$5,108 Social Security Payments: If you’ve seen headlines or viral posts promising a $5,108 Social Security payment in October 2025, you might wonder if Uncle Sam is about to drop a windfall into your bank account. Well, let’s clear the air — yes, the number $5,108 is real, but it’s not a universal payout or stimulus check. That figure represents the maximum monthly benefit a retiree can receive from the Social Security Administration (SSA) in 2025 — and reaching it takes decades of consistent, high earnings. Still, it’s a good benchmark to understand how Social Security works and how you might raise your own benefit amount.

$5,108 Social Security Payments

The buzz around the $5,108 Social Security payment in October 2025 stems from confusion between maximum benefits and universal payments. Only Americans who’ve earned high wages over decades and waited until 70 to retire can claim that top-tier amount. For everyone else, Social Security remains a cornerstone of financial security — reliable, inflation-adjusted, and crucial for millions of households.

| Topic | Details |

|---|---|

| Maximum Social Security Payment (2025) | $5,108 per month (for retirees claiming at age 70) |

| Average Monthly Benefit (2025) | Around $1,915 for retired workers |

| Eligibility Requirements | 35+ years of high earnings, maximum taxable income, delayed claiming until age 70 |

| October 2025 Payment Dates | Oct 8, Oct 15, Oct 22 (by birth date); SSI on Oct 1 & Oct 31 |

| COLA (Cost-of-Living Adjustment) 2025 | Estimated 3.2% increase |

| Official Source | Social Security Administration Payment Schedule (PDF) |

| Common Myth | $5,108 is not a one-time “bonus” or “stimulus” check |

What Does the $5,108 Social Security Payments Really Mean?

Let’s start by busting the myth. The $5,108 payment is not something everyone will receive in October 2025. It’s the maximum benefit amount the SSA could pay to someone who:

- Worked for at least 35 years,

- Earned the maximum taxable income each of those years, and

- Waited until age 70 to claim retirement benefits.

In other words, it’s the Social Security “gold medal.” Only a small percentage of retirees will qualify for it.

The average retiree in 2025 will receive about $1,915 per month, according to the SSA’s data. That’s still essential income for over 65 million Americans, many of whom rely on these payments to cover their rent, groceries, and healthcare.

For the majority, Social Security represents about one-third of their total retirement income, but for nearly 25% of beneficiaries, it’s their only source of income.

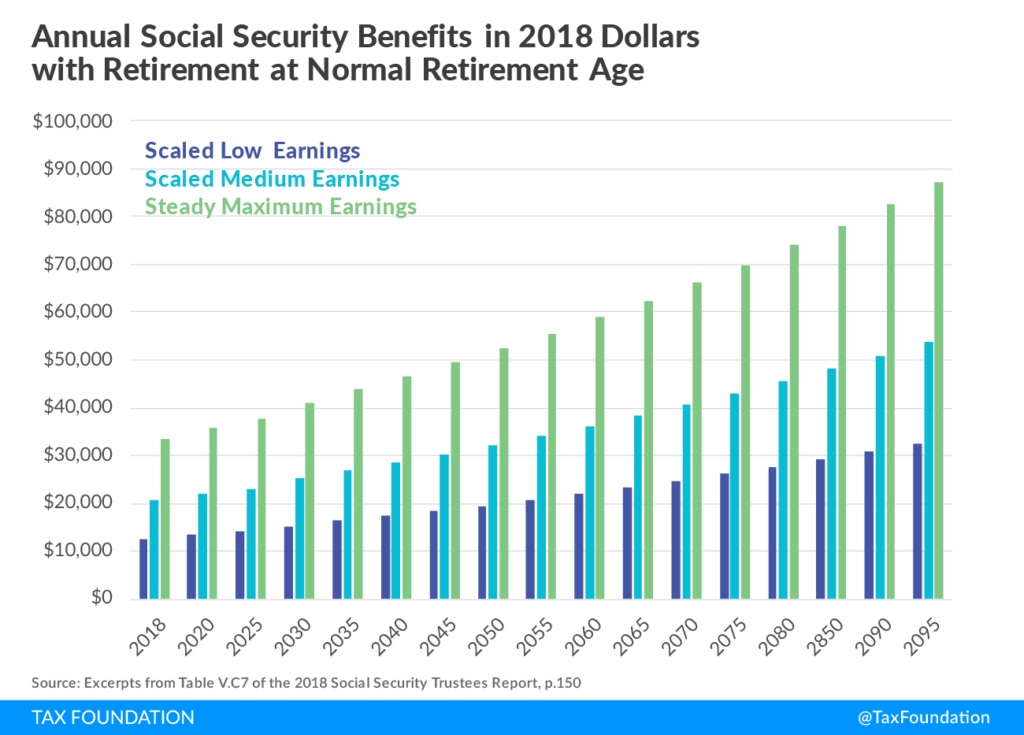

Understanding How Social Security Payments Are Calculated

To understand why your neighbor might get $2,800 while someone else gets $1,400, it helps to know how the SSA calculates benefits.

The Four Key Factors

- Your Lifetime Earnings – The SSA looks at your 35 highest-earning years, adjusted for inflation.

- Work Credits – You earn up to four credits per year; most people need 40 credits (about 10 years of work) to qualify for retirement benefits.

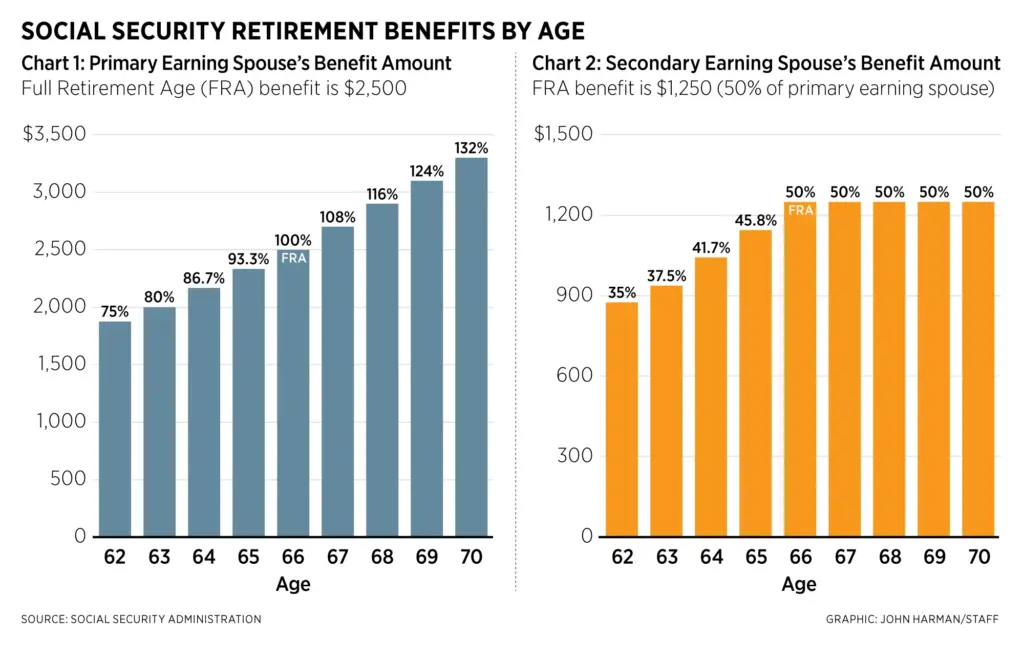

- When You Start Receiving Benefits – Claiming early (as soon as age 62) cuts your monthly amount by up to 30%. Waiting until full retirement age (around 67) gives you the standard rate.

- Delayed Retirement Credits – Each year you wait beyond your full retirement age adds 8% to your benefit, up to age 70.

So, if you’ve been earning the maximum taxable wage and hold off until 70, you could potentially reach that $5,108 ceiling. But even if you’re not there, understanding the math helps you make smarter financial choices.

October 2025 Social Security Payment Schedule

Social Security benefits don’t all arrive on the same day. Instead, they’re staggered to manage the millions of payments SSA issues each month. Here’s the breakdown for October 2025:

| Birth Date | Payment Date |

|---|---|

| 1st–10th | Wednesday, October 8, 2025 |

| 11th–20th | Wednesday, October 15, 2025 |

| 21st–31st | Wednesday, October 22, 2025 |

| SSI Recipients | October 1 and October 31, 2025 |

Why two SSI payments? Because November 1, 2025, lands on a Saturday, and SSA doesn’t send payments on weekends. So, November’s SSI payment goes out a day early — on October 31.

What Is the Cost-of-Living Adjustment (COLA) for 2025?

Every year, the SSA adjusts benefits based on inflation through the Cost-of-Living Adjustment, or COLA. This ensures your Social Security keeps up with rising prices.

In 2025, the projected COLA is around 3.2%, following a similar increase in 2024. That means the average retiree could see about $60 more per month in their check.

The SSA bases COLA on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which measures changes in the cost of goods and services.

How to Qualify for the Maximum $5,108 Social Security Payments?

Let’s be real — earning the max Social Security check doesn’t happen overnight. But if you plan early, you can get closer. Here’s how:

1. Earn the Maximum Taxable Income

In 2025, only income up to $168,600 (projected) counts toward Social Security taxes. That means earning more won’t increase your benefit — but hitting that threshold for many years will.

2. Work at Least 35 Years

If you have fewer than 35 years of work, SSA counts the missing years as $0, lowering your average.

3. Delay Benefits Until Age 70

Waiting beyond your full retirement age earns delayed retirement credits, boosting your payment by up to 24% if you wait from 67 to 70.

4. Check Your Statement Annually

You can review your projected benefits and work history by creating a My Social Security account at https://www.ssa.gov/myaccount/. This lets you catch errors early and plan accordingly.

5. Coordinate Spousal Benefits

Married couples can strategize — for example, one spouse claiming earlier while the other delays — to maximize household income.

Common Misconceptions About the $5,108 Payment

Myth 1: Everyone gets $5,108 in October 2025.

No — this is the highest possible payment, not a bonus or stimulus.

Myth 2: It’s a one-time extra check.

Wrong. SSA never sends “special” or “bonus” payments except for certain back-pay cases (e.g., disability approvals).

Myth 3: You can apply now to get it.

The benefit is tied to your lifetime earnings record — not an application window.

Myth 4: It’s part of a new government aid program.

No such program exists.

Protect Yourself from Social Security Scams

With so many viral stories floating around, scammers often jump in pretending to offer “help” securing these mythical payments. The SSA warns that:

- It will never call, text, or email asking for your SSN, bank info, or payment.

- It will never threaten your benefits.

- If you suspect fraud, report it to the Office of the Inspector General at https://oig.ssa.gov/.

A good rule of thumb? If it sounds too good to be true, it probably is.

Real-Life Examples: How Benefit Differences Add Up

Let’s look at two fictional but realistic examples.

Example 1: Sarah, a nurse from Ohio

Sarah worked for 35 years earning an average of $65,000 per year. She retired at 67 and began collecting her full benefit. Her monthly payment? Around $2,100 in 2025 — steady, dependable income that covers her mortgage and medical bills.

Example 2: Tom, an engineer from California

Tom earned the maximum taxable income for 35 years and waited until age 70 to claim benefits. In October 2025, he qualifies for the maximum benefit of $5,108. It’s a great reward for long, high-earning years — but Tom’s situation is rare.

These examples show that while $5,108 is achievable, the majority of Americans fall somewhere in between.

The Bigger Picture: Why Social Security Still Matters

Social Security isn’t just about a check — it’s about financial stability.

In 2025, with inflation still hovering near 3% and healthcare costs rising, these payments remain a vital cushion for millions.

The SSA reports that:

- 21% of married couples and nearly 45% of single retirees rely on Social Security for 90% or more of their income.

- The program lifts roughly 22 million Americans out of poverty each year.

So even if you’re not near the $5,108 mark, your benefit is part of something much larger — a national safety net built on shared work and contribution.

Social Security Just Changed at 69 – Here’s How It Could Drastically Impact Your Retirement

Goodbye Taxes? New U.S. Law Could Make 90% of Social Security Payments Tax-Free by 2026

Tips to Boost Your Future Benefits

- Keep working if possible. More years of earnings can replace low-earning years in your record.

- Track your income and credits. Mistakes happen — SSA records aren’t infallible.

- Plan withdrawals smartly. If you’re drawing from a 401(k) or IRA, consider how timing affects taxes and benefits.

- Consult a certified financial planner. The rules are complex, and professional guidance can help you coordinate benefits with your broader retirement plan.