60% VA Disability Getting a Big Raise: If you’ve been keeping up with VA disability news, you’ve probably heard the buzz: folks with a 60% VA disability rating are getting a raise in 2025. Yep, it’s official—the Department of Veterans Affairs (VA) has announced the latest Cost-of-Living Adjustment (COLA), and it means bigger checks are on the way for veterans and their families. This isn’t just a random increase—it’s tied to inflation and economic pressures that affect everyone. Think about it: when the price of eggs, rent, or gas goes up, veterans’ buying power shouldn’t go down. That’s where COLA comes in. Now, let’s unpack exactly how much you’ll be getting, why the increase matters, and how to make the most of your benefits.

60% VA Disability Getting a Big Raise

The 60% VA disability raise for 2025 is more than a bump in pay—it’s a safeguard against inflation. With the 2.5% COLA increase, veterans at this rating will now receive $1,395.93 per month tax-free, with more if they have dependents. Between COLA increases, state-level perks, and possible appeals for higher ratings, veterans have multiple ways to maximize support. At the end of the day, this isn’t just money—it’s recognition of sacrifice, service, and resilience.

| Topic | Details |

|---|---|

| Effective Date | New rates start December 1, 2024, first payable January 2025 |

| COLA Increase | 2.5% raise tied to Social Security’s cost-of-living adjustment |

| 60% Disability Base Rate (2025) | $1,395.93 per month (veteran alone) |

| With Spouse | $1,523.93 per month |

| With Spouse + 1 Parent | $1,625.93 per month |

| With Spouse + 2 Parents | $1,727.93 per month |

| Tax Status | Tax-Free federal benefit |

| Source | VA Official Rates |

Why the 60% VA Disability Getting a Big Raise? The COLA Connection

Every year, the VA adjusts compensation through the Cost-of-Living Adjustment (COLA). COLA is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks inflation. If the cost of goods goes up—like groceries, rent, gas, or even healthcare—COLA helps veterans keep up.

Let’s be real: veterans shouldn’t have to stretch the same check when inflation eats away at it. COLA increases make sure your benefits reflect real-world costs.

- In 2023, the COLA increase was 8.7%, the biggest in 40 years. That was huge because inflation spiked.

- In 2024, COLA slowed to 3.2%, matching a cooling economy.

- For 2025, the 2.5% increase shows inflation is more stable but still impacting daily expenses.

Over time, these raises add up. A veteran who was rated at 60% back in 2020 is receiving hundreds more per month in 2025, even without filing for new claims.

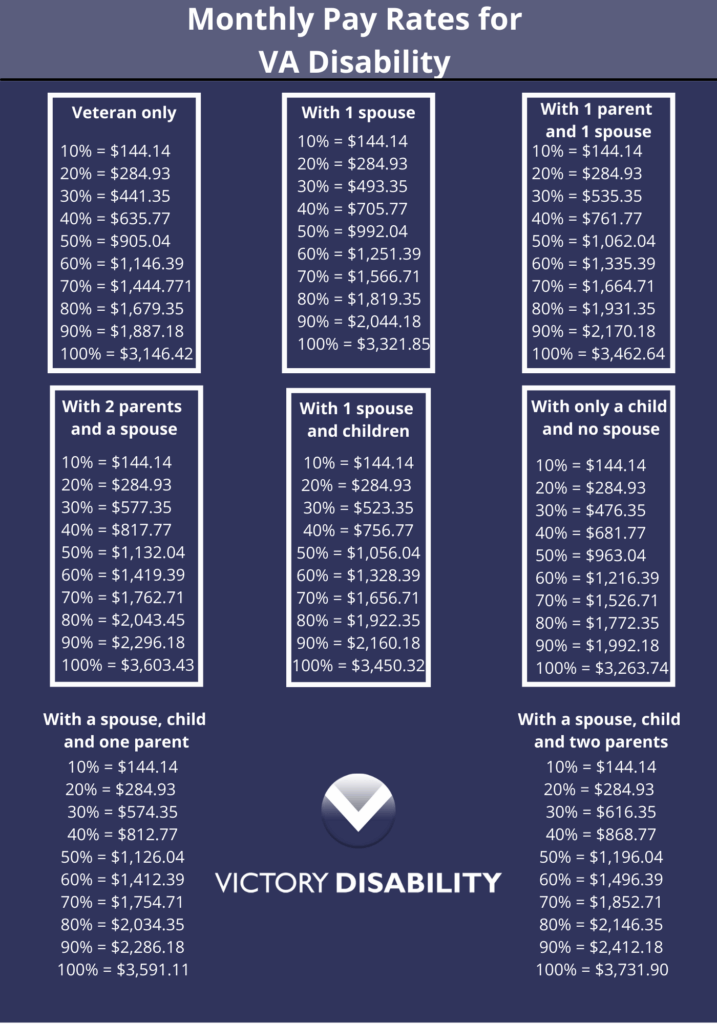

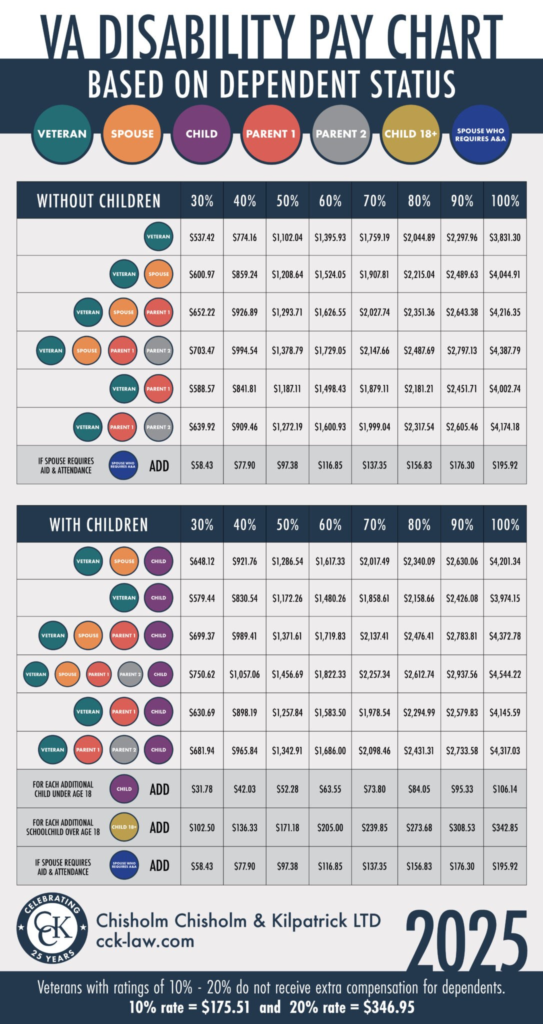

New 2025 VA Disability Payment Chart (60% Rating)

Here’s what veterans rated 60% disabled can expect in 2025. These are base amounts, before special benefits like Aid & Attendance or Special Monthly Compensation (SMC):

- Veteran alone: $1,395.93

- Veteran + spouse: $1,523.93

- Veteran + spouse + 1 parent: $1,625.93

- Veteran + spouse + 2 parents: $1,727.93

- Veteran + 1 parent: $1,497.93

- Veteran + 2 parents: $1,599.93

Example: If you’re married, with two kids in college, your monthly rate is higher because the VA adds for dependents. Over a year, those extra amounts can cover a semester’s worth of books or a chunk of tuition.

A Quick Look Back: Historical Increases

History shows how COLA protects veterans:

- 2021 COLA: 1.3% (modest increase)

- 2022 COLA: 5.9% (inflation started climbing)

- 2023 COLA: 8.7% (highest since 1981)

- 2024 COLA: 3.2%

- 2025 COLA: 2.5%

If you compare a 60% disability check in 2020 versus 2025, you’re looking at a difference of hundreds of dollars a month. That’s the COLA safety net at work.

Who Qualifies for 60% VA Disability Getting a Big Raise?

Eligibility for VA compensation depends on several factors:

- Service Connection – You must prove your condition is related to service. This can be direct (injury in combat), secondary (diabetes caused nerve damage), or aggravated (a pre-existing condition worsened by service).

- Medical Evidence – Strong medical records, VA exams (C&P exams), and doctor opinions carry weight. The VA uses the Schedule for Rating Disabilities (VASRD) to decide how severe your condition is.

- Rating Assigned – A 60% disability rating means your condition causes serious challenges but doesn’t completely prevent you from working.

- Discharge Status – Most vets need an honorable or general discharge. A dishonorable discharge can disqualify you.

What Does a 60% Rating Cover?

A 60% rating is significant. It usually covers:

- PTSD with frequent panic attacks, nightmares, and work limitations.

- Heart disease or chronic lung issues limiting exercise.

- Diabetes with complications like neuropathy or kidney issues.

- Chronic back pain or joint injuries making it hard to walk or lift.

- Hearing/vision loss that disrupts daily functioning.

Some veterans hold multiple smaller ratings (30% for back, 20% for hearing, 20% for knee) that combine into a 60% overall rating. That’s where VA math comes in.

Real-Life Example: Meet Mike

Mike, an Army vet, has a 60% rating for knee injuries and PTSD. In 2024, he was receiving $1,362 per month. With the new COLA, his check bumps to $1,395.93 in 2025.

That’s nearly $400 extra for the year—enough to cover his truck insurance and groceries for a month. For Mike, this isn’t just numbers on paper—it’s peace of mind.

Step-by-Step Guide: How to Maximize Your Benefits

1. Check Your Current Rating

Log into VA.gov or call your VA office. Many veterans discover errors or missing dependents that lower their payments.

2. Understand VA Math

VA math doesn’t simply add percentages. Example:

- Rated 50% for PTSD.

- Add 30% for a knee injury.

- VA calculates 30% of the remaining healthy 50%. That equals 15%.

- 50% + 15% = 65%, which rounds down to 60%.

This system explains why two disabilities don’t always “stack” the way you expect.

3. File for an Increase if Needed

If your conditions worsen, don’t wait—file for an increase. Provide updated doctor records, lay statements from family/friends, and proof of how it affects your daily life.

4. Use Veteran Service Officers (VSOs)

Organizations like DAV, VFW, or the American Legion offer free help. They know the system and can catch errors you might miss.

5. Check State Benefits

Many states give additional perks:

- Texas: Property tax exemptions.

- Florida: Free college tuition for dependents of disabled vets.

- California: Free hunting/fishing licenses.

Always check with your state’s Department of Veterans Affairs.

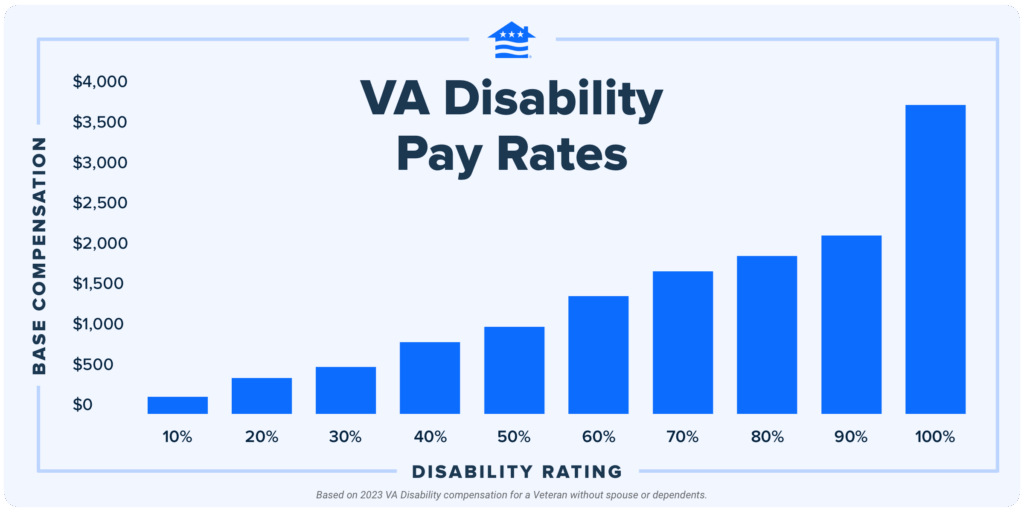

Comparison: 60% vs 100% VA Disability

- 60% Disability (2025): $1,395.93/month (single, no dependents).

- 100% Disability (2025): $3,737.85/month.

That’s a difference of over $28,000 per year. But remember: if your conditions prevent steady work, you may qualify for TDIU (Total Disability Individual Unemployability), which pays at the 100% rate.

Tax-Free Advantage

VA disability compensation is completely tax-free. That’s a huge deal.

Example: A veteran receiving $1,395.93 per month tax-free would need to earn about $1,700–$1,800 pre-tax in a civilian job to bring home the same amount.

Over a year, that’s $16,750 tax-free for a single veteran. For vets with dependents, it can climb well past $20,000.

Common Misunderstandings

- “Do I need to apply for the raise?” Nope—it’s automatic.

- “Does COLA change eligibility?” No, just payment amounts.

- “Can I work with a 60% rating?” Yes, unless you’re on TDIU.

- “Will this reduce my Social Security benefits?” No, VA and SSA benefits are separate.

- “Does remarriage affect benefits?” It can for dependents but not for your own compensation.

California’s $725 Stimulus Payment in October 2025 – Is it really coming or not? Check Here

New DMV Rule Changes in 2025 Will Impact All U.S. Drivers Over 70; Are You Prepared?

Say Goodbye to Paper Checks: Social Security Payments Transition to Digital Next Week