$5,000 Wells Fargo Settlement Payout: If you’ve heard folks talking about a “$5,000 Wells Fargo settlement payout”, you’re probably wondering: Is that real? Am I eligible? How do I get my money? Well, friend, let’s walk through it together. This story isn’t some internet rumor—it’s tied to two major real-world Wells Fargo settlements:

- A $19.5 million “call-recording” settlement for Californians whose phone conversations were recorded without consent.

- A $185 million mortgage forbearance settlement for borrowers placed in forbearance without approval during COVID-19.

Both involve payouts—some as high as $5,000 per call in the first case—and both highlight how powerful consumer rights can be when people stand up for themselves.

Table of Contents

$5,000 Wells Fargo Settlement Payout

If you received a recorded call from Wells Fargo’s affiliate in California between 2014 and 2023, or had a mortgage placed into forbearance without your consent during 2020–2021, you might have money waiting for you. The $19.5 million call-recording and $185 million mortgage-forbearance settlements show how everyday Americans can demand accountability from powerful institutions. Act now—visit the official settlement pages, confirm your eligibility, and file your claim before the deadlines. Don’t sleep on your rights. These payouts are proof that even a single phone call—or a wrongly paused mortgage—can make a difference when you stand up for fair treatment.

| Item | Details |

|---|---|

| Settlement Amount (Call-Recording Case) | $19.5 million total fund for California residents and businesses |

| Estimated Per-Call Payout | Around $86 per call, up to $5,000 per call depending on claim volume |

| Eligibility Period | Calls placed Oct 22 2014 – Nov 17 2023 in California |

| Mortgage Forbearance Settlement | $185 million total fund |

| Eligibility Period (Mortgage) | Mortgages placed into forbearance Mar 1 2020 – Dec 31 2021 without informed consent |

| Key Claim Deadlines | Call-Recording – April 11 2025 |

| Average Timeline for Payouts | Call case – Payments expected summer 2025 |

How Did the $5,000 Wells Fargo Settlement Payout Happen?

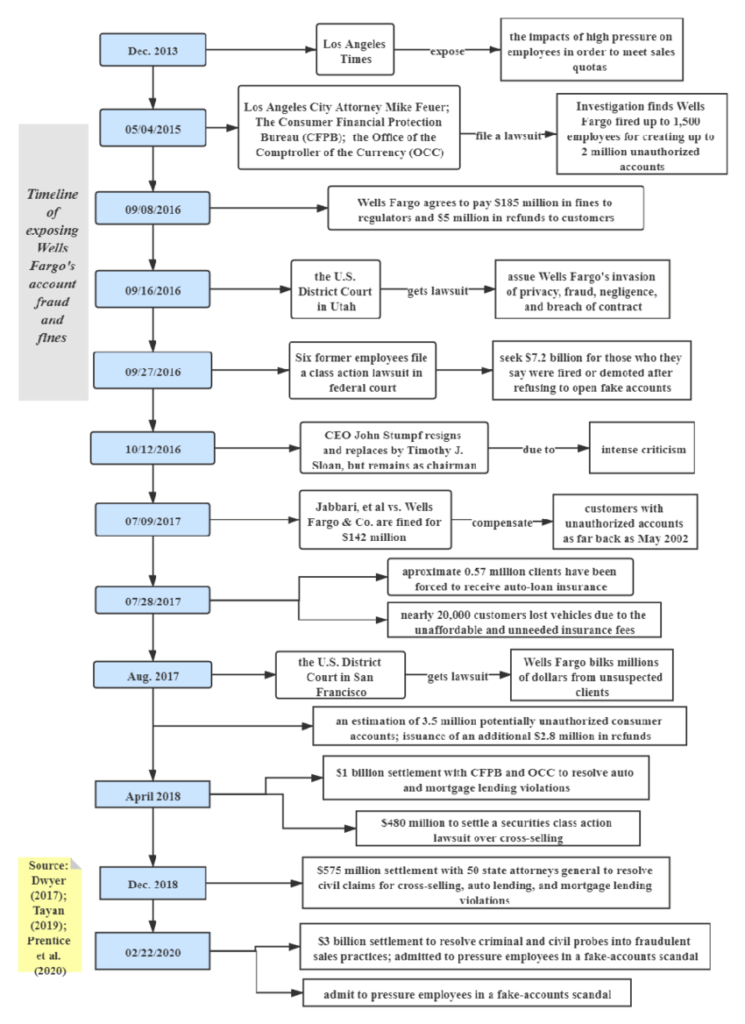

Big banks don’t just hand out millions for no reason. Each of these cases came after years of investigations, legal filings, and class-action lawsuits.

a) The Call-Recording Lawsuit

Between 2014 and 2023, Wells Fargo’s vendor—The Credit Wholesale Company Inc.—allegedly recorded phone calls to California customers without properly telling them.

That’s a big no-no under the California Invasion of Privacy Act (CIPA), which requires that both parties consent to recording.

When consumers found out, they filed lawsuits claiming invasion of privacy. Wells Fargo and its vendor didn’t admit wrongdoing but agreed to settle for $19.5 million to avoid further litigation.

b) The COVID-19 Mortgage Forbearance Case

Fast forward to 2020—COVID hit, chaos reigned, and the government introduced mortgage forbearance programs to help struggling homeowners.

But Wells Fargo allegedly placed hundreds of thousands of mortgages into forbearance without borrowers’ permission. Some people only found out when they tried to refinance and were denied.

The fallout was huge: credit-score damage, missed refinance opportunities, and customer confusion.

To make it right, Wells Fargo agreed to pay $185 million in compensation, with checks automatically mailed to eligible homeowners.

These settlements show how U.S. consumer-protection laws work—if a major company slips up, class-action lawsuits give individuals power to push back.

Who Qualifies for the $5,000 Wells Fargo Settlement?

a) For the Call-Recording Settlement

You qualify if:

- You were a California resident or business;

- You received one or more calls between Oct 22 2014 and Nov 17 2023;

- Those calls came from The Credit Wholesale Company Inc. acting for Wells Fargo; and

- The call was recorded without your consent.

Claim Deadline: April 11 2025

Hearing Date: May 20 2025

To claim, visit callrecordingclassaction.com and submit your phone number(s). No payment is required—it’s completely free.

Even if you only got one call, it’s worth filing. If you got multiple, you can claim for each eligible call.

b) For the Mortgage Forbearance Settlement

You qualify if:

- Wells Fargo serviced your mortgage;

- Your loan was placed into forbearance between Mar 1 2020 and Dec 31 2021; and

- You did not give proper consent or weren’t informed.

Automatic checks began mailing in March 2025, but if you suffered extra damage (say, couldn’t refinance or lost money), you can still file a Supplemental Claim Form by January 10 2025.

How Much Can You Actually Get?

a) Call-Recording Case

- Minimum expected payout: ~$86 per call

- Maximum possible: Up to $5,000 per call (if few people file)

- Example: If you got five recorded calls, that’s at least $430; could be $1,000+ if claims are low.

Because the settlement pool is fixed at $19.5 million, the fewer claims that come in, the higher each payout.

b) Mortgage Case

- Base automatic payment: Likely $800–$900 per eligible mortgage (depending on number of borrowers).

- Additional compensation: Up to $10,000+ possible for proven financial harm (credit damage, delayed refinance, etc.).

- Total fund: $185 million.

That’s one of the largest consumer-banking settlements since the 2016 Wells Fargo fake-accounts scandal.

When Will You Get Paid?

For the Call-Recording Settlement

- File deadline: April 11 2025

- Final court approval hearing: May 20 2025

- Payments mailed/issued: Approximately 50–60 days after approval (expected July–August 2025)

If you file online, keep your confirmation number. Paper checks usually come in plain white envelopes—don’t toss them!

For the Mortgage Settlement

- Effective date: February 15 2025

- Automatic payments: Began March 2025

- Supplemental claims: Still being reviewed; expect payment late 2025 or early 2026.

If you haven’t received your check, visit the official site’s “Contact Us” page to verify your status.

Step-by-Step: How to File a $5,000 Wells Fargo Settlement Payout Claim or Check Eligibility

- Check your mail or email

- Many people were notified automatically. Look for mail from the settlement administrator (Rust Consulting LLC or Kroll Settlement Administration).

- Go to the official website

- Call-Recording → callrecordingclassaction.com

- Mortgage → wellsfargocovidforbearancelitigation.com

- Complete the online claim form

- Provide your name, contact info, and phone numbers (for call case).

- For mortgage, you may need your loan number or property address.

- Attach supporting documents (if any)

- Phone records, call logs, mortgage statements, credit reports showing impact—all help strengthen your claim.

- Submit before the deadline

- Late claims are automatically rejected—no exceptions.

- Wait for processing

- Administrators review all submissions to prevent fraud. Payment timing varies but updates will appear on the site.

- Keep your info updated

- If you move, update your address immediately via the site’s “Update Address” form.

Common Mistakes to Avoid

- Falling for fake websites – Only trust the official URLs listed above. Scammers often mimic real settlement sites.

- Throwing away checks – Payments sometimes come in envelopes without logos.

- Missing deadlines – Courts don’t accept late claims, even by one day.

- Submitting false info – Claims are filed under penalty of perjury. Only claim if you truly qualify.

- Ignoring taxes – Technically, settlement payments count as income.

7. Real-World Example: Mary and John

Let’s make it simple.

Mary, a small-business owner in Los Angeles, received eight telemarketing calls from Wells Fargo’s vendor between 2018 and 2022. None disclosed that she was being recorded. She files her claim for eight calls. If the per-call payout ends up $100, she’ll pocket $800; if claims are low, she could see over $4,000.

John, a Texas homeowner, had his mortgage placed into forbearance in 2020 without his consent. When he tried to refinance, his application was denied. He’s now getting an automatic $900 payment, plus he filed a supplemental claim for $3,000 extra due to lost refinance savings.

These examples show how even everyday consumers can benefit from standing up for their rights.

Why This Matters (and What Professionals Can Learn)

From a professional standpoint—whether you’re a banker, compliance officer, or consumer-rights attorney—these cases underscore several lessons:

- Transparency isn’t optional. Recording calls without proper consent can trigger massive liability.

- Vendor oversight matters. Banks often rely on contractors; they’re still responsible for those vendors’ actions.

- Systemic errors cost dearly. The mortgage forbearance case highlights how an internal software glitch can snowball into hundreds of millions in exposure.

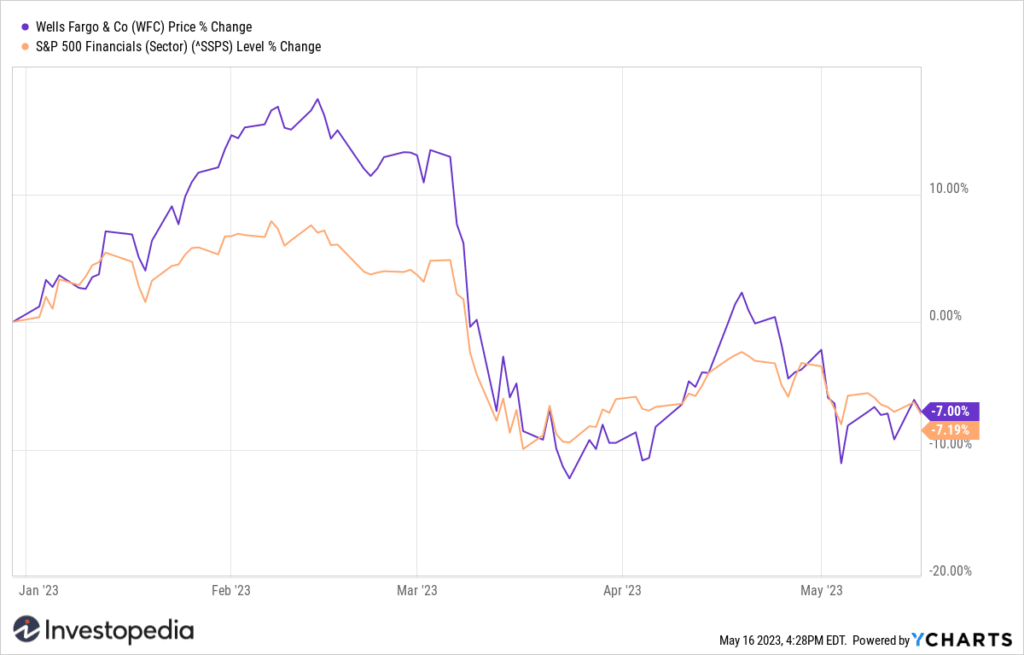

- Consumer trust takes decades to rebuild. Since Wells Fargo’s 2016 fake-accounts scandal, the bank’s reputation has needed years of compliance rebuilding.

- Documentation saves time. When mistakes happen, clear records protect both banks and borrowers.

Professionals should monitor these settlements as templates for improving internal compliance frameworks.

Practical Consumer Advice

- Check your credit report – Even if you get paid, errors may linger.

- Stay vigilant about consent – If you hear “This call may be recorded,” that’s your cue. If you don’t hear it, ask whether you’re being recorded.

- Keep all loan paperwork. You never know when it’ll help you join a class action later.

- Report misconduct. If you suspect new unfair practices, file a complaint with the Consumer Financial Protection Bureau.

- Consult a lawyer if you suffered substantial losses; you might be able to claim more individually.

AT&T $177M Data Breach Settlement – Apply to get $7,500 Payment, Check Eligibility

Millions Getting $51 From Amazon – What You Need to Know About the Prime Subscription Scandal

Broader Economic and Legal Impact

It’s worth noting that these aren’t isolated incidents. In the past decade, Wells Fargo has paid over $6 billion in fines and settlements across various compliance issues.

Why it matters:

- Such settlements push banks to tighten internal controls.

- They show regulators—like the CFPB and OCC—are watching.

- They remind consumers they have a voice.

For the U.S. economy, these payouts return funds to households—small amounts individually, but collectively significant. For lawyers and compliance experts, they mark a precedent for future privacy-law and mortgage-servicing cases.