$600 Bonus for Retirees: If you’re 62 or older and receiving Social Security benefits, there’s some good news on the horizon for 2026. The Social Security Administration (SSA) announced a 2.8% Cost-of-Living Adjustment (COLA) for beneficiaries, meaning your monthly benefit checks will increase starting January 2026. While some chatter about a “$600 bonus” has made rounds, it actually refers to the cumulative increase across the year rather than a one-time payout. This raise helps retirees manage the rising cost of living and ensures Social Security continues to provide a stable financial base through changing economic times. Whether you’re new to Social Security or have been collecting for years, this guide breaks down everything you need to know about the 2026 COLA, making it clear and approachable for all—and valuable for professionals managing retirement income strategies.

Table of Contents

$600 Bonus for Retirees

The 2.8% COLA increase set for 2026 provides millions of beneficiaries a vital financial lift to counter inflation’s bite. Though some expect a $600 bonus, it’s actually the sum of monthly increases spread over the year, enhancing purchasing power steadily. Social Security remains a bedrock of financial security for older and disabled Americans, adapting yearly to keep pace with economic realities.

| Aspect | Details |

|---|---|

| COLA Percentage Increase | 2.8% increase for Social Security and Supplemental Security Income (SSI) benefits |

| Effective Date | January 2026 (December 31, 2025, for SSI recipients) |

| Average Monthly Increase | About $56 more per month for the average retiree |

| Number of Beneficiaries Affected | Nearly 71 million Social Security and 7.5 million SSI recipients |

| Taxable Maximum Earnings | Raised to $184,500 from $176,100 |

| Earnings Limits (Under FRA) | $24,480 annually; $1 withheld for every $2 earned above this amount |

| Earnings Limits (Year Reaching FRA) | $65,160 annually; $1 withheld for every $3 earned above this amount |

| Official Source for COLA | Social Security Administration |

What Is the Social Security COLA, and Why Does It Matter?

The Social Security Cost-of-Living Adjustment (COLA) is an annual increase to Social Security and Supplemental Security Income benefits to keep pace with inflation. Inflation means everyday essentials—like groceries, utilities, and gas—become more expensive over time. Without COLA, your benefits would purchase less and less, cutting into your financial security.

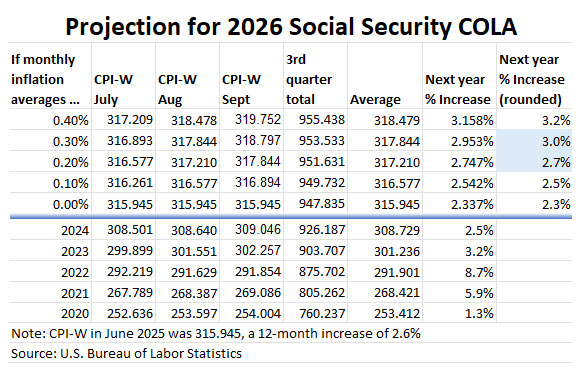

The COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a government measure of inflation reflecting price changes for goods and services urban workers buy. If CPI-W goes up, so does your COLA, and subsequently, your benefits.

For 2026, the COLA is set at 2.8%. So, if your monthly benefit is $2,000, expect an increase of about $56 per month starting January. While modest compared to recent years’ spikes, it’s a crucial boost toward covering rising expenses.

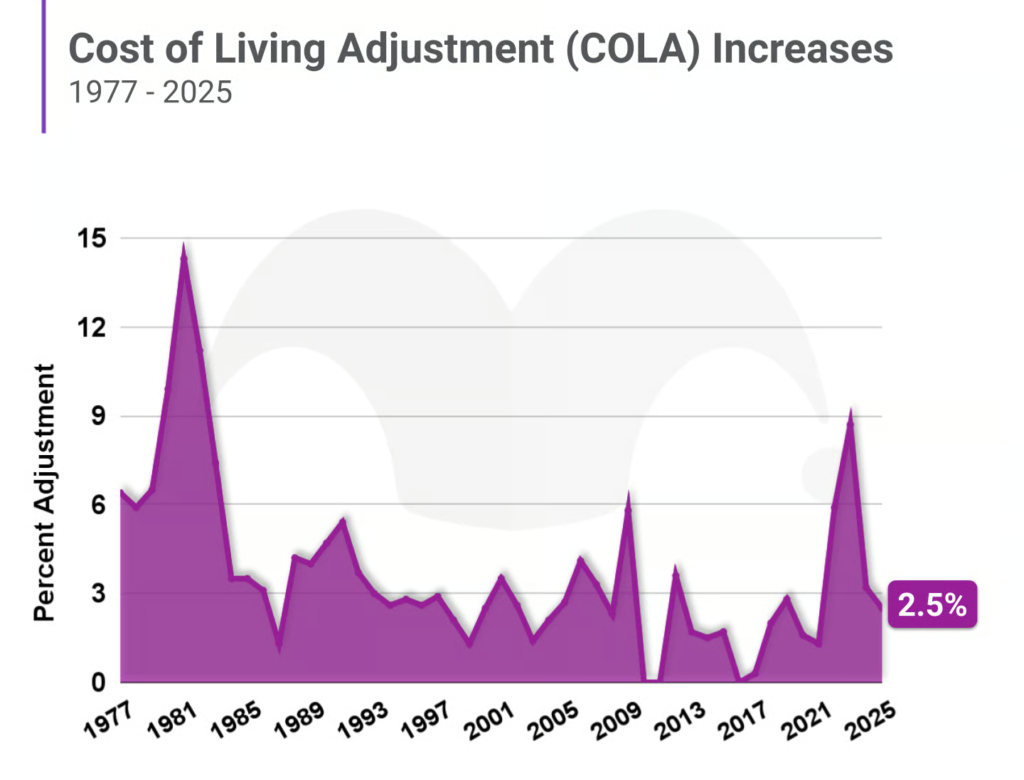

Historical Perspective: How Has COLA Changed Over the Years?

COLA has been an annual feature of Social Security since 1975. Since then, it has fluctuated with inflation levels:

- High COLA years—like 1980 and 1981—saw increases exceeding 10%, reflecting runaway inflation.

- Recent years have seen more moderate adjustments: 8.7% in 2023, 3.2% in 2024, and 2.5% in 2025.

- The average COLA in the last decade is around 3.1%, making 2026’s 2.8% increase slightly below average but still important.

The varying COLA reflects changing economic realities, and it remains integral to Social Security’s promise to protect beneficiaries’ purchasing power.

Clearing Up the “$600 Bonus for Retirees” Myth

You might’ve heard about a “$600 bonus” for Social Security recipients. Here’s the deal: There is no one-time $600 bonus payment authorized by the SSA.

The “$600” comes from multiplying the monthly COLA increase by 12 months. For example, with a $56 increase monthly, over the entire year, that totals about $672—close to $600 but paid out across every monthly check, not as a lump sum.

This misunderstanding often leads to disappointment when beneficiaries expect a large single payment, but the steady monthly increase adds meaningful financial support all year round.

Who Benefits from the COLA Increase?

Retirees and Disabled Beneficiaries

If you’re receiving Social Security retirement or disability benefits, your monthly check will go up by about 2.8%. This adjusts payments to reflect inflation, helping you afford daily needs more comfortably.

Working Beneficiaries Under Full Retirement Age (FRA)

- For 2026, the earnings limit before Social Security reduces benefits is $24,480 annually ($2,040/month).

- If you earn more, SSA deducts $1 from benefits for every $2 over that limit.

- In the year you reach FRA, the limit rises to $65,160 annually ($5,430/month), with a $1 deduction for every $3 over until the month you hit FRA.

- After reaching FRA, there’s no limit on earnings and no benefit reduction.

Understanding these rules is key for retirees who continue working, preventing surprises in benefit payments.

Supplemental Security Income (SSI) Recipients

Around 7.5 million people receive SSI, a needs-based program for low-income seniors and disabled individuals. Their payments will increase by 2.8%, effective December 31, 2025, aligning with Social Security payment adjustments to help cover living costs.

How Will Taxes and Other Benefits Be Affected?

Federal Taxes on Social Security

Social Security benefits may be taxable depending on your “combined income”—including adjusted gross income, nontaxable interest, and half your Social Security benefits. With the COLA increase, your taxable income may rise slightly, possibly increasing your tax liability.

State Taxes

Some states tax Social Security benefits; others don’t. It’s important to check your state tax rules to understand any potential impacts.

Medicare Premiums

Medicare Part B and D premiums can increase annually. For some seniors, higher Medicare premiums can reduce the net effect of the COLA increase, as many report.

When and How Will You Receive Your $600 Bonus for Retirees?

The SSA will send letters detailing new benefit amounts by early December 2025, either by mail or through your my Social Security online account, where you can get the news sooner.

The increased benefit payments start with the January 2026 Social Security checks. SSI recipients will see the increase starting the end of December 2025.

Practical Tips for Beneficiaries

- Watch for Your COLA Notice: Check your mailbox or my Social Security account for official communications.

- Keep Earnings in Mind: If you’re working and receiving benefits, track your earnings relative to limits to avoid penalties.

- Create or Use Your my Social Security Account: Manage benefits, track payments, and receive alerts securely and conveniently.

- Plan for Taxes: Understand how the increased benefits might affect your tax return.

- Stay Vigilant Against Scams: The SSA never asks for personal info by phone or email.

For Financial Advisors: Planning Considerations

- Help clients update retirement income projections with the 2.8% COLA.

- Review income impacts on Medicare premiums and tax planning.

- Counsel clients about the effects of working while receiving benefits.

- Encourage digital account management to improve beneficiary engagement and security.

Social Security COLA Hike 2026 – Experts Predict Major Boost Amid Rising Inflation

Say Goodbye to Paper Checks: Social Security Payments Transition to Digital Next Week

Social Security Disability Insurance (SSDI) Payments in October 2025: Check Payout Amount and Date