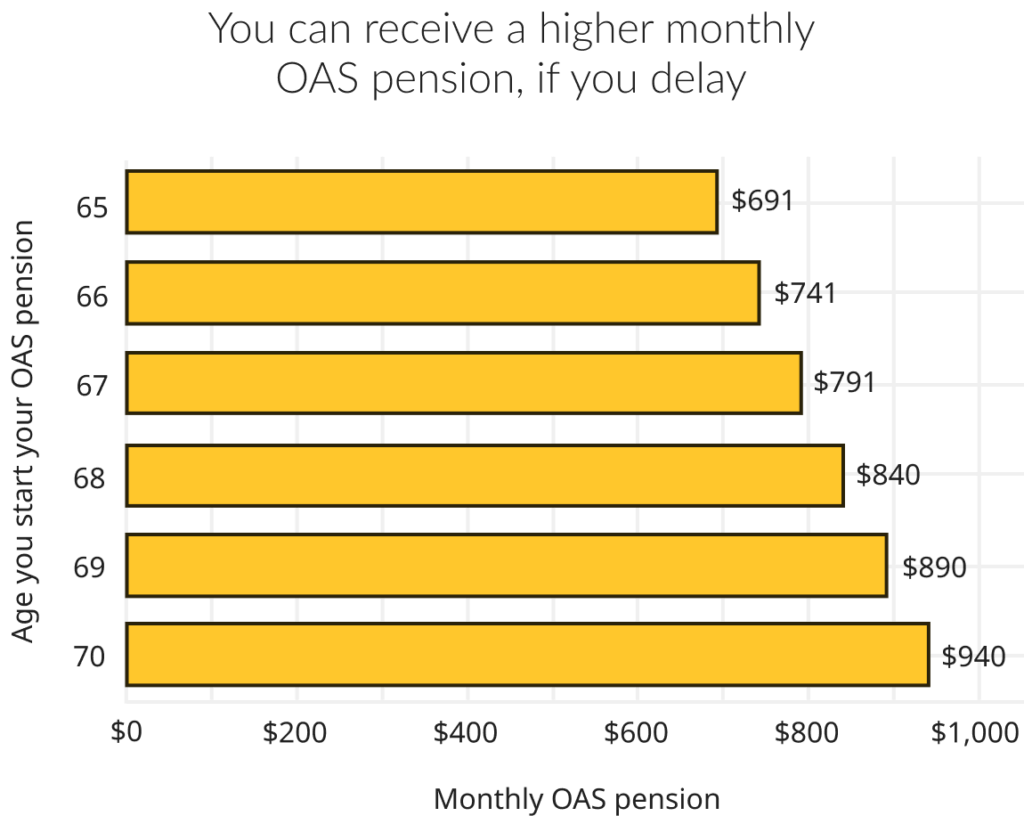

OAS Payment Details

- Payment schedule: Deposits typically occur the third-last business day of each month.

- October 2025 payment date: October 29, 2025.

- Current max payment:

- Age 65–74: $740.09/month

- Age 75+: $814.10/month

- OAS recovery tax: If your income exceeds $90,997, 15% of the excess is clawed back through tax until your OAS is fully repaid.

CPP Explained: Earned Through Your Work

The Canada Pension Plan (CPP) is different from OAS — it’s contribution-based. If you’ve worked in Canada and paid into the CPP (through payroll deductions or self-employment contributions), you’re eligible to receive benefits when you retire.

Key Features of CPP

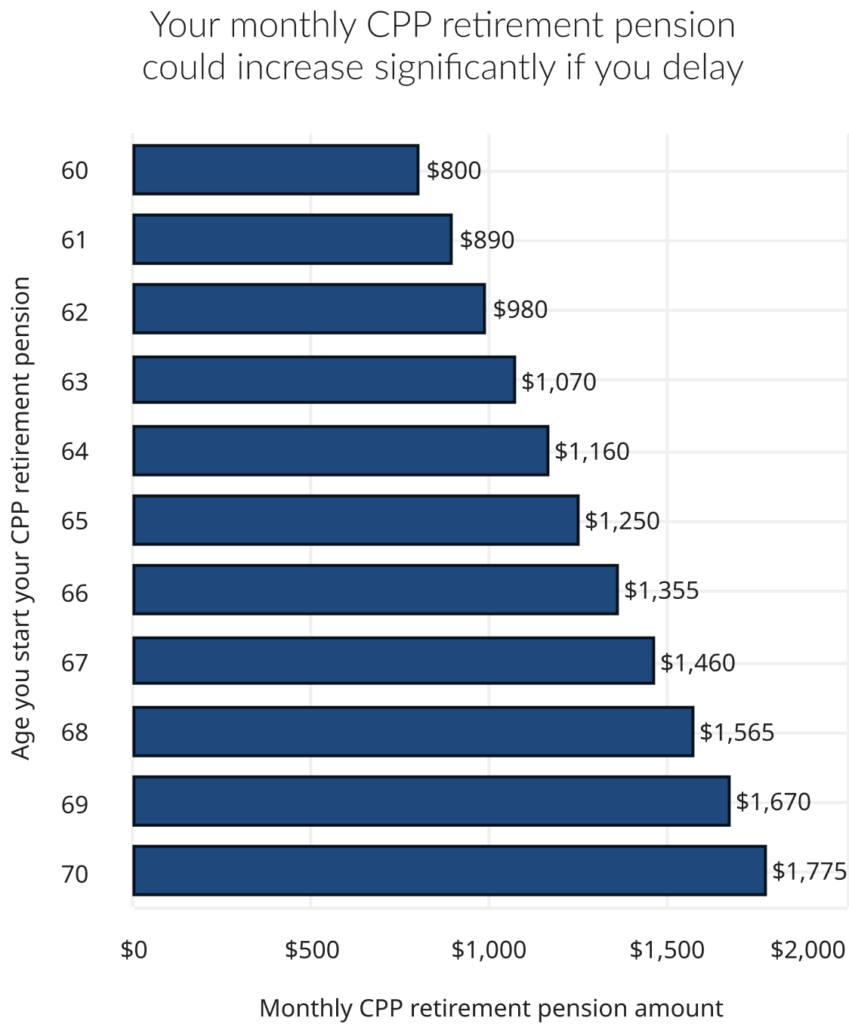

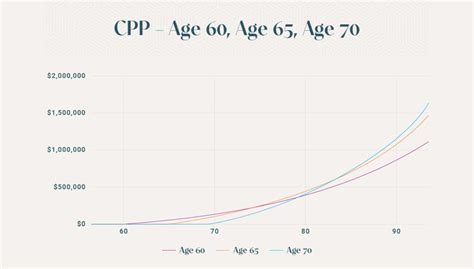

- Start age: You can begin receiving CPP as early as 60, but payments are reduced by 0.6% per month before 65.

- Delay option: You can delay up to age 70, increasing payments by 0.7% per month after 65 (up to +42%).

- Average payment (2025): Around $814/month, though the maximum can exceed $1,300 depending on your contributions.

- Post-Retirement Benefits (PRBs): If you keep working while collecting CPP, your additional contributions earn extra pension increases automatically.

CPP Enhancement

In recent years, CPP has been gradually enhanced, meaning future retirees will receive higher benefits because contribution rates and pensionable earnings have increased. This ensures the system remains sustainable while improving payout values for younger workers.

Guaranteed Income Supplement (GIS) — The Hidden Gem

If you’re already receiving OAS and your income is low, you may qualify for the Guaranteed Income Supplement (GIS) — an extra monthly payment that helps with living expenses.

For October–December 2025, GIS amounts are as follows:

- Single, widowed, or divorced: Up to $1,105.43/month

- Married/common-law (both receive OAS): Up to $665.01/month each

GIS is non-taxable, but it’s income-tested — meaning if your annual income rises above a certain threshold, your GIS is reduced or stopped.

What’s the Deal with the $600 OAS & CPP Bonus Claim?

So, where did the $600 OAS & CPP bonus rumor even come from?

Some social media posts and blogs claim that a “government relief payment” or “senior stimulus bonus” is being sent in October 2025. However, no official legislation, press release, or budget update has been issued by the Government of Canada confirming such a payment.

Why People Believe It?

- Cost of living: Inflation has made groceries, rent, and gas more expensive. A $600 bonus sounds like a much-needed relief.

- Past precedents: The government has provided one-time top-ups before — such as the $500 OAS supplement for seniors 75+ in August 2021.

- Clickbait headlines: Some websites use catchy titles like “$600 coming to seniors soon!” to drive traffic without citing credible sources.

Reality Check

- No parliamentary approval: Any new payment must be announced in the federal budget or a government press release.

- Official channels only: If it’s not on Canada.ca or announced by Service Canada, it’s not official.

- October 2025 deposits: Expect your regular OAS and CPP payments only, unless new legislation is passed.

How to Verify Real Benefits (and Avoid Scams)?

Online misinformation often targets seniors. Here’s how to stay safe:

- Use official government websites: Always confirm news through Canada.ca or CRA pages.

- Don’t click unknown links: Scammers use fake “payment claim” links to steal personal data or banking info.

- Call official numbers: Service Canada (1-800-277-9914) can verify your benefit status.

- Check My Service Canada Account: Your online portal will show any legitimate payment updates.

If a $600 payment appears in your account, check the payment description. Real OAS/CPP payments show clear designations like “OAS Pension” or “CPP Retirement.”

Step-by-Step: How to Prepare for $600 OAS & CPP Coming

Step 1: Confirm Your Eligibility

Log into My Service Canada Account (MSCA) to check:

- Your current benefits;

- Eligibility for OAS, CPP, and GIS;

- Whether your personal info is up to date.

Step 2: Budget Based on Confirmed Income

Plan your finances using known monthly OAS/CPP amounts. Don’t count on any unverified bonuses until officially confirmed.

Step 3: Track Payment Dates

Bookmark the official payment calendar. For 2025, the dates include:

- October 29, 2025

- November 26, 2025

- December 22, 2025

Step 4: Watch for Legislative Announcements

Check for updates around Budget 2025 or fall fiscal statements, where such programs would be announced if approved.

Step 5: Optimize Your Benefits

- Delay OAS or CPP for higher monthly payouts.

- Continue working while receiving CPP to earn Post-Retirement Benefits.

- Apply for GIS if your income is below the threshold.

Case Study: Meet Harold and Linda

Harold (70) and Linda (68) live in Saskatchewan. Harold delayed his CPP until 70 and now receives about $1,360/month. Linda gets $740 from OAS and $900 from CPP.

When they heard about the rumored $600 payment, they checked Canada.ca — nothing official. Instead of assuming the rumor was true, they used the time to:

- Update their direct deposit information;

- Verify eligibility for GIS;

- Budget for the winter based on confirmed payments.

Come October 29, 2025, they’ll see their usual deposits — and if a bonus ever happens, it’ll be a pleasant surprise, not a disappointment.

Canada $2988 OAS Per Month for these Seniors: Check Eligibility and Payment Date

Canada OAS and CPP Changes in October 2026: Is this true? Check Revised Eligibility

Canada CRA $1693 CPP Increase in 2025 – Will you get this payment? Check Eligibility & Payment Date

The Bigger Picture: Why Rumors Like This Spread

Retirement finances are a hot-button issue. Many seniors live on fixed incomes, and even a modest boost can make headlines. However, false expectations can lead to budgeting errors, disappointment, or falling for scams.

The best strategy? Rely on verified sources, stay financially aware, and avoid decisions based on online hype.