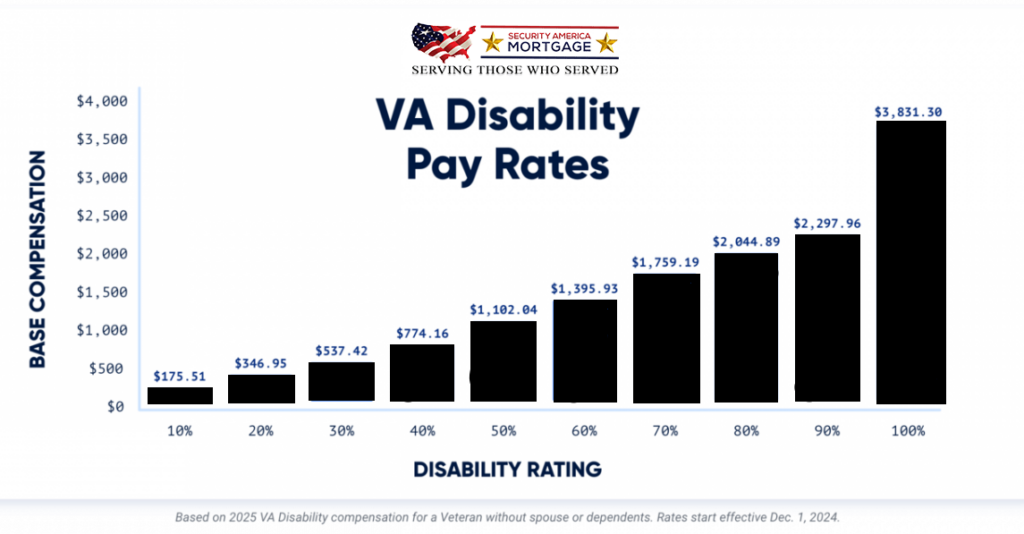

60 VA Disability Pay Increase: The 2025 VA Disability Pay Increase is here — and if you’re a veteran wondering how much extra you’ll see in your next check, you’re in the right place. This year’s 2.5% Cost-of-Living Adjustment (COLA) might sound modest, but it represents another important step in ensuring veterans’ benefits keep pace with inflation. Whether you’re rated at 60%, 100%, or somewhere in between, understanding how this increase affects your bottom line helps you plan smarter, protect your family’s finances, and make sure you’re receiving everything you’ve earned through your service.

Table of Contents

60 VA Disability Pay Increase

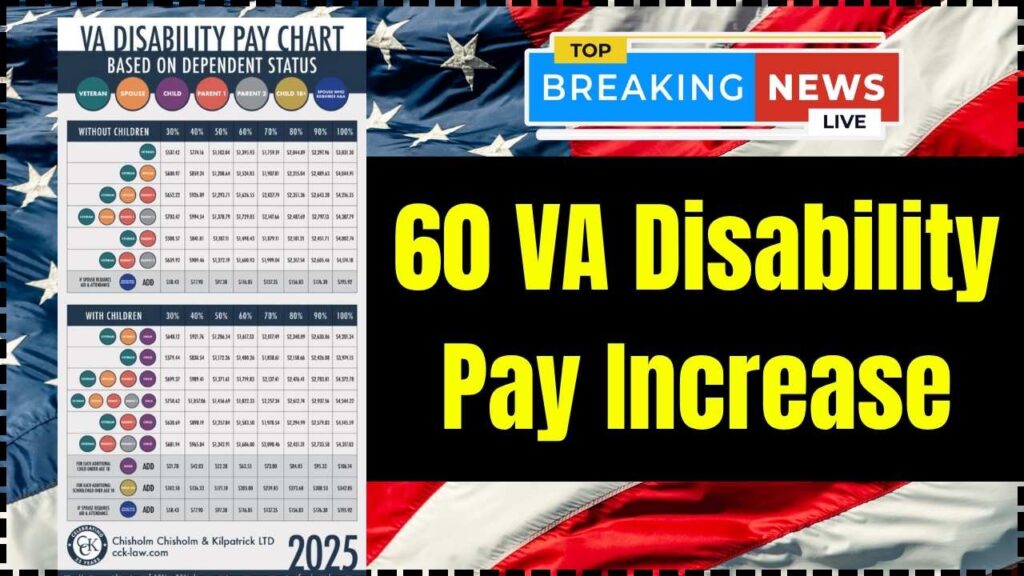

The 2025 VA Disability Pay Increase brings a 2.5% boost, ensuring veterans’ benefits keep pace with inflation. For a 60% disability rating, that’s $1,395.93 per month for single veterans — and more for those with spouses or dependents. If your condition worsens or your status changes, don’t wait — file for an increase and make sure you’re getting the compensation you deserve. Your service earned it — and this annual adjustment helps ensure it continues to serve you.

| Topic | Key Details / Data |

|---|---|

| 2025 COLA | 2.5% increase based on inflation |

| Effective Date | December 1, 2024 |

| First Increased Payment | January 2025 |

| 60% Rating (No Dependents) | $1,395.93/month |

| 60% + Spouse (No Children) | $1,523.93/month |

| Tax Status | 100% tax-free |

| Dependent Add-Ons | Extra pay for spouse, children, or dependent parents |

| Special Monthly Compensation (SMC) | Available for severe disabilities |

| Official Source | VA Disability Compensation Rates |

Why the 60 VA Disability Pay Increase Matters?

Every December, the Department of Veterans Affairs (VA) adjusts its disability compensation rates to match the Social Security Administration’s (SSA) cost-of-living adjustment. This keeps your buying power steady as the cost of essentials like groceries, rent, gas, and medical care continues to rise.

In 2025, the official COLA is 2.5%, effective December 1, 2024 — meaning your new payment amount begins with your January 2025 deposit.

While 2.5% might seem small compared to 2023’s historic 8.7% increase, it still makes a real difference — especially over a full year. For many veterans, this bump can translate into hundreds of extra dollars annually, all of it tax-free.

A Quick Refresher: What VA Disability Pay Is

VA disability pay is a tax-free monthly benefit given to veterans who were injured or developed illnesses during (or worsened by) their service.

Your payment amount depends on your disability rating, which runs from 0% to 100%, and your dependent status (spouse, kids, or parents). Each year’s COLA ensures that the value of those payments keeps up with inflation so you don’t lose purchasing power.

The VA calculates these rates using data from the Bureau of Labor Statistics’ Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) — the same index that determines Social Security adjustments.

How the VA Determines Your Pay?

Here’s how the math behind your monthly benefit works:

1. Start with Your Disability Rating

This percentage reflects how severe your service-connected condition is. For example, a 60% rating means your disabilities are estimated to reduce your overall working capacity by 60%.

If you have multiple disabilities, VA uses a combined-ratings formula — it’s not simple addition. Two 30% ratings don’t equal 60%; they combine to around 51%.

2. Apply the Base Rate

Once you know your rating, check the VA’s disability compensation table for your base monthly payment.

3. Add Dependents and Special Allowances

If you’re married, have dependent children, or provide care for a parent, you’re entitled to additional pay. Likewise, if you have severe injuries (like loss of limbs or total blindness), you may qualify for Special Monthly Compensation (SMC) — a higher-tier benefit that acknowledges greater hardship.

4. Receive Tax-Free Income

VA disability pay is exempt from federal income tax and most state taxes. This means your gross amount equals your net — what you see is what you keep.

Example: 60% Rating Pay for 2025

If your disability rating is 60%, here’s how the 2025 numbers stack up:

| Dependent Status | 2025 Monthly Payment |

|---|---|

| Veteran alone | $1,395.93 |

| Veteran with spouse | $1,523.93 |

| Veteran with spouse + 1 child | $1,621.93 |

| Each additional child under 18 | +$63.00 |

| Each child 18–23 in college | +$208.00 |

| Spouse with Aid & Attendance | +$100.00 |

So, for example, a veteran rated at 60% with a spouse and two children would receive roughly $1,747.93 per month, or $20,975 per year — all tax-free.

That’s up from roughly $1,705.30 per month in 2024, showing the clear benefit of that 2.5% COLA.

How 2025’s COLA Compares to Previous Years?

Let’s take a look at the historical context:

| Year | COLA (%) |

|---|---|

| 2021 | 1.3% |

| 2022 | 5.9% |

| 2023 | 8.7% |

| 2024 | 3.2% |

| 2025 | 2.5% |

You can see how inflation trends influence these numbers. The pandemic years brought unusually large increases, while 2025 reflects a return to steadier inflation.

Even so, every point of increase matters. A veteran rated at 60% will now see roughly $33 more per month than last year.

Real-World Examples

Let’s bring this to life with a few typical cases:

Example 1: Single Veteran, 60% Rating

Your monthly check: $1,395.93. Over a year, that’s $16,751.16 tax-free income.

Example 2: Married Veteran, 60% Rating + 2 Kids

- Base rate: $1,621.93

- $63 for each child under 18 (x2 = $126)

- Total: $1,747.93/month, or $20,975/year.

Example 3: Married Veteran, 60% Rating, Spouse Needs Aid & Attendance

- Base: $1,523.93

- Aid & Attendance: $100

- Total: $1,623.93/month

Each dollar here is non-taxable, meaning it stretches further than comparable taxable income.

Why You Should Double-Check Your Benefits?

Thousands of veterans miss out on full pay simply because their information isn’t up-to-date. To ensure you’re getting the right amount:

- Verify your dependent status in your VA.gov profile.

- Check your direct-deposit details to avoid missed payments.

- Review your VA letter for your updated rate.

- Use a VA-accredited representative or Veterans Service Officer (VSO) to help correct errors or file for increases.

What If Your Disability Has Worsened?

If your service-connected condition has gotten worse, you may be entitled to a higher disability rating. The process is called a “Request for Increase.”

To do this:

- Log in to VA.gov.

- File a supplemental claim or upload medical evidence.

- Attend any scheduled Compensation & Pension (C&P) exams.

If approved, your rating (and pay) will increase retroactively to the date you filed the claim.

What About Special Monthly Compensation (SMC)?

SMC is additional tax-free pay for veterans with particularly severe disabilities — for example, those who have lost the use of limbs, eyesight, or who require daily assistance.

SMC rates are tiered (SMC-K through SMC-T) and can exceed $10,000 per month for high-tier cases.

How to Calculate Your 2025 Pay?

Here’s a simple formula to figure your total:

- Find your rating’s base rate on VA.gov.

- Add dependents: spouse (+$128), each child (+$63 under 18, +$208 in college).

- Include special circumstances: Aid & Attendance, dependent parents, etc.

Example:

- Base rate (60%) = $1,395.93

- Spouse = $128

- Two children = $126

- Total = $1,649.93/month

$4196 VA Disability Payment Coming in October 2025; Check Eligibility Criteria & Credit Date

60% VA Disability Getting a Big Raise; Check New Payment Amounts & Who Qualifies Now

$1700 ACTC Coming In October 2025 – Who will get this? Check Eligibility & Payment Schedule

The Bigger Picture: Veterans, Inflation, and Financial Stability

Over 5 million veterans currently receive VA disability compensation. For many, it’s a primary income source, and COLA adjustments are vital.

The 2025 increase is part of a broader trend toward economic recovery and controlled inflation. According to the Bureau of Labor Statistics, consumer prices have stabilized somewhat after years of volatility — hence the smaller 2.5% bump.

Still, the power of tax-free income shouldn’t be underestimated. A $1,395 monthly check from VA is equivalent to nearly $1,700 in taxable wages for someone in a 20% tax bracket.

That’s real value — and a good reason to stay informed and proactive about your benefits.