$5500 Stimulus Checks: There’s a lot of buzz lately about $5,500 stimulus checks expected in October 2025. If you’ve seen posts or videos claiming the government is about to drop thousands into your bank account, you’re not alone. Millions of Americans are searching: “Is this real?” or “Do I qualify?” Here’s the reality check: there’s no official confirmation from the IRS or Congress about any new $5,500 payment. It’s a rumor—one built on wishful thinking, political chatter, and confusion over ongoing IRS payments. But let’s not stop at “no.” In this article, we’ll break down what’s actually true, why people believe the rumor, how you can verify any payment, and what legitimate relief options still exist in 2025.

Table of Contents

$5500 Stimulus Checks

Rumors about a $5,500 stimulus check in October 2025 make for great headlines but don’t stand up to scrutiny. There’s no law, no budget, and no official announcement to support it. The truth: the IRS is still finalizing past payments, states are issuing smaller rebates, and the Treasury is phasing out paper checks by the end of 2025. Stay alert, stay informed, and remember — in the financial world, facts beat viral posts every time.

| Topic | Current Reality / Data | What It Means for You |

|---|---|---|

| Official Status | No $5,500 stimulus approved by Congress or confirmed by IRS (irs.gov) | Treat all such posts as speculation |

| Existing Federal Payments | IRS still issuing “plus-up” corrections for missed 2021 Recovery Rebate Credits | Some taxpayers may get up to $1,400, not $5,500 |

| Paper Checks Ending | Treasury to phase out paper payments by Sept 30, 2025 | Future payments will be direct deposit or prepaid card |

| Economic Conditions | Inflation at 3.5%; wages lagging behind living costs | High demand for relief despite no new bill |

| Scam Alerts | Fake texts, emails, and sites promising instant checks | Always verify via IRS.gov before giving any information |

The 2025 Economy: Why the Stimulus Talk Feels Real

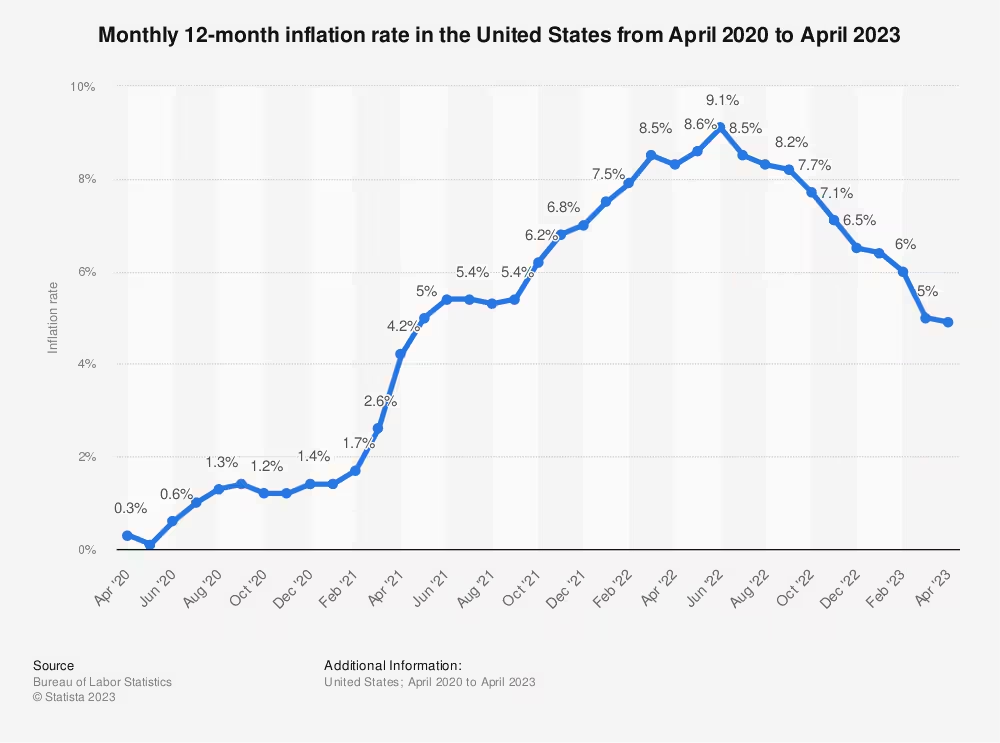

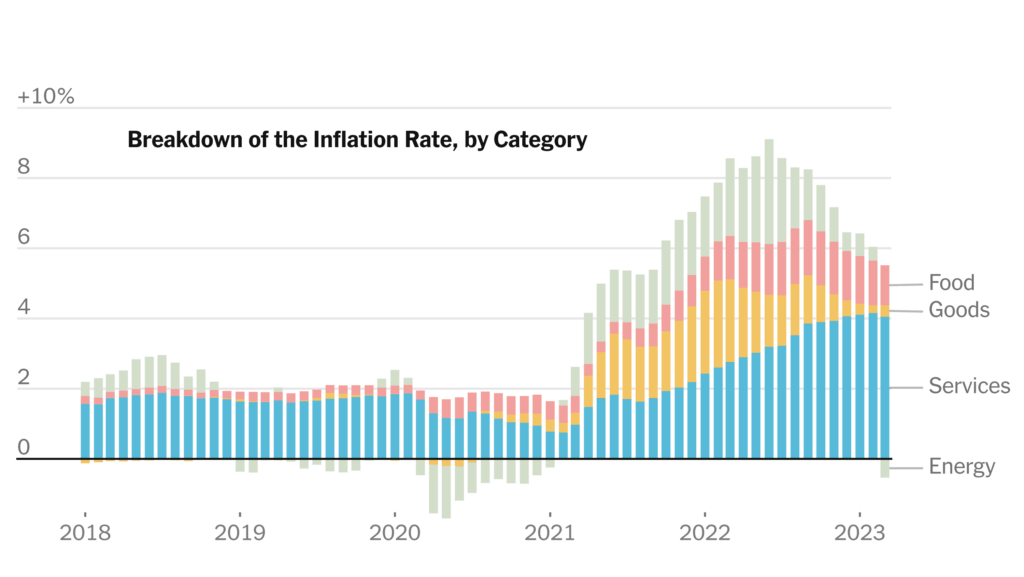

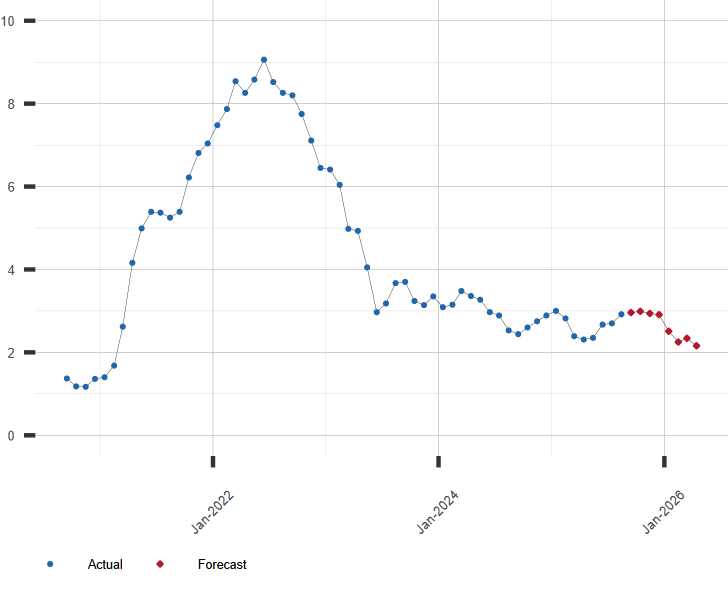

Inflation, rent, and groceries are eating deeper into paychecks. The U.S. Bureau of Labor Statistics reports that average consumer prices are still 17% higher than pre-pandemic levels, even after interest rate hikes. Average rent in major cities tops $2,000 a month, and food prices continue to rise by around 4% year-over-year.

Even though unemployment is relatively low at 4.2%, real wages haven’t caught up to living costs. Families are burning through their savings. According to the Federal Reserve, personal savings rates fell below 4% in 2025 — the lowest since 2019.

So when people hear “$5,500 checks are coming,” it doesn’t sound far-fetched. Folks remember the pandemic relief checks that helped them stay afloat. It’s normal to hope for another round. But hope isn’t the same as policy — and that’s where the rumor falls apart.

Where the $5500 Stimulus Checks Rumor Started?

The rumor gained traction after small finance blogs and social-media influencers started sharing posts titled “IRS to Send $5,500 Relief in October!” Many of them referenced vague mentions of “inflation relief” or “One Big Beautiful Bill,” a 2025 tax reform law that indeed reshaped deductions and credits.

However, when you actually read the text of that bill (Public Law 119-21), nowhere does it authorize direct stimulus payments. It focuses on tax simplification, business incentives, and renewable-energy credits — not cutting $5,500 checks.

Officially, the IRS and Treasury Department have both said no new stimulus round has been approved. (irs.gov)

Yet misinformation spreads fast. Search trends show that in September 2025, Google searches for “October stimulus check” jumped more than 450% week-over-week. And that’s partly because some people are still receiving legitimate payments — just not new ones.

Real IRS Payments Happening in 2025

Let’s talk facts. Some Americans are getting money from the IRS right now — but it’s not a new round of stimulus.

- Recovery Rebate Credit “Plus-Ups”

The IRS is still correcting 2021 returns for people who missed earlier stimulus credits. Around 1 million taxpayers are being issued supplemental payments of up to $1,400 per person.

These are back payments, not fresh aid. - Tax Refund Adjustments

The IRS is also paying refunds for amended returns filed under the 2023–24 inflation adjustment. But again, these depend on individual tax filings — not blanket checks for everyone. - State-Level Relief Programs

A handful of states, like California, New Mexico, and Maine, are offering targeted rebate programs funded by budget surpluses. These range from $200 to $1,000 depending on income or family size. Check your state’s Department of Revenue for details.

Expert Commentary: What Economists Say

Financial experts agree that a $5,500 national payout would be massive — and politically unlikely right now.

Mark Zandi, Chief Economist at Moody’s Analytics, estimated such a program would cost about $1.6 trillion, adding pressure to the national debt. He stated, “A broad-based stimulus of that scale would undermine current inflation control efforts.”

Treasury Secretary Janet Yellen, speaking in June 2025, clarified:

“While the government remains committed to supporting American families, the focus is on targeted tax relief, not large-scale direct payments.”

The Brookings Institution echoed that view: “Direct cash relief remains a powerful short-term anti-poverty tool, but repeating it without crisis justification risks fiscal imbalance.”

So while experts don’t rule out future relief, a nationwide $5,500 stimulus isn’t in the cards right now.

Comparing Past Stimulus Payments to the $5,500 Rumor

| Stimulus Program | Year | Amount per Adult | Income Cap (Single) | Status |

|---|---|---|---|---|

| CARES Act | 2020 | $1,200 | $75,000 | Completed |

| Consolidated Appropriations Act | 2021 | $600 | $75,000 | Completed |

| American Rescue Plan | 2021 | $1,400 | $75,000 | Completed |

| Rumored “October 2025” Payment | 2025 | $5,500 | Unknown | Not Authorized |

Every prior stimulus required Congressional approval and presidential signature. No such law exists for 2025, so any site claiming otherwise is stretching the truth.

If It Did Happen: Who Might Qualify?

Let’s play hypotheticals. If Congress somehow did pass a $5,500 relief bill, it likely wouldn’t be “for everyone.” Past rounds excluded high-income earners and phased out gradually.

Eligibility would likely include:

- Individuals earning under $75,000 annually

- Married couples earning under $150,000 jointly

- Parents and dependents eligible for partial payments

- Social Security, SSI, and veterans’ beneficiaries

- U.S. citizens and resident aliens with valid SSNs

Those above the income threshold would see partial or no payment, depending on phase-out formulas.

The Real Issue: Rising Cost of Living and Political Timing

Another reason this rumor feels believable is the political calendar. With elections approaching, discussions of “relief” often heat up. Lawmakers on both sides of the aisle have proposed different ways to help struggling households — but these are mostly targeted tax credits, not checks.

For example:

- The Child Tax Credit expansion proposal would add up to $2,000 per child, not $5,500.

- The Energy Rebate Initiative offers homeowners rebates for installing efficient systems.

- Several state-level “grocery and gas relief” measures are being debated, but those are regional.

So, while “help” is being discussed, it’s not the blanket check some online posts promise.

What You Can Do Right Now?

Even without a $5,500 check, there are legitimate steps you can take to improve your financial situation or catch unclaimed credits.

Step 1: File or Amend Your 2021 Tax Return

If you didn’t claim the Recovery Rebate Credit, you could still be owed up to $1,400 per person. The final deadline is April 15, 2025. File using Form 1040-X or consult a tax professional.

Step 2: Verify All IRS Communication

Go directly to IRS.gov or your IRS Online Account to check payment history. The IRS does not contact taxpayers through social media or instant messaging.

Step 3: Watch for Legitimate State Rebates

Check your state’s official revenue department website — not blogs — for programs like:

- California’s Middle Class Tax Refund

- New Mexico’s Household Relief Payment

- Maine’s Winter Energy Rebate Program

Step 4: Protect Yourself from Scams

Beware of:

- Texts promising “early access” to checks

- Websites asking for Social Security numbers or fees

- “IRS agent” phone calls demanding verification

Step 5: Keep Your Info Updated

Make sure the IRS has your latest bank account and address to avoid payment delays for refunds or future credits.

What Economists Predict Instead of Stimulus

Economists expect the government to rely more on targeted tax incentives than on universal stimulus. These might include:

- Expanded Earned Income Tax Credit (EITC) for low-income workers

- Enhanced Child Tax Credit (CTC)

- Home energy and electric vehicle credits

- Small business recovery programs

While none of these hand out lump-sum checks, they do increase disposable income for millions of households.

Retirement at 69? The Controversial Plan That Could Slash Benefits for Millions of Americans

$5,108 Social Security Payments in October 2025: Check Eligibility Criteria and Payment Dates!

SSI and SSDI Payments in October 2025: Check Official Payment Schedule and Eligibility Criteria!