$5,108 Stimulus Payment for Seniors: If you’ve been browsing news headlines or scrolling through Facebook and TikTok, you might have seen bold claims about a $5,108 Stimulus Payment for Seniors in October 2025. At first glance, it sounds like the government is about to hand out a fat check to every senior citizen, just in time for the holidays. But here’s the truth: this so-called stimulus payment isn’t really a stimulus at all. That $5,108 figure comes from the maximum monthly Social Security retirement benefit a person can receive in 2025. Not a one-time handout, not a COVID-style economic relief package, but the absolute ceiling of what Social Security pays out — and only to those who meet very strict requirements. So, if you’ve been wondering whether this money is headed your way, let’s break down the facts, bust the myths, and talk about what it takes to qualify.

$5,108 Stimulus Payment for Seniors

The chatter about a $5,108 stimulus payment for seniors in October 2025 is mostly noise. The reality? That figure represents the maximum Social Security monthly benefit for high earners who waited until 70 to claim. Most retirees will receive much less, closer to $1,907. But with smart planning — delaying retirement, monitoring your records, and coordinating spousal benefits — you can maximize your Social Security. And by steering clear of scams and relying on official sources like the SSA, you’ll protect both your wallet and your peace of mind.

| Topic | Details |

|---|---|

| What is the $5,108 payment? | The maximum monthly Social Security benefit in 2025, not a stimulus check. |

| Who qualifies? | Workers with 35+ years of maxed-out earnings, paying Social Security taxes, and delaying benefits until age 70. |

| Average retiree benefit in 2025 | About $1,907/month (SSA). |

| COLA adjustment for 2025 | 3.2% increase — boosting checks across the board. |

| Tax implications | Up to 85% of benefits may be taxable, depending on income. |

| Official source | Social Security Administration |

| Key takeaway | Don’t fall for stimulus rumors; plan around your real Social Security estimate. |

Understanding the $5,108 Stimulus Payment for Seniors

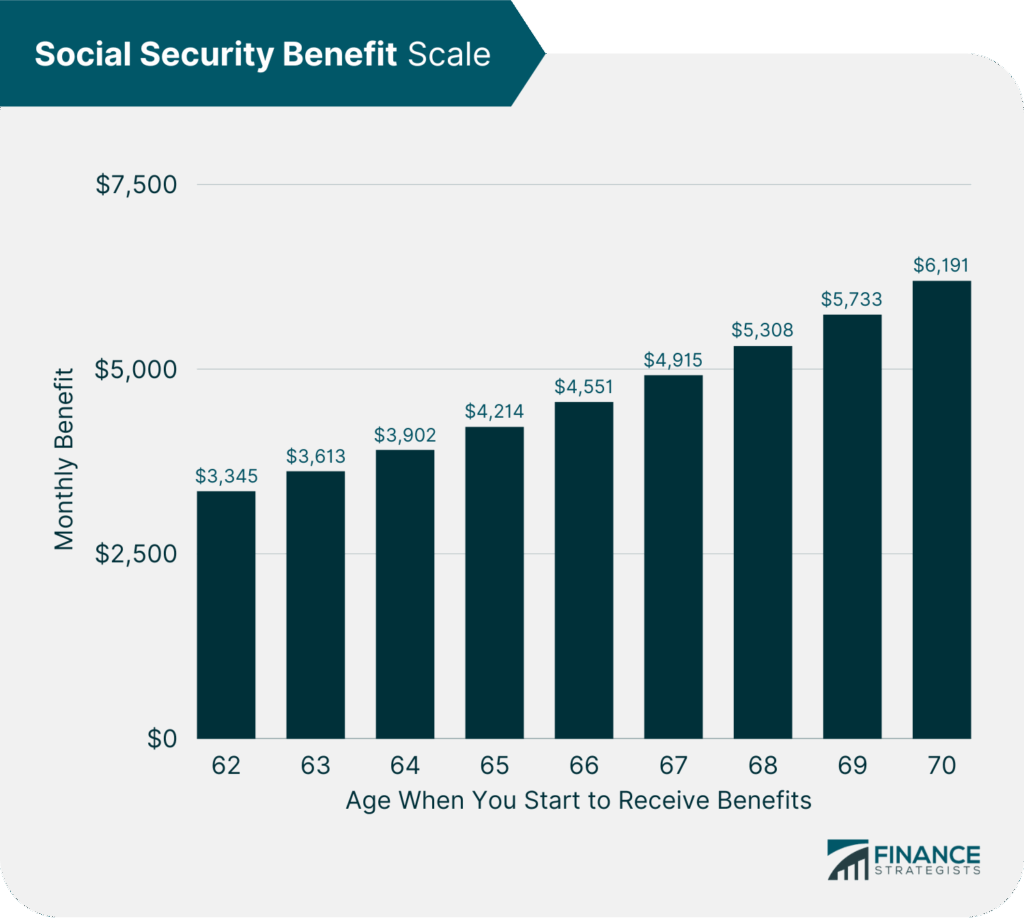

The Social Security Administration calculates retirement benefits based on a worker’s lifetime earnings. In 2025, the maximum monthly benefit available to retirees at age 70 is $5,108. To reach that number, you must:

- Have worked for at least 35 years.

- Earned at or above the Social Security taxable maximum each year (in 2025, $176,400).

- Delayed claiming benefits until age 70.

This number climbs each year due to wage growth and inflation. For comparison:

- 2023 maximum: $4,555/month.

- 2024 maximum: $4,873/month.

- 2025 maximum: $5,108/month.

That’s a big jump in just two years — but remember, very few workers actually qualify for the maximum.

Stimulus Checks vs. Social Security Benefits

It’s easy to see why people are confused. The term “stimulus check” became popular during the pandemic when the federal government sent out one-time payments ($1,200 in 2020, $600 in 2021, $1,400 later in 2021).

But Social Security isn’t the same thing:

- Stimulus checks: Temporary relief, not tied to work history.

- Social Security: Monthly benefits earned over a lifetime of paying payroll taxes.

So while some blogs and YouTubers use the word stimulus to grab attention, it’s misleading. The $5,108 figure is part of regular Social Security retirement, not a new government giveaway.

Who Can Actually Get $5,108 Stimulus Payment for Seniors?

Most seniors won’t qualify for the max benefit, but here’s who can:

1. A Consistent High Earner

You need to hit or come close to the taxable maximum for 35 years. That’s not easy — in 2025, the cap is $176,400, and it’s been climbing every year.

2. A Long Work History

Social Security averages your highest 35 years of earnings. If you have fewer than 35 years, the missing years are counted as zero.

3. Someone Who Waits Until 70

If you claim early (age 62), you’ll see a reduction of up to 30%. If you wait until 70, you’ll see about 8% more for each year after your full retirement age (FRA).

4. No Gaps in Earnings

Years with little or no income hurt your average, lowering the final benefit.

The Role of Cost-of-Living Adjustments (COLA)

A key part of Social Security is its annual COLA increase, which helps retirees keep up with inflation.

- In 2025, COLA is 3.2%, meaning every retiree’s check will rise.

- Average retiree: about $59 more per month.

- Maximum retiree: about $158 more per month.

COLA changes annually based on the Consumer Price Index. This is why benefits rise even for retirees who’ve already claimed.

Taxes on Social Security Benefits

Many retirees are surprised to learn that Social Security isn’t always tax-free.

- If you’re single and earn over $25,000 (including pensions, wages, investments), part of your benefits may be taxable.

- For married couples filing jointly, the threshold is $32,000.

- Up to 85% of benefits may be taxed, depending on your income bracket.

Real-Life Scenarios

Let’s paint a clearer picture of what these numbers mean in daily life.

- Average Retiree ($1,907/month): Enough for groceries, utilities, Medicare premiums, and modest rent in small towns. But in big cities like Los Angeles or New York, that check barely scratches the surface.

- Maximum Retiree ($5,108/month): Offers a comfortable lifestyle in many parts of the U.S. — covering mortgage, health insurance, and even some travel. But in ultra-expensive states like California or Hawaii, it may still feel stretched.

This shows how Social Security must be paired with savings, pensions, or part-time income to create a stable retirement.

State-by-State Differences

Social Security benefits are federal, but cost of living varies dramatically:

- Retirees in states like Mississippi, Arkansas, and Oklahoma can stretch $2,000–$3,000/month much further.

- Retirees in California, New York, and Hawaii face much higher housing and healthcare costs.

Practical Steps to Maximize Your Benefits

- Create a My Social Security account at ssa.gov/myaccount to check your earnings and projected benefits.

- Correct errors early. If your earnings record is wrong, your benefits will be too.

- Delay claiming if possible. Every year you wait (up to 70) increases your monthly check.

- Coordinate spousal benefits. Couples can strategize so one claims early while the other delays.

- Plan for taxes. Factor in federal and possible state taxes.

- Diversify income. Relying solely on Social Security may not be enough.

Beware of Scams

Scammers know seniors are worried about money. Be cautious of:

- Calls claiming to be from SSA asking for bank info.

- Emails or texts promising early access to “stimulus” checks.

- Fake websites mimicking ssa.gov.

Remember: SSA will never ask for personal financial details over the phone or email.

Say Goodbye to Paper Checks: Social Security Payments Transition to Digital Next Week

Social Security COLA Hike 2026 – Experts Predict Major Boost Amid Rising Inflation

7 Years Until Social Security Cuts? How Trump’s “Big, Beautiful Bill” Played a Role